If a property owner or other party adversely affected by a lien satisfies that lien, Nevada statutes require that the lienholder file a release of lien with the county recorder within ten days of the date the lien was satisfied. Failure to do so within ten days will result in the lienholder being liable in a civil action for any actual damages or for $100, whichever is greater.

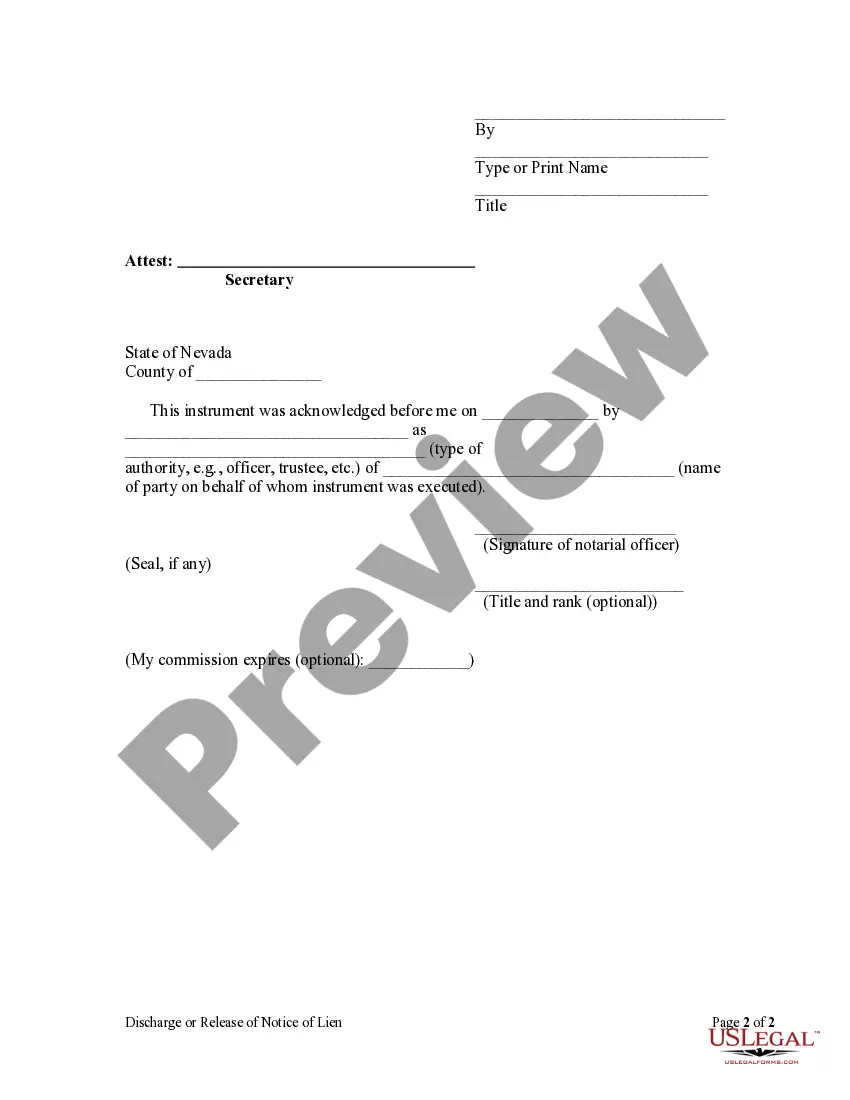

A Clark Nevada Discharge or Release of Lien — Corporation refers to a legal document that releases or discharges a lien that a corporation may have against a property in Clark County, Nevada. Liens are typically placed on properties to secure debts or financial obligations. However, once the debt has been fully repaid or settled, it becomes necessary to release the lien to ensure clear ownership of the property. When a corporation issues a Clark Nevada Discharge or Release of Lien, it signifies that the corporation acknowledges that the lien is no longer necessary or valid. This document is crucial for both the property owner and the corporation, as it provides evidence that the lien has been officially released and eliminates any future claims or disputes over the property. Some relevant keywords that can be associated with Clark Nevada Discharge or Release of Lien — Corporation include: 1. Lien: A legal claim or encumbrance on a property to secure a debt or obligation. 2. Corporation: A legal entity that is separate from its owners and operates as a business entity. 3. Property: Refers to land, buildings, or any other assets that can be owned. 4. Release: The act of setting free or relinquishing a claim, in this context, a lien. 5. Discharge: The act of officially removing or eliminating a debt or obligation, in this case, a lien. 6. Clark County, Nevada: A county located in the state of Nevada, USA, known for its vibrant city of Las Vegas. Types of Clark Nevada Discharge or Release of Lien — Corporation may include: 1. Full Release of Lien: This type of release signifies the complete discharge of a corporation's lien on a property, indicating that the debt or obligation has been fully settled. 2. Partial Release of Lien: In some cases, a corporation may agree to release only a portion of the lien, usually when a partial payment has been made. This allows the property owner to proceed with certain transactions or developments while still acknowledging the remaining balance. 3. Conditional Release of Lien: This type of release is granted with certain conditions or stipulations. It ensures that the lien is released upon the fulfillment of specific requirements or obligations by the property owner. 4. Temporary Release of Lien: In rare cases, a corporation may issue a temporary release of lien for a specific period or purpose. This type of release indicates a temporary suspension of the lien, allowing the property owner to meet certain objectives or requirements within a limited timeframe. Overall, a Clark Nevada Discharge or Release of Lien — Corporation serves as a critical legal document that validates the release of a lien by a corporation on a property in Clark County, Nevada. Whether it is a full or partial release, conditional or temporary, this document holds immense importance in ensuring the clear and unencumbered ownership of the property.A Clark Nevada Discharge or Release of Lien — Corporation refers to a legal document that releases or discharges a lien that a corporation may have against a property in Clark County, Nevada. Liens are typically placed on properties to secure debts or financial obligations. However, once the debt has been fully repaid or settled, it becomes necessary to release the lien to ensure clear ownership of the property. When a corporation issues a Clark Nevada Discharge or Release of Lien, it signifies that the corporation acknowledges that the lien is no longer necessary or valid. This document is crucial for both the property owner and the corporation, as it provides evidence that the lien has been officially released and eliminates any future claims or disputes over the property. Some relevant keywords that can be associated with Clark Nevada Discharge or Release of Lien — Corporation include: 1. Lien: A legal claim or encumbrance on a property to secure a debt or obligation. 2. Corporation: A legal entity that is separate from its owners and operates as a business entity. 3. Property: Refers to land, buildings, or any other assets that can be owned. 4. Release: The act of setting free or relinquishing a claim, in this context, a lien. 5. Discharge: The act of officially removing or eliminating a debt or obligation, in this case, a lien. 6. Clark County, Nevada: A county located in the state of Nevada, USA, known for its vibrant city of Las Vegas. Types of Clark Nevada Discharge or Release of Lien — Corporation may include: 1. Full Release of Lien: This type of release signifies the complete discharge of a corporation's lien on a property, indicating that the debt or obligation has been fully settled. 2. Partial Release of Lien: In some cases, a corporation may agree to release only a portion of the lien, usually when a partial payment has been made. This allows the property owner to proceed with certain transactions or developments while still acknowledging the remaining balance. 3. Conditional Release of Lien: This type of release is granted with certain conditions or stipulations. It ensures that the lien is released upon the fulfillment of specific requirements or obligations by the property owner. 4. Temporary Release of Lien: In rare cases, a corporation may issue a temporary release of lien for a specific period or purpose. This type of release indicates a temporary suspension of the lien, allowing the property owner to meet certain objectives or requirements within a limited timeframe. Overall, a Clark Nevada Discharge or Release of Lien — Corporation serves as a critical legal document that validates the release of a lien by a corporation on a property in Clark County, Nevada. Whether it is a full or partial release, conditional or temporary, this document holds immense importance in ensuring the clear and unencumbered ownership of the property.