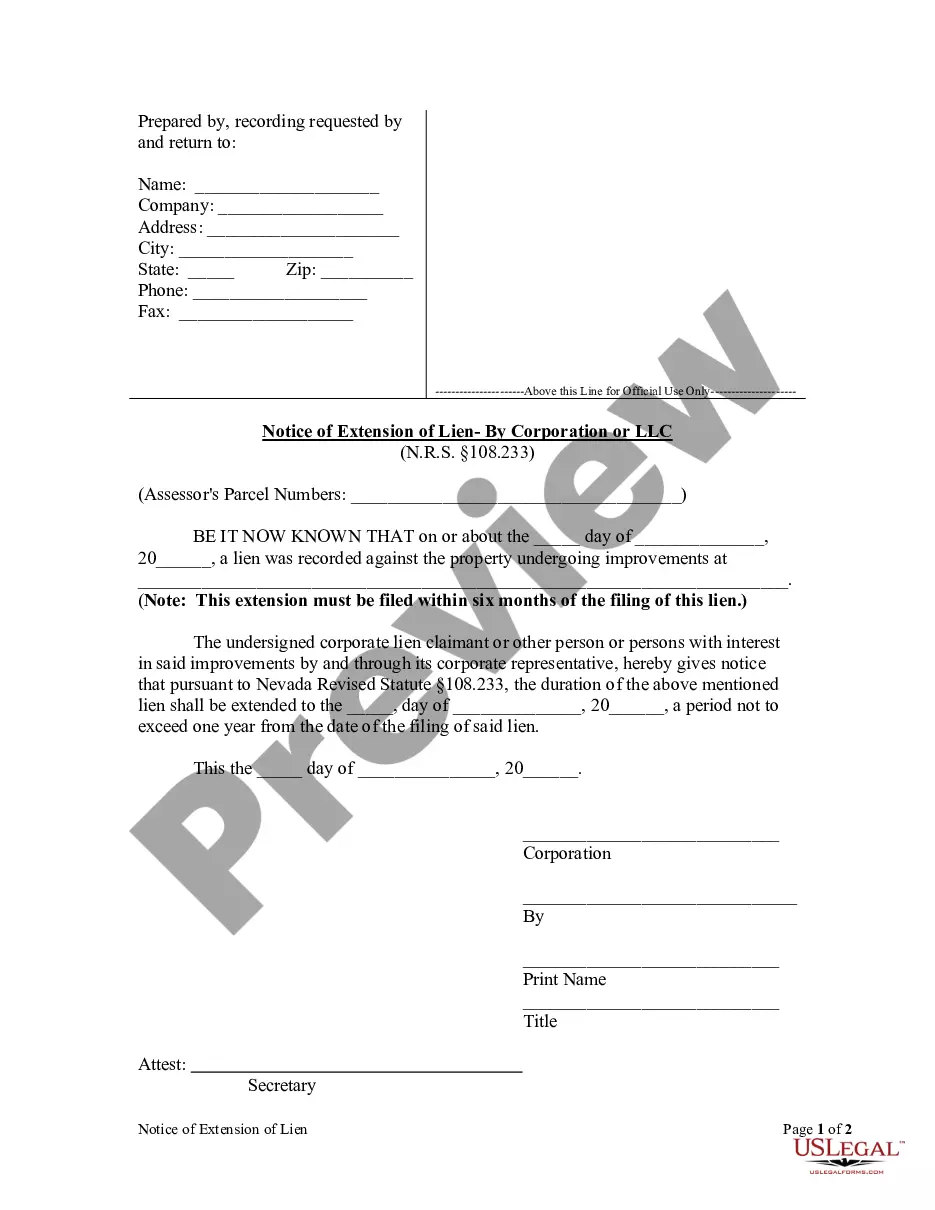

Pursuant to Nevada law, a properly filed lien is only effective for six months after it has been filed, unless the lien claimant files suit during that time. However, the party claiming the lien may extend the duration of his lien by filing a notice of extension. The notice of extension must be filed within six months of the original filing and may not extend the duration of the lien beyond one year from the original lien filing.

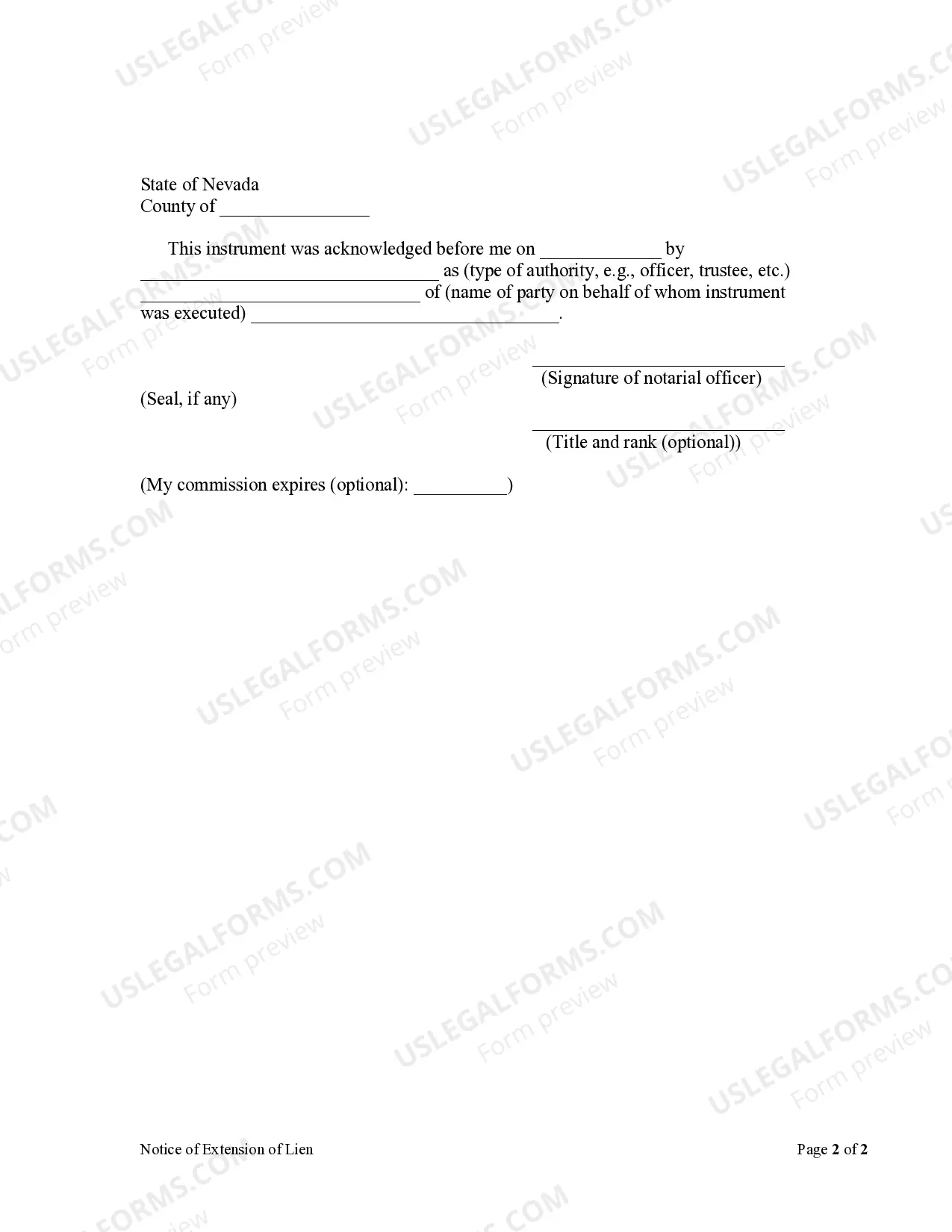

The Clark Nevada Notice of Extension of Lien — Corporation or LLC is an essential legal document used to notify parties involved about an extended lien placed on a property by a corporation or a limited liability company (LLC). This notice provides important information regarding the lien, its extension, and the parties involved. When a property owner fails to fulfill their financial obligations to a corporation or LLC, the entity may file a lien against the property to secure the debt owed to them. However, if the original lien's expiration date is approaching and the debt remains unpaid, the corporation or LLC has the option to file a notice of extension of lien to prolong the validity of the security interest. This extension allows the entity to retain their rights to the property until the debt is fully satisfied. There are several types of Clark Nevada Notice of Extension of Lien — Corporation or LLC, depending on the specific circumstances. Some possible variations include: 1. Clark Nevada Notice of Extension of Mechanic's Lien — Corporation or LLC: This type of notice is filed by a corporation or LLC involved in construction, repair, or improvement projects. It extends the duration of a mechanic's lien placed on the property to secure payment for labor or material provided. 2. Clark Nevada Notice of Extension of Contractor's Lien — Corporation or LLC: This notice is typically filed by a contracting company or LLC and extends the validity of a contractor's lien. It serves to protect the contractor's right to seek payment for services rendered or provided to the property owner. 3. Clark Nevada Notice of Extension of Supplier's Lien — Corporation or LLC: This notice is utilized by corporations or LCS acting as suppliers of goods, materials, or equipment to extend the duration of a supplier's lien on the property. It guarantees payment for the supplies provided to the property owner. Regardless of the specific type, a Clark Nevada Notice of Extension of Lien — Corporation or LLC must contain important information such as the legal name and contact information of the corporation or LLC extending the lien, details about the property subject to the lien, the original lien's recording information, the expired lien date, and the new extended expiration date. It is vital for all parties involved in a Clark Nevada Notice of Extension of Lien — Corporation or LLC to consult with legal professionals and understand the relevant state laws and regulations to ensure the notice is prepared accurately and effectively preserves the entity's legal rights.