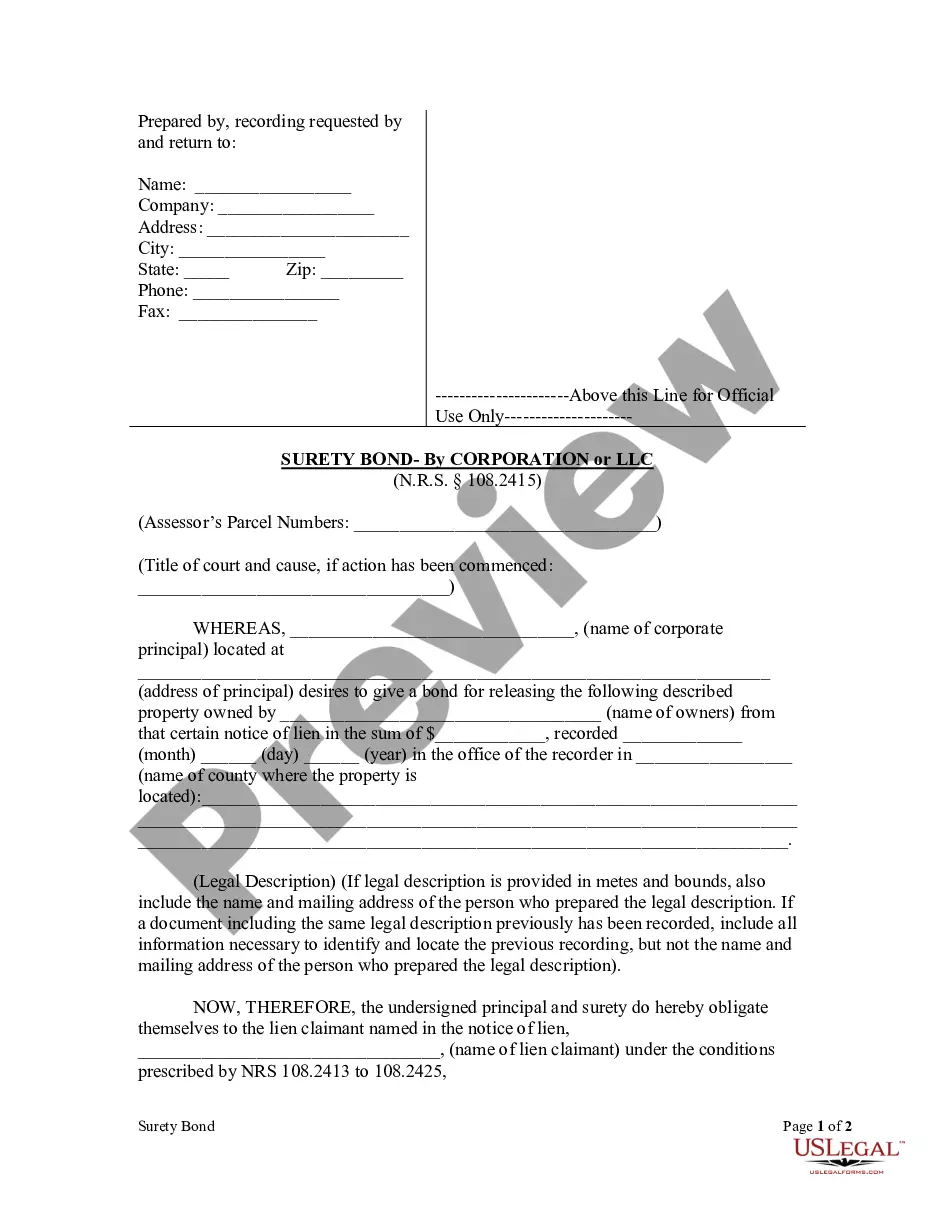

One principal method by which a mechanic's lien may be removed from a piece of improved property is for the property owner or principal contractor to obtain a bond in the amount of one and one-half times the amount of the lien claim. Nevada statutes require the bond to be substantially in the form of NV-06A-09.

A Sparks Nevada Surety Bond Form — Corporation or LLC is a legal document that serves as a guarantee for the proper execution of specific actions or obligations by corporations or limited liability companies (LCS) registered in Sparks, Nevada. This bond is often required by the state or other relevant authorities as a condition to grant business licenses or permits. It aims to protect consumers and governments from potential financial losses resulting from non-compliance or misconduct by corporations or LCS. There are several types of Sparks Nevada Surety Bond Forms applicable to both corporations and LCS. The most common ones include: 1. Business License Surety Bond: This bond is typically required when obtaining a business license in Sparks, Nevada. It assures that the corporation or LLC will adhere to all applicable laws and regulations while conducting its business operations. 2. Contractor License Surety Bond: If a corporation or LLC intends to work as a contractor in Sparks, Nevada, a contractor license surety bond may be mandatory. This bond guarantees that the licensed corporation or LLC will fulfill its contractual obligations, pay subcontractors, and comply with laws and regulations governing the construction industry. 3. Tax Bond: Companies involved in the collection, administration, or payment of taxes may be required to post a tax bond. This bond ensures that the corporation or LLC will promptly pay the required amount of taxes and comply with all tax-related regulations in Sparks, Nevada. 4. Permit Bond: Certain corporations or LCS may require specific permits or licenses to operate in Sparks, Nevada. A permit bond guarantees that the company will comply with the terms and conditions of the permit and fulfill any financial obligations associated with it. 5. Court Bond: In certain legal proceedings, such as civil litigation or appeals, a corporation or LLC may be required to post a court bond. This bond ensures that the corporation or LLC will fulfill its obligations as determined by the court and cover any financial losses suffered by the opposing party. Obtaining the appropriate Sparks Nevada Surety Bond Form — Corporation or LLC is essential for businesses operating in Sparks. By ensuring compliance with legal and financial obligations, these bonds help maintain a secure and trustworthy business environment for consumers, contractors, and the overall community.A Sparks Nevada Surety Bond Form — Corporation or LLC is a legal document that serves as a guarantee for the proper execution of specific actions or obligations by corporations or limited liability companies (LCS) registered in Sparks, Nevada. This bond is often required by the state or other relevant authorities as a condition to grant business licenses or permits. It aims to protect consumers and governments from potential financial losses resulting from non-compliance or misconduct by corporations or LCS. There are several types of Sparks Nevada Surety Bond Forms applicable to both corporations and LCS. The most common ones include: 1. Business License Surety Bond: This bond is typically required when obtaining a business license in Sparks, Nevada. It assures that the corporation or LLC will adhere to all applicable laws and regulations while conducting its business operations. 2. Contractor License Surety Bond: If a corporation or LLC intends to work as a contractor in Sparks, Nevada, a contractor license surety bond may be mandatory. This bond guarantees that the licensed corporation or LLC will fulfill its contractual obligations, pay subcontractors, and comply with laws and regulations governing the construction industry. 3. Tax Bond: Companies involved in the collection, administration, or payment of taxes may be required to post a tax bond. This bond ensures that the corporation or LLC will promptly pay the required amount of taxes and comply with all tax-related regulations in Sparks, Nevada. 4. Permit Bond: Certain corporations or LCS may require specific permits or licenses to operate in Sparks, Nevada. A permit bond guarantees that the company will comply with the terms and conditions of the permit and fulfill any financial obligations associated with it. 5. Court Bond: In certain legal proceedings, such as civil litigation or appeals, a corporation or LLC may be required to post a court bond. This bond ensures that the corporation or LLC will fulfill its obligations as determined by the court and cover any financial losses suffered by the opposing party. Obtaining the appropriate Sparks Nevada Surety Bond Form — Corporation or LLC is essential for businesses operating in Sparks. By ensuring compliance with legal and financial obligations, these bonds help maintain a secure and trustworthy business environment for consumers, contractors, and the overall community.