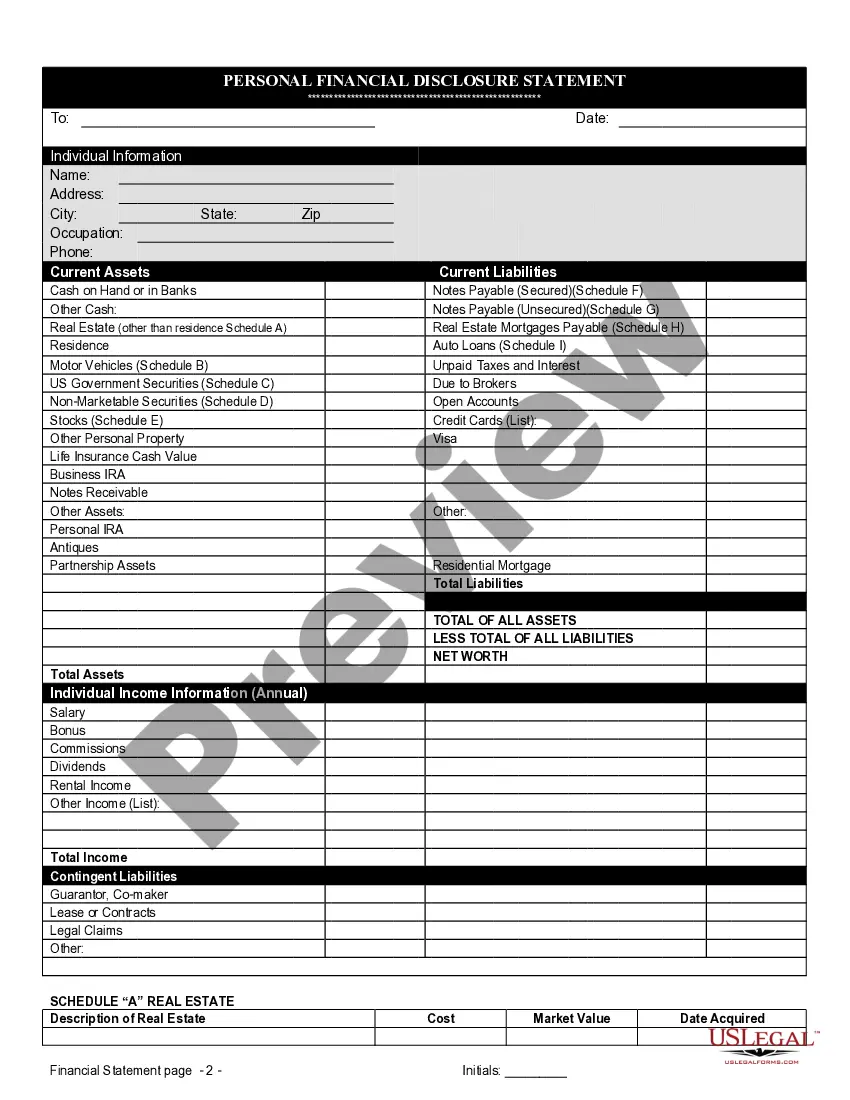

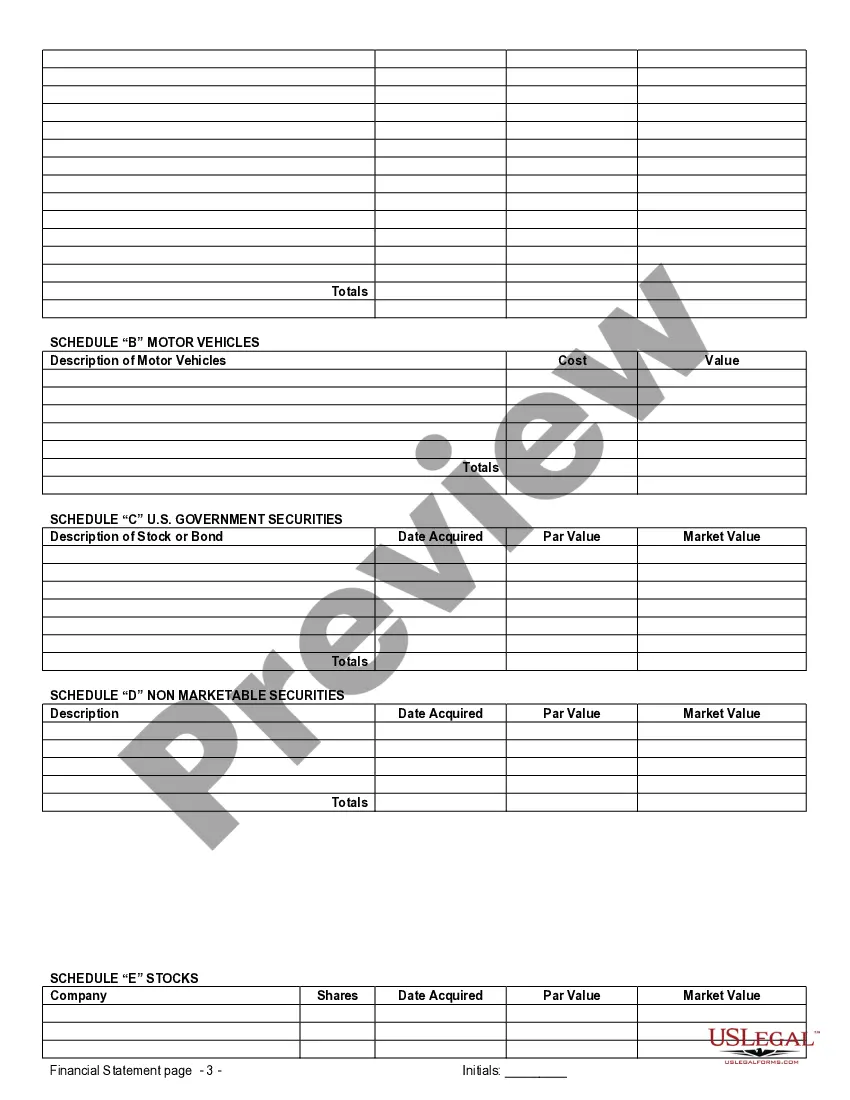

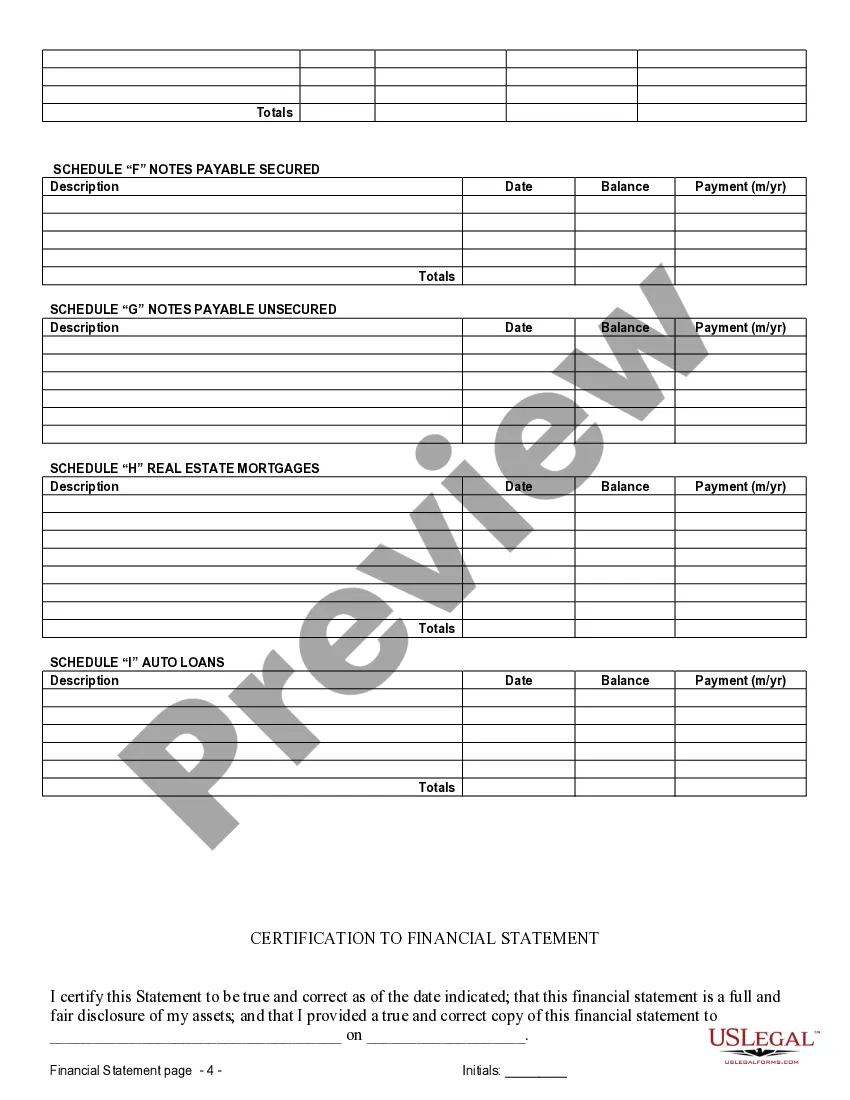

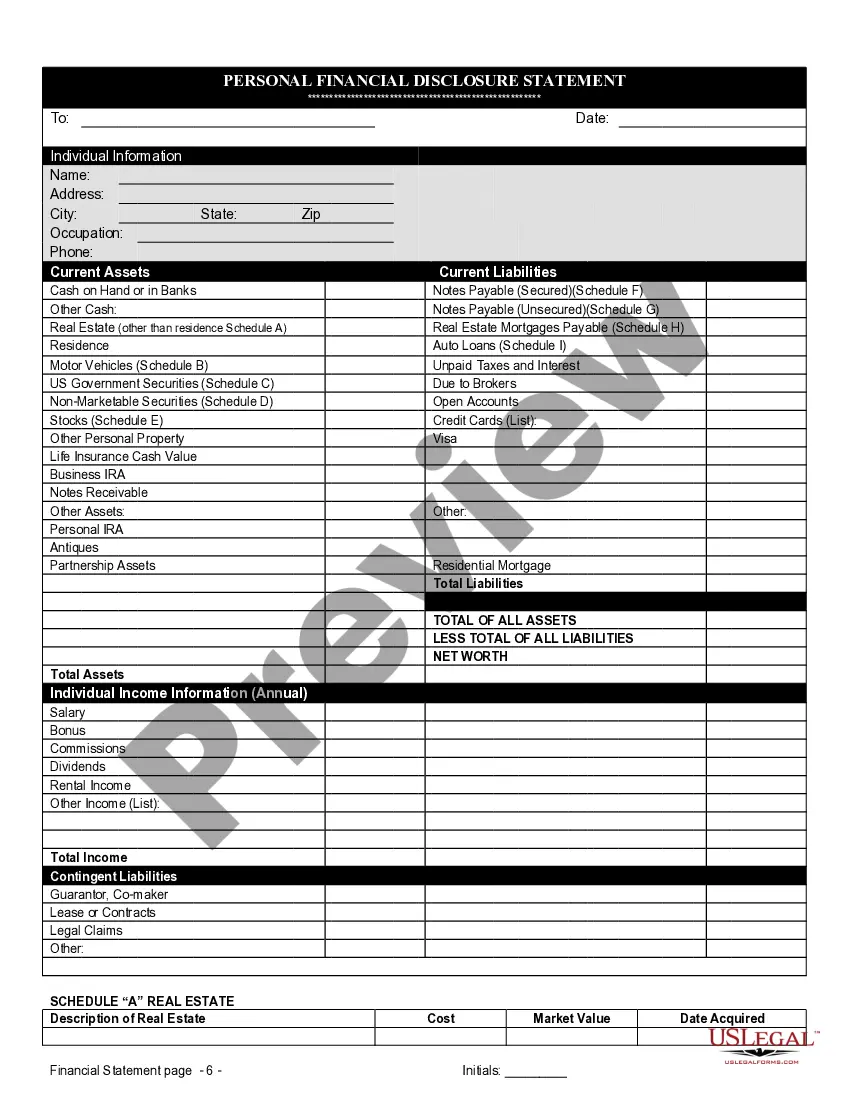

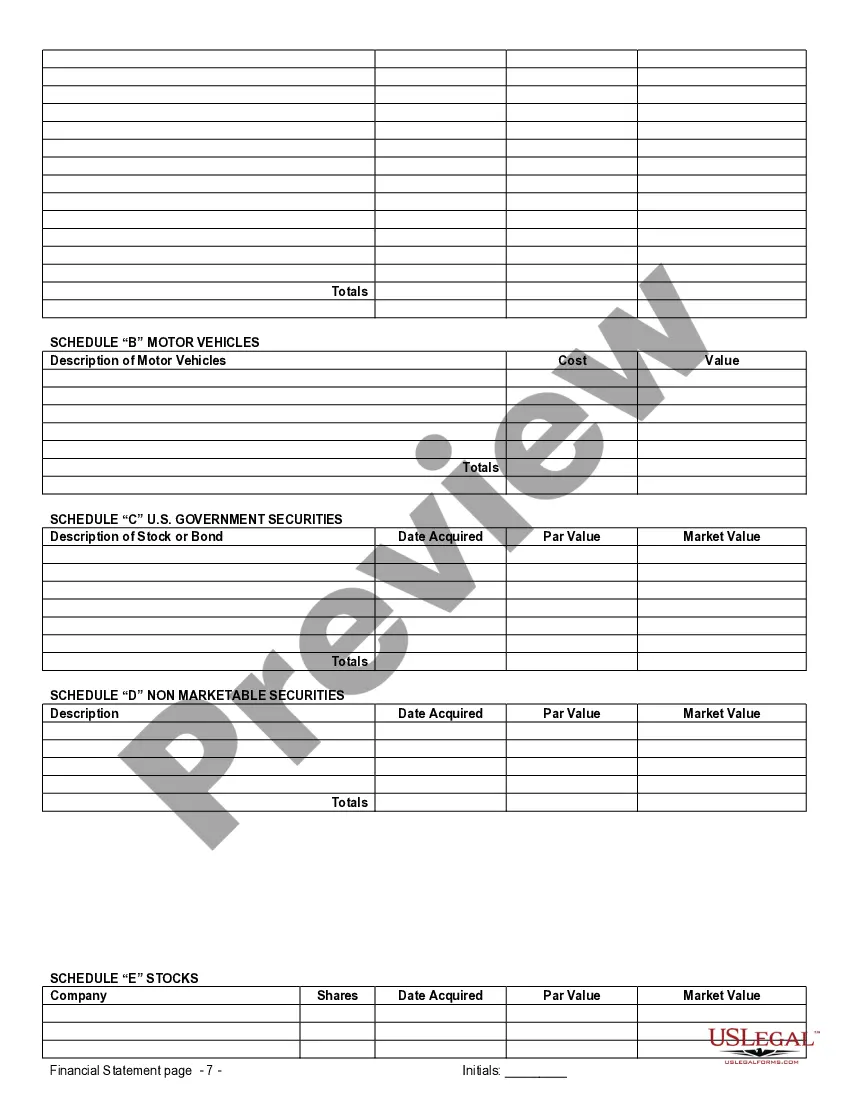

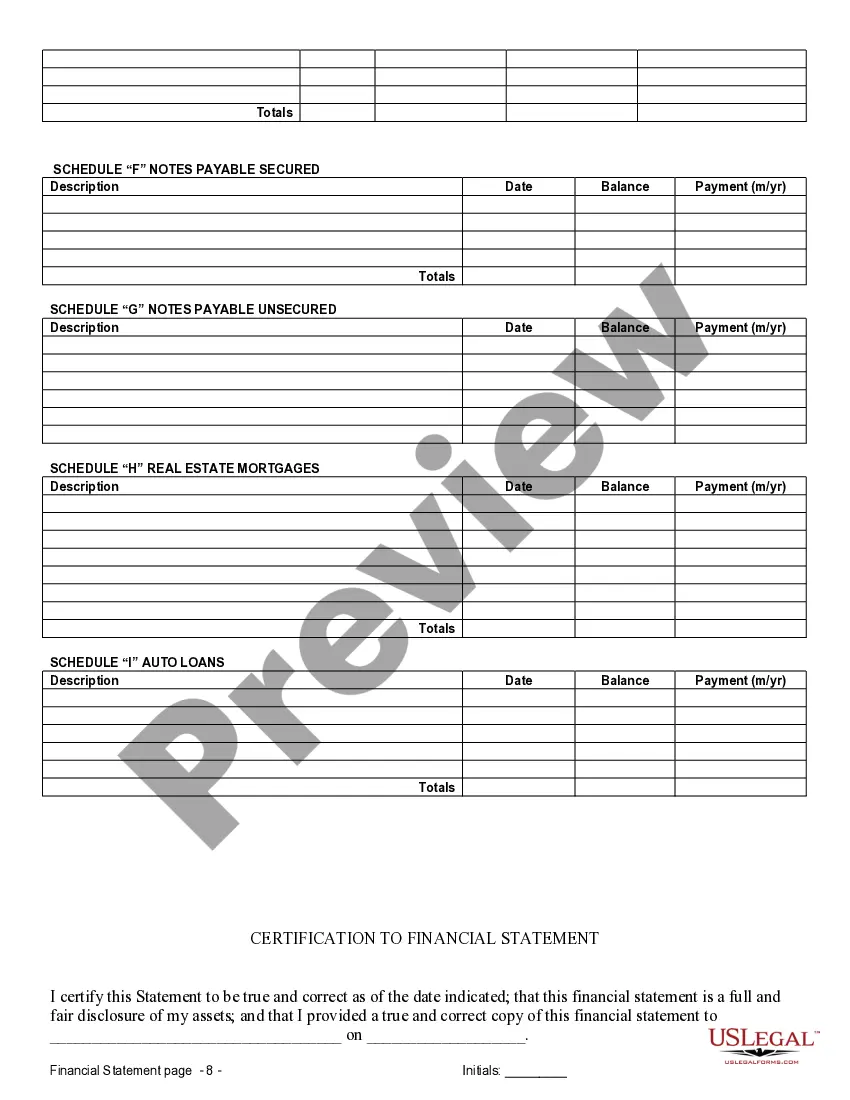

Sparks Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement serve as crucial documentation when entering into a legal contract that outlines the division of assets in the event of a divorce or separation between two parties. These statements provide a comprehensive overview of an individual's financial status, including their assets, liabilities, income, and expenses. By disclosing this information, both parties can make informed decisions and negotiate fair terms within the prenuptial agreement. There are different types of Sparks Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement, based on the level of detail and complexity required: 1. Basic Financial Statements: These statements include the essential financial information of each party, including their bank account balances, investment portfolios, real estate holdings, and outstanding debts such as mortgages or loans. Additionally, it may include information on income sources, such as salaries, bonuses, and any other regular or irregular earnings. 2. Detailed Asset Valuation Financial Statements: These statements provide an in-depth evaluation of the monetary value of each party's assets. This includes properties, vehicles, businesses, retirement accounts, stocks, and other investments. Accurate valuation is crucial to ensure an equitable division of assets in case of divorce or separation. 3. Income and Expense Financial Statements: These statements focus on documenting the sources of income and regular expenses of each party. The income section includes details of salaries, self-employment income, dividends, rental income, etc. Expenses section includes monthly bills, loan repayments, childcare costs, personal expenditures, and others. This level of detail helps provide a clear understanding of the financial resources and obligations of each party. 4. Debts and Liabilities Financial Statements: This type of statement concentrates on disclosing any financial obligations, such as outstanding loans, credit card debt, or lines of credit. Accurate representation of debts and liabilities is crucial in order to establish the distribution of responsibility and ensure that both parties are fully aware of their financial commitments. When creating Sparks Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement, accuracy and transparency are of utmost importance. It is highly recommended seeking the guidance of an attorney who specializes in family law, as they can provide expert advice to ensure that all financial information is properly disclosed and the prenuptial agreement effectively protects the interests of both parties.

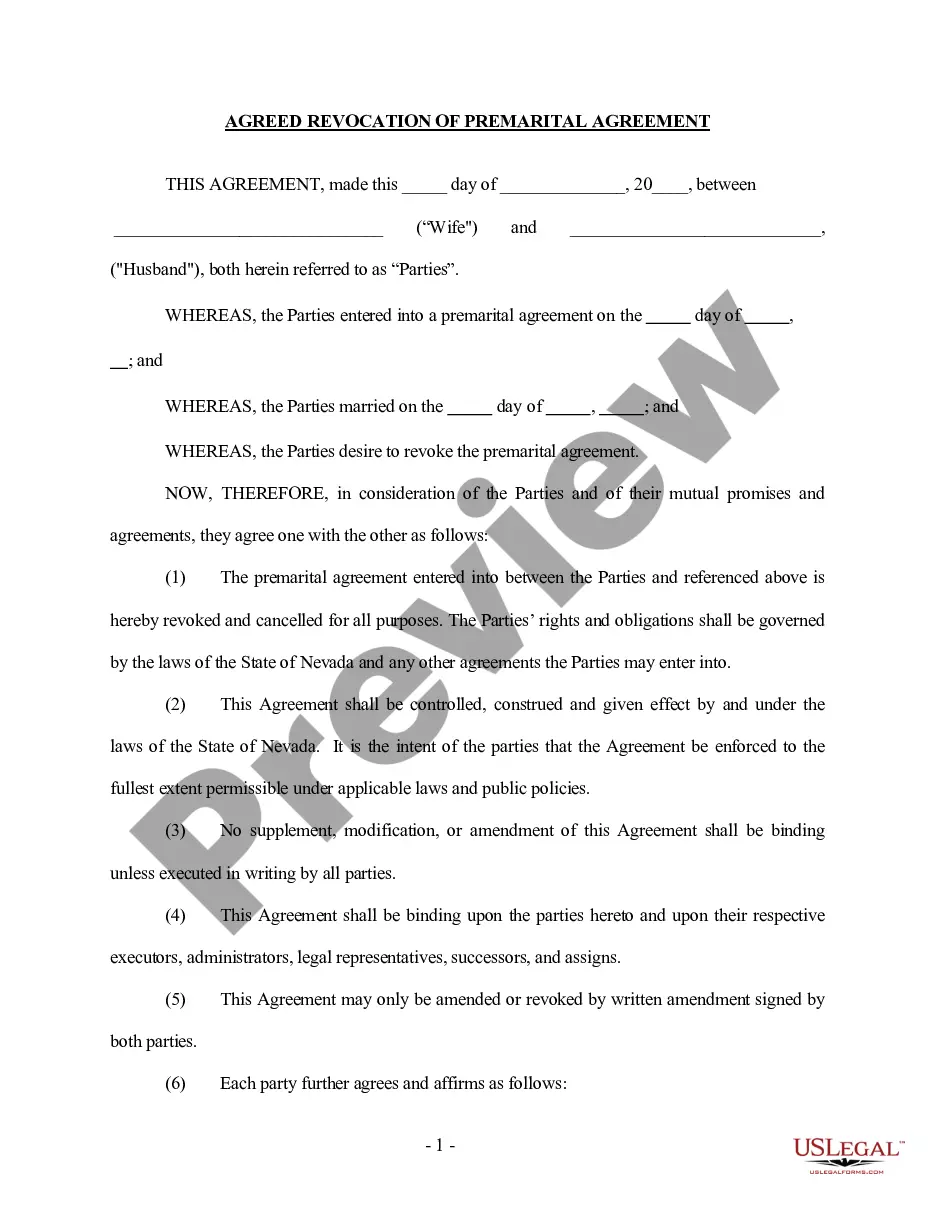

Sparks Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Sparks Nevada Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Are you looking for a reliable and affordable legal forms supplier to get the Sparks Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed based on the requirements of separate state and county.

To download the form, you need to log in account, locate the needed form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Sparks Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is intended for.

- Restart the search in case the form isn’t suitable for your legal situation.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is done, download the Sparks Nevada Financial Statements only in Connection with Prenuptial Premarital Agreement in any available file format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time learning about legal paperwork online for good.