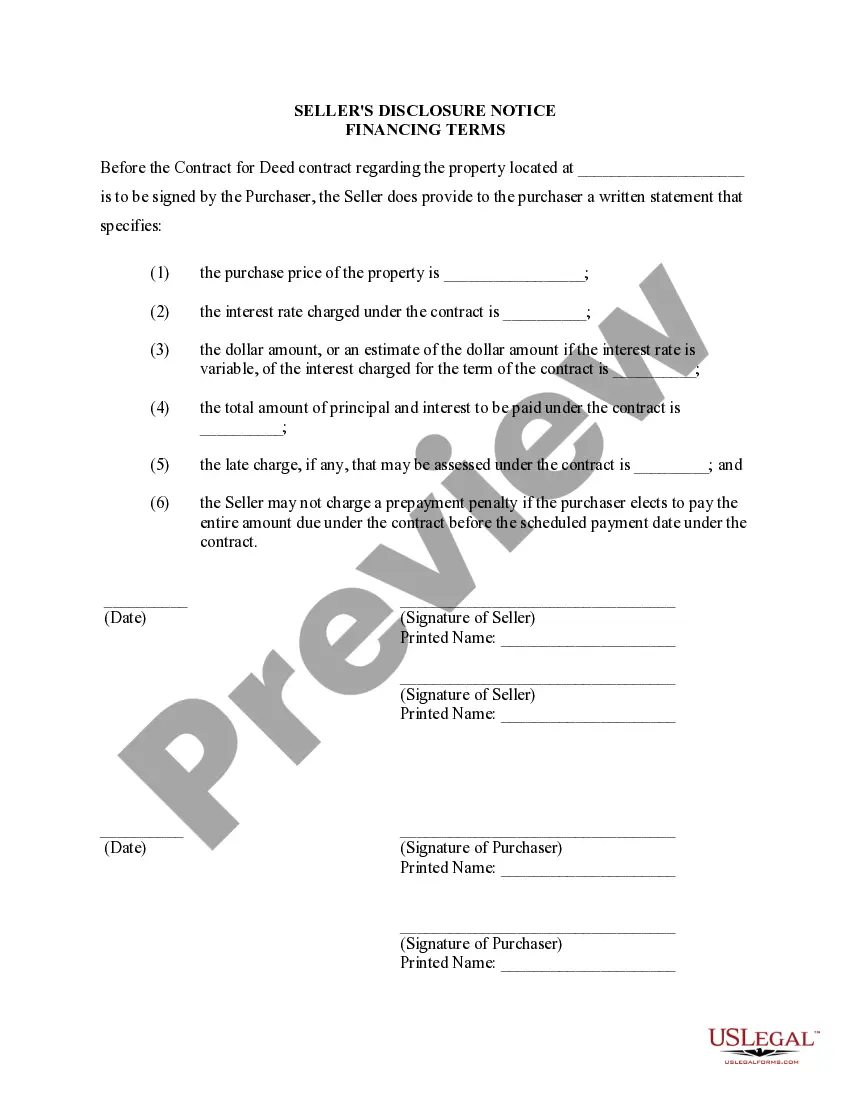

The Clark Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a comprehensive document that outlines the specific terms and conditions related to the financing of a residential property in Clark County, Nevada. This disclosure is a crucial component of the contract or agreement between the seller and buyer, ensuring transparency and clarity in the financing arrangement. Various types of Clark Nevada Seller's Disclosure of Financing Terms for Residential Property may exist based on the specific financing terms and conditions agreed upon between the parties involved. Here are a few examples: 1. Clark Nevada Seller's Disclosure of Financing Terms for Residential Property with Fixed Interest Rate: This type of disclosure pertains to a land contract in which the interest rate remains fixed throughout the duration of the agreement. It outlines the exact interest rate, repayment schedule, and any prepayment penalties or other pertinent details related to the fixed-rate financing. 2. Clark Nevada Seller's Disclosure of Financing Terms for Residential Property with Adjustable Interest Rate: This disclosure deals with a land contract in which the interest rate is adjustable or variable. It includes detailed information about the initial interest rate, frequency of rate adjustments, index used to determine rate changes, and any caps or limits on interest rate fluctuation. 3. Clark Nevada Seller's Disclosure of Financing Terms for Residential Property with Balloon Payment: This type of disclosure is applicable when the land contract includes a balloon payment clause. It outlines the specific terms and conditions regarding the balloon payment, such as the amount, due date, and any provisions for refinancing or renegotiation. 4. Clark Nevada Seller's Disclosure of Financing Terms for Residential Property with Seller Financing: This disclosure is used when the seller provides financing for the property purchase, acting as the lender. It outlines the agreed-upon interest rate, repayment schedule, any down payment or closing costs, and other terms and conditions related to the seller-funded financing. 5. Clark Nevada Seller's Disclosure of Financing Terms for Residential Property with Assumable Mortgage: In cases where the land contract involves an assumable mortgage, this disclosure provides details about the existing mortgage, including the terms, interest rate, remaining balance, and any related obligations that the buyer assumes or agrees to abide by. It is crucial for sellers and buyers to carefully review and understand the specific terms outlined in the Clark Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract, ensuring both parties are fully aware and informed about the financing arrangement for the residential property transaction.

Clark Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Clark Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you are searching for a valid form, it’s extremely hard to choose a better place than the US Legal Forms website – one of the most comprehensive online libraries. With this library, you can get a huge number of templates for business and individual purposes by categories and states, or keywords. With our high-quality search option, getting the newest Clark Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is as elementary as 1-2-3. Moreover, the relevance of every document is confirmed by a team of skilled lawyers that on a regular basis check the templates on our platform and update them in accordance with the most recent state and county demands.

If you already know about our system and have a registered account, all you should do to get the Clark Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the form you require. Read its description and use the Preview option (if available) to explore its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to discover the proper document.

- Confirm your selection. Choose the Buy now option. Next, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the form. Pick the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Clark Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract.

Each form you save in your profile has no expiry date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you need to get an additional version for enhancing or creating a hard copy, feel free to come back and save it again at any time.

Make use of the US Legal Forms professional collection to gain access to the Clark Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract you were seeking and a huge number of other professional and state-specific samples on one website!