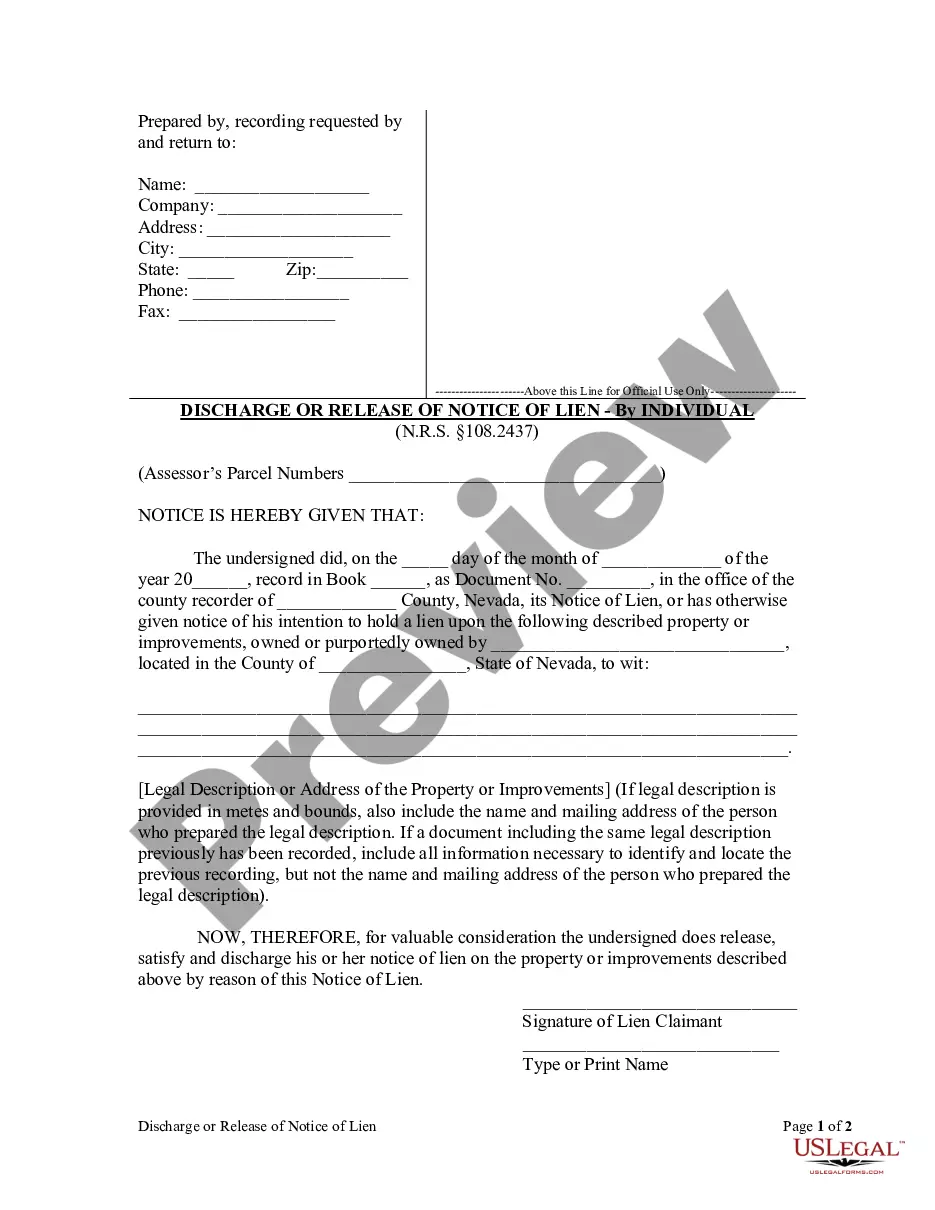

If a property owner or other party adversely affected by a lien satisfies that lien, Nevada statutes require that the lienholder file a release of lien with the county recorder within ten days of the date the lien was satisfied. Failure to do so within ten days will result in the lienholder being liable in a civil action for any actual damages or for $100, whichever is greater.

Las Vegas Nevada Discharge or Release of Lien - Individual

Description

How to fill out Nevada Discharge Or Release Of Lien - Individual?

Regardless of social or career standing, finalizing legal documents is an unfortunate requirement in today’s workplace.

Too frequently, it’s nearly unfeasible for someone lacking legal education to generate such paperwork from scratch, primarily due to the intricate language and legal nuances they entail.

This is where US Legal Forms proves beneficial.

Ensure the template you selected is appropriate for your area, as the regulations of one state or region may not apply to another.

Review the document and read a brief description (if available) of the situations the document can be used for. If the form you chose does not meet your requirements, you can start again and look for the correct form.

- Our platform provides an extensive library with over 85,000 ready-to-use state-specific templates applicable to virtually any legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors who aim to save time by utilizing our DIY documents.

- No matter if you require the Las Vegas Nevada Discharge or Release of Lien - Individual, or any other document suitable for your state or region, with US Legal Forms, everything is readily available.

- Here’s how to quickly obtain the Las Vegas Nevada Discharge or Release of Lien - Individual using our reliable platform.

- If you are already a registered user, you can proceed to Log In to your account to download the necessary form.

- If you are new to our platform, ensure to follow these steps before acquiring the Las Vegas Nevada Discharge or Release of Lien - Individual.

Form popularity

FAQ

When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

If your local DMV does not provide online access to titles, it is possible to visit their local office and request a title report. This report will provide lien information and in most cases will alert you to any accidents the car has been involved in.

Yes, Nevada is one of the 12 states that provide statutory lien waiver forms that must be used to effectively waive lien rights in Nevada.

No, California statute specifically prohibits waiving lien rights in the contract.

Visiting a local DMV service provider is a fast way to remove a lien from your title. These businesses are authorized by the California DMV to provide a full-range of DMV registration services quickly in-house. DMV service providers charge a nominal fee for processing, but often have little or no wait time.

If you are requesting a lien release from your lender, they can complete form MV37A....You have three options for lien releases: You are not required to submit your lien release to the Department of Motor Vehicles.You can also bring the release to one of our offices to be scanned into the Department of Justice's system.

A judgment lien in Nevada will remain attached to the debtor's property (even if the property changes hands) for six years.

An unlicensed lien claimant (when a license is required) has no right to record a lien (NRS 108.222(2)), and has no right to recover for its performed work or enforce its contract (NRS 624.320). In Nevada, a preliminary notice is called a ?Notice of Right to Lien?.

Effective January 1, 2012, pursuant to Subchapter L, Chapter 53, Texas Property Code, statutory forms are required for any waiver and release of a lien or payment bond claim. House Bill 1456 of the 82nd Legislature contains the statutory wording for the forms and other important changes in law.

To release a lien, the lien holder must sign and date two (2) release of lien forms. Mail one (1), signed and dated, copy of a lien release to the Oklahoma Tax Commission, P.O. Box 269061 Oklahoma City, Ok 73126, and one (1), signed and dated, copy of the lien release to the debtor.