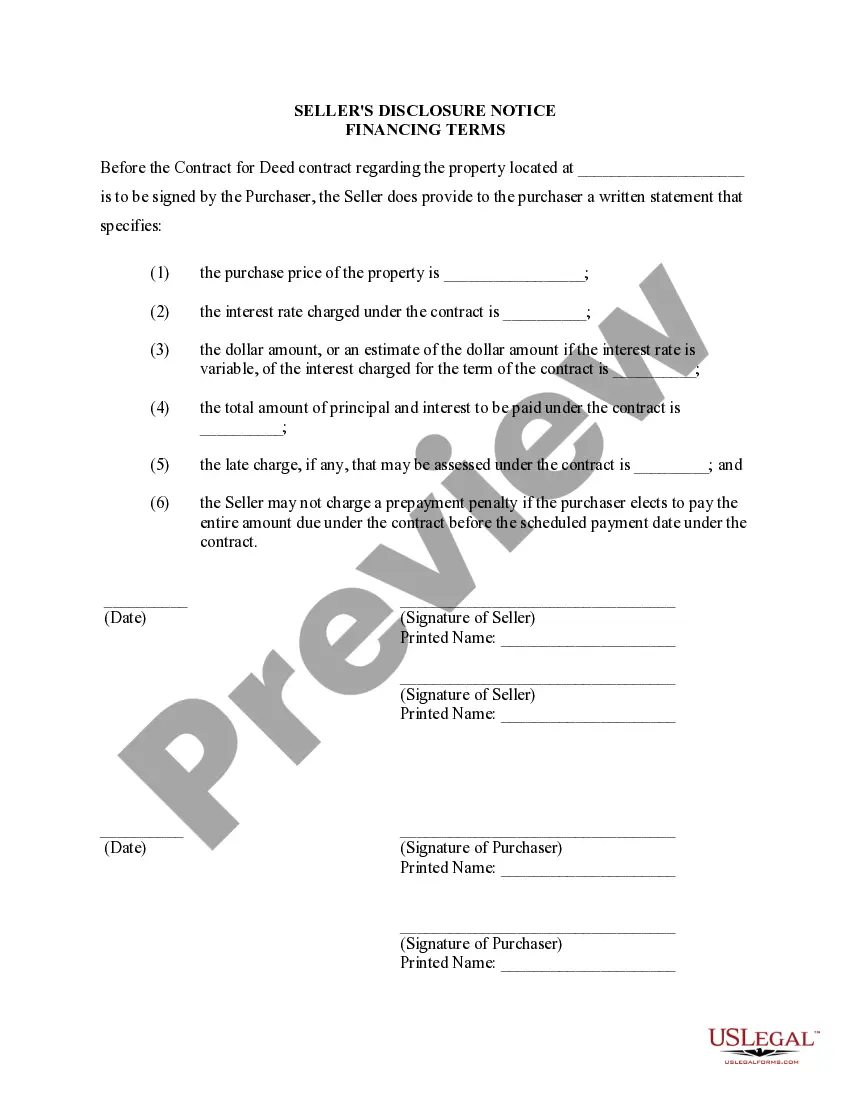

The North Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a legally binding document that outlines the terms and conditions of financing provided by the seller for the purchase of a residential property. This Seller's Disclosure is a crucial aspect of the real estate transaction, ensuring that all parties involved have a clear understanding of the financing terms and obligations. It is important for both the seller and the buyer to familiarize themselves with the disclosure to avoid any potential disputes or misunderstandings in the future. The North Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property typically includes the following information: 1. Purchase Price: This section outlines the agreed-upon purchase price for the residential property, which is usually the total amount to be financed by the seller. 2. Down Payment: The disclosure defines the required down payment amount, which is the initial sum paid by the buyer to secure the property. The terms may specify a particular percentage or a fixed dollar amount. 3. Interest Rate: The Seller's Disclosure states the interest rate that will apply to the financing. This interest rate may be fixed, adjustable, or negotiable based on the terms agreed upon between the buyer and the seller. 4. Repayment Terms: This section describes the repayment terms, including the number of monthly payments, the payment amount, and the due date. It may also outline penalties or late fees for missed or late payments. 5. Duration of Financing: The disclosure specifies the duration of the financing period, which is the time within which the buyer must fully repay the seller. This can vary depending on the agreement and may range from a few months to several years. 6. Default Provisions: The disclosure includes provisions detailing what constitutes default and the consequences for the buyer if they fail to meet their payment obligations. It may describe potential remedies available to the seller such as foreclosure or repossessing the property. 7. Property Conditions: Some Seller's Disclosures include information about the condition of the property being sold. This may include details about any known defects or repairs needed, which could affect the financing terms. It is important to note that the specific content and terms of the Seller's Disclosure may vary based on individual agreements and negotiations between the buyer and seller. Different types of Seller's Disclosures may include variations in interest rates, down payment requirements, and repayment terms, among other factors. In conclusion, the North Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed provides comprehensive information about the financial aspects of a real estate transaction. Both sellers and buyers should carefully review and understand its content to ensure a smooth and successful property purchase experience.

North Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out North Las Vegas Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Make use of the US Legal Forms and have immediate access to any form sample you need. Our helpful website with thousands of documents makes it simple to find and get virtually any document sample you require. You can export, complete, and certify the North Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract in a few minutes instead of surfing the Net for several hours trying to find a proper template.

Using our library is an excellent way to improve the safety of your record filing. Our experienced attorneys regularly check all the records to ensure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the North Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract? If you have a profile, just log in to the account. The Download button will appear on all the documents you view. Furthermore, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instructions listed below:

- Find the form you need. Make certain that it is the form you were seeking: verify its headline and description, and utilize the Preview feature if it is available. Otherwise, use the Search field to find the needed one.

- Start the downloading process. Select Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order using a credit card or PayPal.

- Download the document. Select the format to get the North Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract and change and complete, or sign it according to your requirements.

US Legal Forms is among the most considerable and reliable form libraries on the internet. Our company is always happy to help you in any legal case, even if it is just downloading the North Las Vegas Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract.

Feel free to take full advantage of our form catalog and make your document experience as straightforward as possible!