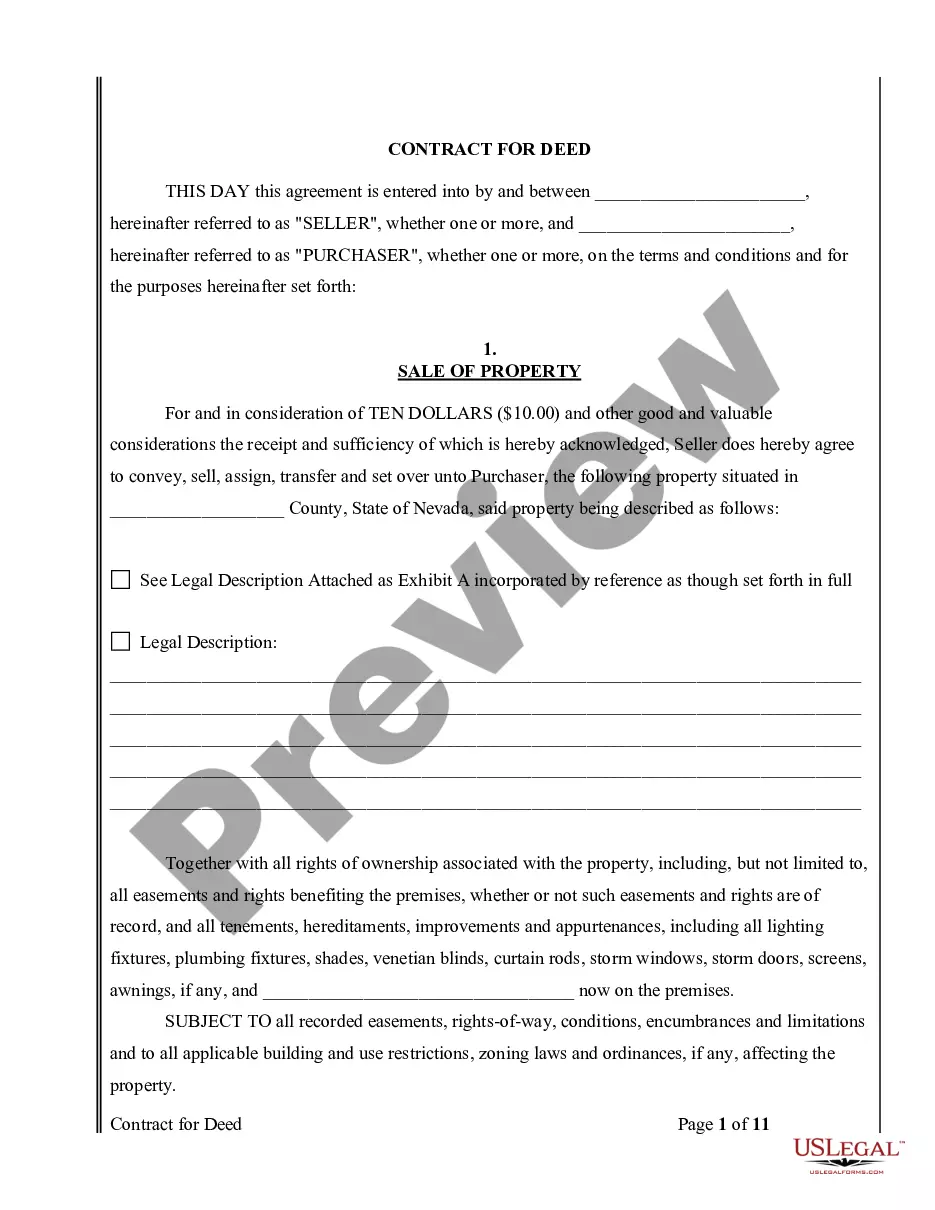

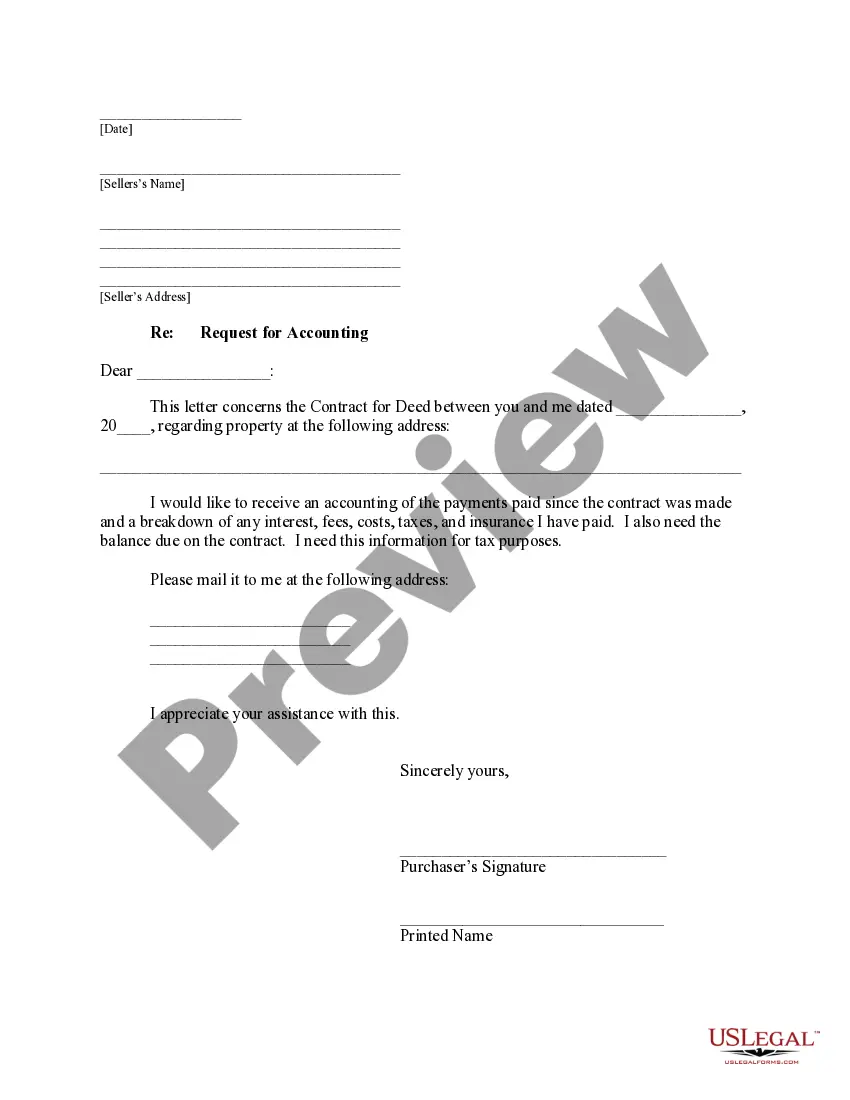

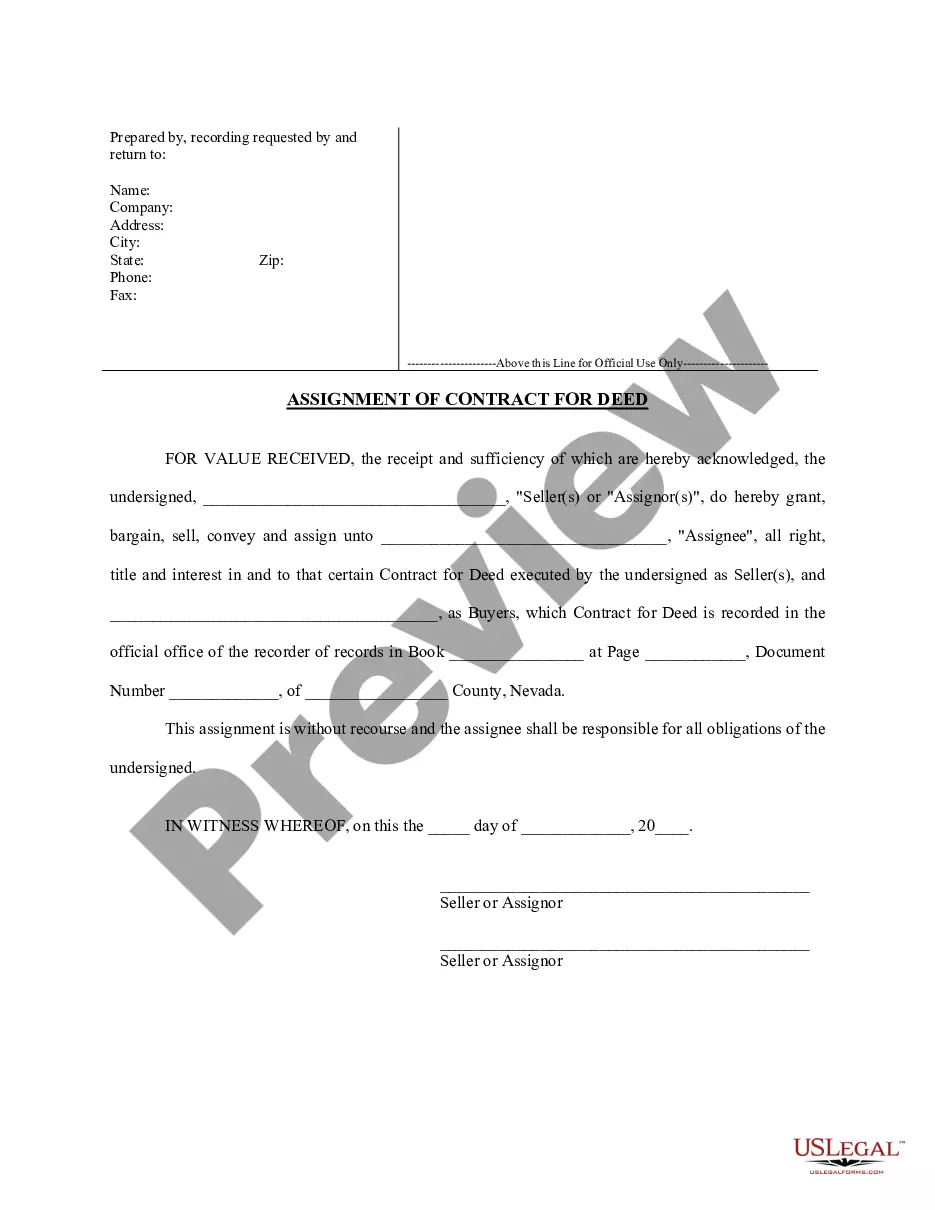

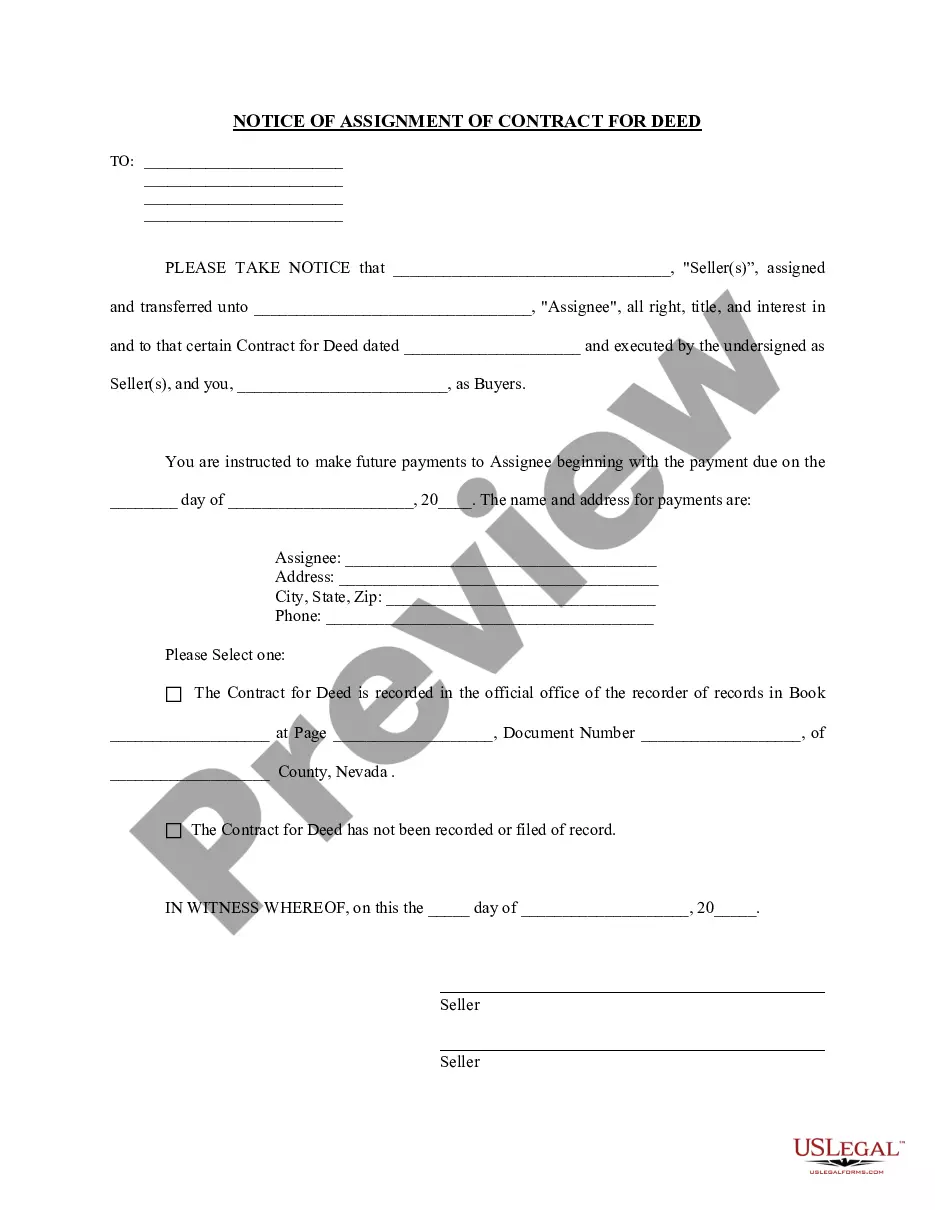

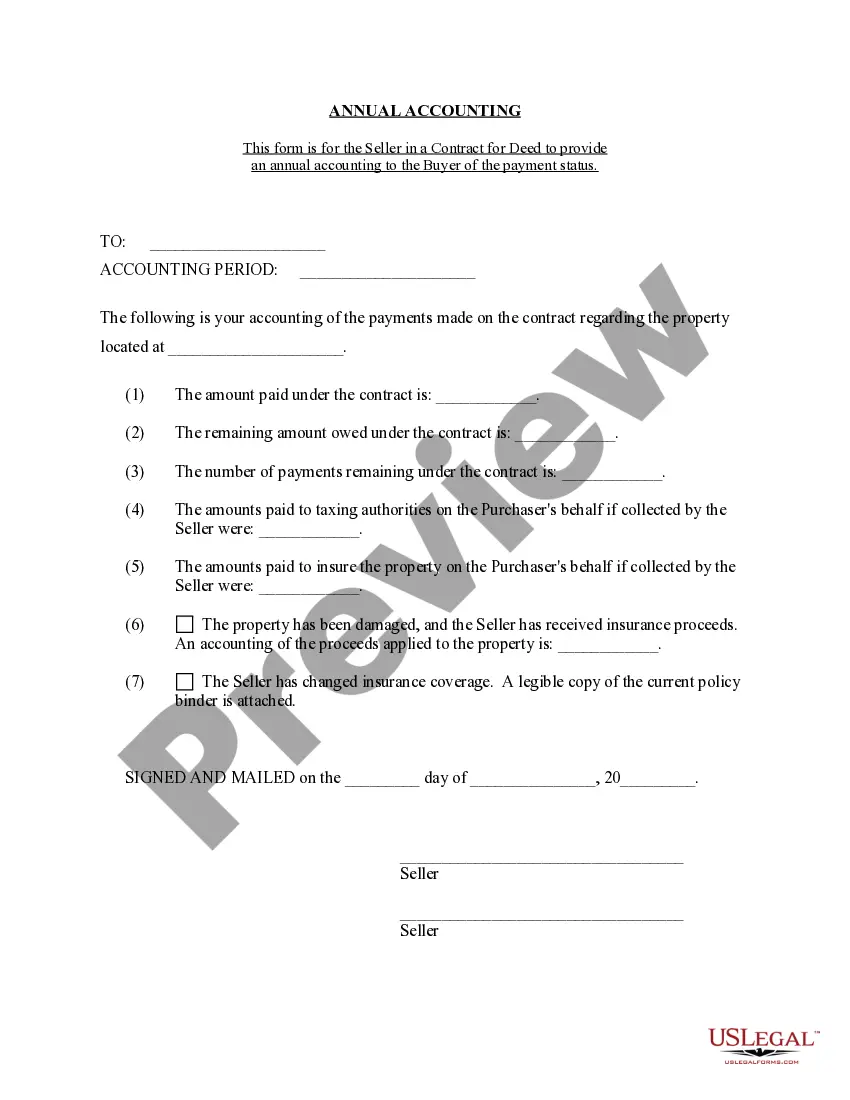

The North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement refers to a financial document that provides a comprehensive breakdown of transactions and records related to a contract for deed agreement in North Las Vegas, Nevada. This statement typically includes crucial information for both sellers and buyers involved in the contract for deed arrangement. The purpose of the Contract for Deed Seller's Annual Accounting Statement is to facilitate transparency and ensure accurate financial reporting. It acts as a detailed record of all financial activities pertaining to the contract for deed, assisting both parties in monitoring payment progress, interest accrued, and other related matters. Key Components of the North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement: 1. Buyer and Seller Information: The statement begins with the identification of the involved parties, providing names, contact details, and contract details. 2. Payment Summary: This section presents a summarized overview of all payments made throughout the year. It includes the total payment amount, any late payment penalties, and the remaining balance. 3. Payment Schedule: The statement may include a schedule outlining the buyer's payment plan, specifying the due dates, payment amounts, and any interest accrued. This helps in tracking the progress of the contract and ensures compliance with its terms. 4. Principal and Interest: This section details the breakdown of principal and interest components of the payments received. It specifies the portion of the payment allocated towards reducing the principal balance and the interest accrued for the respective period. 5. Additional Charges or Fees: If applicable, the statement may include any charges or fees associated with the contract, such as administrative fees, property taxes, or insurance costs. This provides a clear overview of additional expenses incurred. 6. Escrow Account Information: If an escrow account is utilized for managing property taxes or insurance payments, the accounting statement may include details regarding the balance within the account and any transactions or adjustments made during the year. Types of North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statements: 1. Standard Annual Accounting Statement: This type of statement provides a comprehensive overview of the contract for deed agreement, comprising all essential financial details and payment information. 2. Delinquency Notice Statement: In case the buyer is behind on payments or fails to comply with the contract terms, the seller may issue a delinquency notice statement. It highlights the outstanding payments, accrued interest, and any associated penalties or charges. 3. Termination or Final Accounting Statement: When the contract for deed is complete, whether through full payment or another mutually agreed condition, the seller provides a final accounting statement. This statement summarizes the entire financial history of the contract, indicating the total payments received, applicable interest, and any remaining balances or refunds. In conclusion, the North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that ensures transparency between buyers and sellers. By providing detailed records of payments, interest, and other financial elements, it promotes clear communication and facilitates a smooth contract for deed agreement.

North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement

Category:

State:

Nevada

City:

North Las Vegas

Control #:

NV-00470-4

Format:

Word;

Rich Text

Instant download

Description

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement refers to a financial document that provides a comprehensive breakdown of transactions and records related to a contract for deed agreement in North Las Vegas, Nevada. This statement typically includes crucial information for both sellers and buyers involved in the contract for deed arrangement. The purpose of the Contract for Deed Seller's Annual Accounting Statement is to facilitate transparency and ensure accurate financial reporting. It acts as a detailed record of all financial activities pertaining to the contract for deed, assisting both parties in monitoring payment progress, interest accrued, and other related matters. Key Components of the North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement: 1. Buyer and Seller Information: The statement begins with the identification of the involved parties, providing names, contact details, and contract details. 2. Payment Summary: This section presents a summarized overview of all payments made throughout the year. It includes the total payment amount, any late payment penalties, and the remaining balance. 3. Payment Schedule: The statement may include a schedule outlining the buyer's payment plan, specifying the due dates, payment amounts, and any interest accrued. This helps in tracking the progress of the contract and ensures compliance with its terms. 4. Principal and Interest: This section details the breakdown of principal and interest components of the payments received. It specifies the portion of the payment allocated towards reducing the principal balance and the interest accrued for the respective period. 5. Additional Charges or Fees: If applicable, the statement may include any charges or fees associated with the contract, such as administrative fees, property taxes, or insurance costs. This provides a clear overview of additional expenses incurred. 6. Escrow Account Information: If an escrow account is utilized for managing property taxes or insurance payments, the accounting statement may include details regarding the balance within the account and any transactions or adjustments made during the year. Types of North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statements: 1. Standard Annual Accounting Statement: This type of statement provides a comprehensive overview of the contract for deed agreement, comprising all essential financial details and payment information. 2. Delinquency Notice Statement: In case the buyer is behind on payments or fails to comply with the contract terms, the seller may issue a delinquency notice statement. It highlights the outstanding payments, accrued interest, and any associated penalties or charges. 3. Termination or Final Accounting Statement: When the contract for deed is complete, whether through full payment or another mutually agreed condition, the seller provides a final accounting statement. This statement summarizes the entire financial history of the contract, indicating the total payments received, applicable interest, and any remaining balances or refunds. In conclusion, the North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that ensures transparency between buyers and sellers. By providing detailed records of payments, interest, and other financial elements, it promotes clear communication and facilitates a smooth contract for deed agreement.

How to fill out North Las Vegas Nevada Contract For Deed Seller's Annual Accounting Statement?

If you’ve already used our service before, log in to your account and download the North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your North Las Vegas Nevada Contract for Deed Seller's Annual Accounting Statement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!