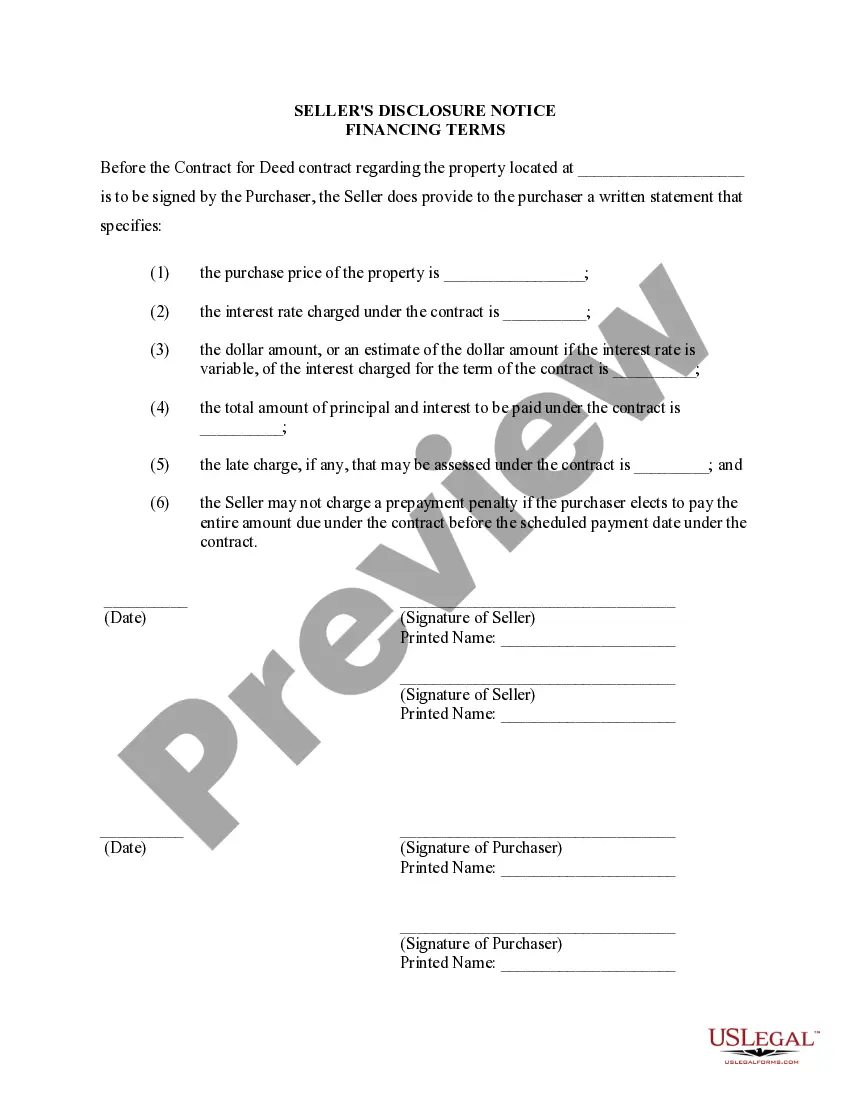

Las Vegas, Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the specific financing terms and conditions related to the sale of residential property in Las Vegas. This disclosure is crucial for both buyers and sellers as it provides transparency and clarity regarding the financial aspects of the transaction. When it comes to Las Vegas, Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, there are several types that may be involved. These variations depend on the specific terms and conditions agreed upon between the buyer and seller. Some common types of disclosures include: 1. Promissory Note: This type of financing disclosure outlines the specific details of the loan, including the loan amount, interest rate, payment schedule, and any additional terms agreed upon between the buyer and seller. 2. Down Payment Agreement: This disclosure highlights the agreed-upon amount of the down payment, the payment schedule, and any conditions or restrictions related to the down payment. 3. Balloon Payment Agreement: In certain cases, the buyer and seller may agree to a balloon payment arrangement, which means a large payment is due at the end of the contract term. This disclosure would detail the amount and timing of the balloon payment, and any accompanying terms. 4. Interest Rate Agreement: This disclosure focuses on the interest rate terms agreed upon between the buyer and seller, including whether the rate is fixed or adjustable, and any append ant conditions or clauses. 5. Payment Schedule: This disclosure outlines the specific payment structure agreed upon, including the frequency (weekly, bi-weekly, monthly, etc.) and the due dates for each installment. 6. Late Payment Agreement: This disclosure addresses the consequences for late payments, including any penalties or fees that may be applied, as well as any grace periods or remedies available to the buyer. 7. Default and Termination Terms: This disclosure covers the terms and conditions related to default and termination of the contract, including the remedies available to the seller in case of buyer default, and the process for terminating the contract. It is worth noting that the specifics of these disclosures may vary depending on individual negotiations and the requirements of the seller or buyer involved. Therefore, it is crucial for both parties to carefully review and understand the Las Vegas, Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed before entering into any agreement. Additionally, seeking legal advice is highly recommended ensuring compliance with local laws and regulations.

Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Las Vegas Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

If you have previously utilized our service, Log In to your account and retrieve the Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed also known as Land Contract onto your device by clicking the Download button. Ensure your subscription is current. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these simple steps to acquire your document.

You have uninterrupted access to every document you have acquired: you can find it in your profile within the My documents menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to swiftly locate and preserve any template for your personal or professional use!

- Ensure you've located the appropriate document. Review the description and use the Preview option, if available, to verify if it meets your requirements. If it doesn't suit you, utilize the Search tab above to find the correct one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property related to Contract or Agreement for Deed also known as Land Contract. Choose the file format for your document and store it on your device.

- Complete your template. Print it out or use professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Texas is a non-disclosure state because no law exists that requires disclosure as is the case in other states. Zillow and a lot of other sites attempt to provide you a ?value.? The fact of the matter is that none of them have access to sold data. Only Realtors and Appraisers have access.

In Nevada, according to NRS 40.770, deaths (including homicide or suicide) do not need to be disclosed unless the death resulted from a condition of the property itself. Be sure to check out NRS 40.770 to see what other information does not need to be disclosed when purchasing a home.

A: While Nevada law does not explicitly require the actual home inspection reports to be shared in future deals like our neighbors California do, our statutes certainly require the seller who now has the knowledge gained from those reports to disclose these now known material defects to new buyers (Seller's Real

Disclosure Laws in Nevada for Home Sales The statute provides that, at least ten days before residential property is conveyed to the buyer, the seller must complete a disclosure form covering all known defects that materially affect the value or use of the property in an adverse manner.

The seller must complete the ?Seller's Real Property Disclosure? form, detailing the condition of the property, known defects, and any other aspects of the property which may affect its use or value. A real estate licensee, unless he is the seller of the property, may not complete this form.

Except as otherwise provided in subsection 2: (a) At least 10 days before residential property is conveyed to a purchaser: (1) The seller shall complete a disclosure form regarding the residential property; and (2) The seller or the seller's agent shall serve the purchaser or the purchaser's agent with the completed

Sellers Real Property Disclosure Nevada's law does not explicitly state what aspects or areas of property require disclosure, unlike other states. The Nevada Real Estate Division, which is the state agency that regulates real estate, offers the sellers real property disclosure (SEPD) form.

The seller must complete the ?Seller's Real Property Disclosure? form, detailing the condition of the property, known defects, and any other aspects of the property which may affect its use or value. A real estate licensee, unless he is the seller of the property, may not complete this form.