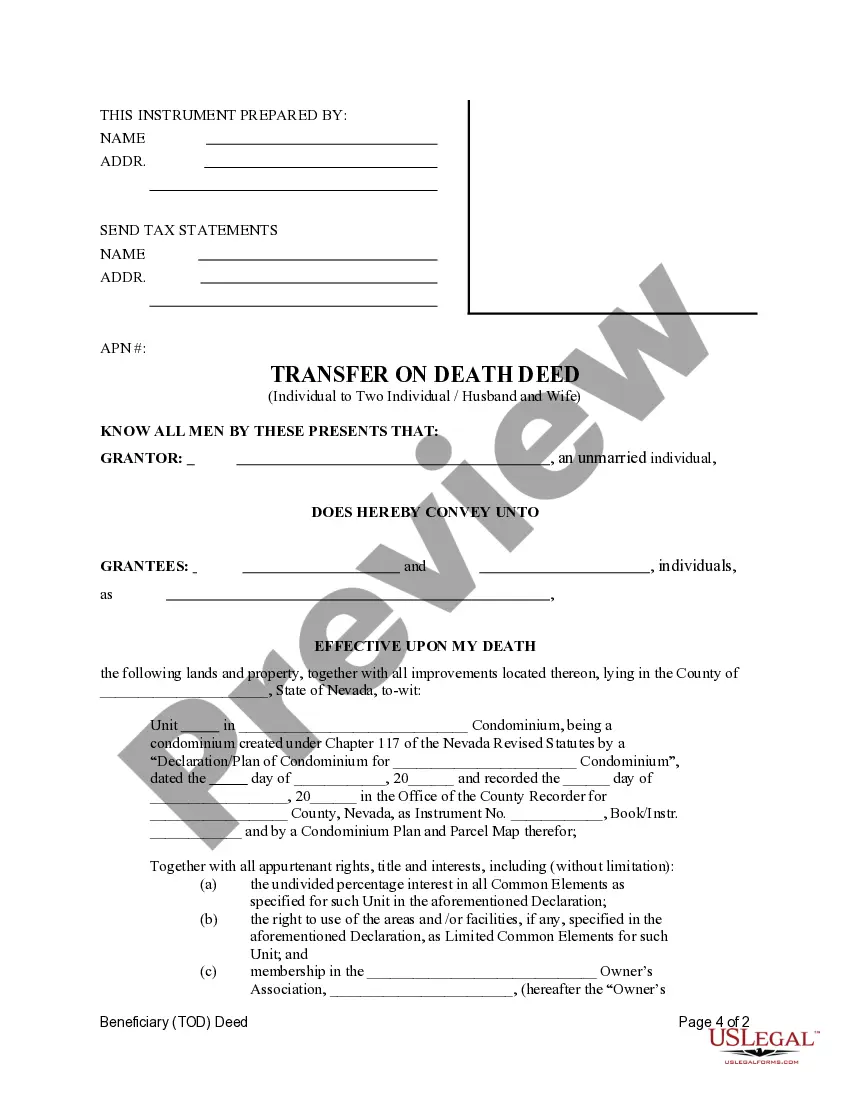

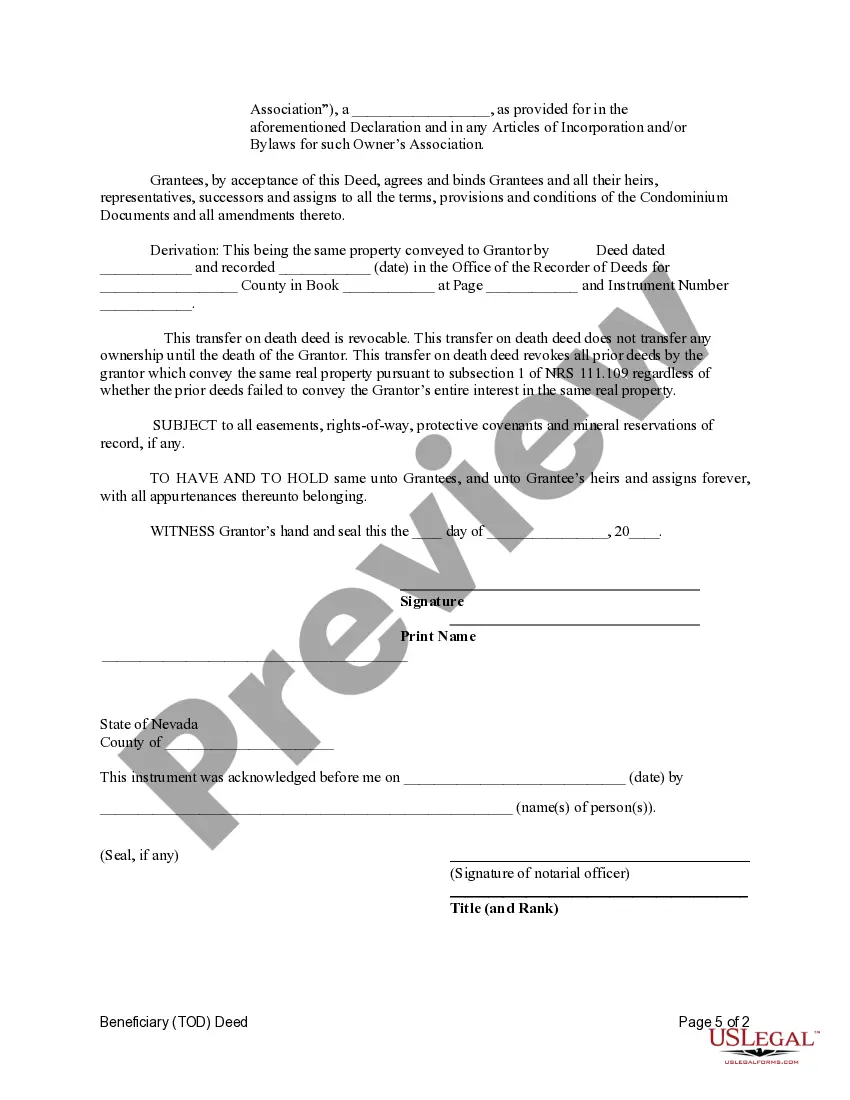

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantees are two individuals or husband and wife. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife

Description

How to fill out Nevada Beneficiary Deed (TOD) For A Condominium From An Individual To Two Individuals / Husband And Wife?

If you are in search of an appropriate form template, it’s incredibly challenging to select a superior service than the US Legal Forms website – likely the most extensive collections available online.

With this collection, you can obtain a vast array of templates for both business and personal needs based on categories, states, or keywords.

With our top-notch search tool, acquiring the latest Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to complete the registration process.

Acquire the form. Choose the file format and download it to your device.

- Furthermore, the pertinence of each document is validated by a team of qualified attorneys who routinely evaluate the templates on our site and update them in accordance with the latest state and county laws.

- If you are already acquainted with our platform and possess a registered account, all you need to do to obtain the Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife is to Log In to your user account and click the Download button.

- If this is your first time using US Legal Forms, simply follow the directions below.

- Ensure you have located the form you need. Review its description and utilize the Preview feature to examine its contents. If it doesn’t fulfill your requirements, use the Search box at the top of the page to find the desired document.

- Verify your selection. Click the Buy now button. Then select your desired subscription plan and provide your details to create an account.

Form popularity

FAQ

A Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife does not, in itself, avoid capital gains tax, as taxes typically arise when the property is sold. However, the responsible management of the property and understanding of tax implications can help minimize potential taxes due. Additionally, inheriting property can offer some tax benefits, such as a stepped-up basis, which can reduce capital gains when sold. It’s beneficial to discuss these details with a tax advisor to ensure you navigate potential tax issues effectively.

Yes, a Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife generally supersedes a will when it comes to the specific property named in the deed. This means that if the owner of the property passes away, the deed dictates the transfer of the property to the beneficiaries, regardless of what is stated in the will. This can simplify the transfer process but may also cause confusion if not clearly understood. It is wise to consult with a legal professional to ensure that your estate plan reflects your wishes accurately.

Yes, there are some downsides to being named as a beneficiary in a Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife. Beneficiaries may face unexpected tax implications upon the transfer of property, which can be complex and burdensome. Additionally, if the property owner incurs debt or faces legal challenges, this can impact the beneficiary’s inheritance. Understanding these implications is key to making an informed decision.

A Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife provides a simpler process than a trust but may not offer all the same protections. While a trust can manage various assets and ensure privacy during probate, a beneficiary deed focuses specifically on transferring real estate directly to beneficiaries. This can be advantageous for those looking for a straightforward solution. However, consider your unique circumstances carefully, as certain scenarios may require a trust for complete asset protection.

Adding a name to a deed can complicate property ownership. This action may lead to shared decision-making, which requires agreement on property matters between individuals involved. For a Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife, this could be a potential challenge if disagreements arise. It's important to consider these factors carefully, and utilizing the USLegalForms platform can help address these concerns with reliable legal resources.

Although beneficiary deeds offer advantages, there are some downsides to consider. One concern is that they do not address issues related to creditors; your beneficiaries may still face claims against the property. Additionally, a Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife does not eliminate the need for proper estate planning, which could create complications without comprehensive strategies in place. It's advisable to seek guidance from experts, like those available on the USLegalForms platform.

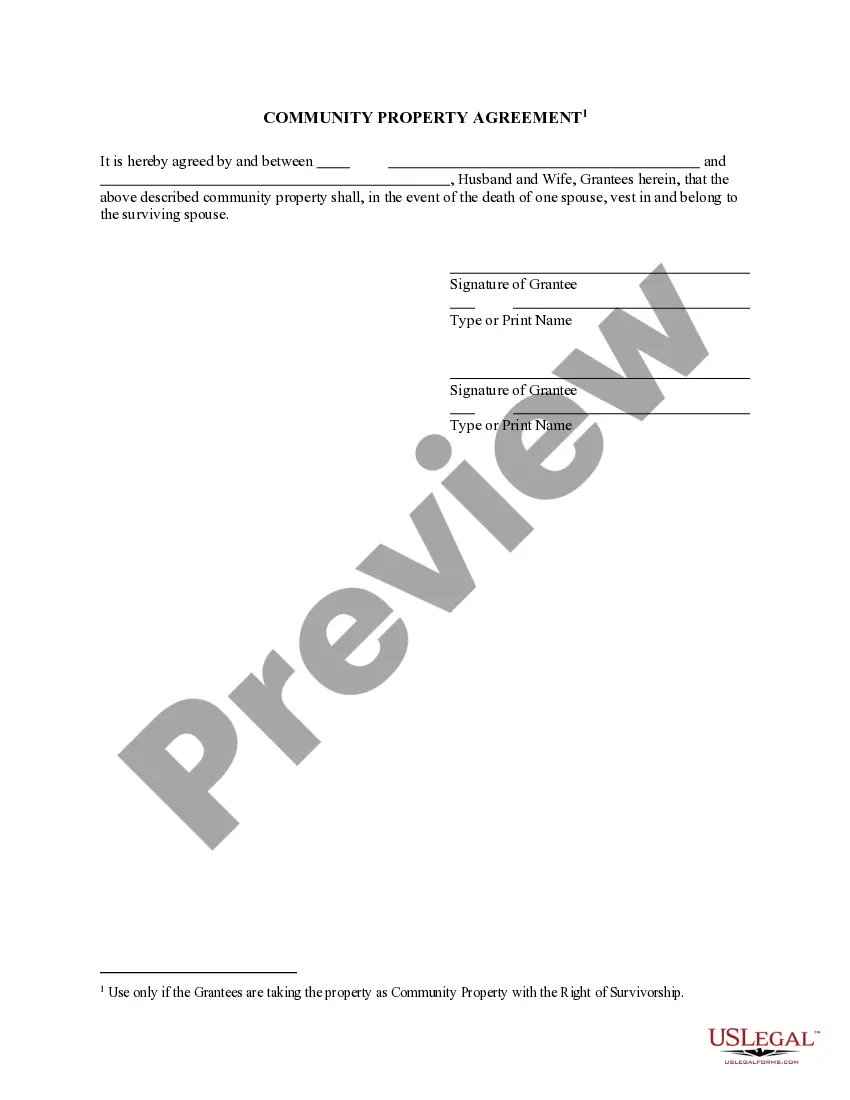

A deed in Nevada can list multiple individuals as owners or beneficiaries. However, it is essential to ensure clarity in the deed to avoid any confusion about ownership and transfer rights. In the case of a Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife, you can specify both parties as equal beneficiaries. This arrangement promotes a seamless transition during inheritance, ensuring that both individuals benefit equally.

Yes, Nevada does allow transfer on death deeds (TOD), making it easier to transfer property upon death without going through probate. These deeds enable an individual to pass on their condominium or other property directly to a beneficiary, streamlining the estate process. If you're contemplating using a Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife, you can feel secure about the legality of this option. For more assistance, the USLegalForms platform offers valuable resources.

In Sparks, Nevada, you can include multiple beneficiaries on your transfer on death deed (TOD) for a condominium. Specifically, you can designate as many individuals as you want, as long as they are recognized beneficiaries. This flexibility allows you to plan your estate according to your preferences and ensure that your assets go to your chosen individuals. Consider consulting with a legal professional or using the USLegalForms platform for streamlined guidance.

While it is not mandatory to hire a lawyer for a transfer on death deed, their expertise can provide valuable insights. A knowledgeable attorney can help ensure that your Sparks Nevada Beneficiary Deed (TOD) for a Condominium from an Individual to Two Individuals / Husband and Wife complies with all legal requirements and accurately represents your wishes. Engaging a legal professional may provide peace of mind and clarity throughout the process.