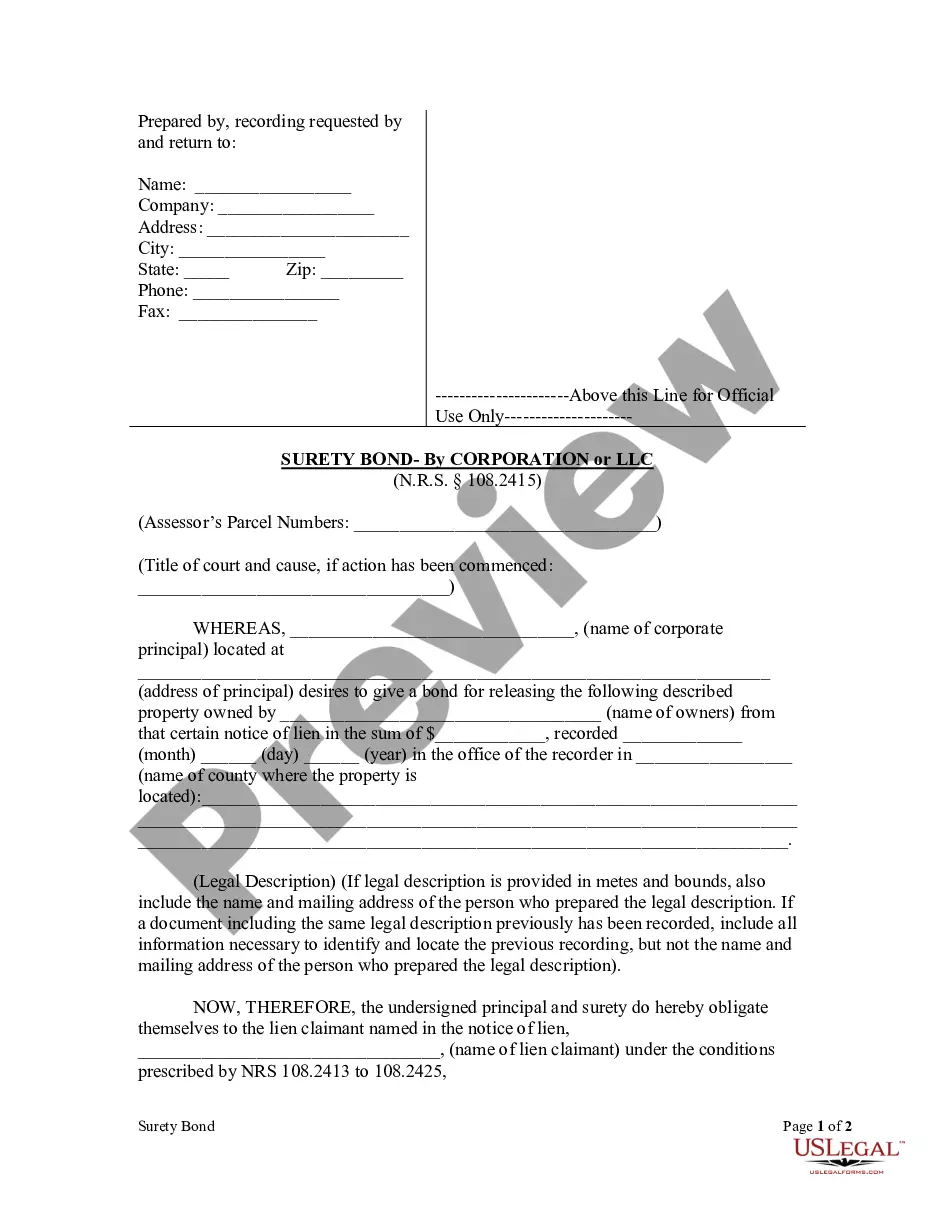

One principal method by which a mechanic's lien may be removed from a piece of improved property is for the property owner or principal contractor to obtain a bond in the amount of one and one-half times the amount of the lien claim. Nevada statutes require the bond to be substantially in the form of NV-06A-09.

Clark Nevada Surety Bond Form — Corporation or LLC is a legal document required in Clark County, Nevada, for corporations and limited liability companies (LCS) operating within the county. This bond form pertains specifically to these business entities and ensures that they comply with local regulations and requirements. The Clark Nevada Surety Bond Form serves as a guarantee to protect the county and its residents from any potential financial losses resulting from the operations of corporations and LCS. It provides a financial safety net in case the business fails to fulfill its responsibilities, such as paying taxes, complying with licensing requirements, or fulfilling contractual obligations. This bond form comes in different types, each catering to specific needs and obligations of corporations and LCS: 1. Tax Bond: This type of bond is required for businesses to guarantee their payment of taxes to the county. It ensures that the corporation or LLC will remit their tax liabilities promptly, as stated by the local tax laws and regulations. 2. License and Permit Bond: This bond is essential for corporations or LCS that need specific licenses or permits operating legally within Clark County. It ensures that the business adheres to all the terms and conditions set forth by the licensing authorities and covers any damages resulting from non-compliance. 3. Contract Bond: A contract bond is necessary for corporations or LCS that engage in construction, public works, or other contractual projects within Clark County. It guarantees that the business will fulfill its contractual obligations and complete the project to the client's satisfaction, protecting against financial loss. To obtain a Clark Nevada Surety Bond Form — Corporation or LLC, businesses need to approach a licensed surety bond agent or agency. The agent will assess the specific requirements and obligations of the corporation or LLC and determine the appropriate type and coverage of the bond. Compliance with the Clark Nevada Surety Bond Form is crucial for corporations and LCS operating within Clark County. It not only fulfills legal obligations but also instills confidence in clients, suppliers, and the local community, showcasing the business's commitment to ethical and responsible operations.Clark Nevada Surety Bond Form — Corporation or LLC is a legal document required in Clark County, Nevada, for corporations and limited liability companies (LCS) operating within the county. This bond form pertains specifically to these business entities and ensures that they comply with local regulations and requirements. The Clark Nevada Surety Bond Form serves as a guarantee to protect the county and its residents from any potential financial losses resulting from the operations of corporations and LCS. It provides a financial safety net in case the business fails to fulfill its responsibilities, such as paying taxes, complying with licensing requirements, or fulfilling contractual obligations. This bond form comes in different types, each catering to specific needs and obligations of corporations and LCS: 1. Tax Bond: This type of bond is required for businesses to guarantee their payment of taxes to the county. It ensures that the corporation or LLC will remit their tax liabilities promptly, as stated by the local tax laws and regulations. 2. License and Permit Bond: This bond is essential for corporations or LCS that need specific licenses or permits operating legally within Clark County. It ensures that the business adheres to all the terms and conditions set forth by the licensing authorities and covers any damages resulting from non-compliance. 3. Contract Bond: A contract bond is necessary for corporations or LCS that engage in construction, public works, or other contractual projects within Clark County. It guarantees that the business will fulfill its contractual obligations and complete the project to the client's satisfaction, protecting against financial loss. To obtain a Clark Nevada Surety Bond Form — Corporation or LLC, businesses need to approach a licensed surety bond agent or agency. The agent will assess the specific requirements and obligations of the corporation or LLC and determine the appropriate type and coverage of the bond. Compliance with the Clark Nevada Surety Bond Form is crucial for corporations and LCS operating within Clark County. It not only fulfills legal obligations but also instills confidence in clients, suppliers, and the local community, showcasing the business's commitment to ethical and responsible operations.