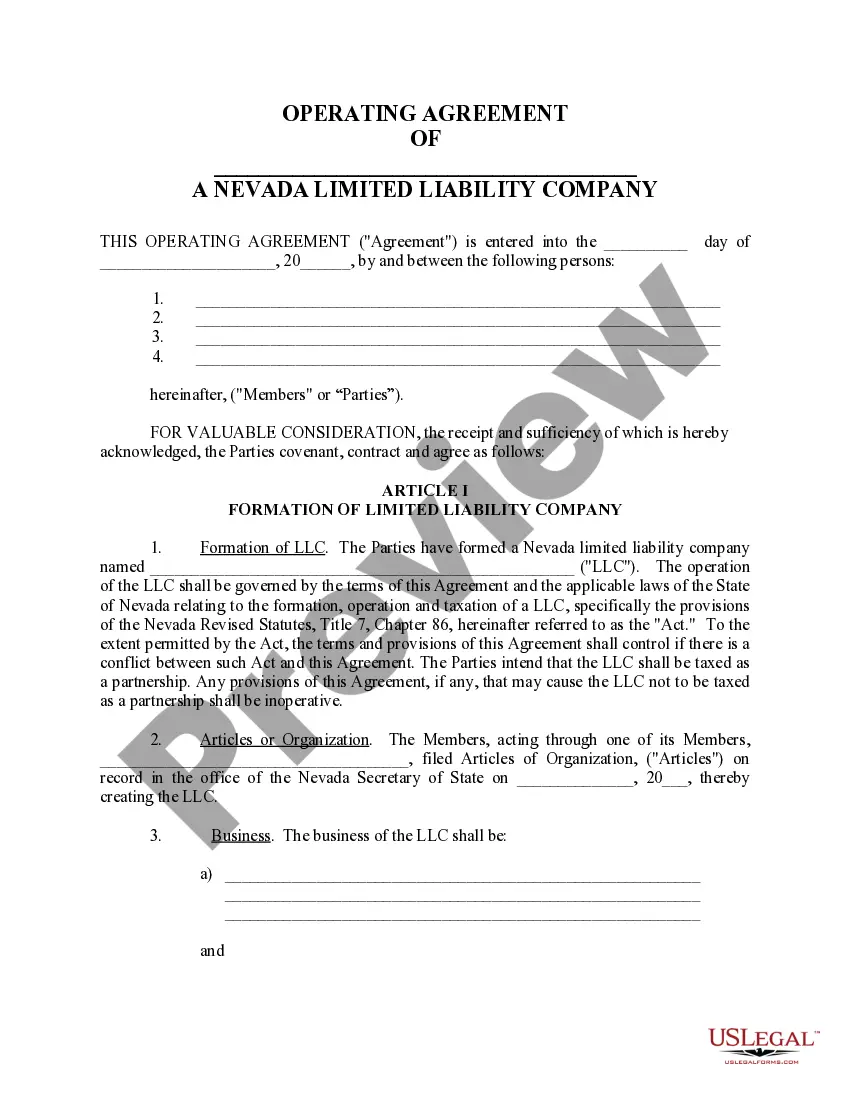

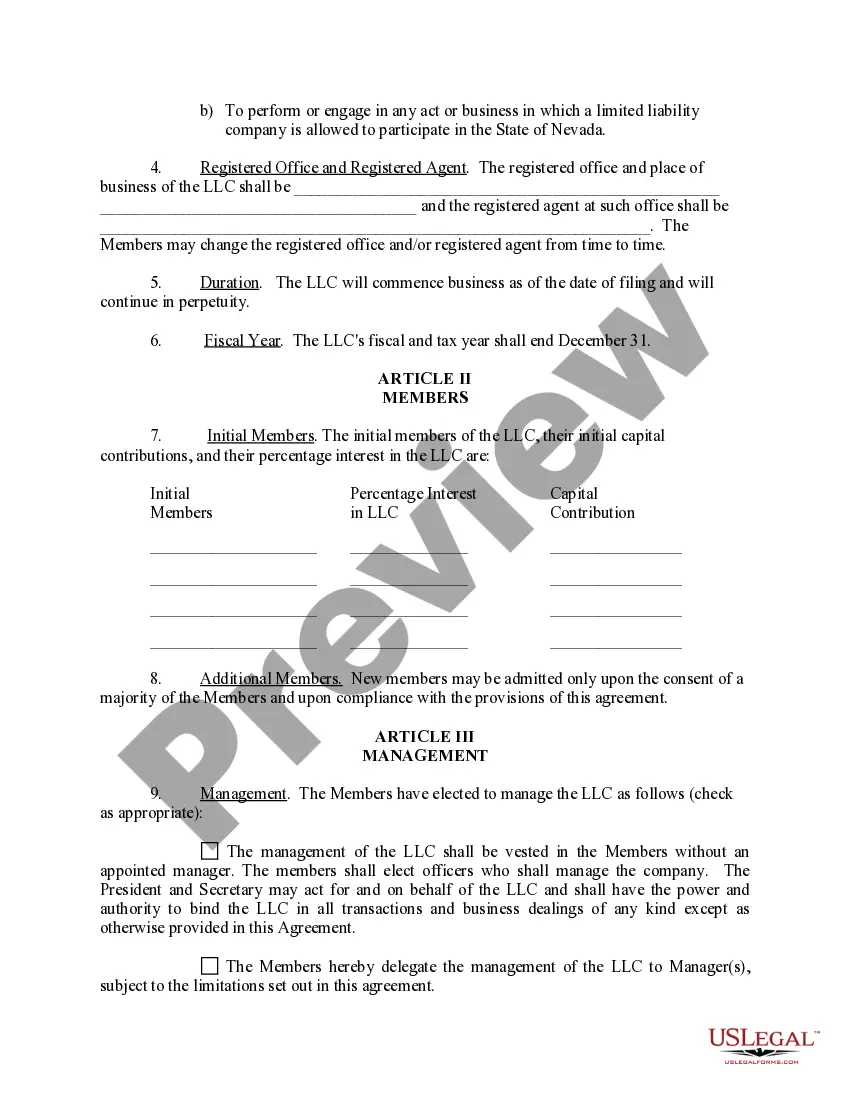

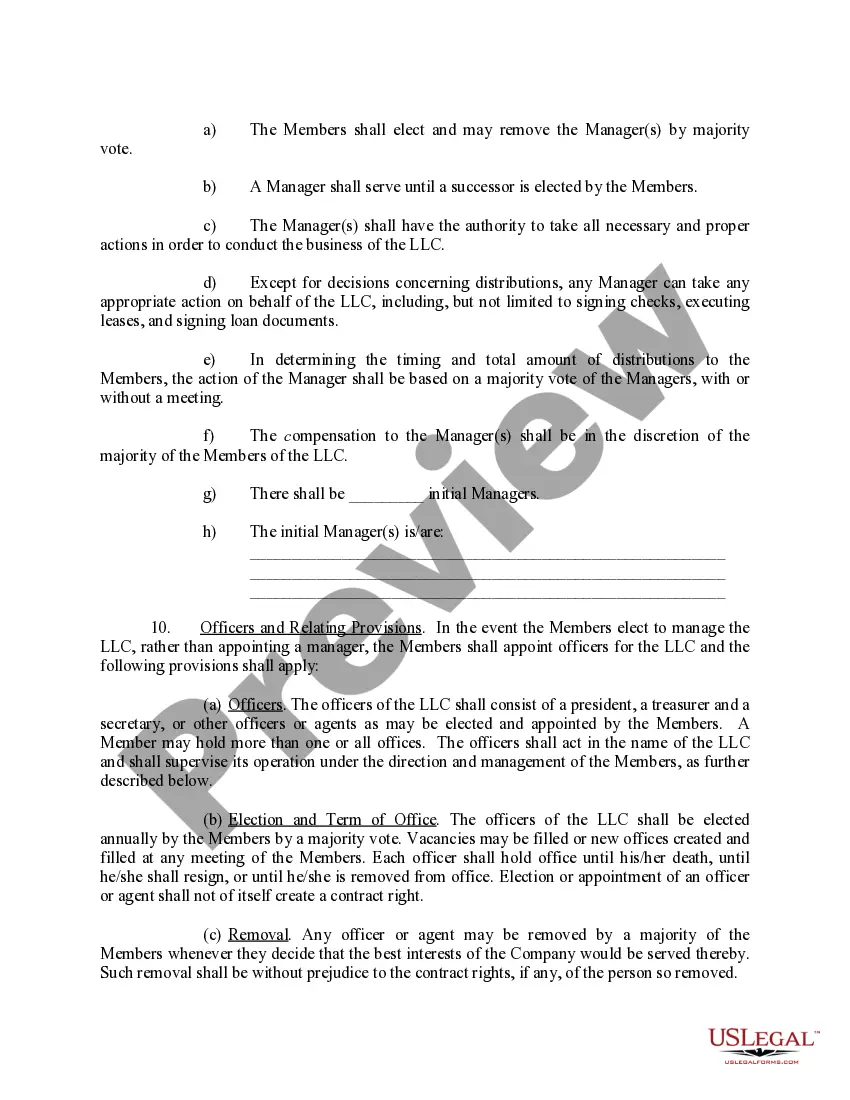

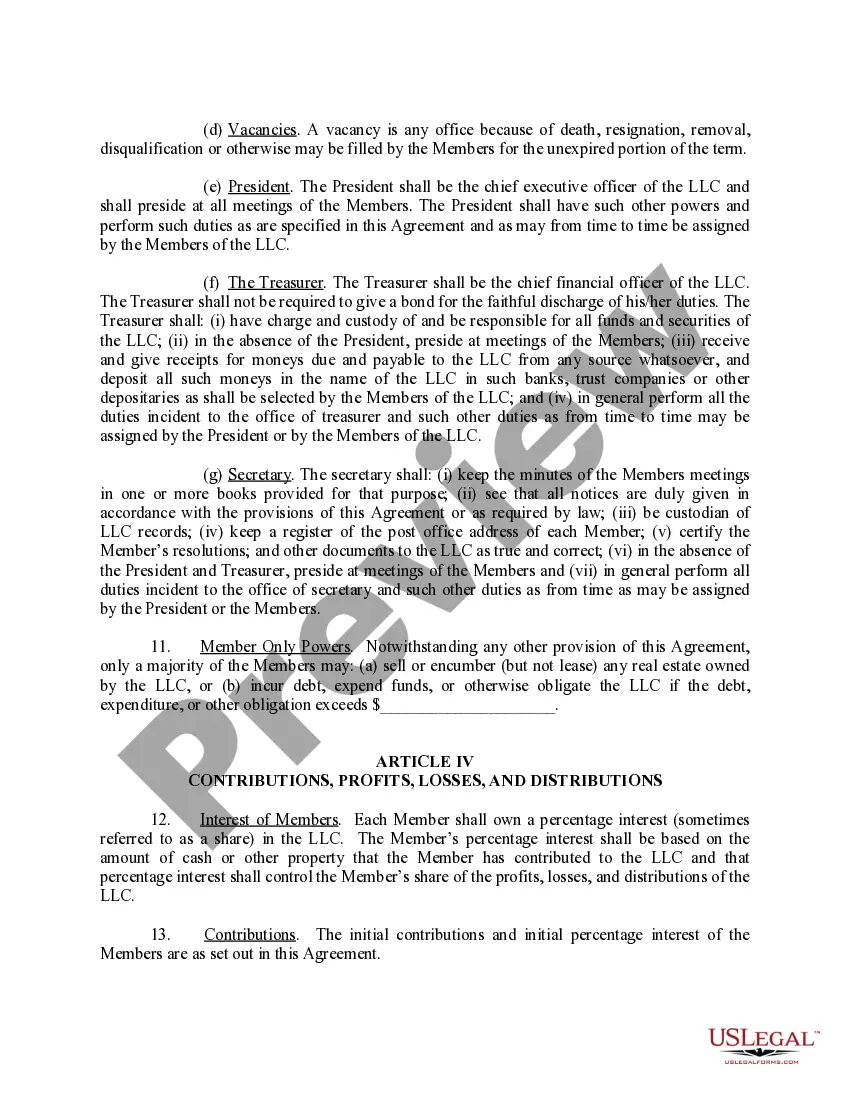

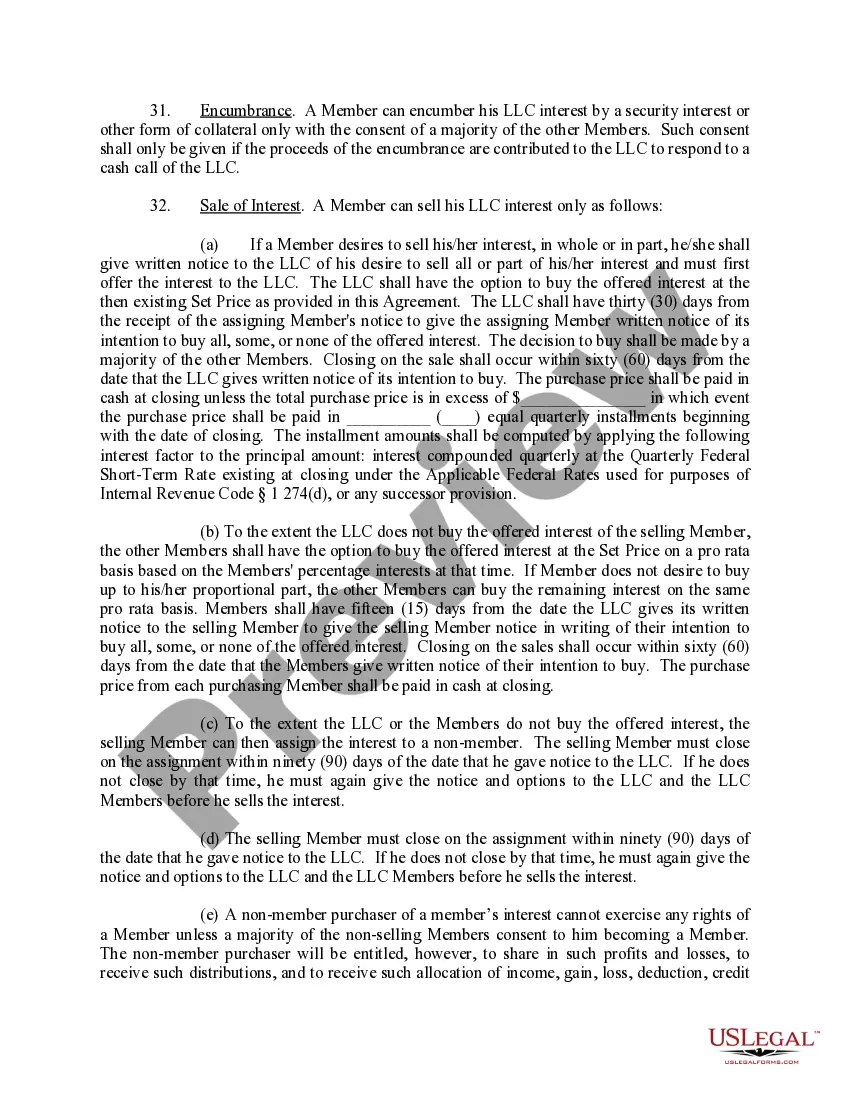

The Clark Nevada Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the rules, regulations, and internal workings of a specific LLC based in Clark County, Nevada. It serves as a crucial foundational document for the company, providing guidelines for operational procedures, member rights and responsibilities, and ownership structure. By having an operating agreement in place, business owners can establish a clear framework for decision-making, dispute resolution, and overall management. The Clark Nevada LLC Operating Agreement covers a wide range of essential aspects, including the following: 1. Formation: This section lays out the LLC's formation details, such as the company's name, principal place of business, and the duration of its existence. 2. Purpose: Here, the agreement defines the purpose and objectives of the LLC, making it clear what type of business activities it will engage in. 3. Members: This section outlines the owners (members) of the LLC, specifying their names, addresses, capital contributions, and the number of ownership units or percentage of interest assigned to each member. It may also describe the procedure for admitting new members or removing existing ones. 4. Management: The operating agreement will specify how the LLC will be managed. It can be either member-managed, where all members have the authority to participate in decision-making, or manager-managed, where a chosen manager or group of managers takes on the responsibility of running the business. 5. Voting and Decision-Making: This part addresses voting rights and how decisions are made within the LLC, whether it is through a majority vote, unanimity, or a weighted voting system. 6. Profit and Loss Distribution: The agreement details how profits and losses will be allocated among the members, which can be based on their ownership percentage or through other agreed-upon methods. 7. Capital Contributions: This section outlines the initial and subsequent monetary or non-monetary contributions made by each member, establishing their respective interests or units in the LLC. 8. Withdrawal and Dissolution: It defines the process and consequences should a member decide to withdraw from the LLC and provides guidelines on how the company can be dissolved if needed. It is important to note that while the basic structure and provisions of a Clark Nevada LLC Operating Agreement remain consistent, there may be different subtypes or variations tailored to specific circumstances. For example, there could be an agreement for a single-member LLC, which addresses the unique needs and obligations of a sole owner. Similarly, a multi-member LLC operating agreement may be designed to accommodate multiple owners, laying out additional provisions for managing conflicts, profit sharing, and decision-making processes. In conclusion, the Clark Nevada LLC Operating Agreement is a vital legal document that establishes the framework and internal guidelines for an LLC in Clark County, Nevada. By customizing this agreement to meet the specific needs and requirements of the company, owners can ensure a smooth operation and protect their interests.

Clark Operating

State:

Nevada

County:

Clark

Control #:

NV-00LLC-1

Format:

Word;

Rich Text

Instant download

Description clark liability

This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

The Clark Nevada Limited Liability Company (LLC) Operating Agreement is a legal document that outlines the rules, regulations, and internal workings of a specific LLC based in Clark County, Nevada. It serves as a crucial foundational document for the company, providing guidelines for operational procedures, member rights and responsibilities, and ownership structure. By having an operating agreement in place, business owners can establish a clear framework for decision-making, dispute resolution, and overall management. The Clark Nevada LLC Operating Agreement covers a wide range of essential aspects, including the following: 1. Formation: This section lays out the LLC's formation details, such as the company's name, principal place of business, and the duration of its existence. 2. Purpose: Here, the agreement defines the purpose and objectives of the LLC, making it clear what type of business activities it will engage in. 3. Members: This section outlines the owners (members) of the LLC, specifying their names, addresses, capital contributions, and the number of ownership units or percentage of interest assigned to each member. It may also describe the procedure for admitting new members or removing existing ones. 4. Management: The operating agreement will specify how the LLC will be managed. It can be either member-managed, where all members have the authority to participate in decision-making, or manager-managed, where a chosen manager or group of managers takes on the responsibility of running the business. 5. Voting and Decision-Making: This part addresses voting rights and how decisions are made within the LLC, whether it is through a majority vote, unanimity, or a weighted voting system. 6. Profit and Loss Distribution: The agreement details how profits and losses will be allocated among the members, which can be based on their ownership percentage or through other agreed-upon methods. 7. Capital Contributions: This section outlines the initial and subsequent monetary or non-monetary contributions made by each member, establishing their respective interests or units in the LLC. 8. Withdrawal and Dissolution: It defines the process and consequences should a member decide to withdraw from the LLC and provides guidelines on how the company can be dissolved if needed. It is important to note that while the basic structure and provisions of a Clark Nevada LLC Operating Agreement remain consistent, there may be different subtypes or variations tailored to specific circumstances. For example, there could be an agreement for a single-member LLC, which addresses the unique needs and obligations of a sole owner. Similarly, a multi-member LLC operating agreement may be designed to accommodate multiple owners, laying out additional provisions for managing conflicts, profit sharing, and decision-making processes. In conclusion, the Clark Nevada LLC Operating Agreement is a vital legal document that establishes the framework and internal guidelines for an LLC in Clark County, Nevada. By customizing this agreement to meet the specific needs and requirements of the company, owners can ensure a smooth operation and protect their interests.

Free preview clark company llc

How to fill out Clark Nevada Limited Liability Company LLC Operating Agreement?

If you’ve already utilized our service before, log in to your account and save the Clark Nevada Limited Liability Company LLC Operating Agreement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Clark Nevada Limited Liability Company LLC Operating Agreement. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!