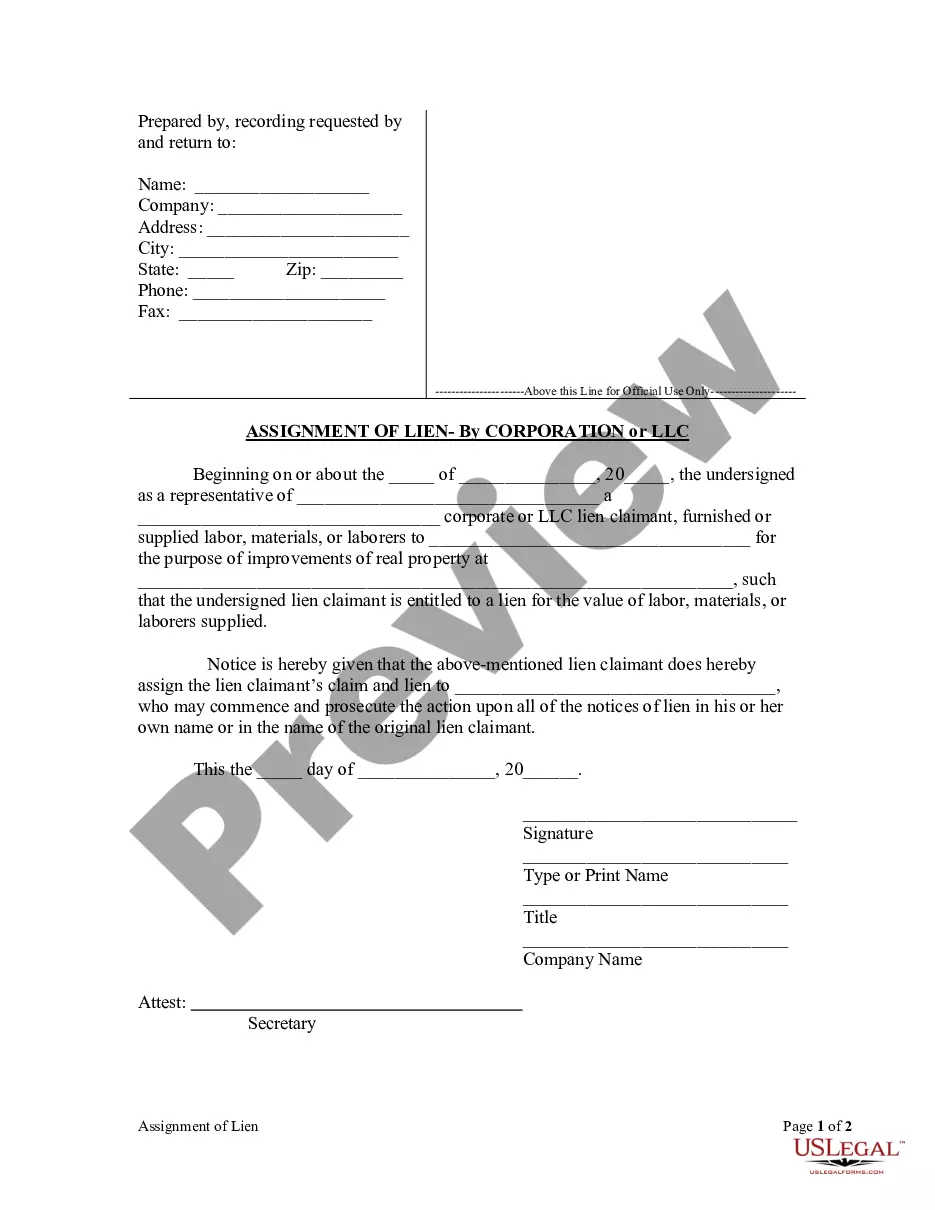

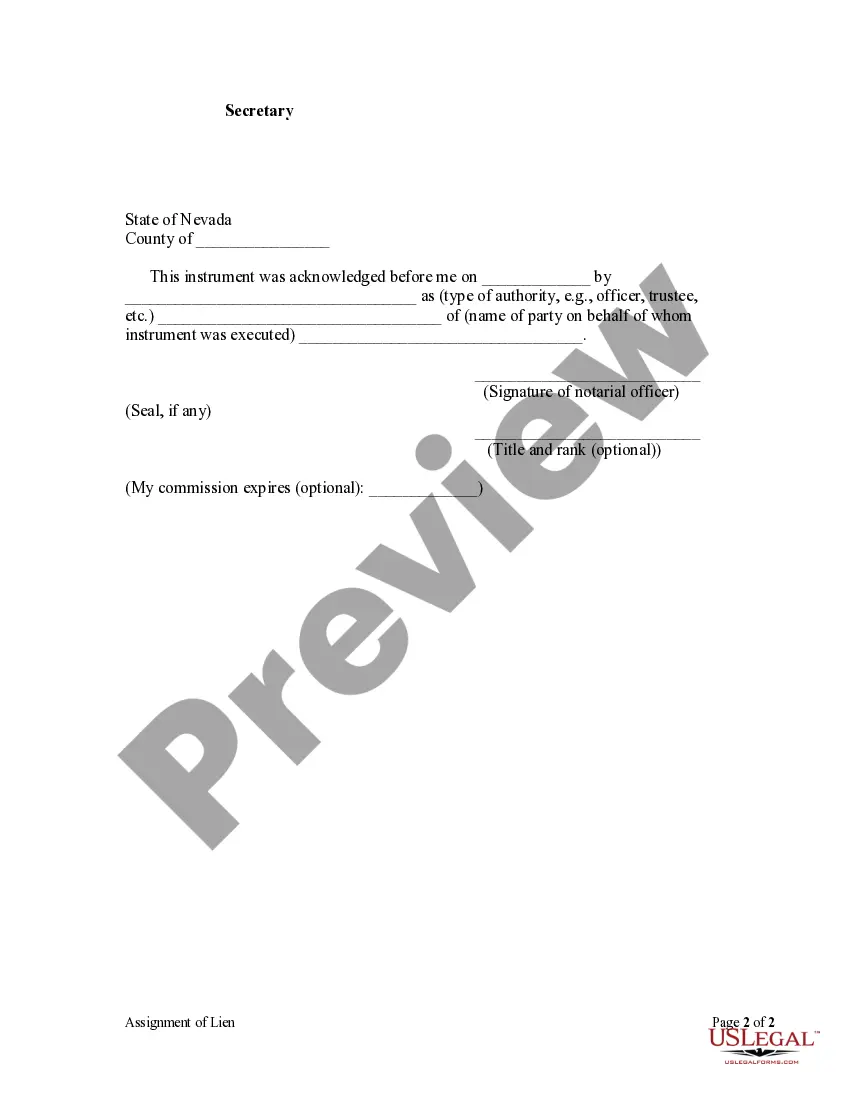

This Assignment of Lien form is for use by a corporate lien claimant who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property and is thus entitled to a lien for the value of labor, materials, or laborers supplied to provide notice that the lien claimant assigns its claim and lien to an individual who may commence and prosecute the action upon all of the notices of lien in his or her own name or in the name of the original lien claimant.

Clark Nevada Assignment of Lien - Corporation

Description

How to fill out Nevada Assignment Of Lien - Corporation?

Are you in search of a trustworthy and affordable supplier of legal forms to obtain the Clark Nevada Assignment of Lien - Corporation or LLC? US Legal Forms is your ideal choice.

Whether you require a basic agreement to establish rules for living with your partner or a collection of forms to facilitate your separation or divorce process through the courts, we have what you need. Our site offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic and are tailored to the specifications of individual state and county regulations.

To download the document, you must Log In to your account, locate the needed form, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents section.

Is this your first visit to our site? No need to be concerned. You can create an account in a matter of minutes; however, ensure you do the following first: Discover if the Clark Nevada Assignment of Lien - Corporation or LLC meets the regulations of your state and local jurisdiction. Review the form’s description (if available) to understand who and what the form is applicable for. Restart the search if the form is not appropriate for your unique circumstance.

Try US Legal Forms today, and put an end to wasting hours searching for legal documents online once and for all.

- Now you can register your account.

- Then select the subscription plan and proceed to payment.

- Once the payment is completed, download the Clark Nevada Assignment of Lien - Corporation or LLC in any available file format.

- You can revisit the site at any moment and redownload the document at no extra cost.

- Locating current legal forms has never been simpler.

Form popularity

FAQ

Whether a lien is good or bad largely depends on the context. Liens serve as legal protections for creditors, ensuring they can recover debts owed. However, for property owners, an unpaid lien can harm credit ratings and complicate property sales. Being aware of the implications of liens, particularly in connection to Clark Nevada Assignment of Lien - Corporation, can help you maintain your financial health.

An assignment of lien is a legal process where the rights to a lien on a property are transferred from one party to another. This often occurs when a creditor decides to sell the lien to another company or individual. Grasping the concept of the assignment of lien is essential for anyone involved in real estate transactions, especially under Clark Nevada Assignment of Lien - Corporation, as it impacts financial obligations.

In Nevada, liens typically remain valid for a specific duration, often ranging from six months to several years, depending on the type. In some situations, a lien can be renewed if the associated debt remains unpaid. Understanding the timeframes associated with liens allows you to better navigate your property ownership responsibilities and make informed decisions regarding Clark Nevada Assignment of Lien - Corporation.

In some cases, it is possible for someone to place a lien on your house without your immediate knowledge. This often occurs when debts go unpaid, and creditors file liens in compliance with state laws. Staying informed about your financial obligations and utilizing services like Clark Nevada Assignment of Lien - Corporation can help manage or address any potential issues.

The assignment of lien refers to the transfer of the rights to a lien from one party to another. This process often takes place when a creditor sells the debt associated with the lien to a different entity. When working within the framework of Clark Nevada Assignment of Lien - Corporation, understanding this transfer process is crucial for managing real estate transactions.

A lien is a legal claim against a property, usually due to unpaid debts. An assignment occurs when one party transfers their rights or interests in the lien to another party. Understanding these concepts, especially in the context of Clark Nevada Assignment of Lien - Corporation, helps property owners navigate their obligations and rights more effectively.

To look up a tax lien in Nevada, you can visit the Nevada Department of Taxation's website or contact your local county assessor’s office. These resources often provide online databases where you can search for tax liens using specific details, such as property address or owner name. Utilizing the Clark Nevada Assignment of Lien - Corporation, you can also find comprehensive legal forms that help streamline the process.

A lien can be placed on a property in Nevada for various durations depending on the type. For instance, judgment liens typically last for six years, while mechanic's liens may have different time frames based on circumstances. After their duration, liens may require action for renewal to remain enforceable. Staying informed about the terms of your Clark Nevada Assignment of Lien - Corporation can enhance your financial security.

A lien release does not expire in Nevada once properly executed and filed; it permanently removes the lien from the property records. However, if the release is not recorded, it may lead to confusion or legal challenges. It is essential to keep proper documentation of any Clark Nevada Assignment of Lien - Corporation to prevent future disputes. Using a legal service ensures that you follow correct procedures and maintain clear records.

In Nevada, the statute of limitations varies based on the nature of the claim. Most contracts, including those related to liens, have a statute of limitations of six years. However, some liens may have shorter or longer periods depending on specific circumstances. Knowing these timelines is critical when working with a Clark Nevada Assignment of Lien - Corporation to ensure timely action.