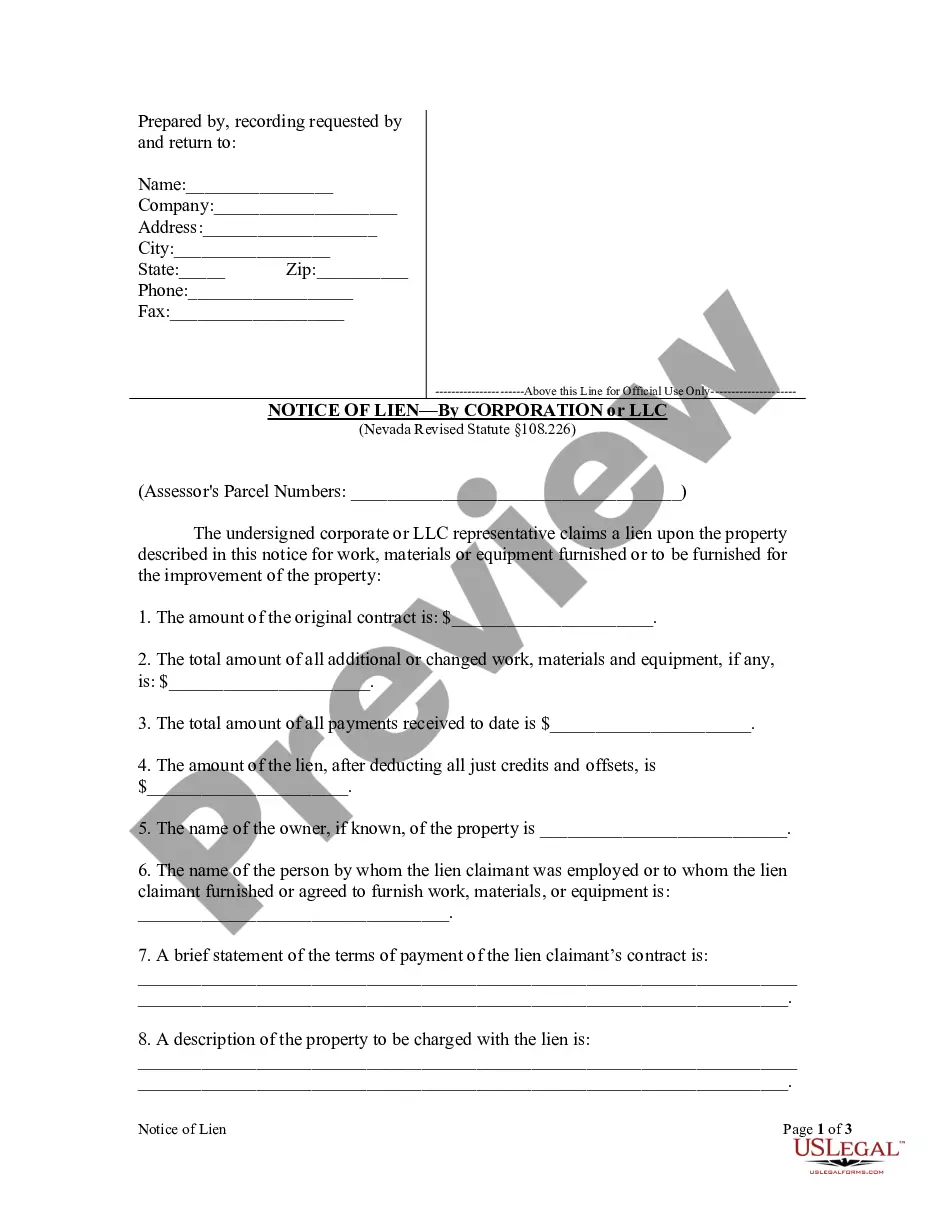

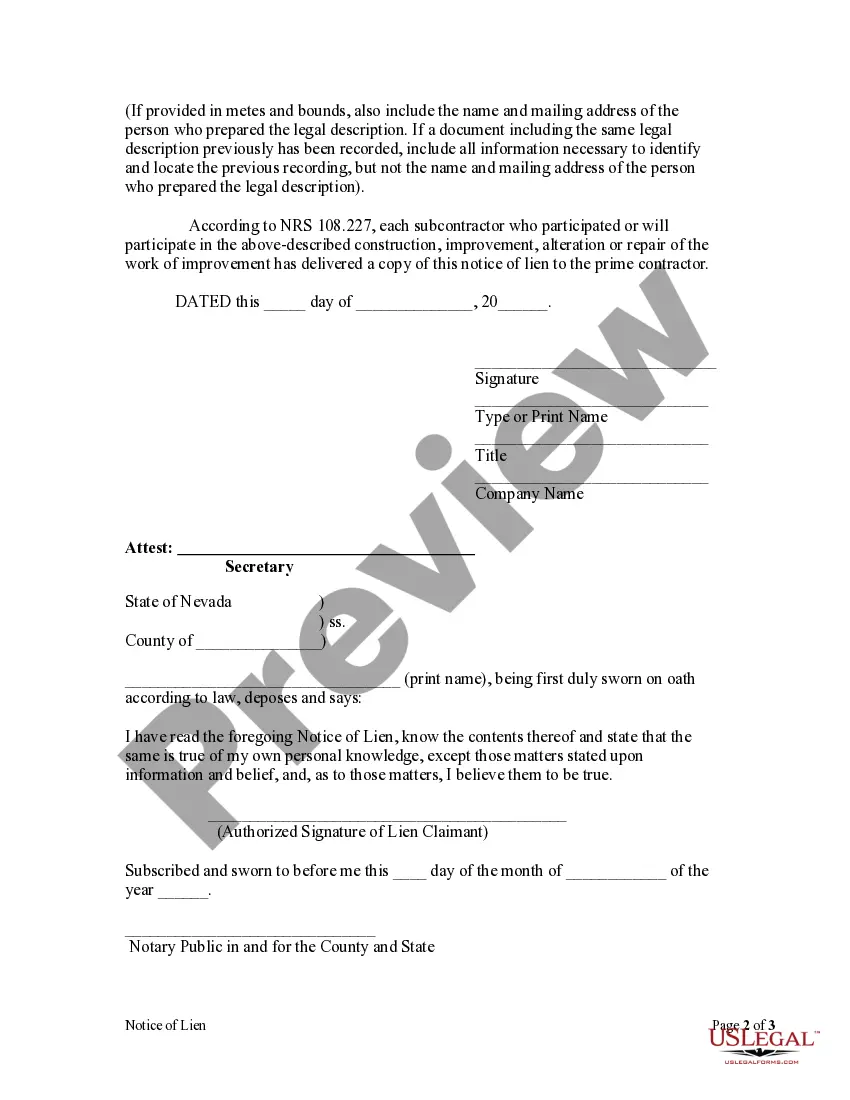

This notice, properly filed, serves to put all parties with an interest in a piece of property that has been improved on notice that the corporate lien claimant has a claim for the value of labor or materials expended in the improvement.

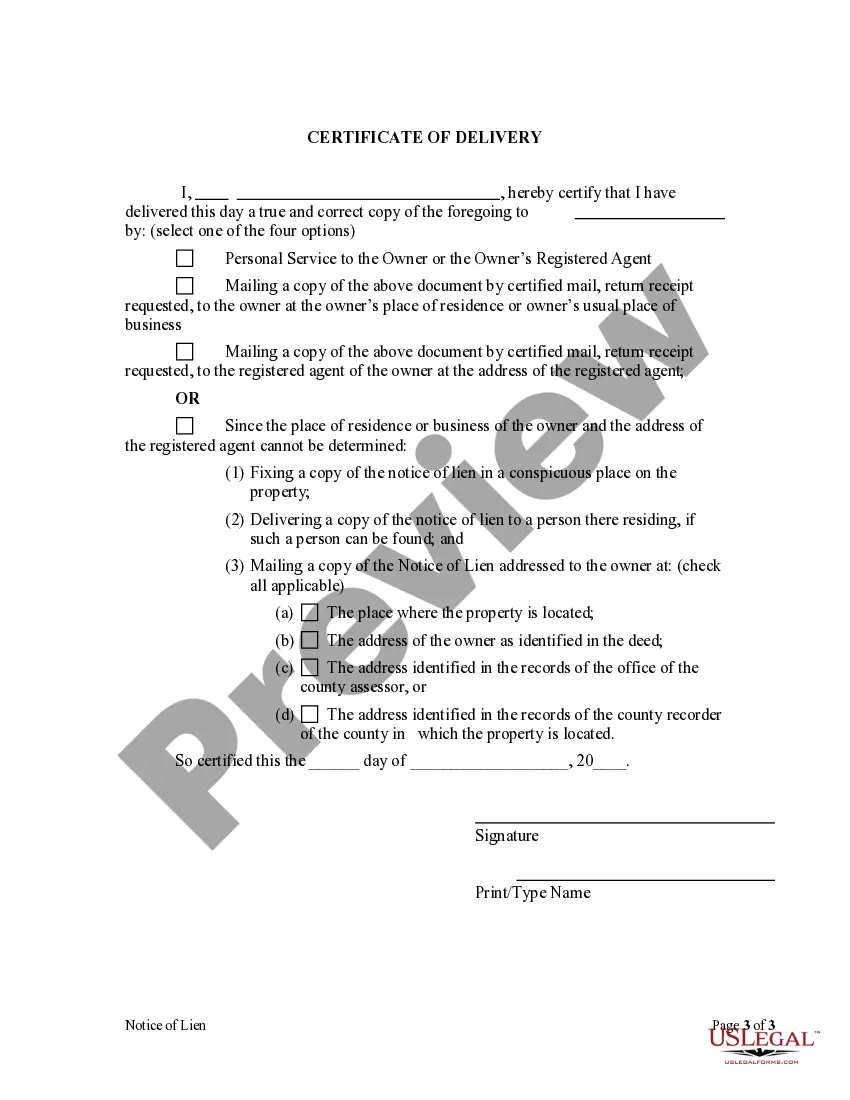

Clark Nevada Notice of Lien — Corporation or LLC is an important legal document used in Clark County, Nevada, to assert a lien on the property of a corporation or limited liability company (LLC). This notice is typically filed by a creditor or a party seeking payment for services rendered or debts owed by the corporation or LLC. The primary purpose of filing a notice of lien is to secure the creditor's rights and interest in the debtor's assets. The Clark Nevada Notice of Lien — Corporation or LLC serves as a public record, notifying potential buyers or lenders about the outstanding debt or obligation tied to the corporation or LLC. It helps protect the creditor's claim by establishing a priority position in the event that the debtor's property is sold, transferred, or liquidated. Filing this notice acts as a warning to other interested parties that certain assets may have a prior claim and that proceeding with a transaction may result in legal consequences. There are a few different types of Clark Nevada Notice of Lien — Corporation or LLC that can be filed, depending on the nature and scope of the debt: 1. General Lien: A general lien covers all current and future debts owed by the corporation or LLC to the creditor. It secures the creditor's claim against all assets of the debtor, providing broad protection. 2. Specific Lien: A specific lien is limited to a particular asset or property owned by the corporation or LLC. It allows the creditor to claim a specific property in case of non-payment or default, providing more targeted protection. 3. Tax Lien: In certain cases, government agencies or tax authorities may file a notice of lien to enforce collection of unpaid taxes. These liens take priority over other liens and can have significant consequences for the debtor. Filing a Clark Nevada Notice of Lien — Corporation or LLC involves specific procedures and requirements, including providing information about the debtor's identity, the amount owed, the property subject to the lien, and the creditor's contact information. It is essential to ensure accurate and complete information is included in the notice to avoid potential challenges or disputes. In conclusion, the Clark Nevada Notice of Lien — Corporation or LLC plays a crucial role in protecting creditors' rights and interests when dealing with corporations or LCS in Clark County, Nevada. By filing this notice, creditors can establish a legal claim on the debtor's assets, securing their position in case of non-payment or default. Understanding the various types of liens and adhering to the specific filing requirements is important for creditors seeking the proper enforcement of their claims.Clark Nevada Notice of Lien — Corporation or LLC is an important legal document used in Clark County, Nevada, to assert a lien on the property of a corporation or limited liability company (LLC). This notice is typically filed by a creditor or a party seeking payment for services rendered or debts owed by the corporation or LLC. The primary purpose of filing a notice of lien is to secure the creditor's rights and interest in the debtor's assets. The Clark Nevada Notice of Lien — Corporation or LLC serves as a public record, notifying potential buyers or lenders about the outstanding debt or obligation tied to the corporation or LLC. It helps protect the creditor's claim by establishing a priority position in the event that the debtor's property is sold, transferred, or liquidated. Filing this notice acts as a warning to other interested parties that certain assets may have a prior claim and that proceeding with a transaction may result in legal consequences. There are a few different types of Clark Nevada Notice of Lien — Corporation or LLC that can be filed, depending on the nature and scope of the debt: 1. General Lien: A general lien covers all current and future debts owed by the corporation or LLC to the creditor. It secures the creditor's claim against all assets of the debtor, providing broad protection. 2. Specific Lien: A specific lien is limited to a particular asset or property owned by the corporation or LLC. It allows the creditor to claim a specific property in case of non-payment or default, providing more targeted protection. 3. Tax Lien: In certain cases, government agencies or tax authorities may file a notice of lien to enforce collection of unpaid taxes. These liens take priority over other liens and can have significant consequences for the debtor. Filing a Clark Nevada Notice of Lien — Corporation or LLC involves specific procedures and requirements, including providing information about the debtor's identity, the amount owed, the property subject to the lien, and the creditor's contact information. It is essential to ensure accurate and complete information is included in the notice to avoid potential challenges or disputes. In conclusion, the Clark Nevada Notice of Lien — Corporation or LLC plays a crucial role in protecting creditors' rights and interests when dealing with corporations or LCS in Clark County, Nevada. By filing this notice, creditors can establish a legal claim on the debtor's assets, securing their position in case of non-payment or default. Understanding the various types of liens and adhering to the specific filing requirements is important for creditors seeking the proper enforcement of their claims.