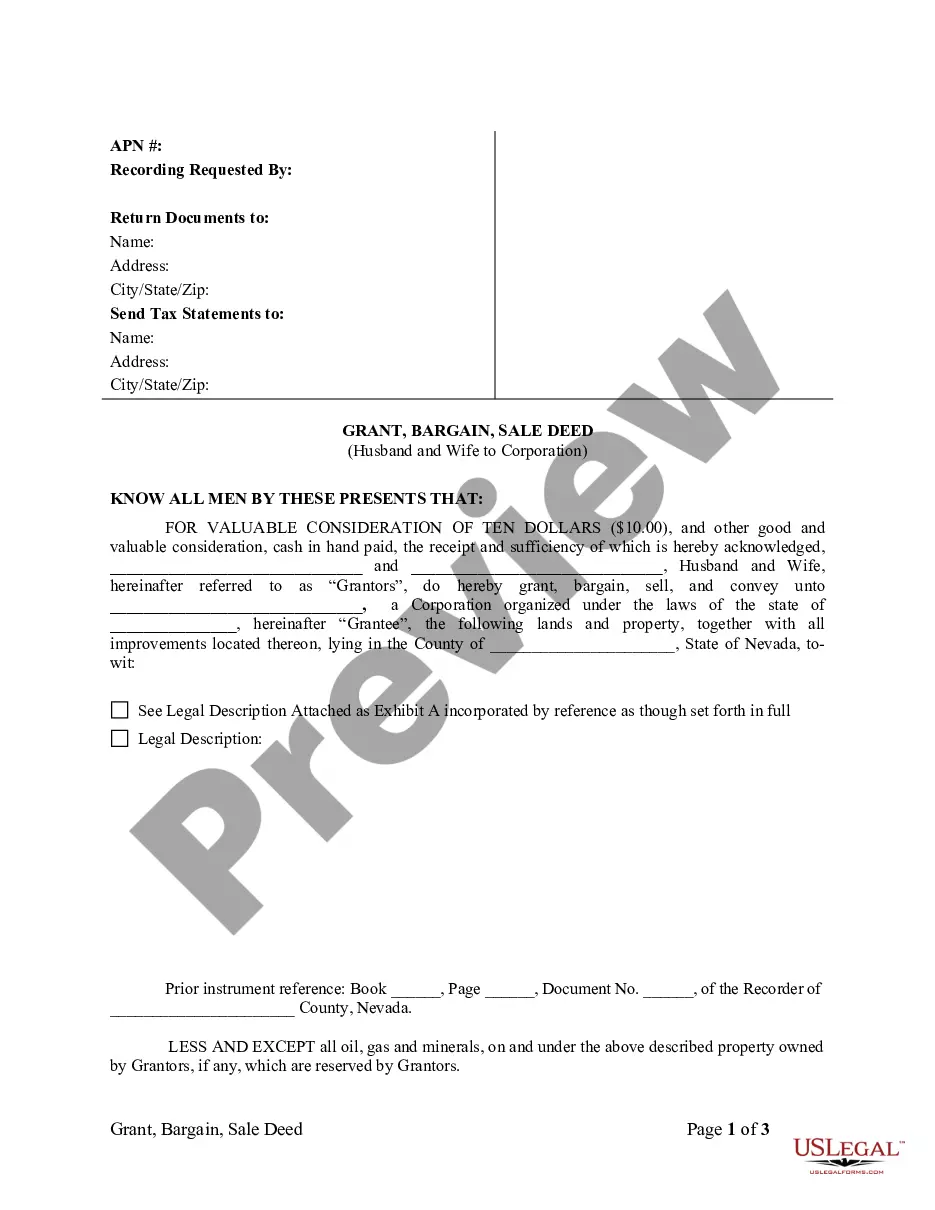

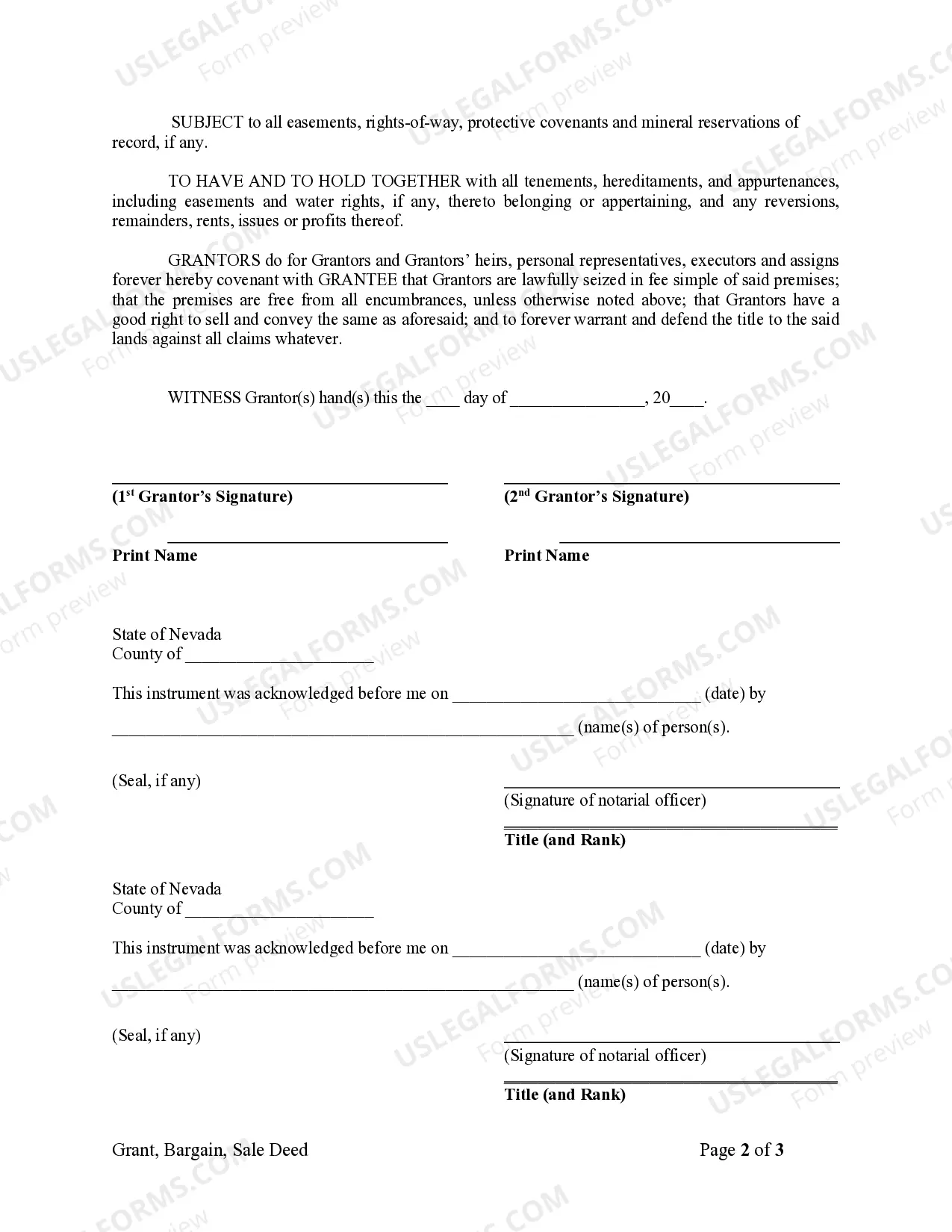

A Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to Corporation is a legal document that transfers ownership of a property from a married couple to a corporation. This type of deed is commonly used when a husband and wife jointly own a property and wish to transfer the asset to a corporation, typically for business purposes or to protect the property from personal liability. The Clark Nevada Grant, Bargain, Sale Deed ensures a clean transfer of ownership rights, providing legal protection to both parties involved. The deed outlines the terms of the sale, including the consideration paid for the property, the names of the husband and wife as granters, and the corporation as the grantee. It may also include details about any encumbrances or restrictions on the property. There are several instances where different variations of Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to Corporation come into play. Some common types include: 1. General Grant Deed: This is the most common type of deed used to transfer ownership of real property. It guarantees that the seller (husband and wife) has the legal right to transfer the property and that there are no undisclosed claims or liens against it. 2. Special Warranty Deed: This type of deed offers a limited warranty, protecting the buyer (corporation) from any claims arising only during the time the husband and wife owned the property. It does not cover any issues that existed before their ownership. 3. Quitclaim Deed: When using a quitclaim deed, the husband and wife transfer their ownership interest in the property to the corporation. However, this type of deed provides no warranties or guarantees regarding ownership rights or any potential encumbrances on the property. Regardless of the specific type of deed used, it is essential to consult with legal professionals specializing in real estate transactions to ensure the proper preparation, execution, and recording of the Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to Corporation. These professionals will guide the parties involved through the process, making sure all legal requirements are met and protecting the interests of everyone involved.

Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to Corporation

Description

How to fill out Clark Nevada Grant, Bargain, Sale Deed From Husband And Wife To Corporation?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no law background to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to Corporation or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to Corporation in minutes using our reliable platform. If you are presently an existing customer, you can go on and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps prior to downloading the Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to Corporation:

- Ensure the form you have chosen is specific to your location since the regulations of one state or area do not work for another state or area.

- Review the document and go through a short description (if available) of scenarios the paper can be used for.

- In case the one you selected doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to Corporation once the payment is completed.

You’re good to go! Now you can go on and print out the document or fill it out online. If you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.