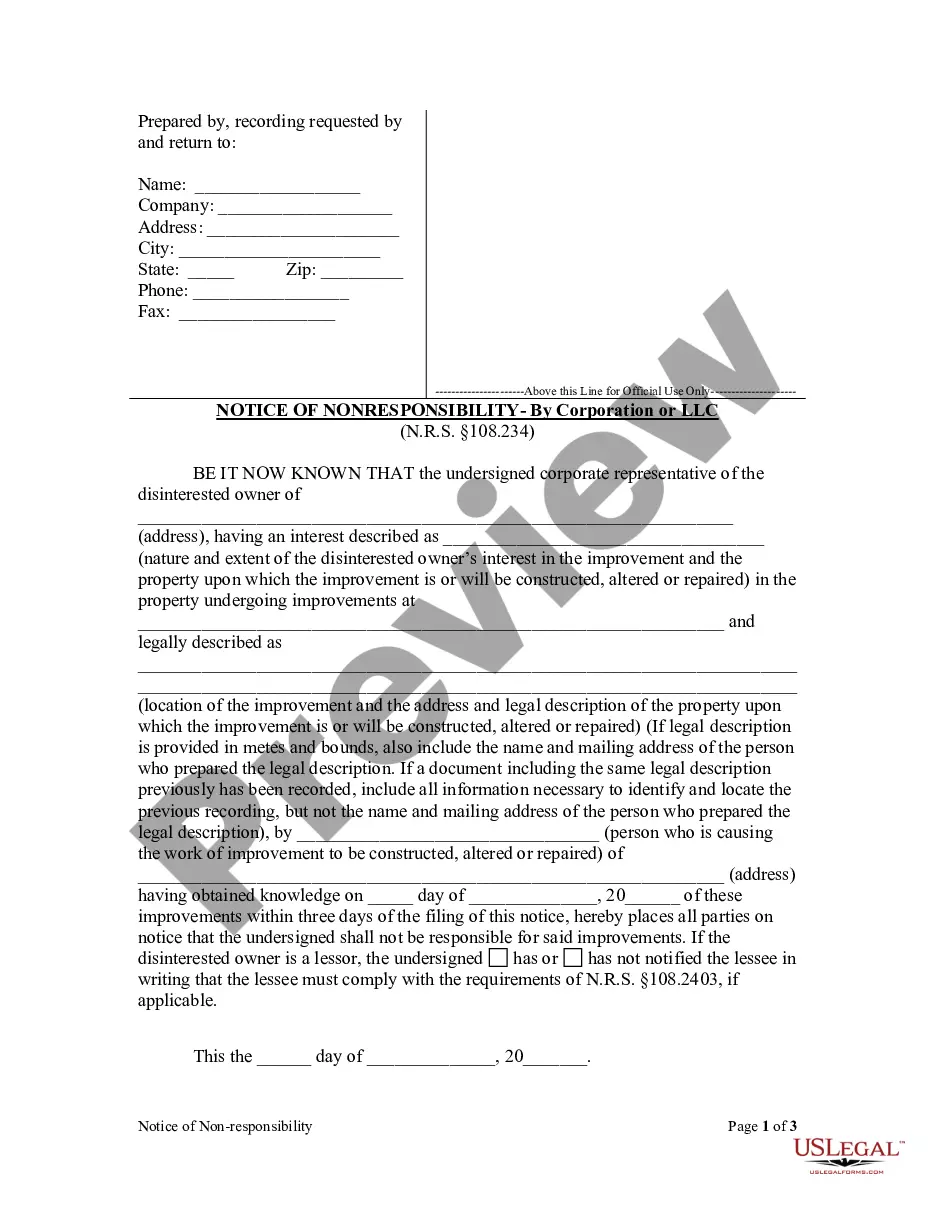

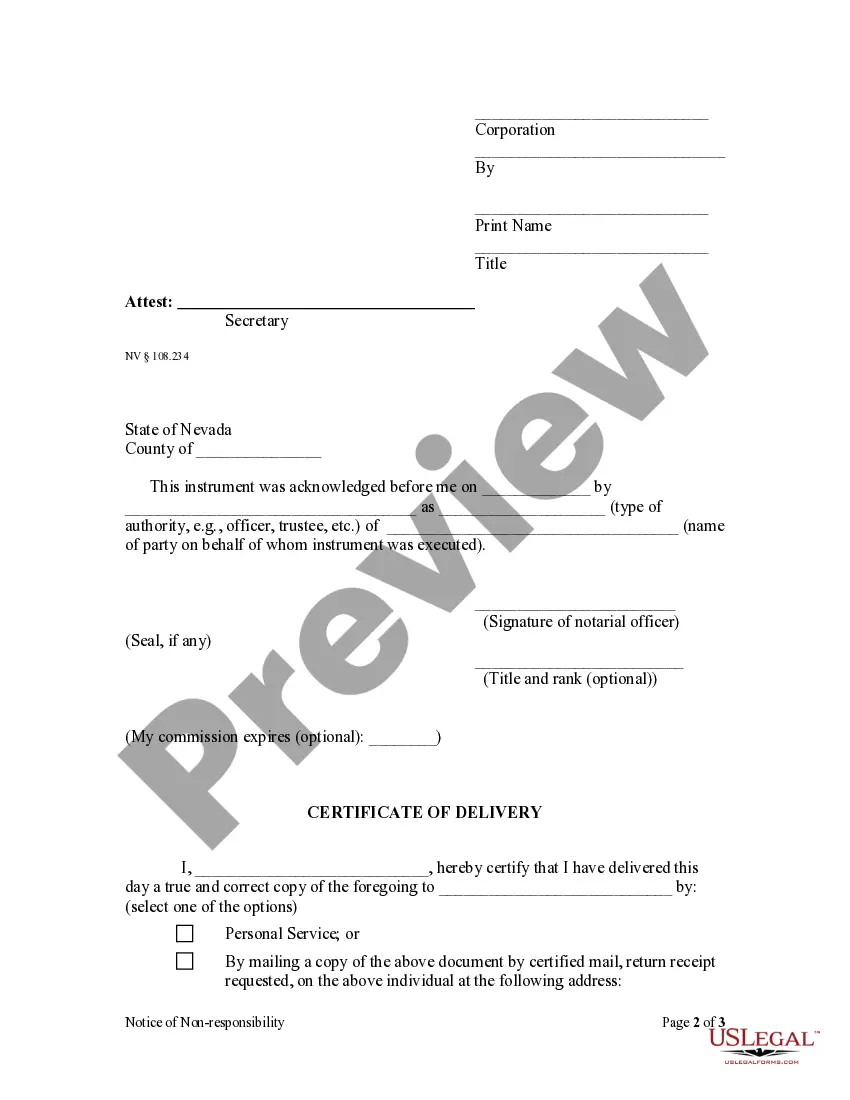

Nevada statutes presume that if individuals are furnishing labor or materials for the improvement of property they do so on behalf of the property owner and are entitled to a lien against the property for the value of the materials or labor provided. However, in the event that a person with an ownership interest in the property does not desire to be held responsible for the improvements, that party may file a notice of non-responsibility with the county recorder within three days of obtaining knowledge that improvements are being made.

The Clark Nevada Notice of Non Responsibility — Corporation or LLC is a legal document that provides a detailed account of the responsibilities and liabilities of corporations or limited liability companies (LCS) in the state of Nevada. This notice aims to inform contractors, suppliers, or other parties that the corporation or LLC has no involvement in or responsibility for certain construction projects or contractual obligations. By filing a Notice of Non Responsibility, corporations or LCS safeguard themselves from any potential legal or financial liabilities that may arise from unauthorized projects or agreements. This document helps to establish a clear separation between the company and any third-party actions, thus protecting the entity's assets and reputation. Several types of Clark Nevada Notice of Non Responsibility — Corporation or LLC exist, depending on the specific situation and requirements. These may include: 1. Clark Nevada Notice of Non Responsibility — Corporation or LLC (General): This is the standard notice used by corporations or LCS to disclaim any responsibility or involvement in unauthorized construction projects or contractual agreements. 2. Clark Nevada Notice of Non Responsibility — Corporation or LLC (Specific Project): In some cases, a corporation or LLC may choose to file a notice specifically for a particular project to ensure that they are not liable for any activities occurring on that site or any financial obligations associated with it. 3. Clark Nevada Notice of Non Responsibility — Corporation or LLC (Under New Ownership): If a corporation or LLC undergoes a change in ownership, a notice of non-responsibility can be filed to notify stakeholders that the new owners are not responsible for any debts, obligations, or disputes that occurred prior to the change. 4. Clark Nevada Notice of Non Responsibility — Corporation or LLC (Termination): When a corporation or LLC decides to terminate its operations, a notice can be filed to inform contracted parties that the entity will not be liable for any further obligations or projects. By filing a Clark Nevada Notice of Non Responsibility — Corporation or LLC, these entities ensure proper disclosure and protection of their interests. It is important to consult with legal professionals to determine the specific type and content of the notice based on the circumstances and individual needs of the corporation or LLC.The Clark Nevada Notice of Non Responsibility — Corporation or LLC is a legal document that provides a detailed account of the responsibilities and liabilities of corporations or limited liability companies (LCS) in the state of Nevada. This notice aims to inform contractors, suppliers, or other parties that the corporation or LLC has no involvement in or responsibility for certain construction projects or contractual obligations. By filing a Notice of Non Responsibility, corporations or LCS safeguard themselves from any potential legal or financial liabilities that may arise from unauthorized projects or agreements. This document helps to establish a clear separation between the company and any third-party actions, thus protecting the entity's assets and reputation. Several types of Clark Nevada Notice of Non Responsibility — Corporation or LLC exist, depending on the specific situation and requirements. These may include: 1. Clark Nevada Notice of Non Responsibility — Corporation or LLC (General): This is the standard notice used by corporations or LCS to disclaim any responsibility or involvement in unauthorized construction projects or contractual agreements. 2. Clark Nevada Notice of Non Responsibility — Corporation or LLC (Specific Project): In some cases, a corporation or LLC may choose to file a notice specifically for a particular project to ensure that they are not liable for any activities occurring on that site or any financial obligations associated with it. 3. Clark Nevada Notice of Non Responsibility — Corporation or LLC (Under New Ownership): If a corporation or LLC undergoes a change in ownership, a notice of non-responsibility can be filed to notify stakeholders that the new owners are not responsible for any debts, obligations, or disputes that occurred prior to the change. 4. Clark Nevada Notice of Non Responsibility — Corporation or LLC (Termination): When a corporation or LLC decides to terminate its operations, a notice can be filed to inform contracted parties that the entity will not be liable for any further obligations or projects. By filing a Clark Nevada Notice of Non Responsibility — Corporation or LLC, these entities ensure proper disclosure and protection of their interests. It is important to consult with legal professionals to determine the specific type and content of the notice based on the circumstances and individual needs of the corporation or LLC.