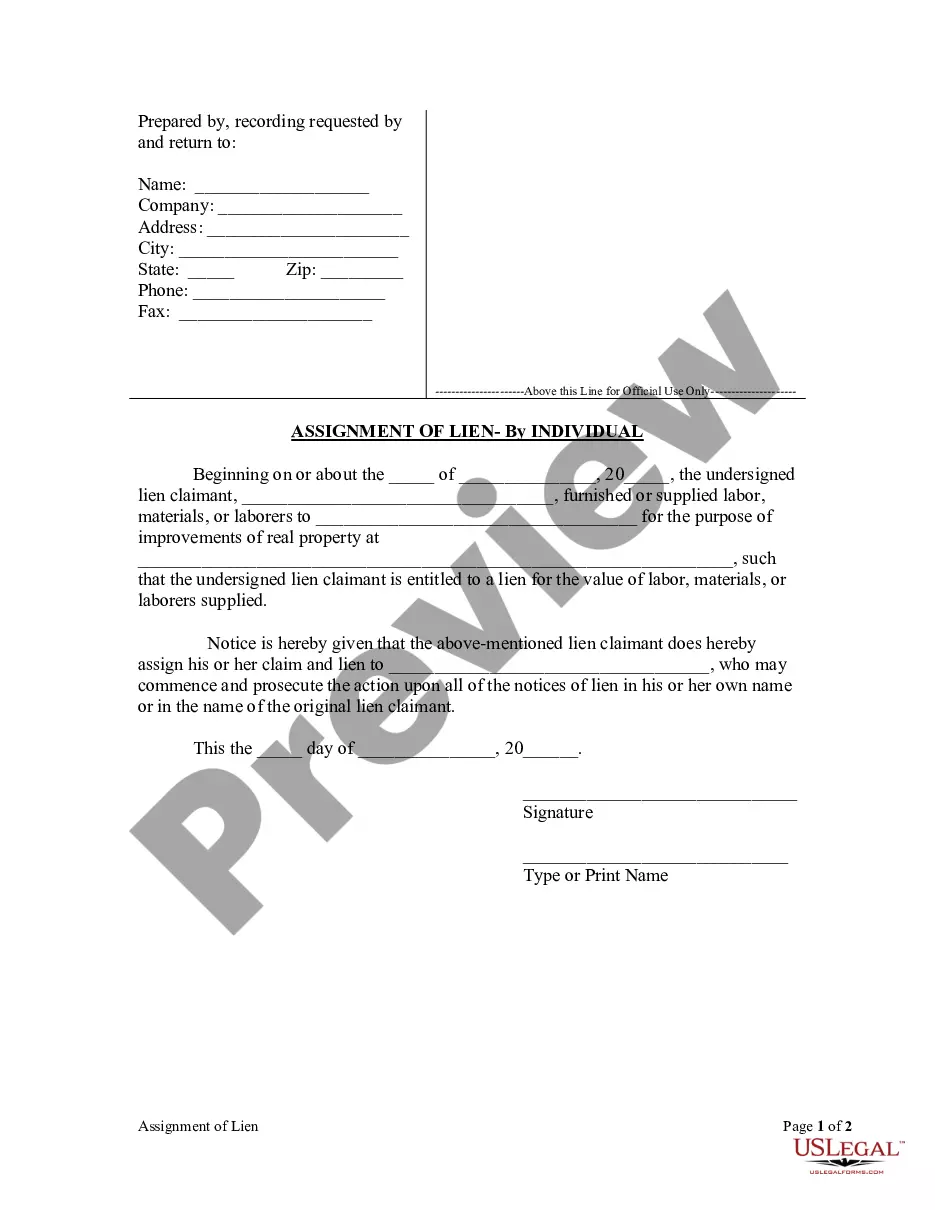

This Assignment of Lien form is for use by an individual lien claimant who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property and is thus entitled to a lien for the value of labor, materials, or laborers supplied to provide notice that he or she assigns his or her claim and lien to an individual who may commence and prosecute the action upon all of the notices of lien in his or her own name or in the name of the original lien claimant.

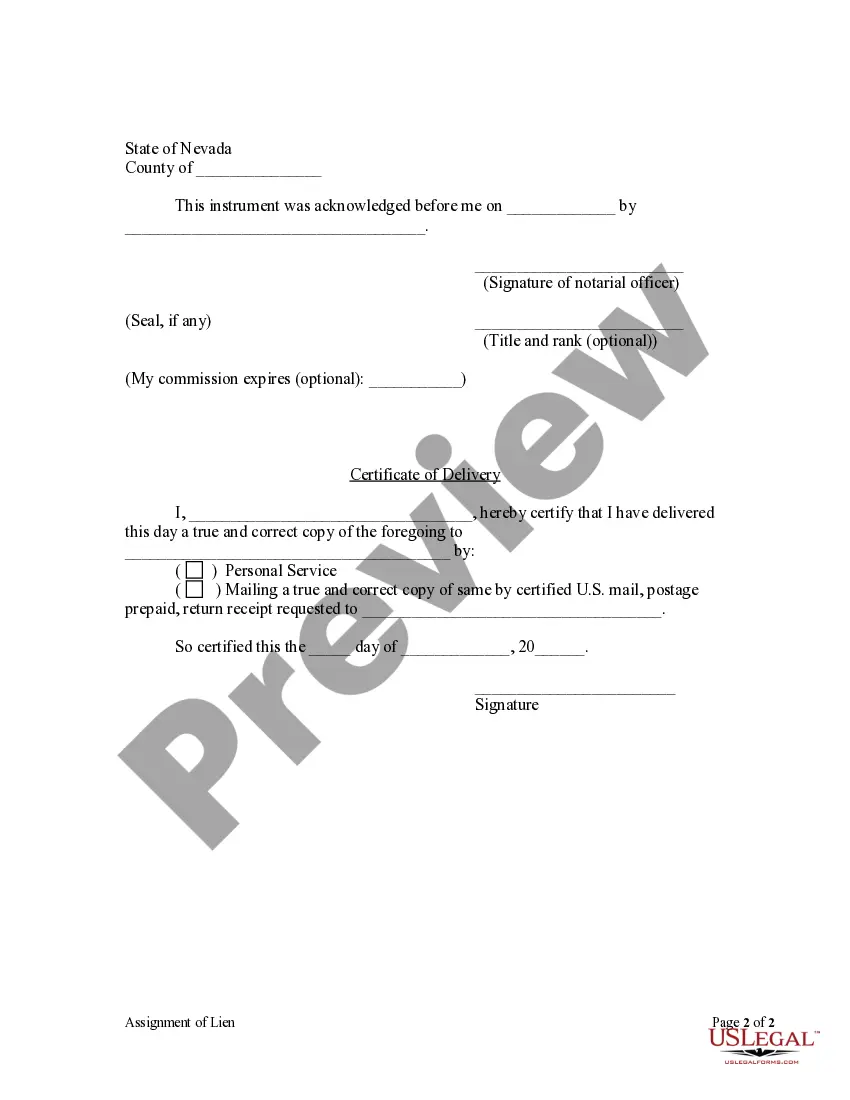

North Las Vegas, Nevada Assignment of Lien — Individual: A Comprehensive Overview In North Las Vegas, Nevada, an Assignment of Lien — Individual refers to the legal transaction where an individual transfers their rights and interest in a lien to another party. Liens are legal claims that individuals or organizations place on a property as collateral for a debt or obligation owed to them. The assignment of a lien allows the assignee to become the new holder and beneficiary of that lien. There are various types of North Las Vegas, Nevada Assignment of Lien — Individual, each serving a specific purpose and involving different parties. Some key types include: 1. Mechanic's Lien Assignment — Individual: This type of assignment occurs when a contractor or subcontractor assigns their mechanic's lien rights to another individual or entity. Mechanic's liens are filed against a property to secure unpaid debts related to construction or improvement work. The assignee becomes responsible for collecting the debt and enforcing the lien rights. 2. Judgment Lien Assignment — Individual: Judgment liens arise when a court awards a monetary judgment against a debtor. In an assignment of judgment lien, the individual to whom the judgment has been awarded assigns their rights to someone else. This allows the assignee to pursue the collection of the judgment amount through various legal means, including placing a lien on the debtor's property. 3. Tax Lien Assignment — Individual: Tax liens are imposed by government agencies, such as the Internal Revenue Service (IRS) or local tax authorities, against a property owner owing unpaid taxes. When an individual owes back taxes, these liens can be assigned to another individual or entity. The assignee then gains the right to collect the outstanding tax amount and potentially foreclose on the property to recover those debts. It's important to note that any assignment of lien in North Las Vegas, Nevada, should be properly documented through a written agreement detailing the transfer of rights, obligations, and any conditions associated with the assignment. Additionally, it is always advisable to seek legal counsel or consultation to ensure compliance with the state's specific laws and regulations regarding assignments of liens. In conclusion, North Las Vegas, Nevada Assignment of Lien — Individual is a legal process that allows the transfer of lien rights from one individual to another. Mechanic's liens, judgment liens, and tax liens are among the various types of liens that can be assigned. Proper documentation and legal guidance are crucial when engaging in such transactions to protect the rights and interests of all parties involved.North Las Vegas, Nevada Assignment of Lien — Individual: A Comprehensive Overview In North Las Vegas, Nevada, an Assignment of Lien — Individual refers to the legal transaction where an individual transfers their rights and interest in a lien to another party. Liens are legal claims that individuals or organizations place on a property as collateral for a debt or obligation owed to them. The assignment of a lien allows the assignee to become the new holder and beneficiary of that lien. There are various types of North Las Vegas, Nevada Assignment of Lien — Individual, each serving a specific purpose and involving different parties. Some key types include: 1. Mechanic's Lien Assignment — Individual: This type of assignment occurs when a contractor or subcontractor assigns their mechanic's lien rights to another individual or entity. Mechanic's liens are filed against a property to secure unpaid debts related to construction or improvement work. The assignee becomes responsible for collecting the debt and enforcing the lien rights. 2. Judgment Lien Assignment — Individual: Judgment liens arise when a court awards a monetary judgment against a debtor. In an assignment of judgment lien, the individual to whom the judgment has been awarded assigns their rights to someone else. This allows the assignee to pursue the collection of the judgment amount through various legal means, including placing a lien on the debtor's property. 3. Tax Lien Assignment — Individual: Tax liens are imposed by government agencies, such as the Internal Revenue Service (IRS) or local tax authorities, against a property owner owing unpaid taxes. When an individual owes back taxes, these liens can be assigned to another individual or entity. The assignee then gains the right to collect the outstanding tax amount and potentially foreclose on the property to recover those debts. It's important to note that any assignment of lien in North Las Vegas, Nevada, should be properly documented through a written agreement detailing the transfer of rights, obligations, and any conditions associated with the assignment. Additionally, it is always advisable to seek legal counsel or consultation to ensure compliance with the state's specific laws and regulations regarding assignments of liens. In conclusion, North Las Vegas, Nevada Assignment of Lien — Individual is a legal process that allows the transfer of lien rights from one individual to another. Mechanic's liens, judgment liens, and tax liens are among the various types of liens that can be assigned. Proper documentation and legal guidance are crucial when engaging in such transactions to protect the rights and interests of all parties involved.