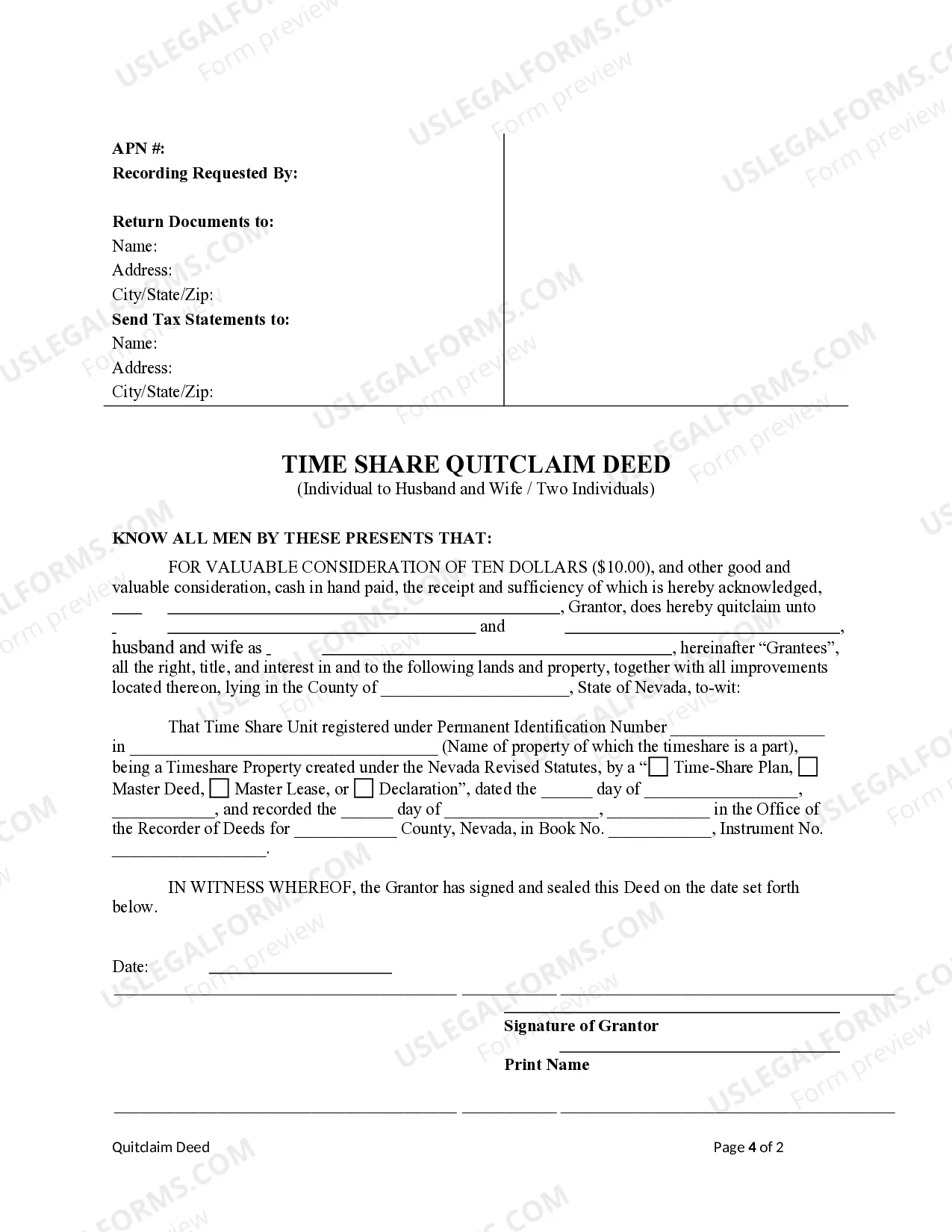

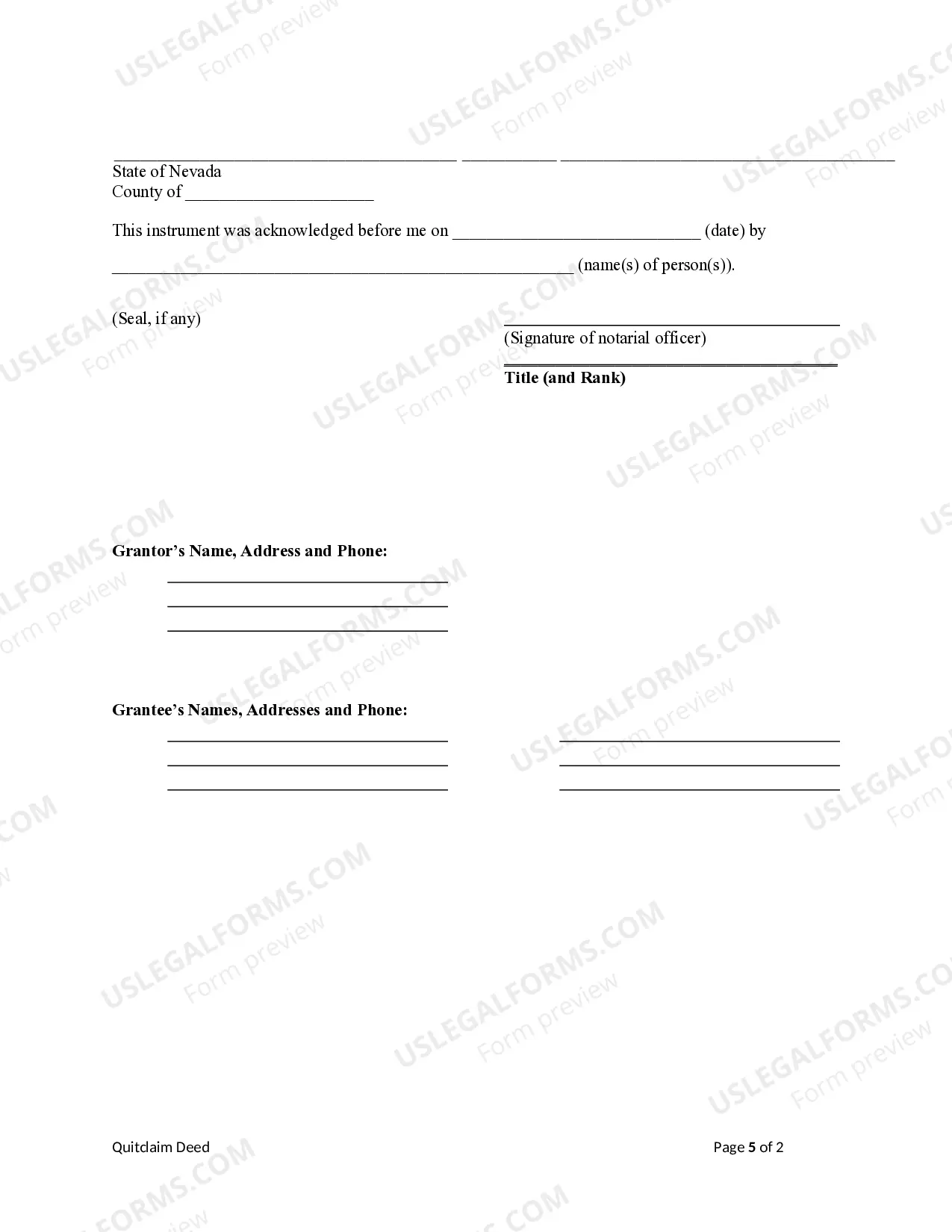

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are husband and wife or two individuals. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantees. This deed complies with all state statutory laws.

A Clark Nevada Time Share Quitclaim Deed — Individual to Two Individuals / Husband and Wife is a legal document that allows an individual to transfer their ownership rights of a time-share property located in Clark County, Nevada, to a married couple or two individuals who are married. This type of deed ensures a smooth transfer of ownership and clearly outlines the rights, interests, and responsibilities of the new owners. The Clark Nevada Time Share Quitclaim Deed — Individual to Two Individuals / Husband and Wife is a widely used legal instrument in the real estate industry, specifically in the time-share market. Time-shares give individuals the opportunity to own a portion of a property for a specific duration, often for vacation purposes. With this specific type of quitclaim deed, an individual who currently owns a time-share can choose to transfer their ownership rights to a married couple or two individuals who are legally recognized as husband and wife. By doing so, the individual relinquishes their ownership rights legally and transfers them to the new owners. This type of quitclaim deed is particularly relevant in Clark County, Nevada, where numerous time-share properties are located. In Clark County, time-share properties can vary in terms of size, amenities, and location. Some common types of time-share properties in Clark County, Nevada, include beachfront resorts, luxury condos, and cabin-style retreats. It's important for all parties involved to understand the terms and conditions outlined in the Clark Nevada Time Share Quitclaim Deed — Individual to Two Individuals / Husband and Wife. This document should clearly state the transfer of ownership rights, including any associated fees, taxes, or maintenance responsibilities. Additionally, the quitclaim deed should specify the duration of the time-share ownership, any restrictions or limitations on the use of the property, and provisions for any potential future transfers of ownership. Overall, the Clark Nevada Time Share Quitclaim Deed — Individual to Two Individuals / Husband and Wife is an essential legal document in the time-share industry, ensuring a clear and legally binding transfer of ownership rights from one individual to a married couple or two individuals. It plays a crucial role in facilitating the smooth transition of ownership while protecting the rights and interests of all parties involved.