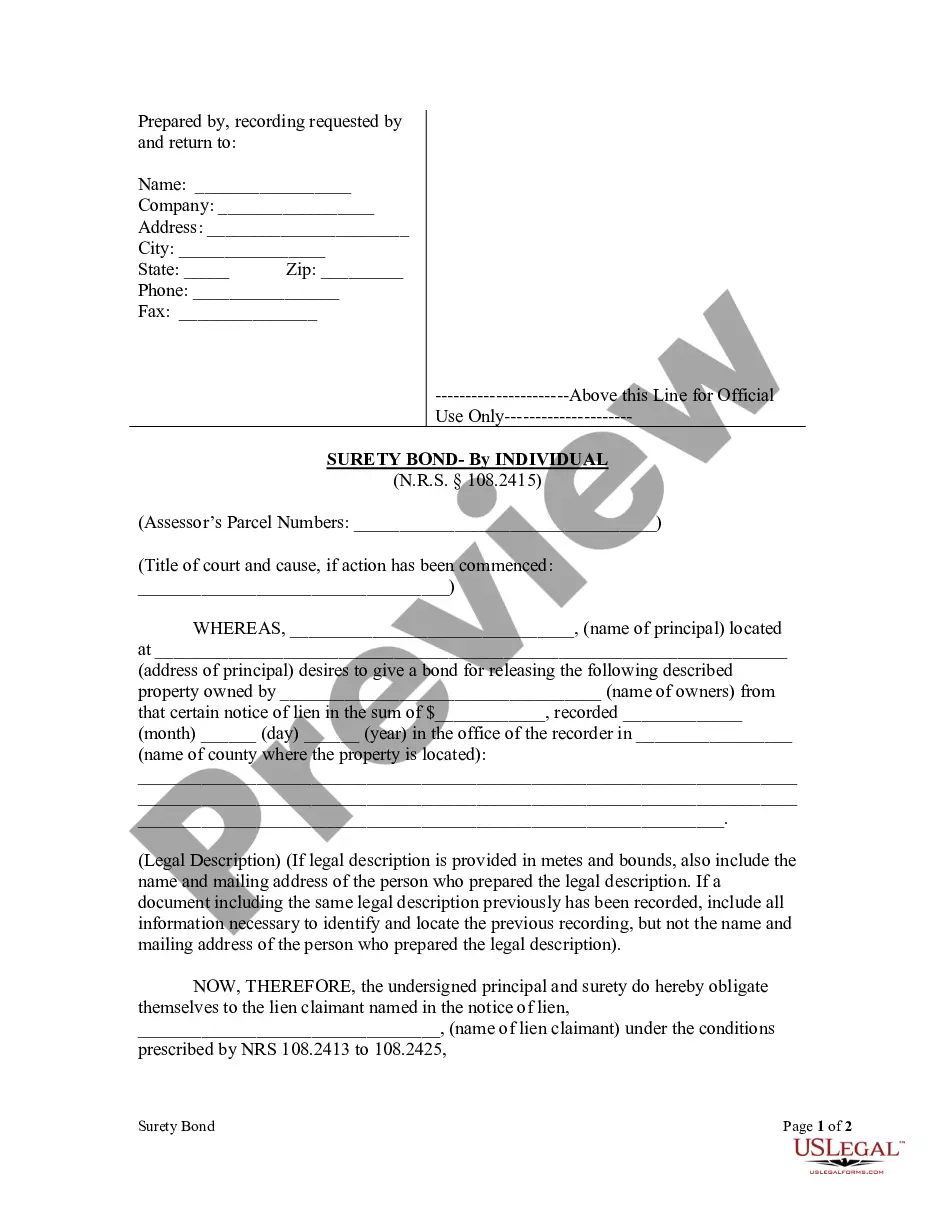

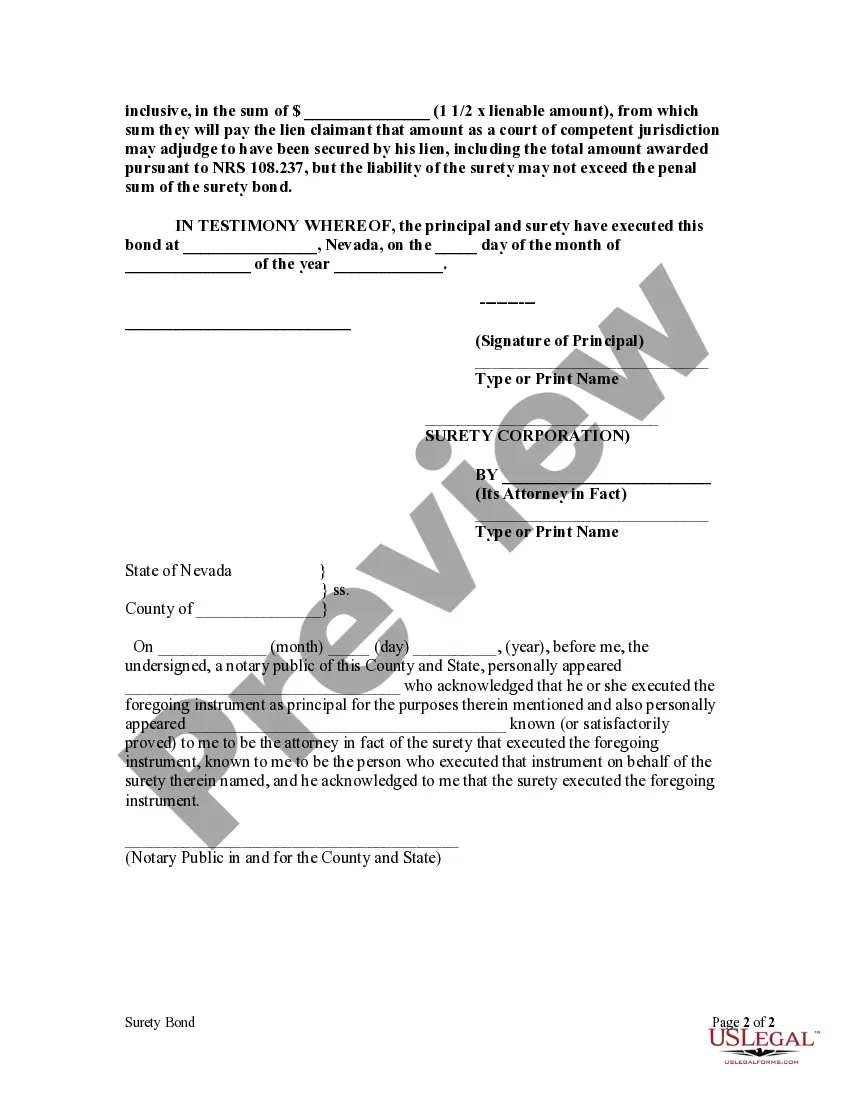

One principal method by which a mechanic's lien may be removed from a piece of improved property is for the property owner or principal contractor to obtain a bond in the amount of one and one-half times the amount of the lien claim. Nevada statutes require the bond to be substantially in the form of NV-06-09.

Clark Nevada surety bond form — Individual is a legal document that serves as a guarantee between three parties: the principal (individual or business), the obliged (government agency or entity requiring the bond), and the surety company (the insurer providing the bond). By obtaining this bond, the principal ensures compliance with specific laws, regulations, or contractual obligations. It acts as a financial protection against potential losses resulting from the principal's failure to fulfill its duties. There are several types of Clark Nevada Surety Bond Form — Individual, namely: 1. Contractor's License Bond: This bond is a prerequisite for contractors operating in Nevada. It ensures compliance with state regulations, including the payment of workers, subcontractors, and suppliers, while also safeguarding against any potential breaches of contract. 2. An Executor Bond: An executor, who manages a deceased person's estate, may be required by the court to obtain this bond. It provides financial security and ensures that the executor faithfully carries out their responsibilities, such as settling debts, distributing assets, and properly managing the estate. 3. Guardian Bond: When an individual is appointed as a guardian for a minor or incapacitated person, they may need to obtain a guardian bond. This bond guarantees that the guardian will act in the best interests of the ward and manage their assets responsibly. 4. Public Official Bond: Public officials, such as notaries, tax preparers, or county clerks, might be mandated to obtain this bond. It guarantees that they will fulfill their duties honestly, ethically, and in accordance with the law, protecting the public from any potential harm. 5. Tax Bond: The Internal Revenue Service (IRS) may require individuals or businesses to obtain a tax bond as a guarantee for the payment of taxes owed. It provides an assurance that the taxpayer will fulfill their tax obligations, thereby safeguarding the government from financial losses. 6. License and Permit Bonds: Individuals operating certain businesses, such as auto dealerships, contractors, or mortgage brokers, may be required to procure license and permit bonds. These bonds protect consumers and ensure that the licensed individual complies with industry regulations, laws, and fulfills contractual obligations. Clark Nevada Surety Bond Form — Individual is crucial for various industries and professionals needing to meet legal requirements. By procuring the appropriate bond, individuals and businesses demonstrate financial responsibility, trustworthiness, and commitment to fulfilling their obligations, ultimately upholding the best interests of the public and clients.Clark Nevada surety bond form — Individual is a legal document that serves as a guarantee between three parties: the principal (individual or business), the obliged (government agency or entity requiring the bond), and the surety company (the insurer providing the bond). By obtaining this bond, the principal ensures compliance with specific laws, regulations, or contractual obligations. It acts as a financial protection against potential losses resulting from the principal's failure to fulfill its duties. There are several types of Clark Nevada Surety Bond Form — Individual, namely: 1. Contractor's License Bond: This bond is a prerequisite for contractors operating in Nevada. It ensures compliance with state regulations, including the payment of workers, subcontractors, and suppliers, while also safeguarding against any potential breaches of contract. 2. An Executor Bond: An executor, who manages a deceased person's estate, may be required by the court to obtain this bond. It provides financial security and ensures that the executor faithfully carries out their responsibilities, such as settling debts, distributing assets, and properly managing the estate. 3. Guardian Bond: When an individual is appointed as a guardian for a minor or incapacitated person, they may need to obtain a guardian bond. This bond guarantees that the guardian will act in the best interests of the ward and manage their assets responsibly. 4. Public Official Bond: Public officials, such as notaries, tax preparers, or county clerks, might be mandated to obtain this bond. It guarantees that they will fulfill their duties honestly, ethically, and in accordance with the law, protecting the public from any potential harm. 5. Tax Bond: The Internal Revenue Service (IRS) may require individuals or businesses to obtain a tax bond as a guarantee for the payment of taxes owed. It provides an assurance that the taxpayer will fulfill their tax obligations, thereby safeguarding the government from financial losses. 6. License and Permit Bonds: Individuals operating certain businesses, such as auto dealerships, contractors, or mortgage brokers, may be required to procure license and permit bonds. These bonds protect consumers and ensure that the licensed individual complies with industry regulations, laws, and fulfills contractual obligations. Clark Nevada Surety Bond Form — Individual is crucial for various industries and professionals needing to meet legal requirements. By procuring the appropriate bond, individuals and businesses demonstrate financial responsibility, trustworthiness, and commitment to fulfilling their obligations, ultimately upholding the best interests of the public and clients.