A Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to LLC is a legal document that transfers ownership of real property from a married couple to a Limited Liability Company (LLC) located in Clark County, Nevada. This type of deed is commonly used when individuals wish to transfer property to a business entity they have established for investment or protection purposes. The Clark Nevada Grant, Bargain, Sale Deed provides specific details about the property being transferred, including the legal description, address, and parcel identification number. It typically includes information about the husband and wife as the granters, the LLC as the grantee, and the consideration or purchase price if applicable. Transferring property to an LLC offers several advantages, such as liability protection and easier management of assets. By holding real estate within an LLC, the individuals can shield their personal assets from potential legal claims or creditors. There are different types of Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to LLC, including: 1. Basic Clark Nevada Grant, Bargain, Sale Deed: This is the standard form used for transferring property from a husband and wife to an LLC. It includes all the necessary details and terms of the transfer. 2. Enhanced Clark Nevada Grant, Bargain, Sale Deed: This type of deed may include additional provisions or clauses related to specific requirements or preferences of the parties involved. For example, it may address issues such as leaseback arrangements, reserved rights to certain portions of the property, or conditions on how the LLC can use the property. 3. Special Warranty Clark Nevada Grant, Bargain, Sale Deed: This variation of the deed provides a limited warranty of title. It guarantees that the granters are the legal owners of the property during their ownership period, but it does not cover any potential title issues before they acquired the property. 4. Quitclaim Clark Nevada Grant, Bargain, Sale Deed: Although not commonly used in this context, a quitclaim deed may also be utilized for the transfer. However, it is essential to consult a qualified attorney to assess the risks and make an informed decision, as a quitclaim deed offers no warranties or guarantees. Whether using a basic, enhanced, special warranty, or quitclaim deed, it is crucial to consult with legal professionals experienced in real estate law to ensure compliance with all local regulations and to protect the interests of all parties involved. In conclusion, a Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to LLC is a legal instrument used to transfer property ownership from a married couple to an LLC located in Clark County, Nevada. There are various types of deeds available, each with its specific provisions and characteristics. Seeking professional legal advice is highly recommended navigating through the complexities and requirements of such transactions.

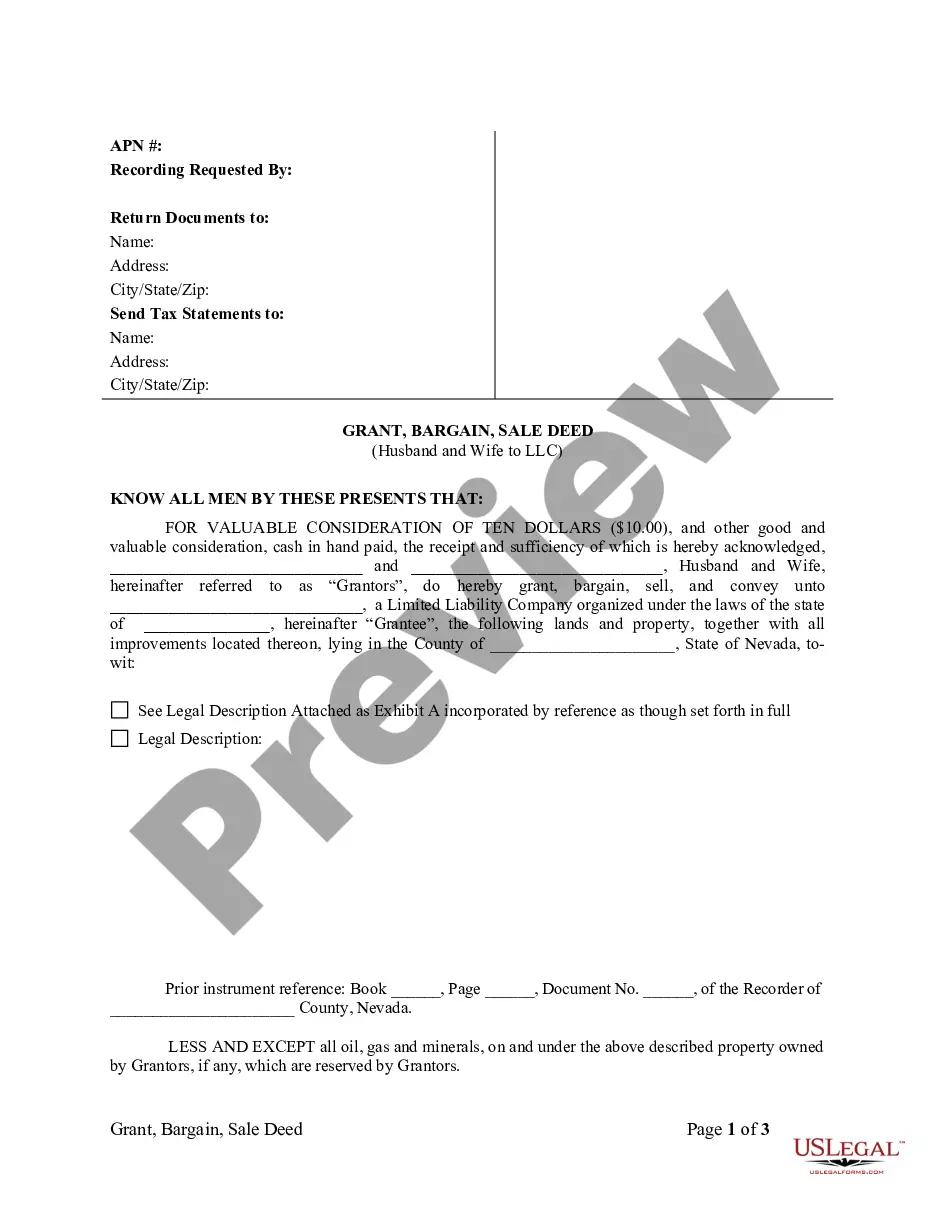

Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to LLC

Description

How to fill out Clark Nevada Grant, Bargain, Sale Deed From Husband And Wife To LLC?

Do you need a trustworthy and affordable legal forms supplier to buy the Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to LLC? US Legal Forms is your go-to solution.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed based on the requirements of particular state and county.

To download the document, you need to log in account, locate the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to LLC conforms to the laws of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Restart the search if the form isn’t good for your specific scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Clark Nevada Grant, Bargain, Sale Deed from Husband and Wife to LLC in any provided file format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about wasting hours learning about legal papers online for good.