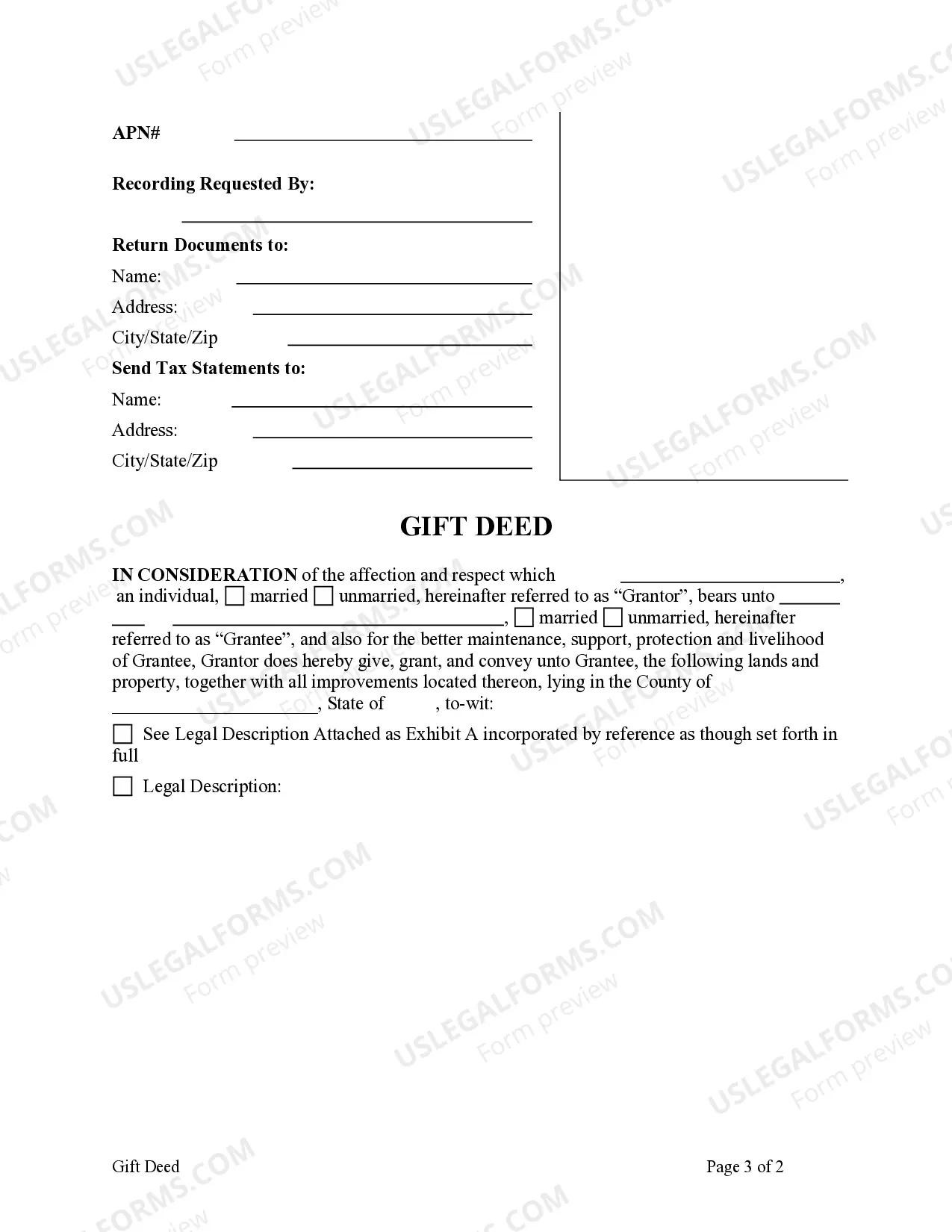

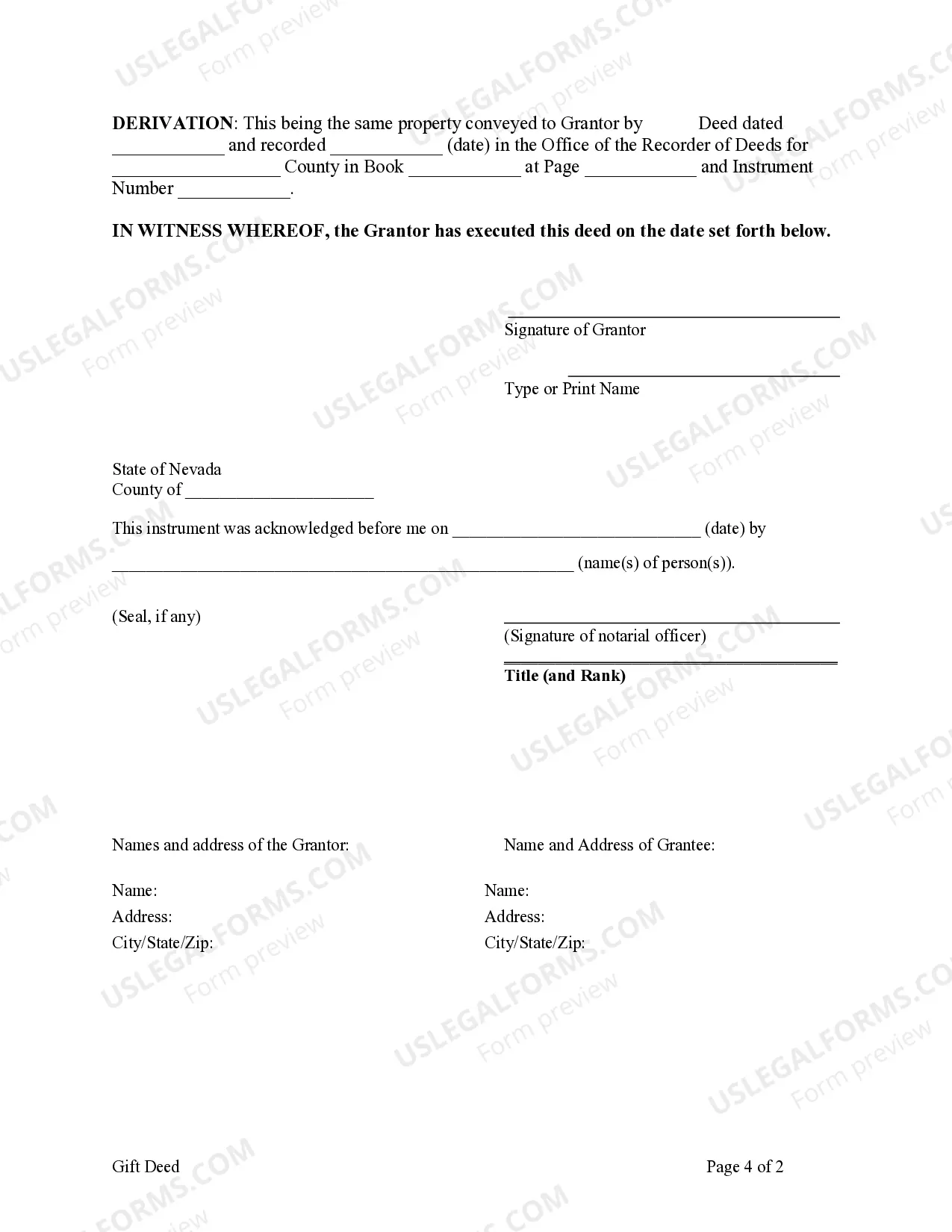

This form is a Gift Deed where the Grantor is an individual and the Grantee ia also an Individual. Grantor grants and conveys the described property to Grantee. This deed complies with all state statutory 0laws.

Las Vegas Nevada Gift Deed — Individual to Individual is a legal document used to transfer ownership of real estate property as a gift from one individual to another in the state of Nevada, specifically in Las Vegas. A gift deed is a common method to convey property without any exchange of money or valuable consideration. Keywords: Las Vegas Nevada, Gift Deed, Individual to Individual, real estate property, ownership transfer, legal document, gift, convey property, valuable consideration. Different types of Las Vegas Nevada Gift Deed — Individual to Individual may include: 1. Residential Gift Deed: This type of gift deed is used when an individual wants to gift their residential property, such as a house or a condominium, to another individual in Las Vegas, Nevada. 2. Commercial Gift Deed: If an individual intends to gift their commercial property, such as an office building, retail space, or industrial facility, to another individual, a commercial gift deed would be used to legally transfer the ownership in Las Vegas, Nevada. 3. Vacant Land Gift Deed: In cases where an individual wants to gift a vacant piece of land or a plot in Las Vegas, Nevada, to another person, a vacant land gift deed would be utilized to transfer the property without any monetary exchange. 4. Timeshare Gift Deed: Timeshares, often popular in Las Vegas, can also be gifted using a timeshare gift deed. This allows one individual to gift their timeshare ownership rights to another individual without any financial transaction. 5. Investment Property Gift Deed: If an individual wishes to gift their investment property, such as a rental property, to someone else in Las Vegas, Nevada, an investment property gift deed is used to transfer the ownership without any monetary consideration. 6. Condominium Gift Deed: A condominium gift deed is specifically used when an individual wants to gift their condominium unit to another individual in Las Vegas, Nevada. This type of gift deed ensures the proper transfer of ownership in compliance with condominium regulations. In conclusion, Las Vegas Nevada Gift Deed — Individual to Individual is a legal document used to gift real estate property without any monetary exchange. It is an effective method for individuals in Las Vegas to transfer ownership of their residential, commercial, vacant land, timeshare, investment property, or condominium to another person.