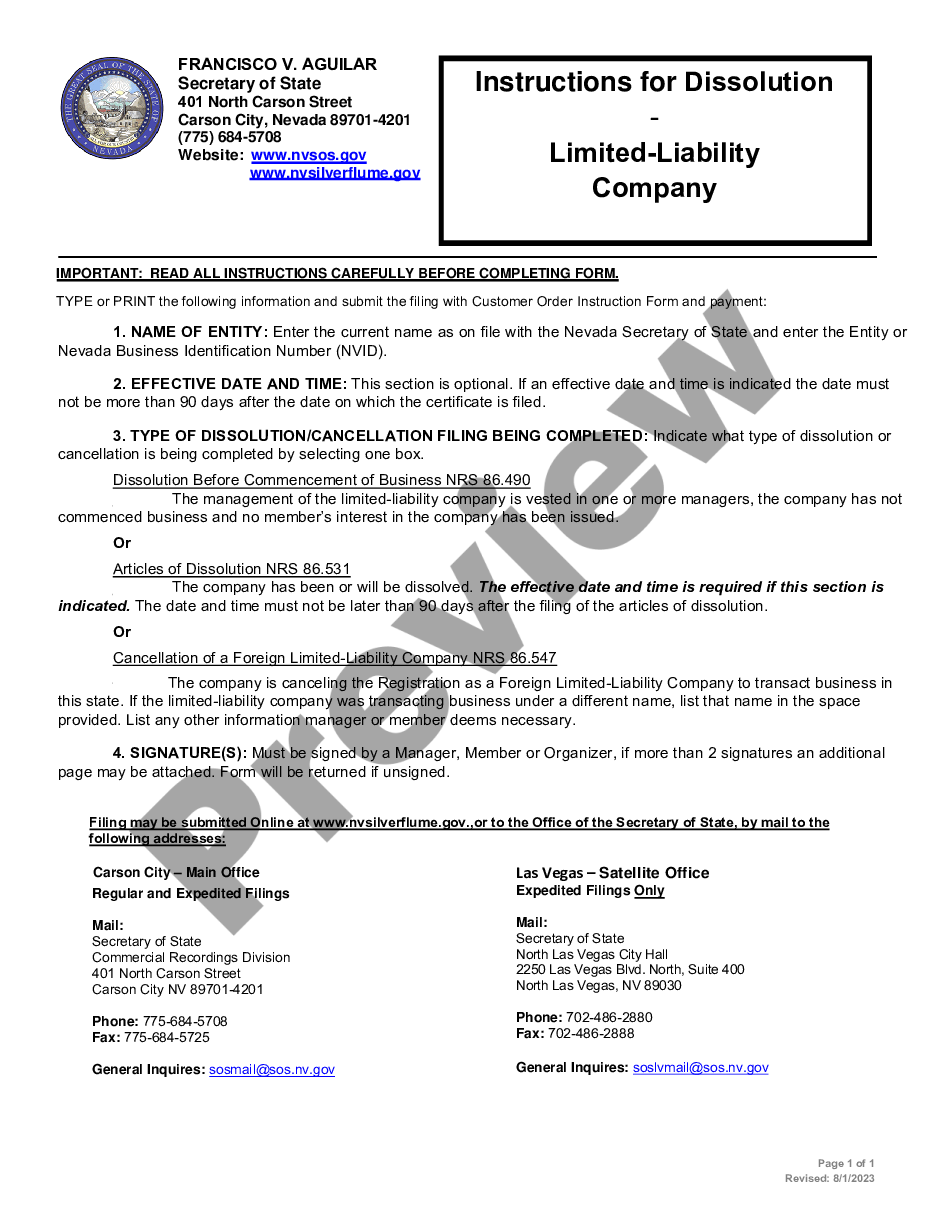

A Clark Nevada Single Member Limited Liability Company LLC Operating Agreement is a legal document that outlines the operations and management of a specific type of business entity in Clark County, Nevada. This agreement serves as a set of rules and guidelines that govern the internal affairs of a single-member limited liability company (LLC). The Clark Nevada Single Member LLC Operating Agreement is designed to cater specifically to LCS with only one member or owner. It lays out the rights and responsibilities of the single member, as well as the procedures for decision-making and other key business matters. Some essential components commonly covered in a Clark Nevada Single Member LLC Operating Agreement include: 1. Name and Purpose: The agreement specifies the official name of the LLC and its purpose or nature of the business it engages in. 2. Member Contributions: It outlines the initial capital or assets contributed by the single member to start the LLC and any future contributions expected. 3. Management and Authority: This section defines the authority of the single member in managing business decisions and operations. It may specify whether the member will act as the sole manager or if they can appoint a manager. 4. Voting and Decision-Making: The agreement sets out rules regarding voting and decision-making processes. It may outline whether each member's voting power is solely based on their ownership percentage or if decisions require unanimity. 5. Allocation of Profits and Losses: This section determines how profits and losses will be divided among the members. In a single-member LLC, the owner typically receives all profits and is responsible for all losses. 6. Distribution of Assets: It covers how the LLC's assets will be distributed upon dissolution or member withdrawal. 7. Resolutions and Amendments: The agreement may include provisions for making resolutions and amending the operating agreement, specifying the necessary procedures and voting requirements. It's important to note that while there may be different variations of a Clark Nevada Single Member LLC Operating Agreement, the core components mentioned above generally remain consistent. However, the specific details and provisions may differ depending on the individual needs and preferences of the LLC owner. Several variations or types of Clark Nevada Single Member LLC Operating Agreements may exist, such as: 1. Standard Single Member Operating Agreement: This is a basic agreement that covers essential elements of the LLC's operations, suitable for simpler business structures. 2. Customized Single Member Operating Agreement: This agreement is tailored to include additional provisions or clauses that best suit the unique requirements of the LLC. 3. Profession-Specific Single Member Operating Agreement: For LCS engaged in specific professions (e.g., healthcare, law, architecture), this agreement may include clauses addressing regulatory compliance, ethics, and professional duties. 4. Single Member Operating Agreement with Asset Protection Provisions: This type of agreement includes specific asset protection strategies and provisions aimed at safeguarding the single member's personal assets from potential liabilities of the LLC. In conclusion, a Clark Nevada Single Member Limited Liability Company LLC Operating Agreement is a crucial document that outlines the governance and internal working of a single-member LLC. The agreement ensures clarity and provides a framework for decision-making, profit distribution, and asset allocation, tailored to meet the specific needs of the single member and comply with Nevada state laws.

Clark Company

State:

Nevada

County:

Clark

Control #:

NV-00LLC-2

Format:

Word;

Rich Text

Instant download

Description

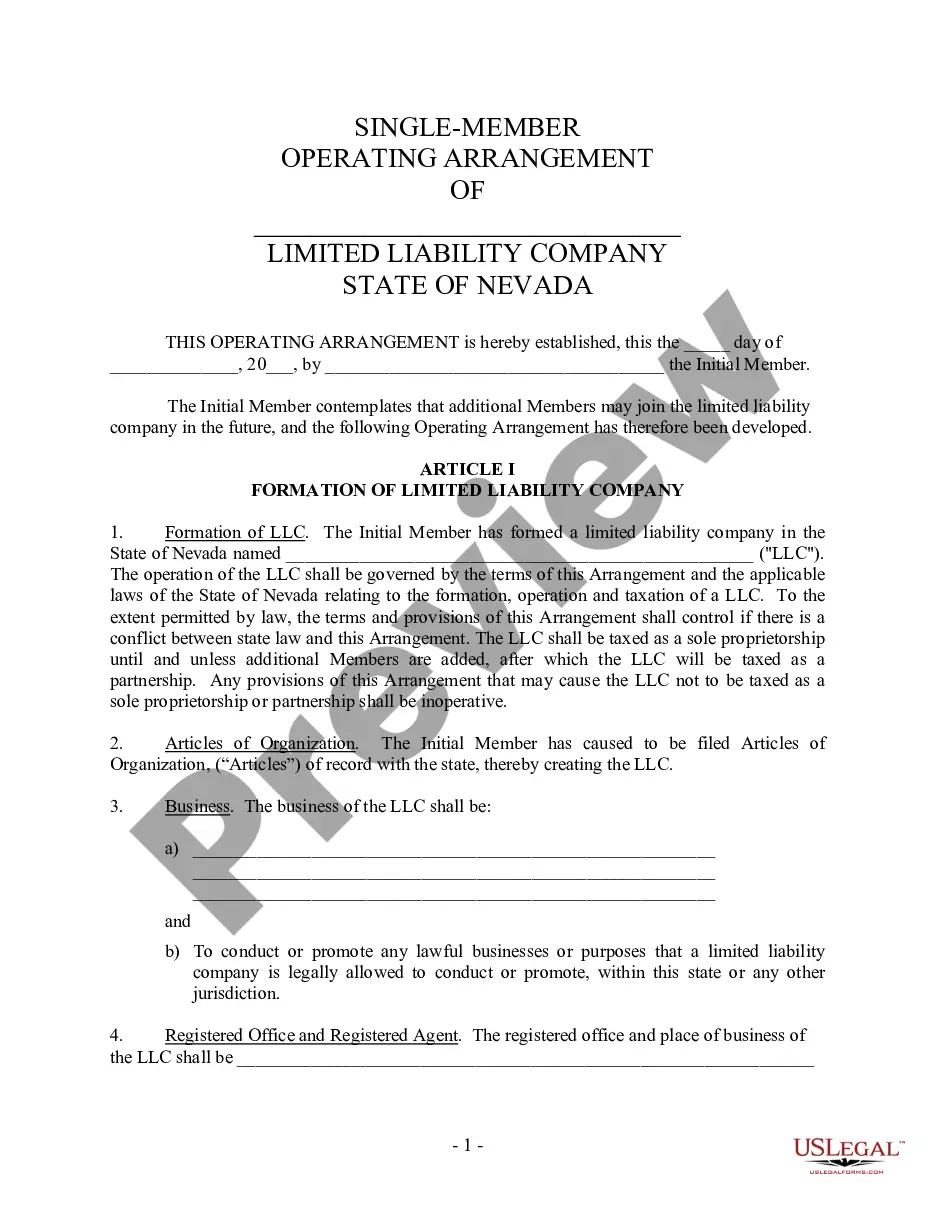

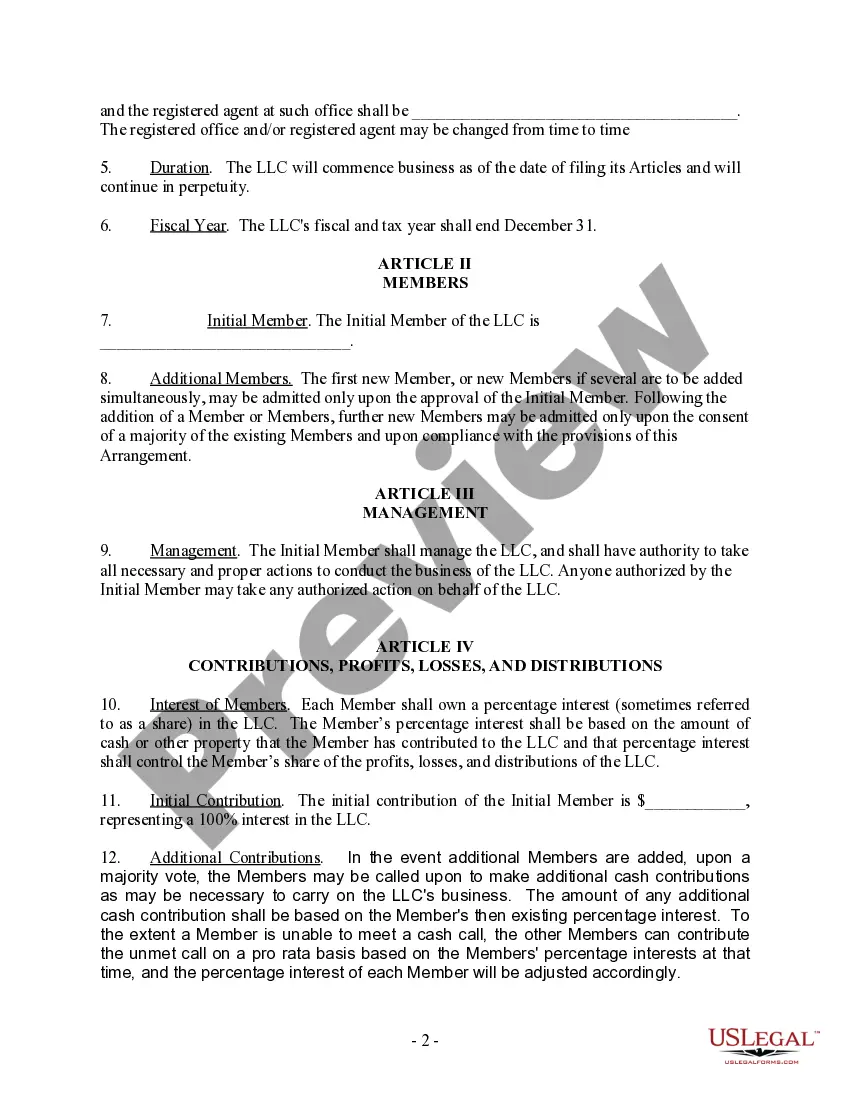

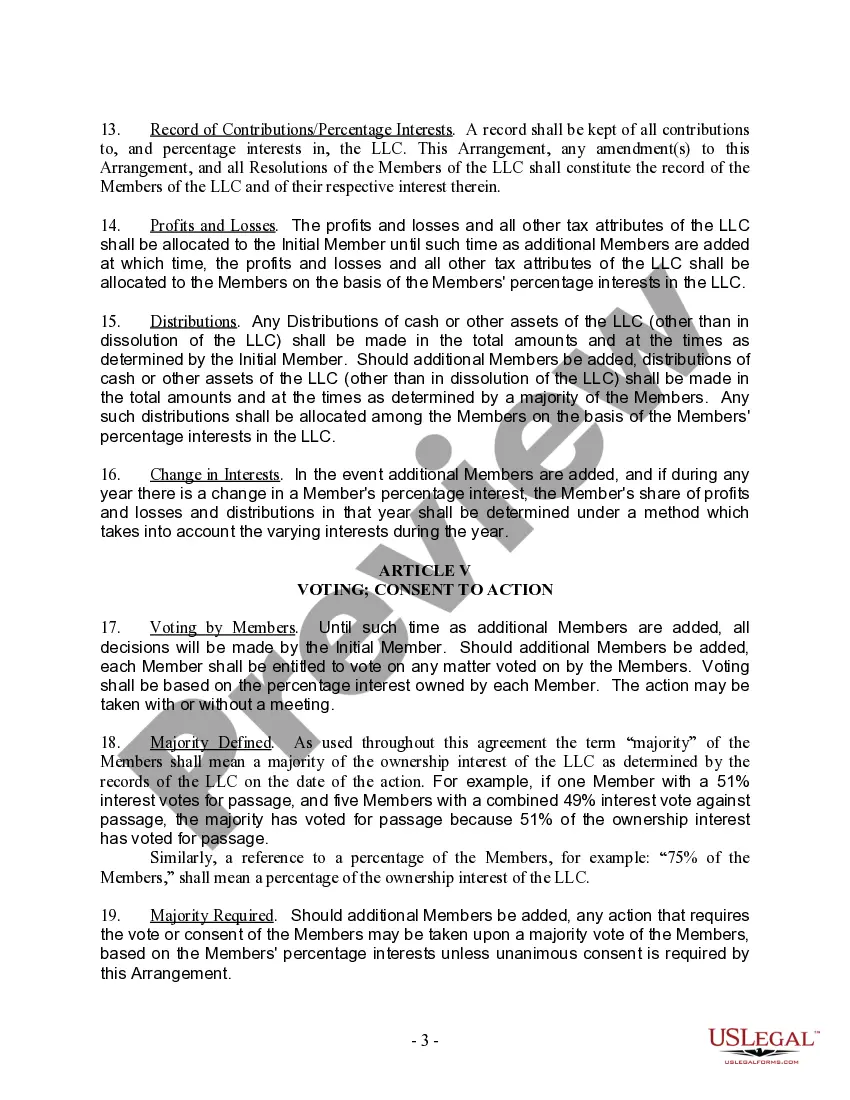

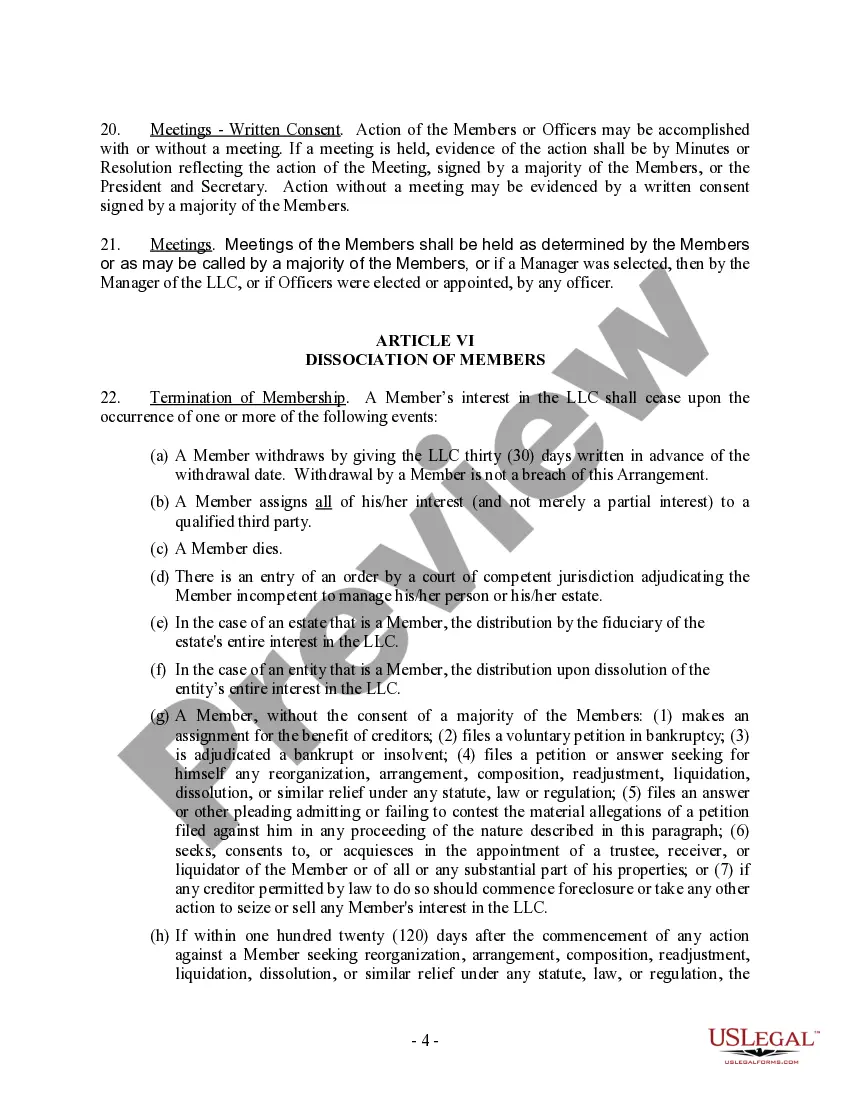

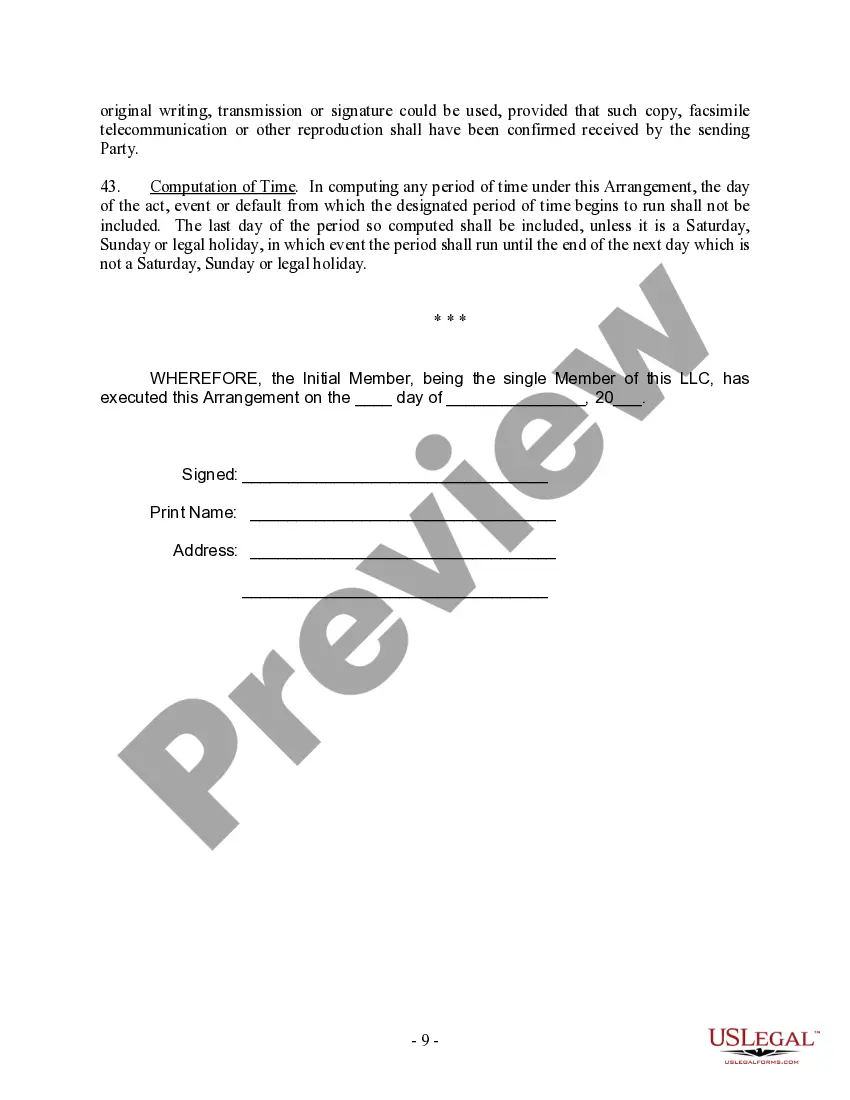

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

A Clark Nevada Single Member Limited Liability Company LLC Operating Agreement is a legal document that outlines the operations and management of a specific type of business entity in Clark County, Nevada. This agreement serves as a set of rules and guidelines that govern the internal affairs of a single-member limited liability company (LLC). The Clark Nevada Single Member LLC Operating Agreement is designed to cater specifically to LCS with only one member or owner. It lays out the rights and responsibilities of the single member, as well as the procedures for decision-making and other key business matters. Some essential components commonly covered in a Clark Nevada Single Member LLC Operating Agreement include: 1. Name and Purpose: The agreement specifies the official name of the LLC and its purpose or nature of the business it engages in. 2. Member Contributions: It outlines the initial capital or assets contributed by the single member to start the LLC and any future contributions expected. 3. Management and Authority: This section defines the authority of the single member in managing business decisions and operations. It may specify whether the member will act as the sole manager or if they can appoint a manager. 4. Voting and Decision-Making: The agreement sets out rules regarding voting and decision-making processes. It may outline whether each member's voting power is solely based on their ownership percentage or if decisions require unanimity. 5. Allocation of Profits and Losses: This section determines how profits and losses will be divided among the members. In a single-member LLC, the owner typically receives all profits and is responsible for all losses. 6. Distribution of Assets: It covers how the LLC's assets will be distributed upon dissolution or member withdrawal. 7. Resolutions and Amendments: The agreement may include provisions for making resolutions and amending the operating agreement, specifying the necessary procedures and voting requirements. It's important to note that while there may be different variations of a Clark Nevada Single Member LLC Operating Agreement, the core components mentioned above generally remain consistent. However, the specific details and provisions may differ depending on the individual needs and preferences of the LLC owner. Several variations or types of Clark Nevada Single Member LLC Operating Agreements may exist, such as: 1. Standard Single Member Operating Agreement: This is a basic agreement that covers essential elements of the LLC's operations, suitable for simpler business structures. 2. Customized Single Member Operating Agreement: This agreement is tailored to include additional provisions or clauses that best suit the unique requirements of the LLC. 3. Profession-Specific Single Member Operating Agreement: For LCS engaged in specific professions (e.g., healthcare, law, architecture), this agreement may include clauses addressing regulatory compliance, ethics, and professional duties. 4. Single Member Operating Agreement with Asset Protection Provisions: This type of agreement includes specific asset protection strategies and provisions aimed at safeguarding the single member's personal assets from potential liabilities of the LLC. In conclusion, a Clark Nevada Single Member Limited Liability Company LLC Operating Agreement is a crucial document that outlines the governance and internal working of a single-member LLC. The agreement ensures clarity and provides a framework for decision-making, profit distribution, and asset allocation, tailored to meet the specific needs of the single member and comply with Nevada state laws.

Free preview

How to fill out Clark Nevada Single Member Limited Liability Company LLC Operating Agreement?

If you’ve already used our service before, log in to your account and save the Clark Nevada Single Member Limited Liability Company LLC Operating Agreement on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Clark Nevada Single Member Limited Liability Company LLC Operating Agreement. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!