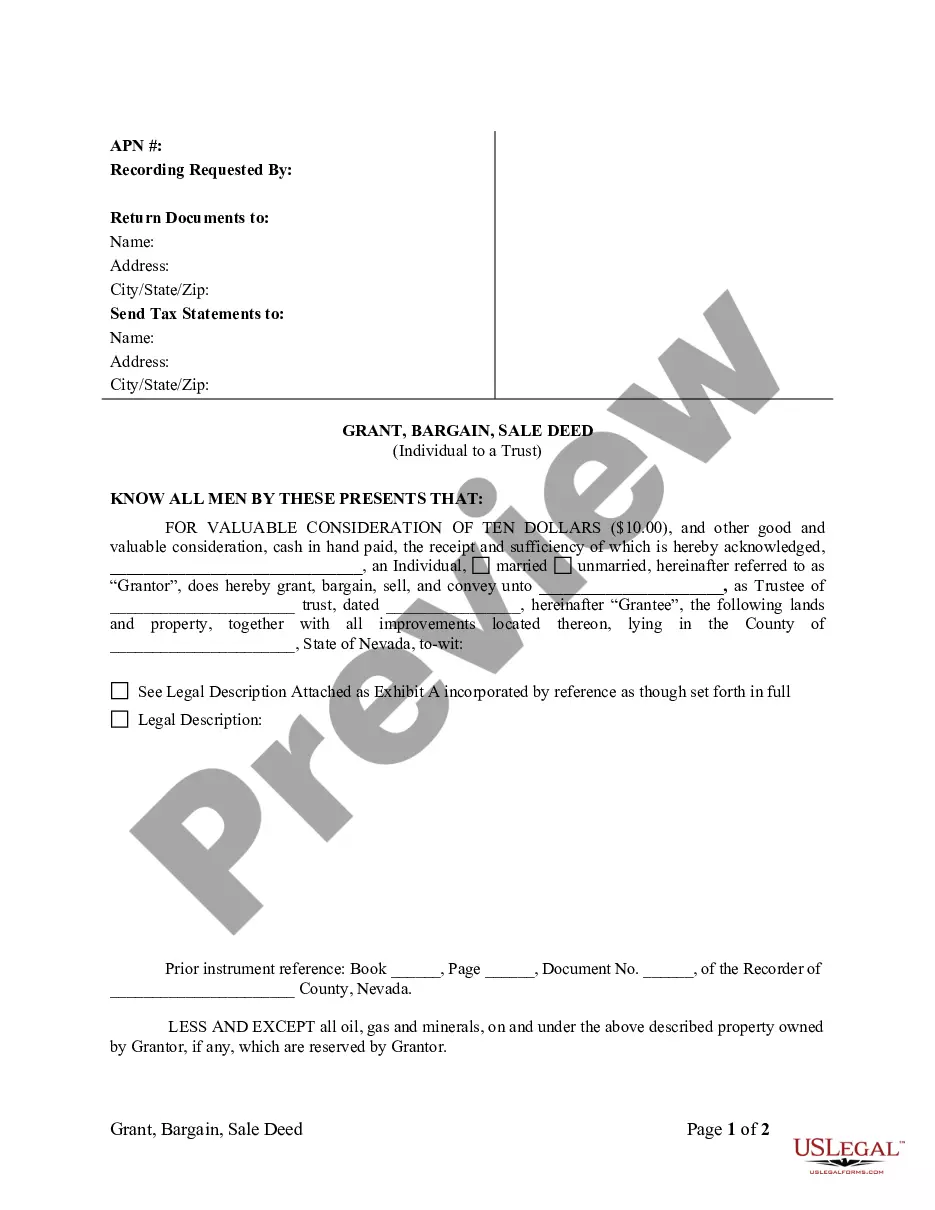

Clark Nevada Grant, Bargain, Sale Deed from Individual to a Trust is a legal document used in real estate transactions in Clark County, Nevada. This specific type of deed involves the transfer of property ownership from an individual to a trust. The purpose of this deed is to ensure that the property is properly titled under the trust's name, allowing for better estate planning, asset protection, and conveyance of property. In this type of transaction, the individual who currently holds the property transfers their ownership rights to a trust, which then becomes the legal owner of the property. The trust can be a revocable living trust, irrevocable trust, or any other type of trust established under Nevada law. The granter is the individual transferring the property, while the grantee is the trust that will receive the property. By transferring the property to a trust, the granter ensures that the property's ownership and management will be handled in accordance with the trust agreement. This can be beneficial in various situations, such as estate planning, asset protection, or facilitating the transfer of property to beneficiaries after the granter's passing. Additionally, placing the property in a trust can provide certain tax advantages and help avoid probate proceedings. It's important to note that there may be different variations or types of Clark Nevada Grant, Bargain, Sale Deed from Individual to a Trust, depending on specific circumstances or particular legal requirements. Some variations might include: 1. Revocable Living Trust Deed: This type of deed involves transferring the property to a revocable living trust, allowing the granter to retain control over the property during their lifetime and make changes to the trust as desired. 2. Irrevocable Trust Deed: In this case, the property is transferred to an irrevocable trust, which means that the granter cannot undo or change the trust without the consent of the beneficiaries. This type of trust can provide greater asset protection and may have different tax considerations. 3. Special Needs Trust Deed: This type of deed is used when transferring property to a trust specifically created for the benefit of a person with special needs. The trust ensures that the individual's access to government benefits is not affected while still providing for their long-term care and support. 4. Charitable Remainder Trust Deed: This variation involves transferring property to a charitable trust, where the granter retains an income interest for a specified period, after which the remaining assets in the trust are donated to a chosen charity. When entering into any Clark Nevada Grant, Bargain, Sale Deed from Individual to a Trust, it is crucial to consult with an experienced attorney or real estate professional familiar with Nevada laws to ensure compliance and to address any specific requirements or considerations related to the transfer of property ownership to a trust.

Clark Nevada Grant, Bargain, Sale Deed from Individual to a Trust

Description

How to fill out Clark Nevada Grant, Bargain, Sale Deed From Individual To A Trust?

If you’ve already used our service before, log in to your account and save the Clark Nevada Grant, Bargain, Sale Deed from Individual to a Trust on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Clark Nevada Grant, Bargain, Sale Deed from Individual to a Trust. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!

Form popularity

FAQ

Upon the transfer of any real property in the State of Nevada, a special tax called the Real Property Transfer Tax is imposed. The County Recorder in the county where the property is located is the agency responsible for the imposition and collection of the tax at the time the transfer is recorded.

A bargain and sale with covenants against grantor's acts contains only one covenant or promise; that is, that the grantor has done nothing to encumber title with easements, liens, judgements and the like while owing the property. The covenant contained in the deed is considered personal. It does not run with the land.

Quitclaim deed. A bargain and sale deed implies or infers that the seller has ownership of the property and can transfer its title, and is most common in foreclosure or tax sales.

Step 1. Determine and prepare the needed requirements for a title transfer. Deed of Conveyance.Photocopies of valid IDs of all signatories in the deed.The Notary Public's official receipt for the deed's notarization. Certified True Copy of the Title (3 copies)Certified True Copy of the latest Tax Declaration.

A grant deed is used to transfer ownership of real property, often in conjunction with tax or foreclosure sales. It offers more protection to the buyer than a quitclaim deed but less than a general warranty deed.

Deed. Deeds are valuable to buyers because they provide certain protections regarding the sale of property. A grant deed is a deed that ?grants? certain promises to the buyer: The property has not already been transferred to someone else.

The Nevada Deed Upon Death is like a regular deed you might use to transfer real estate located in Nevada, but with a crucial difference: It doesn't take effect until your death. At your death, the real estate goes automatically to the person you named to inherit it, without the need for probate court proceedings.

Nevada law recognizes three general types of deeds for transferring real estate: a general warranty deed form; a grant, bargain, and sale deed form; and a quitclaim deed form. These three forms vary according to the guaranty the current owner provides?if any?regarding the quality of the property's title.

The Grantee and Grantor are jointly and severally liable for the payment of the tax. When all taxes and recording fees required are paid, the deed is recorded. Each County Recorder's Office: 1.

How Much Are Transfer Taxes in Nevada? Nevada's statewide real property transfer tax is $1.95 per $500 of value over $100. Some counties in Nevada, such as Washoe and Churchill, add $0.10 to the rate.

Interesting Questions

More info

The City and Chamber of Commerce are not part of the same entity. There are two separate entities. The Office of Legislative Services (or LS or LP or LC of course) is also separate from the City and the Chamber of Commerce. 3) The City×LC is the City's governing body, but there are other governmental agencies that are not city owned such as Parks & Recreation, Board of Supervisors for sure. 4) Clark County is the City and County of Clark, Nevada and the County Clerk & Recorder. Clark County is an entirely separate entity from the City which is why the county is often referred to as just the “County.” The City of Clark has a single owner×manager (Barrack) in addition to several elected offices including City Council, Police Chief and City Manager. Additionally, there are many city funded committees and commissions that support and administer the day-to-day operations of the City.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.