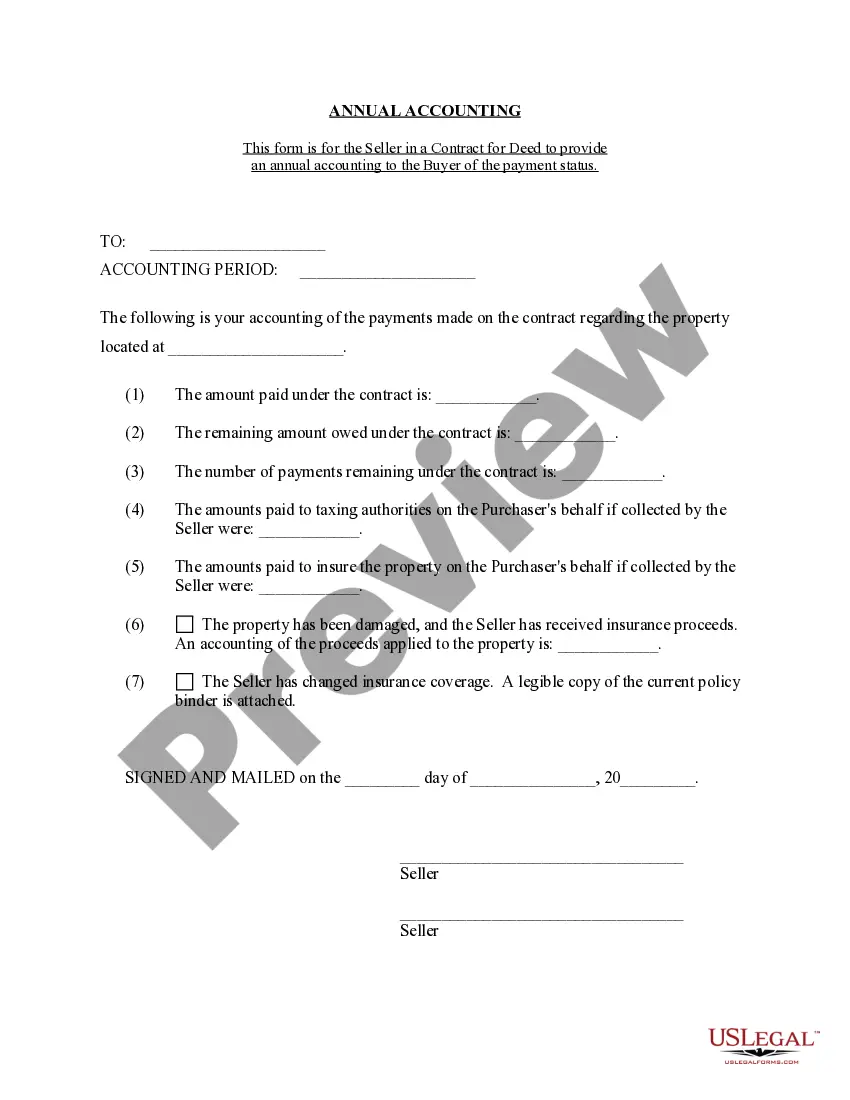

The Clark Nevada Contract for Deed Seller's Annual Accounting Statement is a crucial document in real estate transactions that outlines the financial details between the seller and buyer involved in a contract for deed agreement. This comprehensive statement provides a transparent breakdown of the financial transactions and obligations for the specified period. Keywords: Clark Nevada, contract for deed, seller's annual accounting statement, real estate transactions, financial details, buyer, agreement, comprehensive statement, transparent breakdown, financial transactions, obligations. Different Types of Clark Nevada Contract for Deed Seller's Annual Accounting Statement: 1. Basic Accounting Statement: This type of statement provides a clear overview of the financial transactions and accounting details during the specified annual period. It includes information such as the total purchase price, down payment, monthly installments, interest accrued, principal payments, and any applicable fees or charges. 2. Expense Statement: This variant of the annual accounting statement focuses on the expenses incurred and paid by the seller throughout the year. It lists all the costs related to property maintenance, repairs, insurance premiums, property taxes, and any other relevant expenses. 3. Income Statement: Particularly beneficial for sellers who have multiple properties under contract for deed, this type of accounting statement focuses on the income generated from each property. It includes details of rental or lease payments received, late payment penalties, and any other income associated with the contract for deed properties. 4. Delinquency Statement: This specialized accounting statement highlights any outstanding or delinquent payments made by the buyer during the specified period. It provides a summary of the amount due, payment history, late fees, and any actions taken to address the delinquency. 5. Tax Statement: This annual accounting statement pertains to the tax implications of the contract for deed agreement. It details the seller's tax responsibilities, such as reporting and paying property taxes, and may also include any tax credits or deductions applicable to the contract for deed arrangement. In conclusion, the Clark Nevada Contract for Deed Seller's Annual Accounting Statement is a comprehensive document that ensures transparency between the seller and buyer involved in a contract for deed agreement. By providing detailed financial information, it allows both parties to accurately track and account for their obligations, ultimately fostering a smooth and equitable real estate transaction.

Clark Statement

Description

How to fill out Clark Nevada Contract For Deed Seller's Annual Accounting Statement?

Make use of the US Legal Forms and get immediate access to any form sample you want. Our helpful website with a huge number of document templates allows you to find and obtain almost any document sample you need. You can download, complete, and sign the Clark Nevada Contract for Deed Seller's Annual Accounting Statement in a matter of minutes instead of surfing the Net for several hours seeking a proper template.

Utilizing our catalog is a wonderful way to increase the safety of your document filing. Our professional attorneys regularly check all the records to make certain that the forms are appropriate for a particular region and compliant with new laws and polices.

How can you get the Clark Nevada Contract for Deed Seller's Annual Accounting Statement? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Additionally, you can get all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, stick to the instructions listed below:

- Open the page with the form you require. Ensure that it is the template you were seeking: examine its name and description, and use the Preview option if it is available. Otherwise, utilize the Search field to find the needed one.

- Start the saving process. Click Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Download the document. Select the format to get the Clark Nevada Contract for Deed Seller's Annual Accounting Statement and edit and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable template libraries on the internet. Our company is always happy to assist you in virtually any legal process, even if it is just downloading the Clark Nevada Contract for Deed Seller's Annual Accounting Statement.

Feel free to take advantage of our platform and make your document experience as efficient as possible!