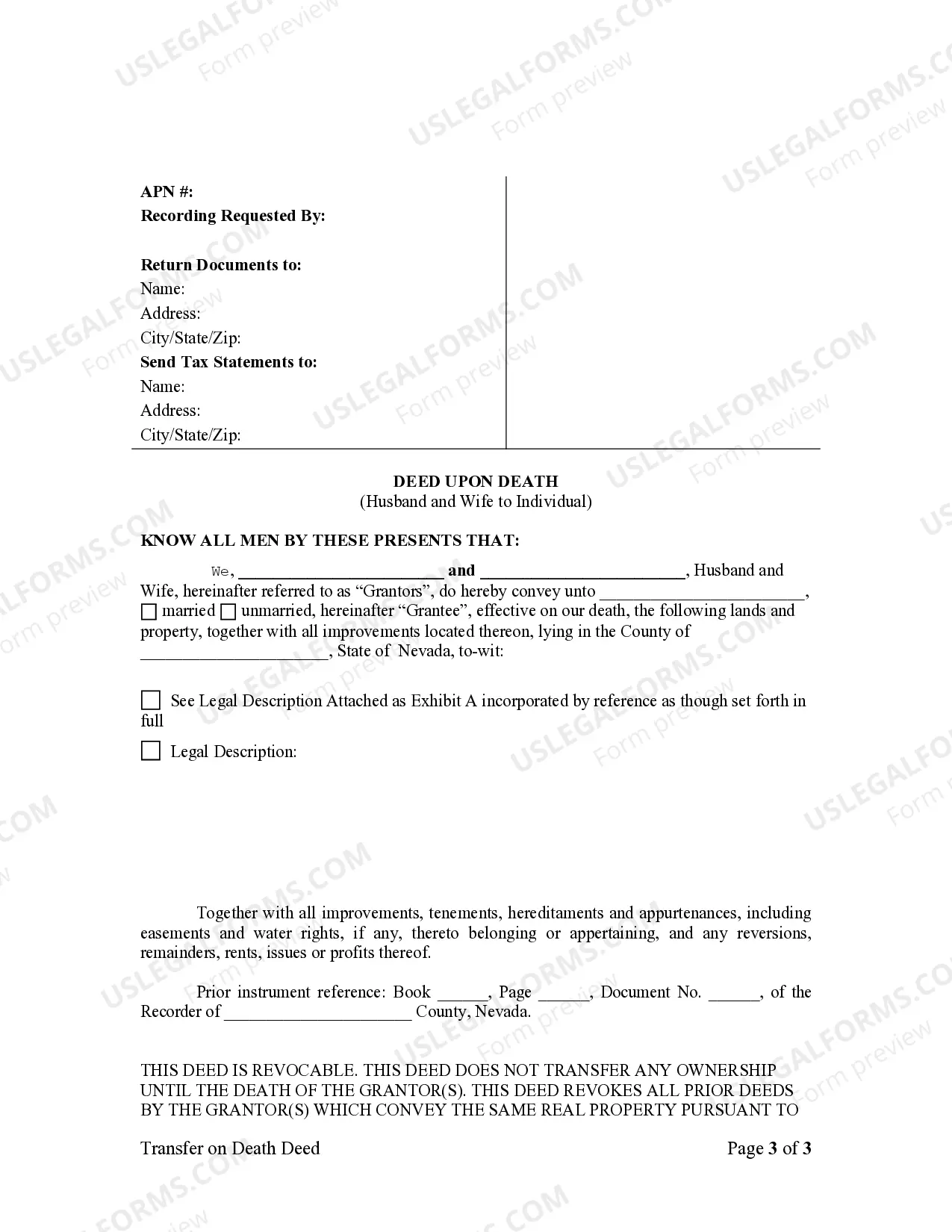

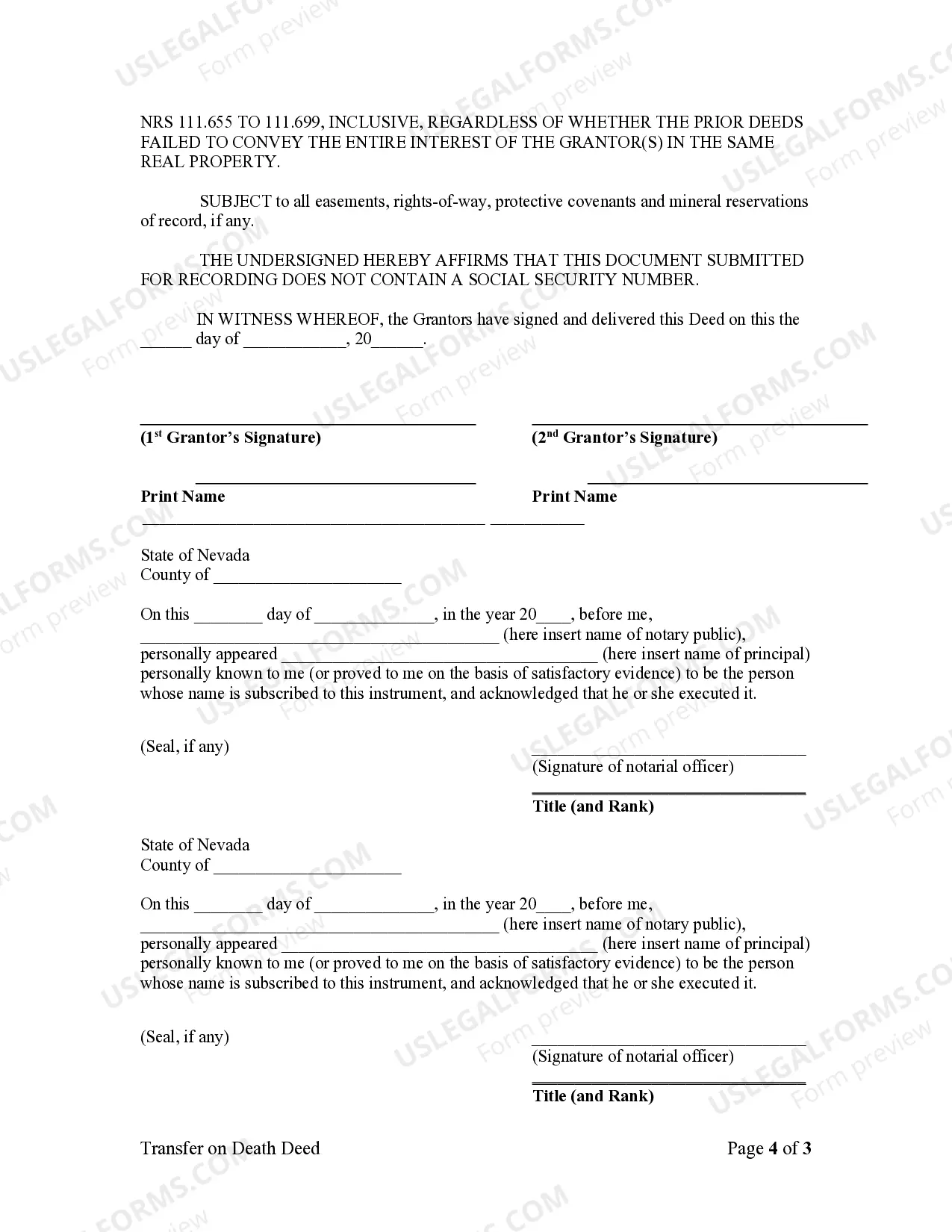

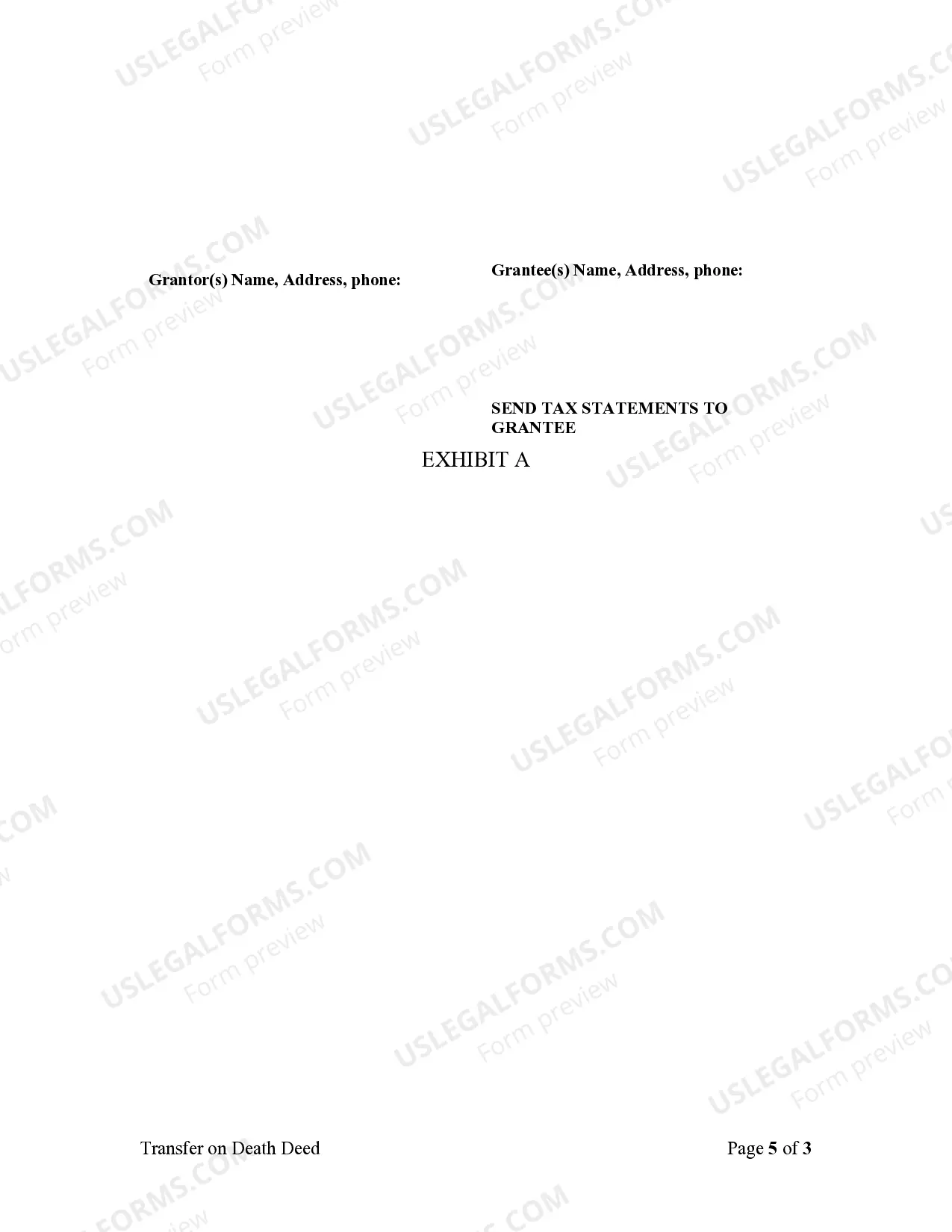

This form is a Transfer on Death or Beneficiary Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and quitclaim the described property to grantee upon their death. This deed complies with all state statutory laws.

Las Vegas Nevada Transfer on Death Deed (TOD) or Beneficiary Deed is a legal document that allows married couples to transfer their real estate property to an individual beneficiary without the need for probate. This type of deed ensures a smooth transition of ownership upon the death of both spouses, providing an efficient and cost-effective solution for estate planning in Las Vegas, Nevada. The TOD deed for husband and wife to an individual beneficiary offers several benefits, such as avoiding the lengthy and expensive probate process, protecting the property's value, and enabling a private transfer of assets. With this deed, the couple retains complete control and ownership of the property during their lifetimes, ensuring flexibility in managing their estate. There are different types of Las Vegas Nevada Transfer on Death Deed (TOD) — Beneficiary Deed for Husband and Wife to Individual, namely: 1. Joint Tenancy TOD Deed: This option allows both spouses to transfer their interest in the property directly to an individual beneficiary upon their deaths. By holding the property in joint tenancy, the surviving spouse automatically becomes the sole owner after the first spouse's death, and the beneficiary receives ownership rights upon the survivor's passing. 2. Tenants in Common TOD Deed: With this type of TOD deed, married couples can designate an individual beneficiary who will receive their respective shares of the property upon their deaths. Unlike joint tenancy, where the surviving spouse automatically inherits the entire property, tenants in common allow each spouse to pass their share to a chosen beneficiary. 3. Community Property with Right of Survivorship TOD Deed: This deed option is available for married couples who own property under the community property laws of Nevada. It grants each spouse an equal interest in the property, and upon the death of one spouse, the surviving spouse becomes the sole owner while still maintaining the ability to transfer the property to an individual beneficiary using a TOD deed. By utilizing the Las Vegas Nevada Transfer on Death Deed TOD — Beneficiary Deed for Husband and Wife to Individual, married couples in Las Vegas can ensure the seamless transfer of their property to a designated beneficiary while avoiding the complexities and costs associated with probate. It is crucial to seek the guidance of an experienced estate planning attorney to ensure that all legal requirements are met and to determine the most suitable type of TOD deed for each individual's unique circumstances.Las Vegas Nevada Transfer on Death Deed (TOD) or Beneficiary Deed is a legal document that allows married couples to transfer their real estate property to an individual beneficiary without the need for probate. This type of deed ensures a smooth transition of ownership upon the death of both spouses, providing an efficient and cost-effective solution for estate planning in Las Vegas, Nevada. The TOD deed for husband and wife to an individual beneficiary offers several benefits, such as avoiding the lengthy and expensive probate process, protecting the property's value, and enabling a private transfer of assets. With this deed, the couple retains complete control and ownership of the property during their lifetimes, ensuring flexibility in managing their estate. There are different types of Las Vegas Nevada Transfer on Death Deed (TOD) — Beneficiary Deed for Husband and Wife to Individual, namely: 1. Joint Tenancy TOD Deed: This option allows both spouses to transfer their interest in the property directly to an individual beneficiary upon their deaths. By holding the property in joint tenancy, the surviving spouse automatically becomes the sole owner after the first spouse's death, and the beneficiary receives ownership rights upon the survivor's passing. 2. Tenants in Common TOD Deed: With this type of TOD deed, married couples can designate an individual beneficiary who will receive their respective shares of the property upon their deaths. Unlike joint tenancy, where the surviving spouse automatically inherits the entire property, tenants in common allow each spouse to pass their share to a chosen beneficiary. 3. Community Property with Right of Survivorship TOD Deed: This deed option is available for married couples who own property under the community property laws of Nevada. It grants each spouse an equal interest in the property, and upon the death of one spouse, the surviving spouse becomes the sole owner while still maintaining the ability to transfer the property to an individual beneficiary using a TOD deed. By utilizing the Las Vegas Nevada Transfer on Death Deed TOD — Beneficiary Deed for Husband and Wife to Individual, married couples in Las Vegas can ensure the seamless transfer of their property to a designated beneficiary while avoiding the complexities and costs associated with probate. It is crucial to seek the guidance of an experienced estate planning attorney to ensure that all legal requirements are met and to determine the most suitable type of TOD deed for each individual's unique circumstances.