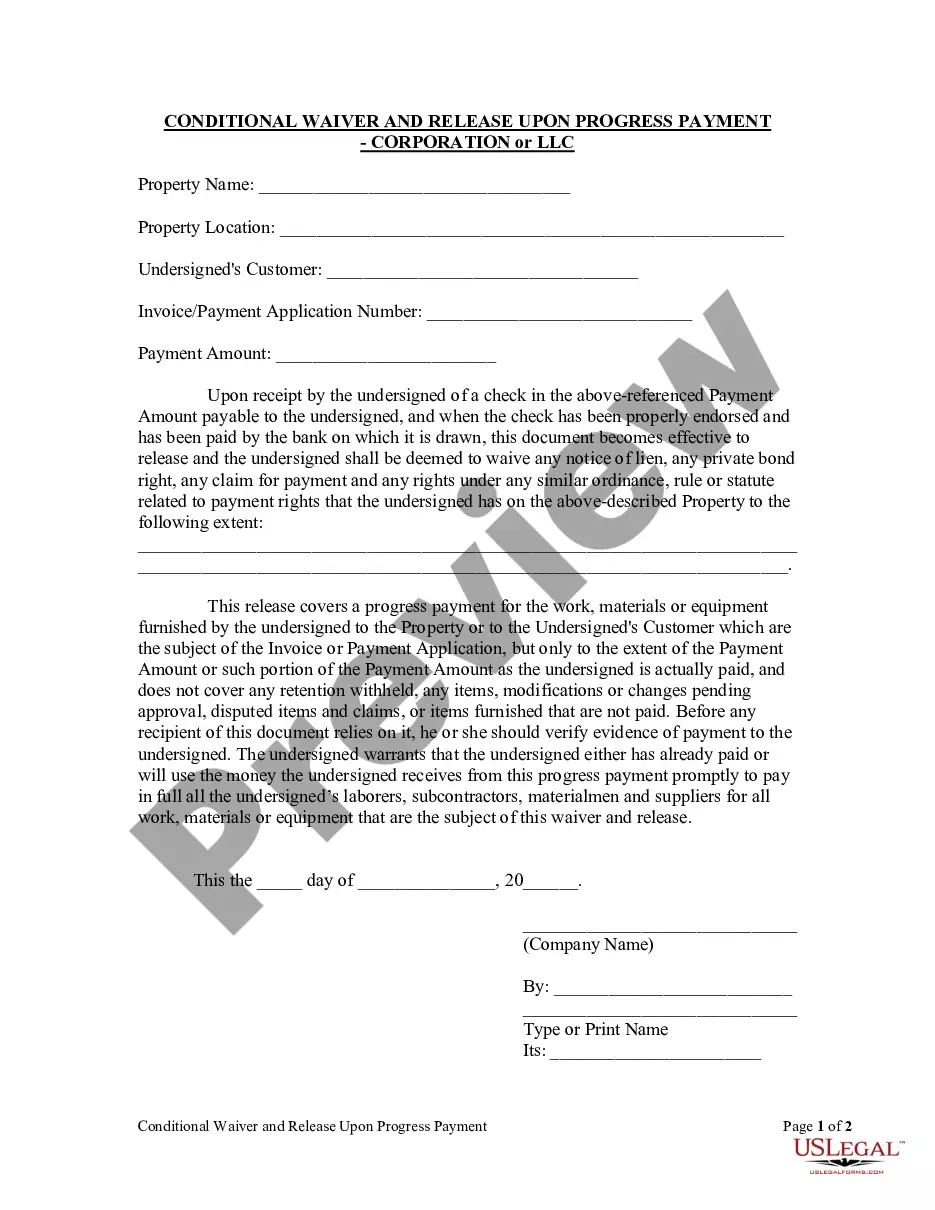

This Conditional Waiver and Release Upon Progress Payment form is for use by a corporation upon receipt of a payment to release and waive any notice of lien, any private bond right, any claim for payment and any rights under any similar ordinance, rule or statute related to payment rights that the corporation has on certain property. This release covers a progress payment for the work, materials or equipment furnished by the lien claimant to the property or to the lien claimant's customer which are the subject of the invoice or payment application, but only to the extent of the payment amount or such portion of the payment amount as the lien claimant is actually paid, and does not cover any retention withheld, any items, modifications or changes pending approval, disputed items and claims, or items furnished that are not paid. The lien claimant warrants that the lien claimant either has already paid or will use the money the lien claimant receives from this progress payment promptly to pay in full all the laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

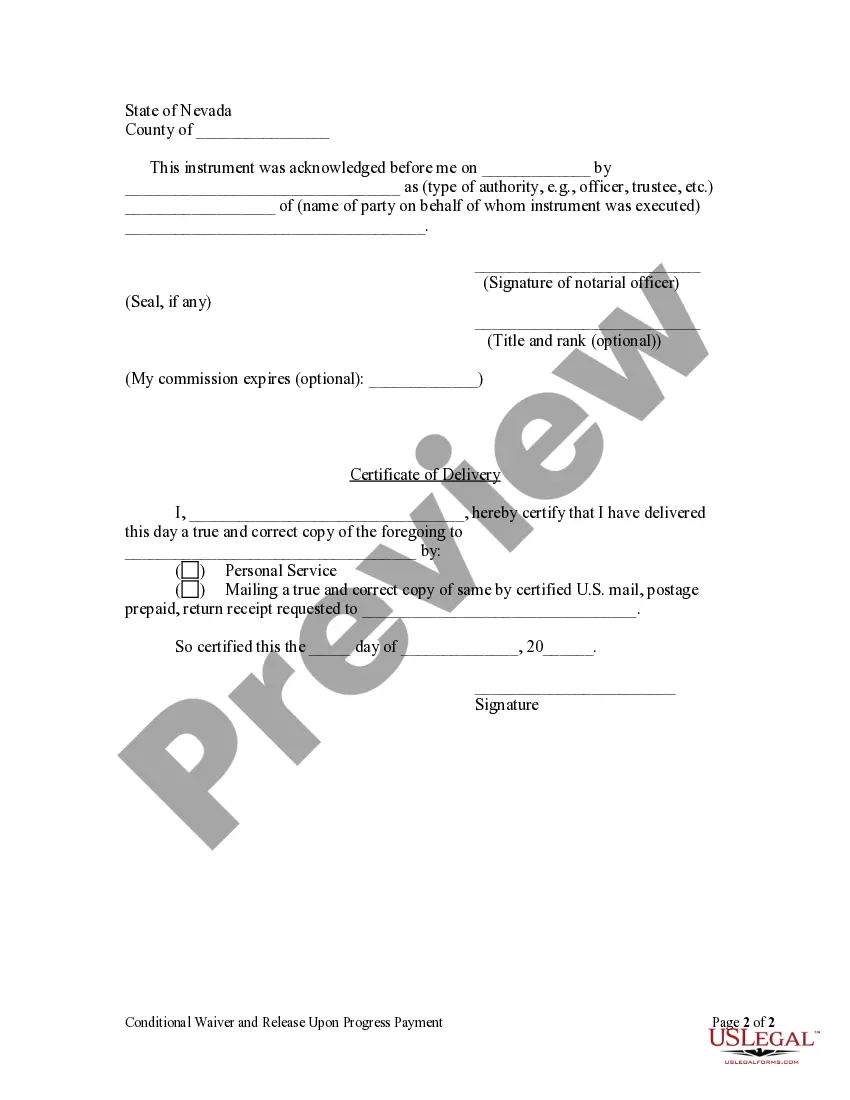

The Clark Nevada Conditional Waiver and Release Upon Progress Payment — Corporation or LLC is a legal document that functions as a written agreement between a contractor or subcontractor (the lien claimant) and a property owner or developer (the property owner), specifying the conditions under which the lien claimant agrees to waive their right to file a mechanic's lien on the property in exchange for receiving progress payments for work performed. This waiver and release form are specifically designed for corporations or limited liability companies (LCS) in the state of Nevada. It serves as a protective measure for both parties involved in a construction project, ensuring that payments are made in a timely manner and that potential disputes related to mechanics' liens are avoided. Some relevant keywords associated with the Clark Nevada Conditional Waiver and Release Upon Progress Payment — Corporation or LLC are: 1. Conditional Waiver: This refers to the conditional nature of the waiver and release, meaning that it is contingent upon receiving progress payments from the property owner. 2. Progress Payment: This refers to partial payments made by the property owner to the contractor or subcontractor during the course of the project, based on the completion of specific milestones or stages of work. 3. Mechanic's Lien: This refers to a legal claim placed on a property by a contractor or subcontractor who has not been paid for their work. By signing this waiver, the lien claimant agrees to waive their right to file a mechanic's lien. 4. Corporation: This highlights that the waiver and release document is specifically tailored for corporations, which are legal entities separate from their owners, offering liability protection. 5. LLC: This acronym stands for limited liability company, a type of business entity that combines the flexibility of a partnership with the limited liability protection of a corporation. This waiver and release form is also suitable for LCS operating in Nevada. 6. Property Owner: This refers to the individual or entity that owns the property where the construction project is taking place and is responsible for making progress payments to the contractor or subcontractor. 7. Contractor/Subcontractor: These terms are used to describe the parties involved in the construction project. A contractor is typically hired by the property owner to oversee the project, while subcontractors are hired by the contractor to perform specific tasks. 8. Clark Nevada: This specifies the geographical location for which the waiver and release form is intended, highlighting its compliance with the laws and regulations of Clark County, Nevada. It's important to note that there may be different versions or variations of the Clark Nevada Conditional Waiver and Release Upon Progress Payment — Corporation or LLC, tailored to specific project types or requirements. These variations may include amendments related to additional provisions, such as retaining certain lien rights, specific payment terms, or required notices. However, the general purpose of these documents remains consistent — to establish a legal agreement between the lien claimant and the property owner regarding progress payments and the release of potential mechanics' liens.The Clark Nevada Conditional Waiver and Release Upon Progress Payment — Corporation or LLC is a legal document that functions as a written agreement between a contractor or subcontractor (the lien claimant) and a property owner or developer (the property owner), specifying the conditions under which the lien claimant agrees to waive their right to file a mechanic's lien on the property in exchange for receiving progress payments for work performed. This waiver and release form are specifically designed for corporations or limited liability companies (LCS) in the state of Nevada. It serves as a protective measure for both parties involved in a construction project, ensuring that payments are made in a timely manner and that potential disputes related to mechanics' liens are avoided. Some relevant keywords associated with the Clark Nevada Conditional Waiver and Release Upon Progress Payment — Corporation or LLC are: 1. Conditional Waiver: This refers to the conditional nature of the waiver and release, meaning that it is contingent upon receiving progress payments from the property owner. 2. Progress Payment: This refers to partial payments made by the property owner to the contractor or subcontractor during the course of the project, based on the completion of specific milestones or stages of work. 3. Mechanic's Lien: This refers to a legal claim placed on a property by a contractor or subcontractor who has not been paid for their work. By signing this waiver, the lien claimant agrees to waive their right to file a mechanic's lien. 4. Corporation: This highlights that the waiver and release document is specifically tailored for corporations, which are legal entities separate from their owners, offering liability protection. 5. LLC: This acronym stands for limited liability company, a type of business entity that combines the flexibility of a partnership with the limited liability protection of a corporation. This waiver and release form is also suitable for LCS operating in Nevada. 6. Property Owner: This refers to the individual or entity that owns the property where the construction project is taking place and is responsible for making progress payments to the contractor or subcontractor. 7. Contractor/Subcontractor: These terms are used to describe the parties involved in the construction project. A contractor is typically hired by the property owner to oversee the project, while subcontractors are hired by the contractor to perform specific tasks. 8. Clark Nevada: This specifies the geographical location for which the waiver and release form is intended, highlighting its compliance with the laws and regulations of Clark County, Nevada. It's important to note that there may be different versions or variations of the Clark Nevada Conditional Waiver and Release Upon Progress Payment — Corporation or LLC, tailored to specific project types or requirements. These variations may include amendments related to additional provisions, such as retaining certain lien rights, specific payment terms, or required notices. However, the general purpose of these documents remains consistent — to establish a legal agreement between the lien claimant and the property owner regarding progress payments and the release of potential mechanics' liens.