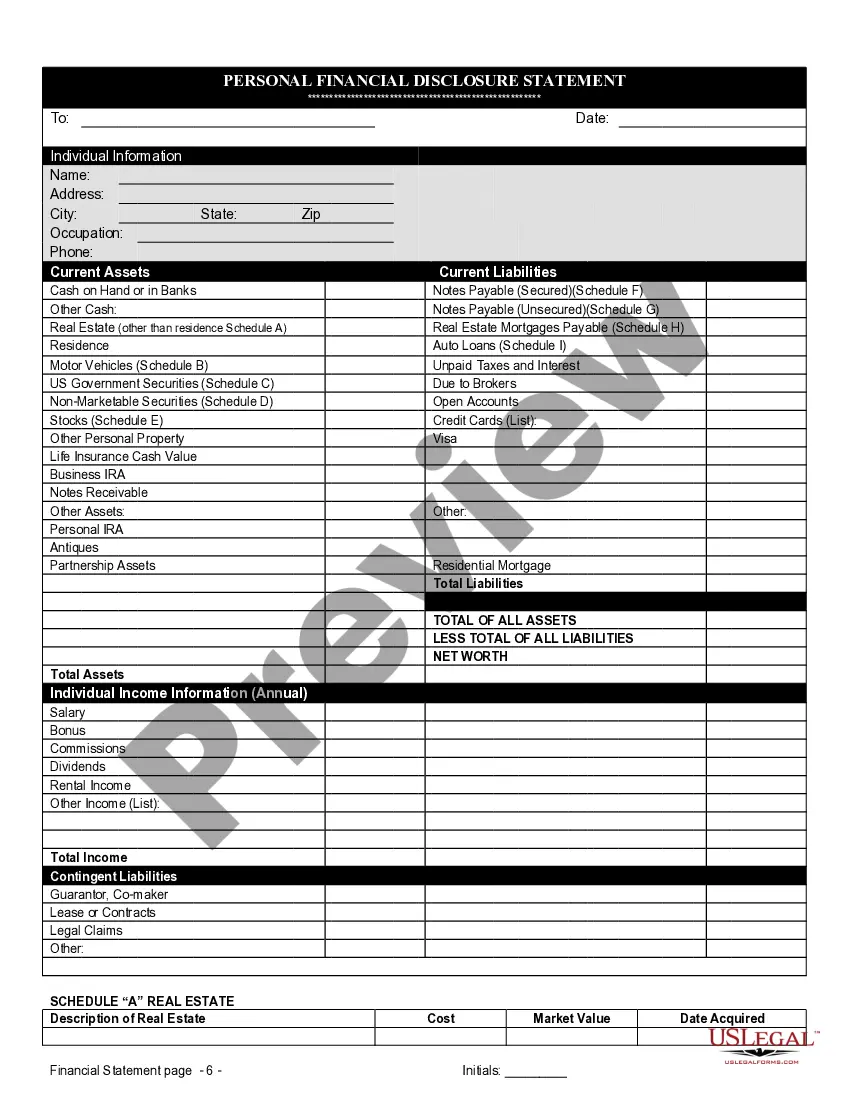

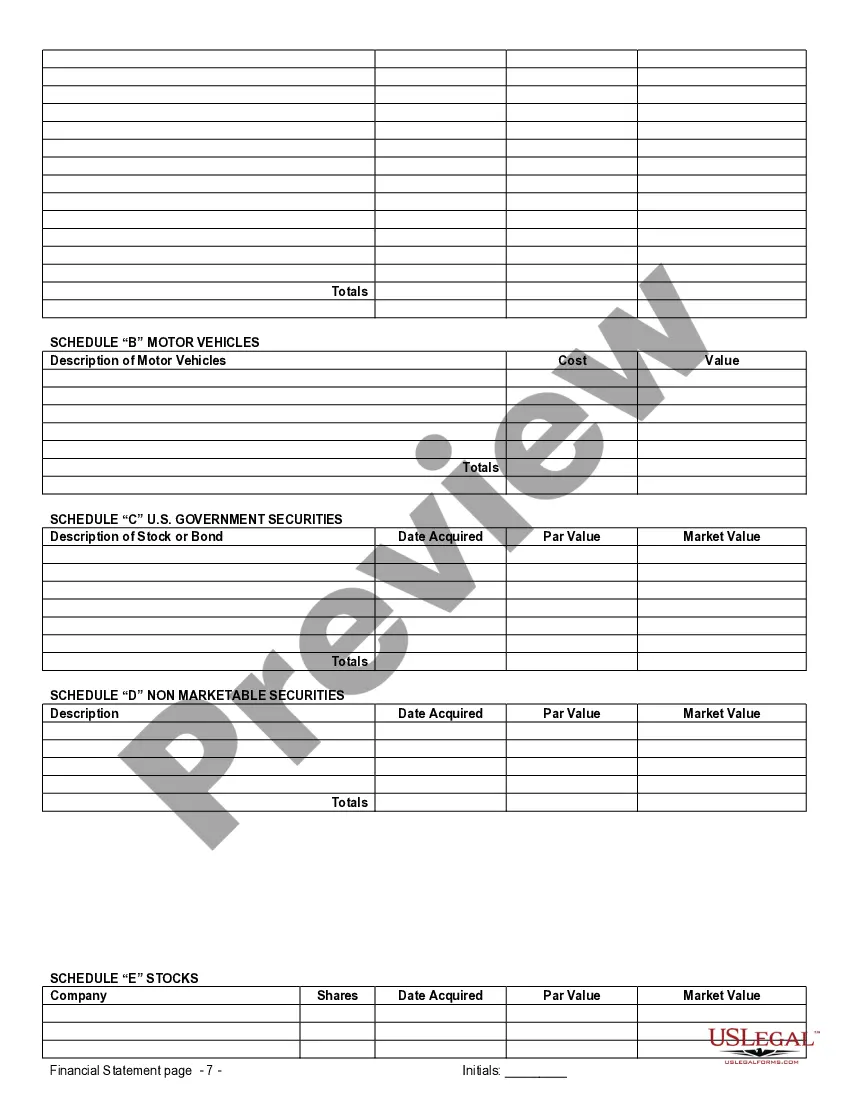

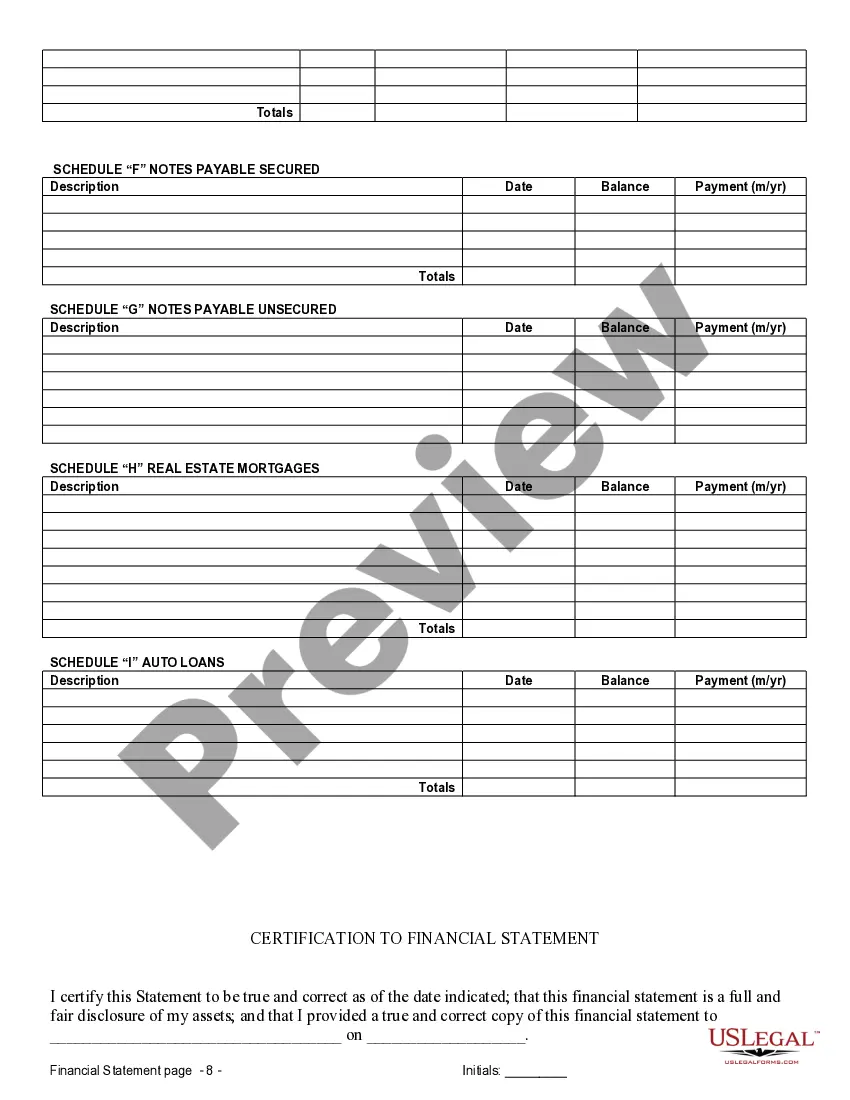

Las Vegas Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Nevada Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Irrespective of societal or occupational standing, fulfilling law-related paperwork is a regrettable requirement in contemporary society.

Frequently, it’s nearly unfeasible for an individual without any legal background to create such documents from scratch, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms steps in to provide assistance.

- Our platform features a vast collection of over 85,000 ready-to-use, state-specific documents that cater to nearly any legal matter.

- US Legal Forms also acts as an invaluable tool for associates or legal advisors looking to enhance their efficiency with our DIY forms.

- Whether you need the Las Vegas Nevada Financial Statements solely for the Prenuptial Premarital Agreement or any other documentation applicable in your state or county, US Legal Forms has everything you need at your disposal.

- Here’s how to quickly obtain the Las Vegas Nevada Financial Statements exclusively for the Prenuptial Premarital Agreement by utilizing our dependable platform.

- If you are an existing subscriber, feel free to Log In to your account to access the necessary form.

- If you are new to our platform, please follow these instructions before downloading the Las Vegas Nevada Financial Statements solely for the Prenuptial Premarital Agreement.

Form popularity

FAQ

Unconscionability Invalidates a Prenuptial Agreement One party signed the agreement involuntarily or not by choice. One party demonstrates that the other party did not divulge all relevant information. One party can prove he/she was not allowed access to an attorney before signing the prenup.

When it comes to monetary assets, a prenup can also protect the future earnings of one or both parties so they are not up for grabs during a divorce.

The short answer is that you can protect, or not protect, nearly anything you want. A valid prenup is legally binding, so whatever you and your partner put into it should stand up in court if you eventually divorce (though every case is different).

Be a written contract?no verbal agreements. Have lawful terms within the prenup. Include the signatures from both parties. Must be signed voluntarily (can't involve coercion, duress, intimidation, or deceit)

Dave Ramsey on Instagram: ?The only time I recommend a prenuptial agreement is in EXTREME money situations, and this one isn't.

Reasons to Get a Prenup Future spouse(s) have a significant stake in family assets or a family business. Future spouse(s) fully or partially own a business. Future spouse(s) had children from a previous marriage. Future spouse(s) had one or multiple prior divorces.

While it is certainly not the most romantic part of your wedding planning, any unwed couple can elect to form a prenuptial agreement not only to protect what they have prior to the marriage, or in some cases, protect any future assets they should acquire during the marriage.

A prenuptial contract won't take effect until a couple actually marries. If the couple cancels their wedding plans, the agreement becomes unenforceable. Prenuptial agreements must be in writing and signed by both spouses. Unlike a will, a prenup doesn't need to be witnessed or notarized in Nevada.

A prenuptial agreement does not cover the following: Child custody or visitation matters. Child support. Alimony in the event of a divorce. Day-to-day household matters. Anything prohibited by the law.

The law does not allow a couple to include any terms regarding child custody, visitation or support in a prenuptial or postnuptial agreement. This is because a judge will make these decisions in a divorce case based on the child's best interests.