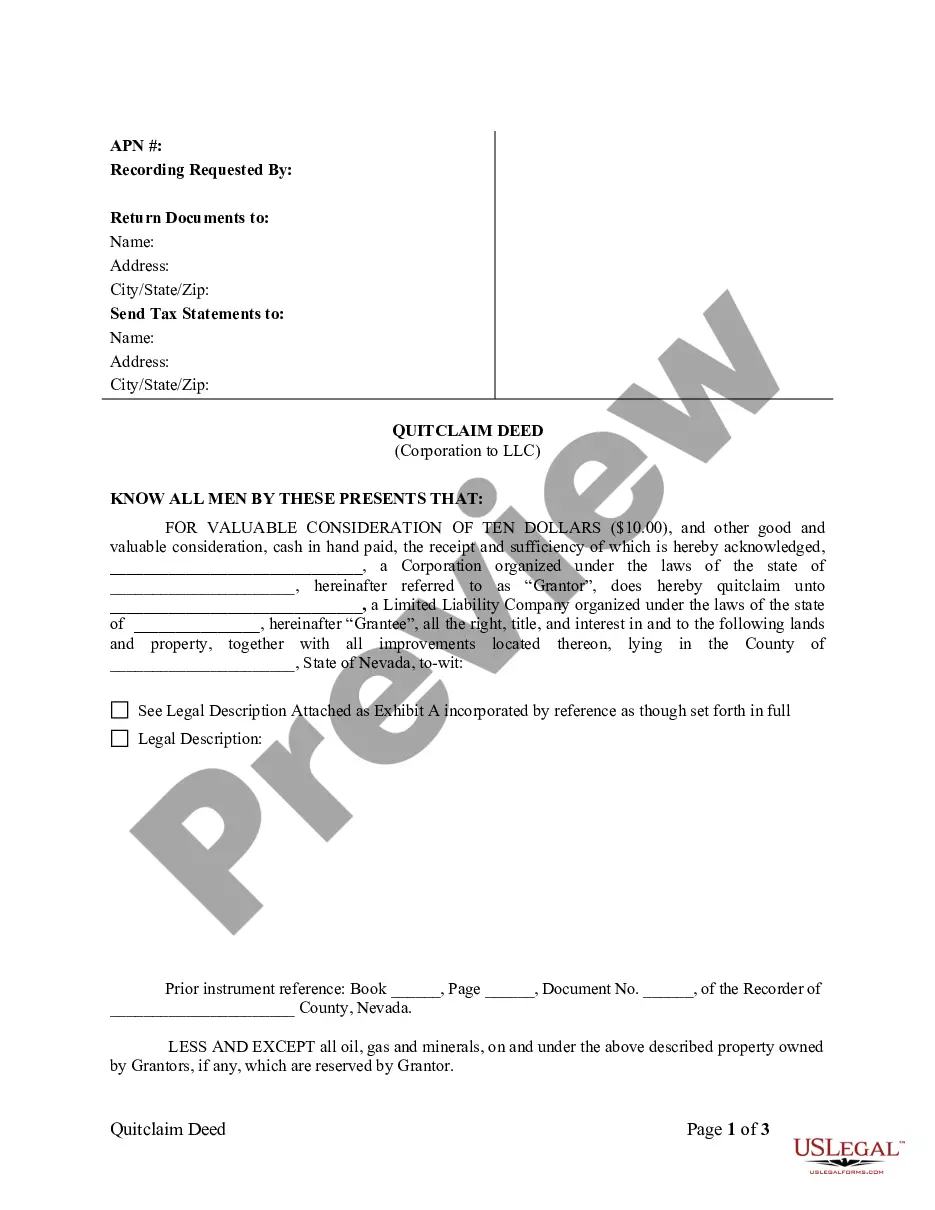

Sparks Nevada Quitclaim Deed from Corporation to LLC: A Comprehensive Guide In Sparks, Nevada, a Quitclaim Deed from Corporation to LLC is a legal document commonly used when transferring property ownership from a corporation to a limited liability company (LLC). This type of deed ensures a smooth and transparent transfer while safeguarding the rights and interests of both entities involved in the transaction. A Sparks Nevada Quitclaim Deed from Corporation to LLC serves as a legally binding contract that details the transfer of property rights, titles, and interests from a corporation to an LLC. By executing this deed, the corporation relinquishes any claims it may have had on the property, thereby transferring it wholly and unencumbered to the LLC. This type of transfer is often sought when a corporation decides to restructure its ownership or investment strategy, and transferring property assets to an LLC is deemed beneficial. LCS provide more flexibility, limited liability, and favorable tax treatment compared to corporations. Therefore, by transferring the property to an LLC, the corporation can benefit from these advantages while maintaining control or involvement, if desired. There are different types of Quitclaim Deeds that can be utilized in Sparks, Nevada, with slight variations depending on the specific requirements and circumstances of the transfer. Some common types include: 1. Standard Sparks Nevada Quitclaim Deed from Corporation to LLC: This is the most straightforward type of deed, used when transferring ownership of a property from a corporation to an LLC without any exceptional terms or conditions. 2. Non-Arms Length Sparks Nevada Quitclaim Deed from Corporation to LLC: In cases where there is a pre-existing relationship between the corporation and the LLC, such as common ownership or control, a non-arms length quitclaim deed is used. This type of deed is executed to reflect the relationship and ensure compliance with legal and tax regulations. 3. Subject-to Sparks Nevada Quitclaim Deed from Corporation to LLC: A subject-to quitclaim deed is utilized when the property being transferred has an existing mortgage or lien. By using this deed, the LLC assumes the property ownership subject to the outstanding mortgage or lien, thus taking over responsibility for the debt. It is essential to consult with a qualified real estate attorney or title company familiar with Sparks, Nevada's laws and regulations to ensure the proper drafting and execution of the Quitclaim Deed. This will help to protect the interests of both the corporation and the LLC involved in the transfer, ensuring a seamless transition of property ownership. In conclusion, a Sparks Nevada Quitclaim Deed from Corporation to LLC is a crucial legal instrument used for transferring property ownership from a corporation to an LLC. By employing the appropriate type of deed, corporations can leverage the benefits offered by LCS, such as limited liability and favorable tax treatment, while maintaining control or involvement in the property. Seeking professional legal assistance is strongly advised to ensure compliance with all legal requirements and to protect the rights and interests of all parties involved.

Sparks Nevada Quitclaim Deed from Corporation to LLC

Description

How to fill out Sparks Nevada Quitclaim Deed From Corporation To LLC?

Do you need a trustworthy and inexpensive legal forms provider to get the Sparks Nevada Quitclaim Deed from Corporation to LLC? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set regulations for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Sparks Nevada Quitclaim Deed from Corporation to LLC conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is intended for.

- Start the search over in case the template isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Sparks Nevada Quitclaim Deed from Corporation to LLC in any provided format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending hours learning about legal papers online once and for all.

Form popularity

FAQ

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

Nevada law recognizes three general types of deeds for transferring real estate: a general warranty deed form; a grant, bargain, and sale deed form; and a quitclaim deed form. These three forms vary according to the guaranty the current owner provides?if any?regarding the quality of the property's title.

Avoiding Personal Liability This is the major advantage of an LLC. You want the best option for limiting your personal liability should an unforeseen circumstance arise relating to your property. LLCs provide that protection.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

To file a quitclaim deed in Nevada, you will need to contact the Recorder of Deeds in the county in which the property is located and ask about the county's specific requirements for quitclaim deeds.

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The title is transferred without any amendments or additions.

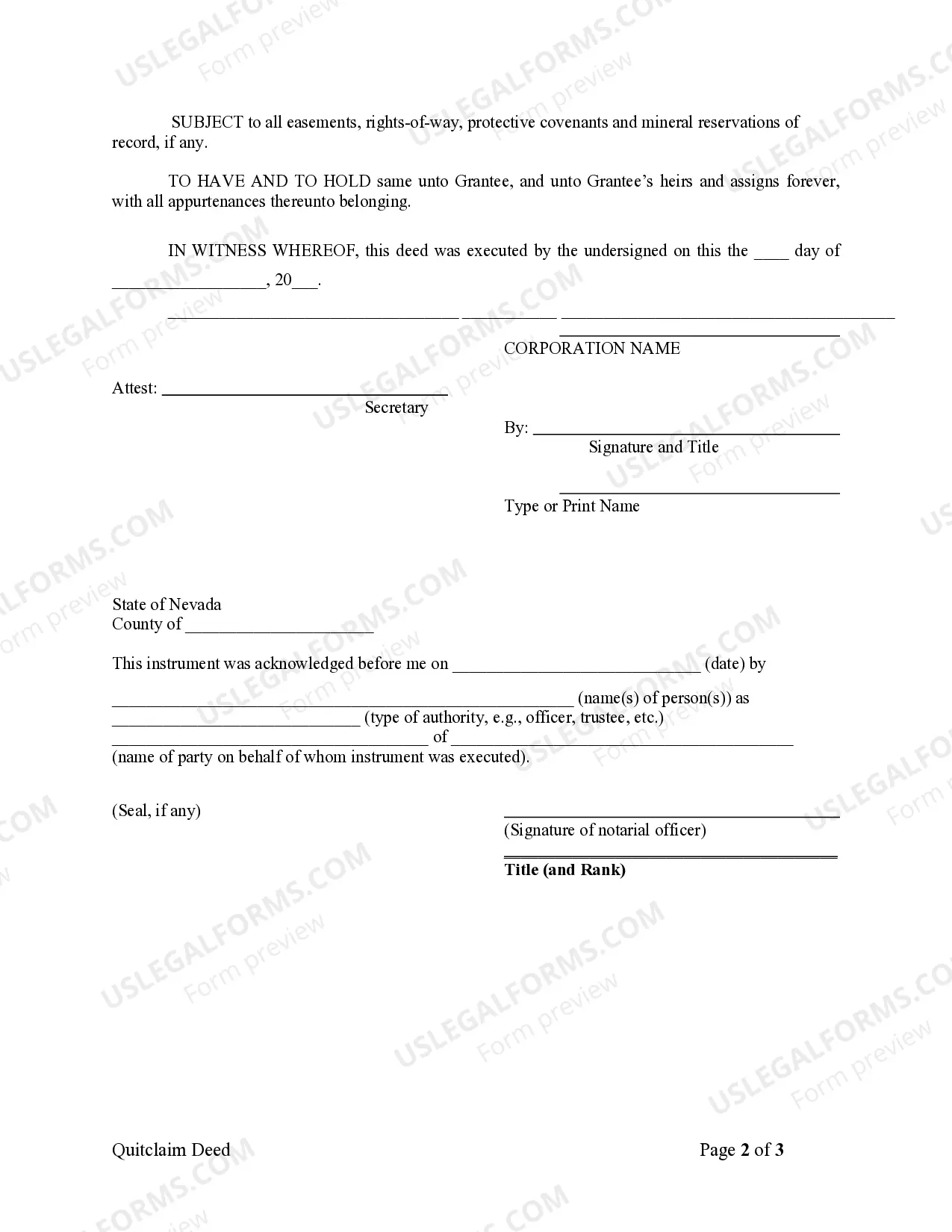

Nevada law requires that deeds include certain information to be recordable and validly transfer ownership of real estate. Names and addresses, a legal description and parcel number for the property, and the current owner's notarized signature all must appear within a quitclaim deed or other Nevada deed.

Here are eight steps on how to transfer property title to an LLC: Contact Your Lender.Form an LLC.Obtain a Tax ID Number and Open an LLC Bank Account.Obtain a Form for a Deed.Fill out the Warranty or Quitclaim Deed Form.Sign the Deed to Transfer Property to the LLC.Record the Deed.Change Your Lease.

A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Under Nevada law, a quitclaim deed must be in writing, contain a legal description of the property, and meet specific signing and acknowledgment requirements. You must pay a transfer tax and record the deed.