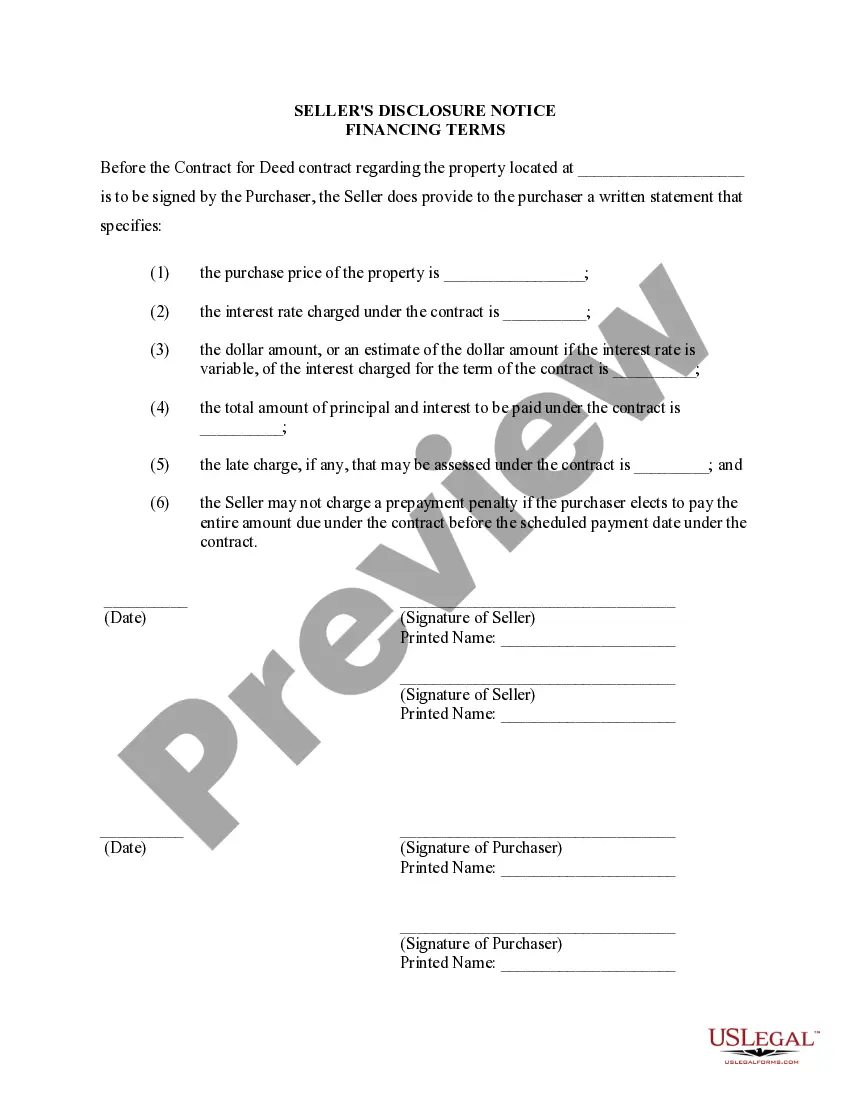

Sparks Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract serves as a crucial document that outlines the specific financing terms and conditions applicable to the sale of residential property. This disclosure is legally required to inform both the seller and buyer about the financial aspects related to the property purchase. By using relevant keywords, we can shed light on the various types and key details of this disclosure document. 1. General Overviews The Sparks Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is a binding agreement between the property seller and the buyer. It discloses the financial arrangements, terms, and conditions relevant to the property sale and highlights the financing options available. 2. Contract or Agreement for Deed The Sparks Nevada Seller's Disclosure of Financing Terms document specifically focuses on the financing option known as a contract or agreement for deed, which is also commonly referred to as a land contract. This type of agreement allows the buyer to make regular payments directly to the seller, gradually acquiring ownership rights over time. 3. Key Components of the Disclosure This disclosure includes essential information to ensure transparency and protect the interests of both parties involved. It typically covers the following aspects: — Purchase Price: The total price of the property and the agreed-upon method of payment, whether in installments or a lump sum. — Down Payment: The amount of money paid upfront by the buyer to initiate the contract or agreement. — Interest Rate: If applicable, the interest rate charged on any unpaid balance, which affects the overall cost for the buyer. — Financing Period: The duration over which the buyer is expected to make payments, often in monthly installments, until the property ownership is fully transferred. — Late Payment Penalties: Any additional charges imposed on the buyer for late or missed payments. — Property Insurance and Taxes: The buyer's responsibilities regarding insurance coverage and property tax payments. — Default Conditions: The consequences or actions that may occur if either party breaches the terms of the agreement. — Prepayment Options: Whether the buyer can make extra payments towards the principal balance, potentially reducing the financing period or interest charges. 4. Protection and Awareness The Sparks Nevada Seller's Disclosure of Financing Terms is designed to protect both the seller and the buyer. It ensures that the buyer fully comprehends the financial implications involved, allowing them to make informed decisions. Likewise, the seller benefits from clear communication concerning their expectations and obligations from the buyer. 5. Additional Variations or Names It's important to note that while typically referred to as the "Sparks Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract," this disclosure document may vary in title depending on local regulations or specific agreements. Some alternative names could include "Seller Financing Disclosure" or "Seller's Disclosure for Land Contract Financing Terms." It's crucial for all parties involved to ensure uniform understanding and compliance with local legal requirements. In conclusion, the Sparks Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract serves as a significant document that outlines the financing terms, conditions, and responsibilities related to the purchase of residential property using a land contract. It is a vital tool to create transparency and protect the interests of both the buyer and the seller throughout the duration of the agreement.

Sparks Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Sparks Nevada Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Do you need a reliable and affordable legal forms supplier to get the Sparks Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract? US Legal Forms is your go-to option.

Whether you require a simple agreement to set regulations for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of specific state and area.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Sparks Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Restart the search in case the form isn’t suitable for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Sparks Nevada Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract in any provided file format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time learning about legal papers online once and for all.