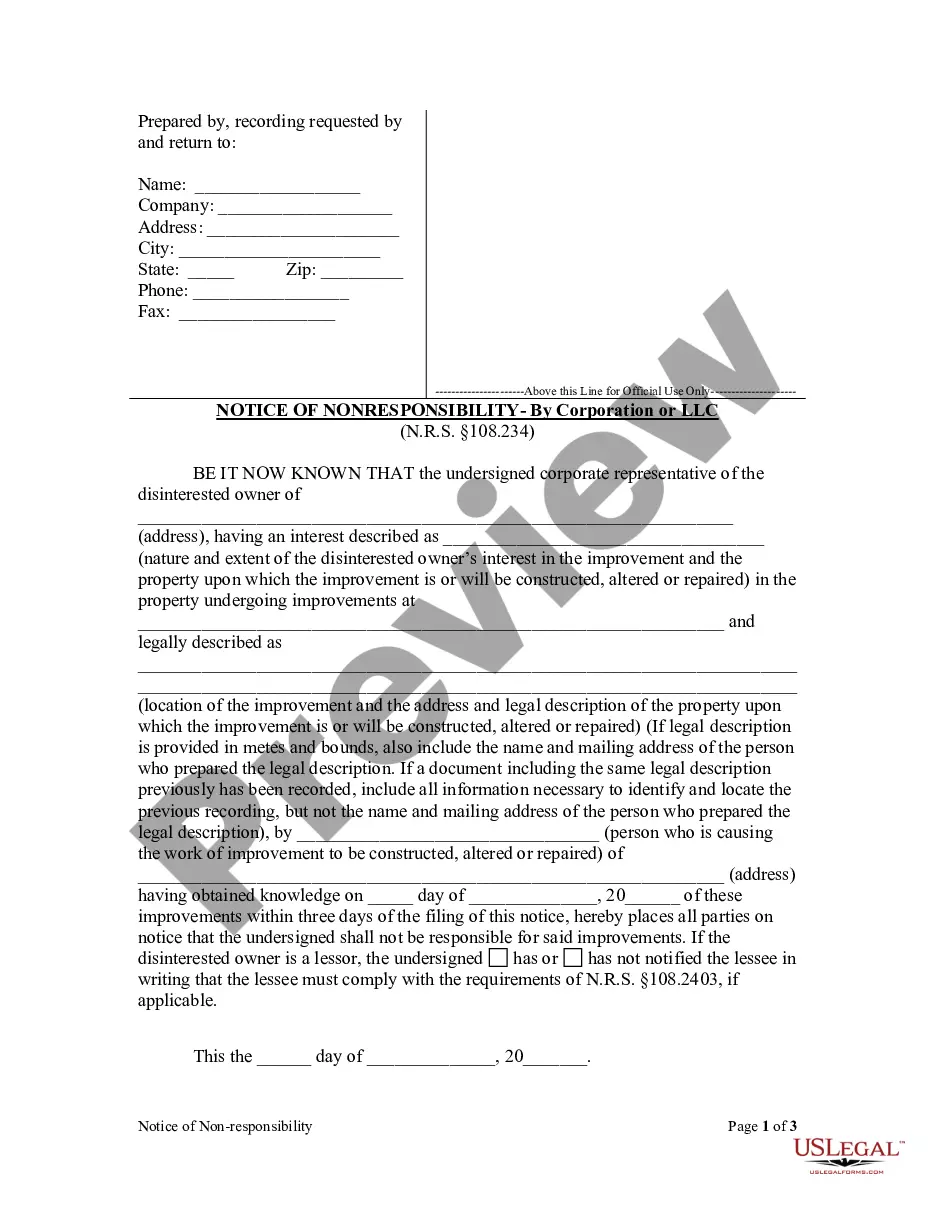

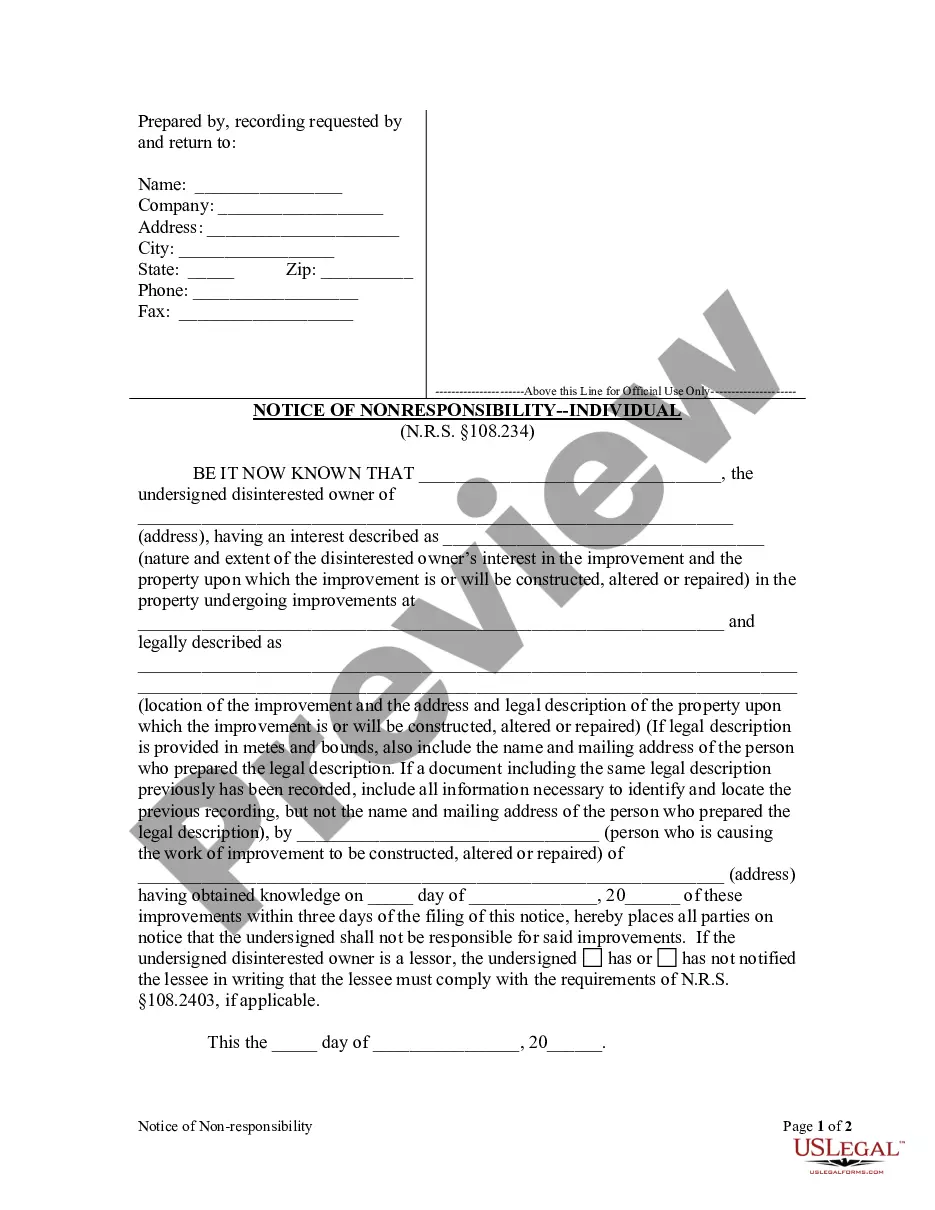

Nevada statutes presume that if individuals are furnishing labor or materials for the improvement of property they do so on behalf of the property owner and are entitled to a lien against the property for the value of the materials or labor provided. However, in the event that a person with an ownership interest in the property does not desire to be held responsible for the improvements, that party may file a notice of non-responsibility with the county recorder within three days of obtaining knowledge that improvements are being made.

Sparks Nevada Notice of Non Responsibility - Corporation

Description

How to fill out Nevada Notice Of Non Responsibility - Corporation?

Finding validated templates that adhere to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements and various real-world circumstances.

All forms are well-organized by usage area and jurisdiction, making it as straightforward as ABC to search for the Sparks Nevada Notice of Non Responsibility - Corporation or LLC.

Maintaining organized paperwork that complies with legal standards is extremely important. Utilize the US Legal Forms library to always have vital document templates readily available for any requirements!

- Review the Preview mode and form description.

- Ensure that you’ve chosen the appropriate document fulfilling your requirements and completely matching your local legal stipulations.

- Search for another template, if necessary.

- If you find any discrepancy, use the Search tab above to locate the correct one. If it fits your needs, move on to the next step.

- Complete the purchase.

- Click the Buy Now button and select your preferred subscription plan. You will need to register an account to access the library’s offerings.

Form popularity

FAQ

A notice of non-responsibility does not protect property owners from valid claims or debts incurred before the notice is filed. Essentially, if there are existing contracts or prior agreements, they still enforce liabilities despite submitting a notice. Additionally, this notice cannot shield the owner against legal disputes stemming from negligence or personal injury claims on the property. It's important to understand these limitations when you explore how a notice of non-responsibility in Sparks, Nevada, can enhance your legal protection.

In Nevada, various parties can place a lien on your property, including contractors, suppliers, and any party providing services or materials for construction or repairs. If these individuals do not receive payment for their work, they may file a lien which can affect your ownership rights. Understanding who can file a lien is essential for property management and financial security. By implementing a notice of non-responsibility in Sparks, Nevada, you can minimize the risk of unwanted liens.

In Nevada, a notice of non-responsibility is a legal tool used by property owners to inform others that they will not be liable for any work or materials provided on their property without explicit consent. This notice is vital in protecting the owner's financial assets from unfounded liens. When utilized effectively, a notice of non-responsibility can serve as a shield for property owners, particularly in Sparks, Nevada. You can ensure compliance with all local laws by seeking assistance through US Legal Forms.

A notice of non-responsibility signifies that a property owner refuses responsibility for any work done on their property without their consent. This legal declaration can prevent future claims against the property, especially from contractors or suppliers who may demand payment. For property owners in Sparks, Nevada, notice of non-responsibility is essential in protecting financial interests during property modifications. It's a wise step to take when you wish to avoid liabilities.

A no cause notice in Nevada indicates that a property owner is not responsible for certain claims related to construction or repair work performed on their property. This notice protects the owner from potential legal action or liens that might arise from unpaid contractors or suppliers. Essentially, it serves as a safeguard for individuals against unwanted financial burdens. Understanding this notice is crucial when engaging in any property work.

A notice of non-responsibility is a declaration intended to inform parties that a specific corporation or property owner is not liable for certain activities, especially when it comes to liabilities associated with property improvements. This notice serves as a shield against claims related to unpaid bills or contractor work. By issuing a Sparks Nevada Notice of Non Responsibility - Corporation, businesses can protect themselves from unforeseen financial responsibilities. Understanding this legal document can be beneficial for all property owners.

The notice of non-responsibility is a formal document that a property owner or corporation files to declare that it is not responsible for certain claims related to their property. This notice is crucial in protecting a corporation's interests and assets in Sparks, Nevada. By filing a notice, the corporation helps prevent potential liens and claims against it. This legal tool is an essential component of risk management for businesses.

Yes, you can challenge a notice of non-renewal if you believe it was issued incorrectly or if circumstances have changed. To effectively contest this notice, you will need solid grounds and possibly supporting evidence. It’s advisable to seek legal counsel to help navigate the complexities involved in this process. Utilizing resources like US Legal Forms can provide you with valuable guidance and necessary documentation for your situation.

The term 'non responsibility' refers to a legal declaration indicating that a party is not accountable for certain actions or claims. In the context of the Sparks Nevada Notice of Non Responsibility - Corporation, it serves as a protection for corporations against potential liabilities related to property. It essentially informs other parties that the corporation does not accept legal responsibility for specific liabilities. Understanding this concept can help you navigate legal obligations more confidently.