Title: Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife: Explained with Different Variations Introduction: In the state of Nevada, a unique type of property deed known as the "Grant, Bargain, and Sale Deed from Husband to Himself and Wife" holds importance for married individuals seeking to transfer ownership of property to both themselves and their spouse. This article aims to provide a detailed description of this particular deed, its purpose, legal implications, and variations that exist within Sparks Nevada. 1. Understanding the Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife: The Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife is a legal instrument used to facilitate the transfer of property ownership between a husband and wife in Nevada. This deed is designed to establish joint ownership of real estate while ensuring the property remains a marital asset. 2. Purpose and Benefits: The primary purpose of this deed is to warrant and guarantee the transfer of property rights between spouses, providing each party with an undivided interest in the property. This transaction generally occurs when a husband, who owns a property in his sole name, wants to include his wife as a co-owner, resulting in equal ownership rights. By executing this deed, the husband and wife acquire a shared interest in the property, meaning they both hold equal rights to utilize, transfer, or dispose of the property. This ensures that both parties enjoy the benefits and protections of joint ownership while reinforcing their marital property rights. 3. Legal Implications and Considerations: The Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife carries legal significance and has several implications worth considering: a) Marital Asset Protection: By including both spouses as co-owners, the property becomes a marital asset, offering safeguards in case of divorce or separation while ensuring equitable distribution during property division. b) Joint Tenancy or Community Property: Depending on the specific situation and personal preferences, the husband and wife can choose either joint tenancy or community property ownership. Joint tenancy includes a right of survivorship, while community property signifies equal ownership without survivorship rights. c) Possible Tax Implications: Property transfers, even within marriage, might have tax implications. Seeking guidance from a tax professional is advisable to understand any potential tax consequences associated with this type of deed. 4. Variations of Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife: Although the general concept remains the same, there might be additional variations or specific names of this deed, such as: a) Sparks Nevada Joint Grant Deed: This variation indicates joint ownership without specifying spouse-to-spouse transfer. It can apply to any two individuals wishing to acquire ownership as co-tenants. b) Sparks Nevada Community Property Grant Deed: This variation emphasizes the intent for the property to be considered community property, conveying equal ownership rights and shared interest between spouses. c) Sparks Nevada Survivorship Deed: Similar to a traditional Grant, Bargain, Sale Deed, here the emphasis is on establishing survivorship rights between spouses, allowing the surviving spouse to automatically assume full ownership upon the other's death. Conclusion: The Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife serves as a crucial legal instrument in Nevada, granting married couples the opportunity to share equal ownership of real estate. By using the appropriate variations of this deed, spouses can customize their property ownership structure to suit their specific requirements and goals, ensuring both partners enjoy the benefits of joint ownership while protecting their marital assets.

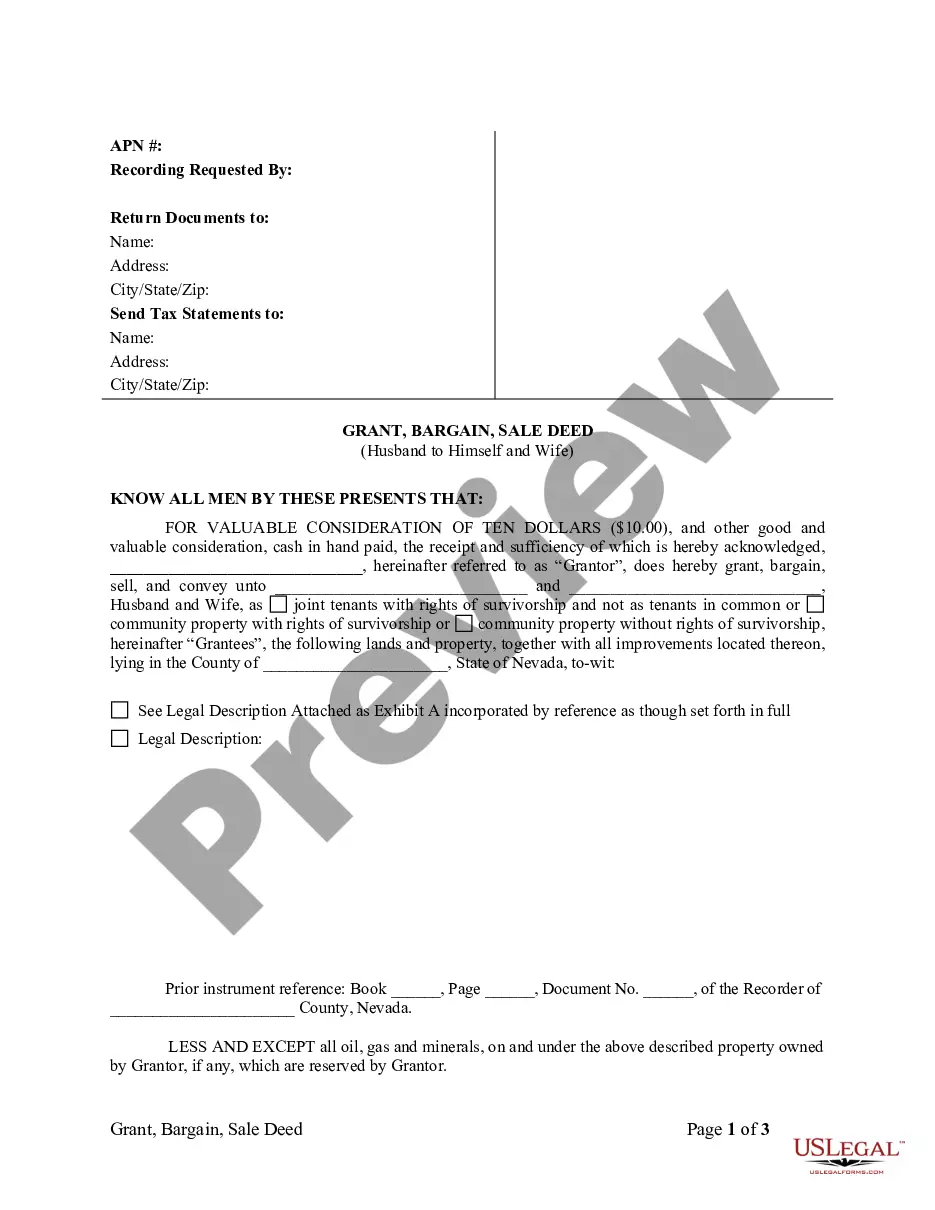

Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife

Description

How to fill out Sparks Nevada Grant, Bargain, Sale Deed From Husband To Himself And Wife?

Benefit from the US Legal Forms and get instant access to any form sample you require. Our useful website with thousands of documents makes it simple to find and get almost any document sample you need. It is possible to export, fill, and certify the Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife in just a matter of minutes instead of surfing the Net for many hours looking for the right template.

Using our collection is an excellent strategy to improve the safety of your document submissions. Our experienced lawyers regularly review all the documents to make sure that the templates are appropriate for a particular state and compliant with new acts and regulations.

How do you get the Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you view. In addition, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the instructions listed below:

- Find the template you require. Ensure that it is the form you were looking for: verify its name and description, and make use of the Preview function when it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the document. Indicate the format to get the Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and trustworthy form libraries on the internet. We are always happy to help you in virtually any legal procedure, even if it is just downloading the Sparks Nevada Grant, Bargain, Sale Deed from Husband to Himself and Wife.

Feel free to benefit from our platform and make your document experience as efficient as possible!