If a property owner or other party adversely affected by a lien satisfies that lien, Nevada statutes require that the lienholder file a release of lien with the county recorder within ten days of the date the lien was satisfied. Failure to do so within ten days will result in the lienholder being liable in a civil action for any actual damages or for $100, whichever is greater.

Sparks Nevada Discharge or Release of Lien - Corporation

Description

How to fill out Nevada Discharge Or Release Of Lien - Corporation?

Utilize the US Legal Forms to gain instant access to any form template you need.

Our helpful website containing thousands of samples makes it easy to locate and acquire nearly any document you desire.

You can download, fill out, and sign the Sparks Nevada Discharge or Release of Lien - Corporation in just a few minutes rather than spending hours searching online for a suitable template.

Leveraging our collection is a great way to enhance the security of your form submission.

If you have not yet created an account, follow the instructions below.

Access the page with the form you need. Ensure that it is the template you are searching for: confirm its title and description, and take advantage of the Preview feature when available. Otherwise, use the Search bar to find the required document.

- Our expert legal consultants regularly examine all documents to ensure that the templates are valid for a specific state and comply with recent laws and regulations.

- How can you access the Sparks Nevada Discharge or Release of Lien - Corporation.

- If you already possess an account, simply Log In to your profile.

- The Download button will be visible on all documents you browse.

- Additionally, you can retrieve all previously saved documents in the My documents section.

Form popularity

FAQ

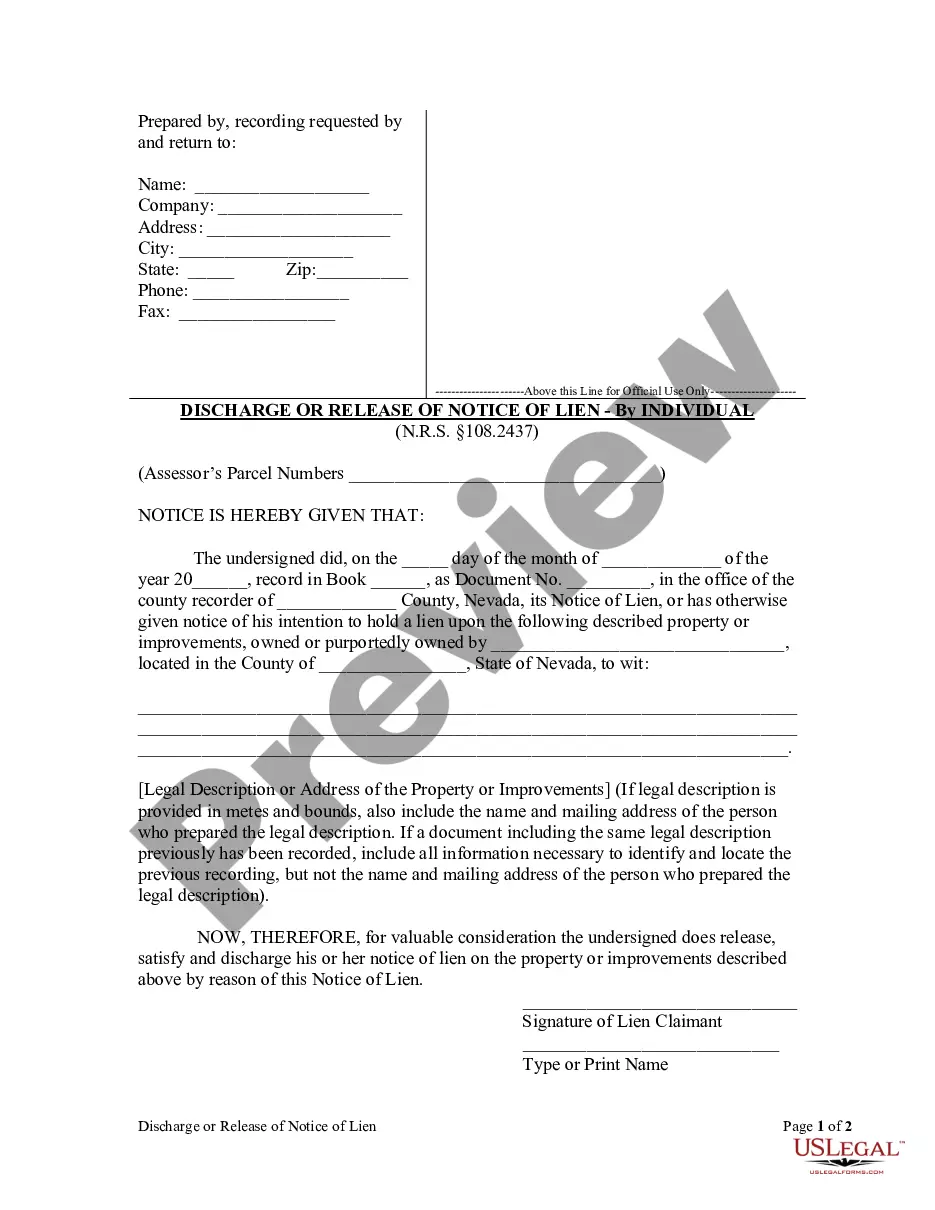

The process of releasing a lien is known as lien discharge or lien release. This process confirms that the obligations related to the lien have been fulfilled and that the lienholder no longer has a claim on the property. Engaging with the Sparks Nevada Discharge or Release of Lien - Corporation solutions can simplify your understanding and execution of this important legal procedure.

A recorded lien release document is an official record that confirms a lien has been discharged. This document is filed with the appropriate county office, marking the lien's removal from the property title. When dealing with property in Sparks, understanding the Sparks Nevada Discharge or Release of Lien - Corporation process ensures that you protect your rights and clear any encumbrances effectively.

Upon receiving a lien release letter, it is essential to properly file it with your county recorder's office. This step ensures that the lien is officially removed from public records. Handling this promptly helps avoid any potential complications in property transactions or title searches, making the Sparks Nevada Discharge or Release of Lien - Corporation a crucial aspect of your real estate dealings.

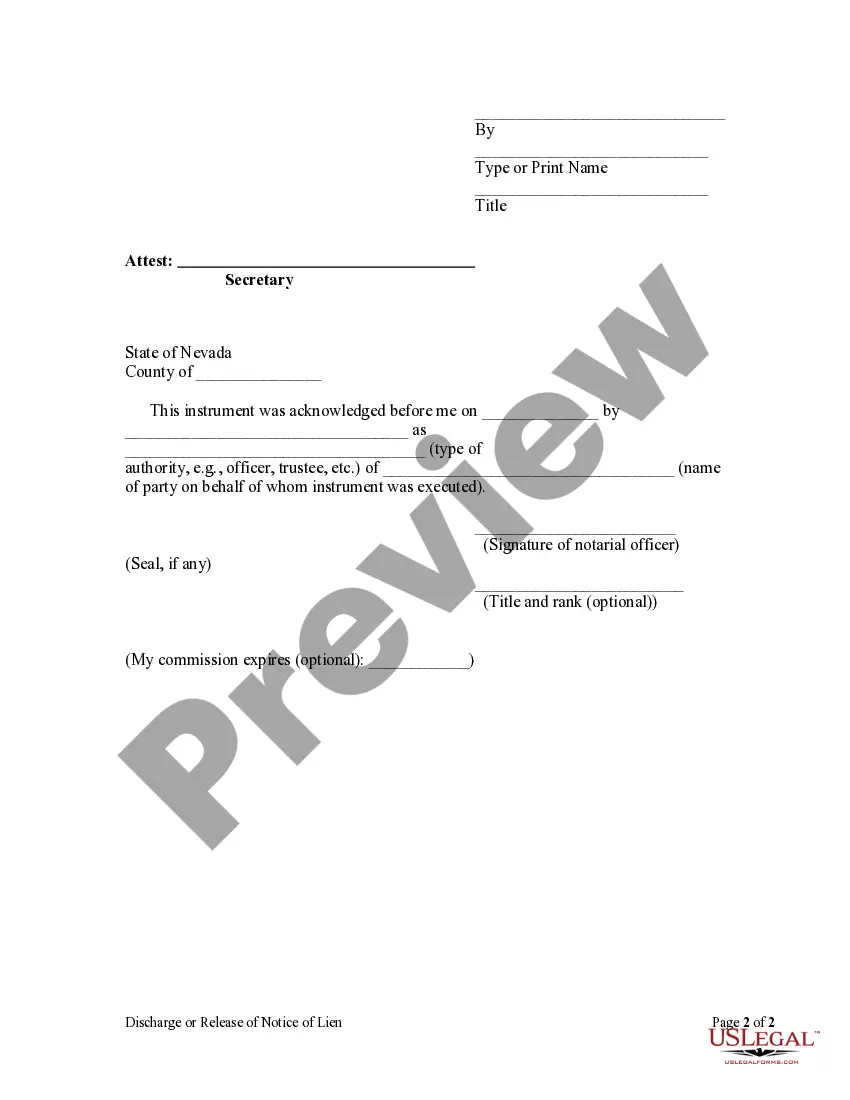

Creating a lien release begins with drafting a document that clearly states the release of the lien. It should include important details such as the property description, the lienholder's name, and the date of the lien's discharge. Using the Sparks Nevada Discharge or Release of Lien - Corporation service can help streamline this process and ensure that your release document meets all legal requirements.

In Nevada, lien waivers do not generally require notarization to be effective. However, it is advisable to have them notarized to ensure their validity and enforceability. The Sparks Nevada Discharge or Release of Lien - Corporation process becomes simpler when all parties agree on the document's authenticity. Therefore, while notarization is not mandatory, it can provide an extra layer of security.

When writing a letter to request a lien release for Sparks Nevada Discharge or Release of Lien - Corporation, start by addressing the appropriate parties and clearly stating your request. Include essential details such as the nature of the lien, the involved parties, and any supporting information that justifies your request. Be clear and concise to enhance the chances of a swift response.

The timeframe for obtaining a lien release in Sparks, Nevada, can vary depending on the complexity of the case and the response time of involved parties. Generally, if all necessary documents are in order, you could receive a lien release within a few business days. Ensuring prompt communication can significantly accelerate this process.

For Sparks Nevada Discharge or Release of Lien - Corporation, you typically need the original lien document, proof of payment, and identification of all parties involved. Be prepared to provide any additional documentation like contracts or agreements that support the claim for the release. Having complete paperwork will facilitate a smoother release process.

Creating a release of lien for Sparks Nevada Discharge or Release of Lien - Corporation involves drafting a formal document that states the lien is no longer valid. You should include specific information such as the date of the original lien, the parties involved, and the reasons for the release. Utilizing the uslegalforms platform can simplify this process by providing templates tailored to your needs.

To fill out a lien affidavit for Sparks Nevada Discharge or Release of Lien - Corporation, start by providing the basic information about the property and the parties involved. You will need to include details such as the legal description of the property and any applicable dates. Ensure that all required fields are accurately completed to avoid delays in processing.