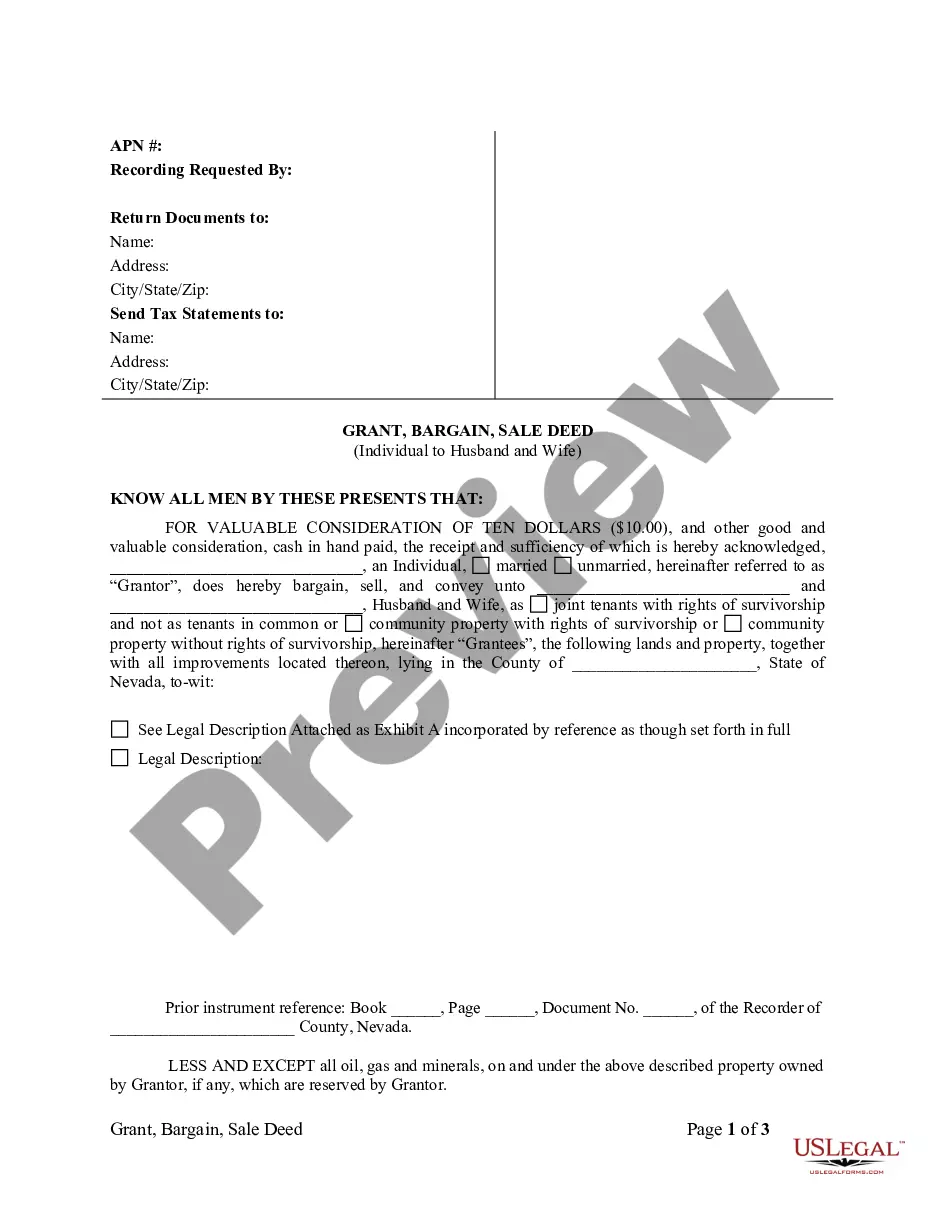

The Clark Nevada Grant, Bargain, Sale Deed from Individual to Husband and Wife is a legal document that transfers ownership of a property from an individual to a married couple in Clark County, Nevada. This deed ensures that both individuals are recognized as joint owners of the property. Keywords: Clark Nevada Grant, Bargain, Sale Deed, Individual, Husband and Wife, Ownership, Property Transfer, Legal Document, Clark County, Nevada, Joint Owners. There are different types of Clark Nevada Grant, Bargain, Sale Deed from Individual to Husband and Wife: 1. General Warranty Deed: This type of deed guarantees that the seller (the individual) has clear ownership of the property and has the right to sell it. It also provides the buyers (the husband and wife) with protection against any future claims on the property. 2. Special Warranty Deed: This type of deed is similar to a general warranty deed, but it only guarantees that the seller has not caused any title defects during their ownership of the property. It does not provide protection against claims that may have existed before the seller owned the property. 3. Quitclaim Deed: A quitclaim deed transfers whatever ownership interest the seller (the individual) has in the property to the buyers (the husband and wife). This type of deed does not guarantee or warrant that the seller has any ownership interest in the property, making it a riskier option for buyers. 4. Grant Deed: A grant deed transfers ownership of the property from the seller to the buyers, guaranteeing that the seller has not transferred the property to anyone else and that the property is free from any undisclosed encumbrances or liens. Each of these deed types has its own specific purpose and level of protection for the buyers. It is important for the individuals involved to carefully consider their options and consult with legal professionals to determine the most suitable type of deed for their specific situation.

Clark Nevada Grant, Bargain, Sale Deed from Individual to Husband and Wife

Description

How to fill out Clark Nevada Grant, Bargain, Sale Deed From Individual To Husband And Wife?

No matter the social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no legal education to draft such paperwork from scratch, mainly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you require the Clark Nevada Grant, Bargain, Sale Deed from Individual to Husband and Wife or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Clark Nevada Grant, Bargain, Sale Deed from Individual to Husband and Wife in minutes using our reliable platform. If you are presently an existing customer, you can proceed to log in to your account to download the appropriate form.

However, in case you are new to our library, ensure that you follow these steps prior to downloading the Clark Nevada Grant, Bargain, Sale Deed from Individual to Husband and Wife:

- Be sure the template you have found is suitable for your area because the regulations of one state or county do not work for another state or county.

- Preview the form and read a short outline (if provided) of scenarios the paper can be used for.

- If the form you selected doesn’t suit your needs, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Clark Nevada Grant, Bargain, Sale Deed from Individual to Husband and Wife as soon as the payment is through.

You’re good to go! Now you can proceed to print the form or complete it online. Should you have any issues getting your purchased forms, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form popularity

FAQ

Quitclaim deed. A bargain and sale deed implies or infers that the seller has ownership of the property and can transfer its title, and is most common in foreclosure or tax sales.

A bargain and sale with covenants against grantor's acts contains only one covenant or promise; that is, that the grantor has done nothing to encumber title with easements, liens, judgements and the like while owing the property. The covenant contained in the deed is considered personal. It does not run with the land.

A Nevada quitclaim deed is a form of deed that functions essentially like a release. It transfers any title, interest, or claim the person signing the deed holds in the real estate with no promises regarding the quality of the transferred interest.

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

Nevada law recognizes three general types of deeds for transferring real estate: a general warranty deed form; a grant, bargain, and sale deed form; and a quitclaim deed form. These three forms vary according to the guaranty the current owner provides?if any?regarding the quality of the property's title.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

?Adding someone to a deed? means transferring ownership to that person. The transfer of ownership can occur during life (with a regular quitclaim deed, for example) or at death (using a lady bird deed, transfer-on-death-deed, or life estate deed).

You would need to record a new Deed document in the Washoe County Recorder's Office to change how title is held to your property. You can obtain document forms from local office supply stores, or legal counsel can draw them up.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

A Nevada grant, bargain, and sale deed form is a statutorily authorized form of deed that transfers real estate with warranty of title limited to the period while the current owner held the property. 2. Grant, bargain, and sale deeds convey Nevada real estate with special warranties.

Interesting Questions

More info

One is a beneficiary of the property by his will. Eve 2, 20 volumes Paging 24 If two or more owners have the same title to a parcel, the property is considered one title and is treated as such by tax collectors. Eve, 25 volumes Paging 6 All conveyances and transfers by any person, other than a sole owner, and all transfers by any person, whether a sole owner, partner, trustee, director, partner of another partner or non-resident, of a share in a corporation with power of attorney as principal and with no right to sell, or assign, any share, if any such share is to be sold or assigned, either in whole or in part, and excepting a sale or assignment to a minor, unless otherwise specified, were made and executed in the name of and only for the benefit of the same corporation.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.