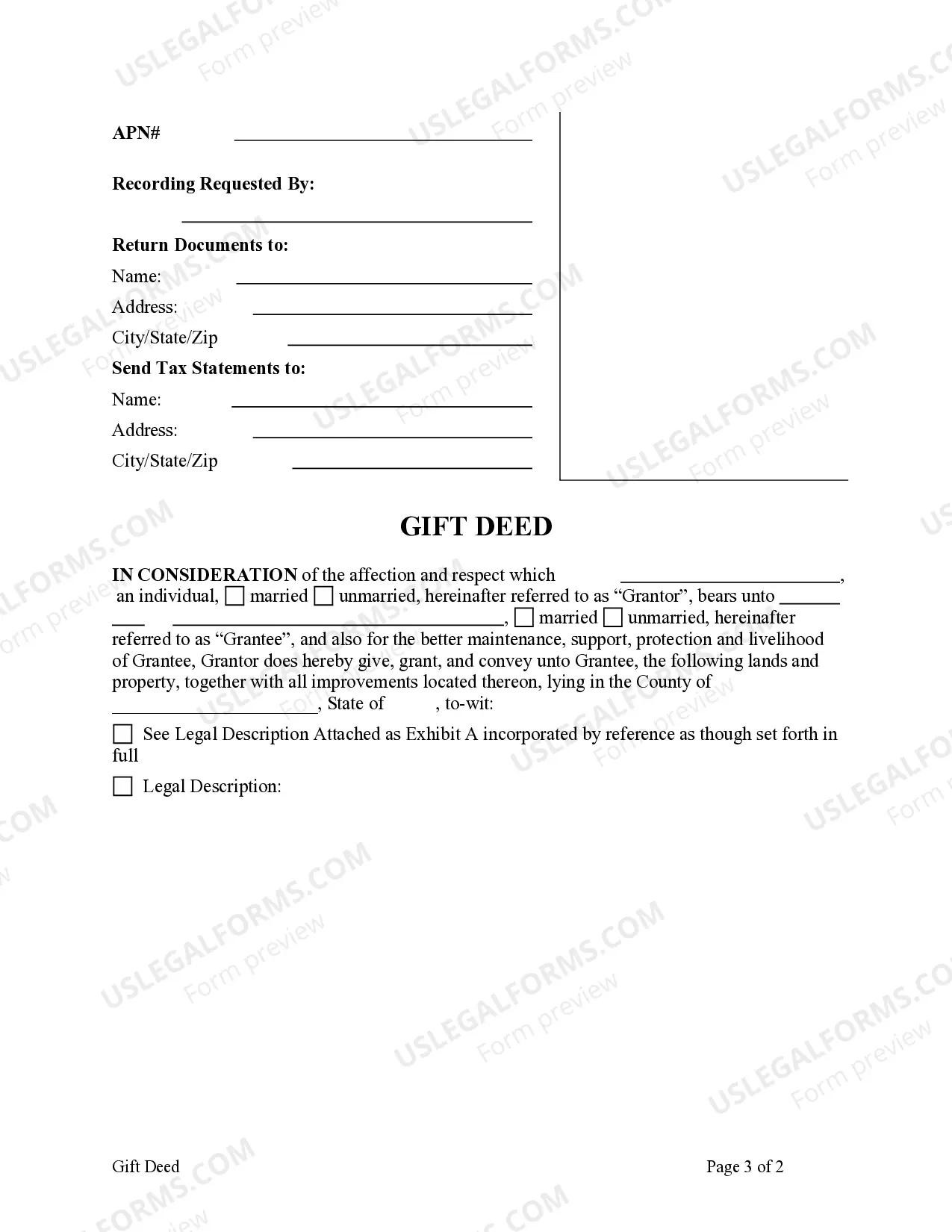

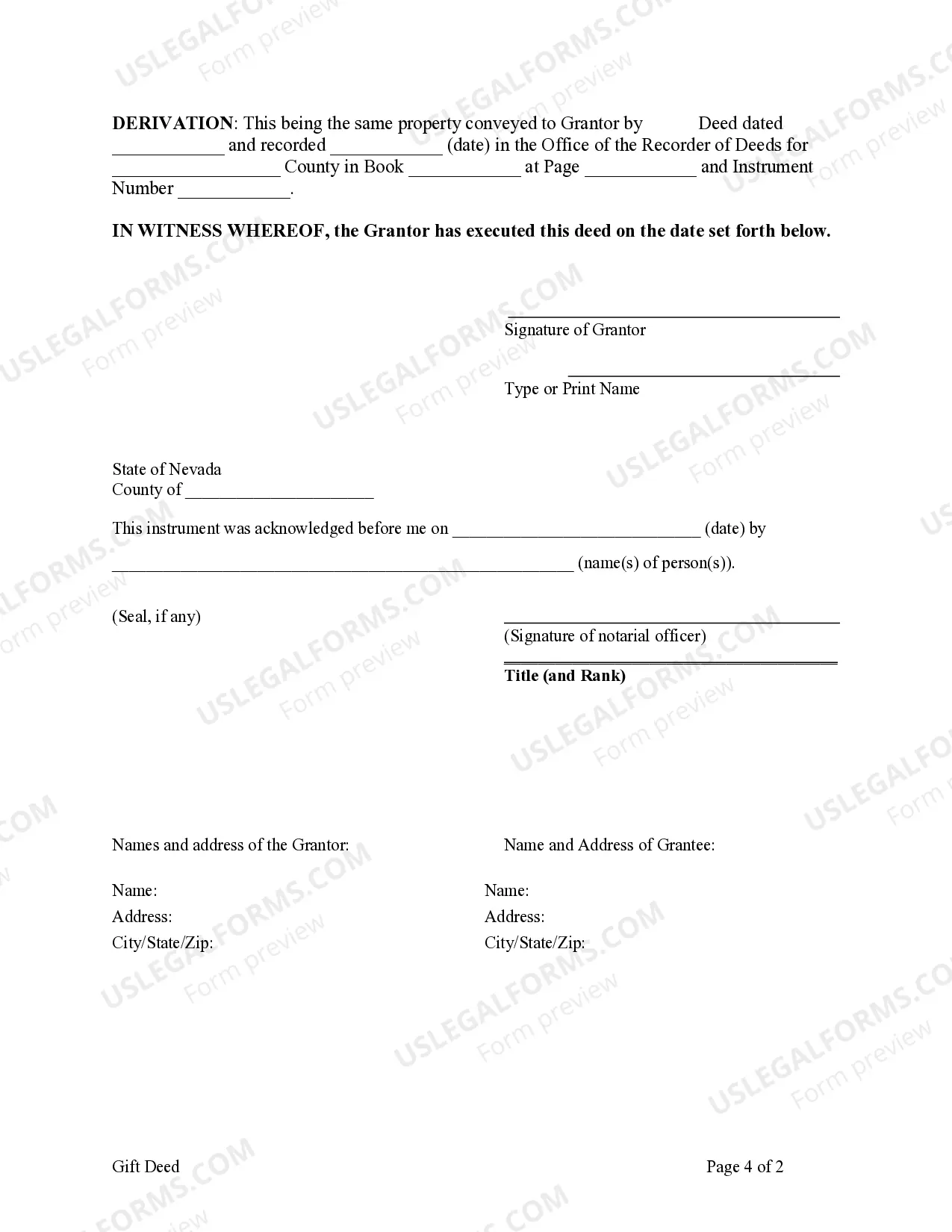

This form is a Gift Deed where the Grantor is an individual and the Grantee ia also an Individual. Grantor grants and conveys the described property to Grantee. This deed complies with all state statutory 0laws.

A Clark Nevada Gift Deed — Individual to Individual is a legal document that allows for the transfer of real property as a gift between two individuals in Clark County, Nevada. This type of deed is commonly used when someone wishes to gift their property to another person without the need for any monetary compensation. The Clark Nevada Gift Deed — Individual to Individual is typically used in situations where the donor (the person giving the gift) wants to transfer their ownership rights in a property to the recipient (the person receiving the gift), such as a family member, friend, or charitable organization. This type of transaction is often done as a way to pass on property assets or to provide financial assistance to a loved one. The gift deed includes specific details about the involved parties, such as their names, addresses, and other identifying information. It also contains a legal description of the property being gifted, including its boundaries, parcel number, and any other relevant details necessary for proper identification. The document will also state that the transfer is being done as a gift without any monetary consideration. There are a few different types of Clark Nevada Gift Deed — Individual to Individual that may be used, depending on the specific circumstances of the gifting process: 1. Simple Gift Deed: This is the most common type of Gift Deed for transferring a property from one individual to another. It involves the straightforward transfer of ownership rights without any conditions or further obligations. 2. Conditional Gift Deed: In certain situations, the donor may choose to include specific conditions or requirements as part of the gift. These conditions usually dictate specific actions or behavior on the part of the recipient, or may specify certain restrictions on how the property can be used. 3. Charitable Gift Deed: If the intended recipient of the gift is a charitable organization recognized under the IRS guidelines, a Charitable Gift Deed may be used. This type of deed provides the donor with potential tax benefits for their charitable contribution. It is important to note that a Clark Nevada Gift Deed — Individual to Individual should be properly executed and recorded with the County Recorder's Office to ensure its validity and establish a clear chain of ownership. It is advisable to consult with an attorney or real estate professional to understand the legal requirements and implications associated with the transfer of property through a gift deed.