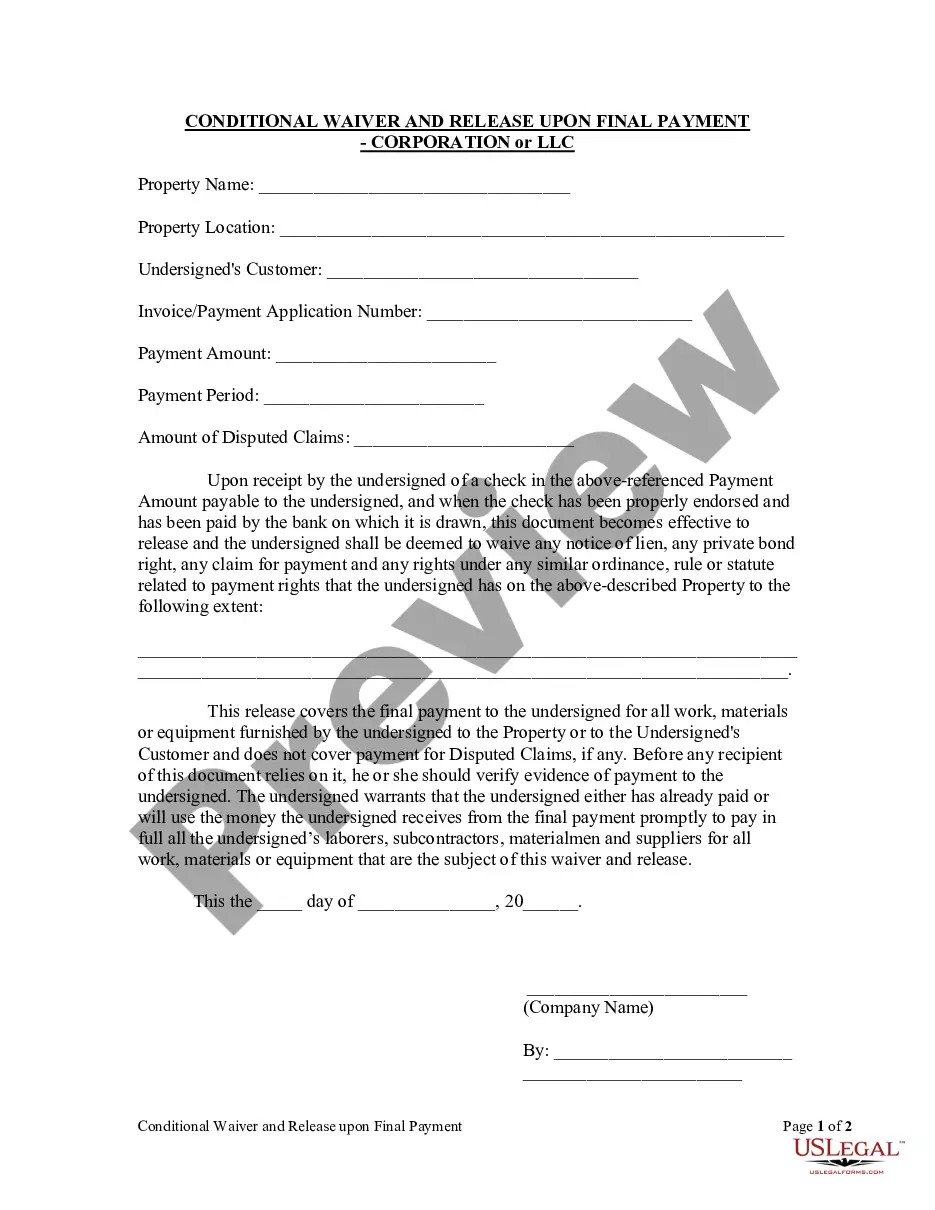

This Conditional Waiver and Release Upon Final Payment is for use by a corporation or LLC upon receipt of payment to release and waive any notice of lien, any private bond right, any claim for payment and any rights under any similar ordinance, rule or statute related to payment rights that the corporation has on the property. This release covers the final payment to the lien claimant for all work, materials or equipment furnished by the lien claimant to the property or to the lien claimant's customer and does not cover payment for disputed claims, if any. The lien claimant warrants that the lien claimant either has already paid or will use the money the lien claimant receives from the final payment promptly to pay in full all the laborers, subcontractors, materialmen and suppliers for all work, materials or equipment that are the subject of this waiver and release.

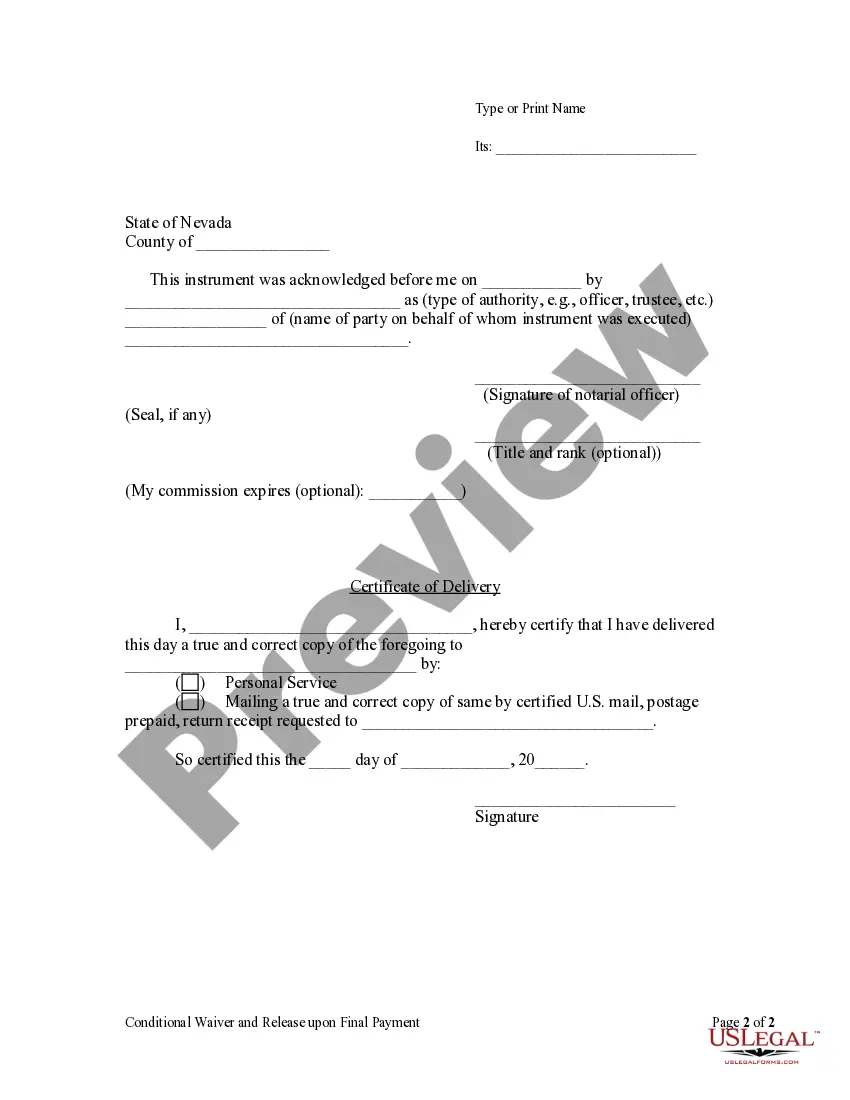

The Clark Nevada Conditional Waiver and Release Upon Final Payment — Corporation or LLC is a legal document that serves as a proof of payment and an assurance that any lien or claim rights are waived upon receiving the final payment for services rendered or materials provided. This specific type of waiver and release is designed for corporations or limited liability companies (LCS) operating within Clark County, Nevada. By using the Clark Nevada Conditional Waiver and Release Upon Final Payment — Corporation or LLC, individuals or entities seeking payment can provide peace of mind to project owners or contractors, stating that they will not file any liens or claims against the property once payment has been settled in full. This waiver and release document allows stakeholders in construction projects or supplier arrangements to finalize any outstanding financial transactions in a legally binding manner. There are different types of conditional waivers and releases available under the Clark Nevada law, depending on the payment structure and the party involved. These may include: 1. Conditional Waiver and Release Upon Final Payment — Corporation or LL— - This waiver and release is applicable when the payment is being made by a corporation or LLC and ensures that the party receiving payment agrees not to claim any liens or rights against the property, materials, or services provided. 2. Unconditional Waiver and Release Upon Final Payment — Corporation or LL— - Similar to the conditional waiver, this document is used to waive any claim or right to file a lien upon receiving final payment. However, unlike the conditional waiver, it is not dependent on the receipt of payment and immediately releases any potential liens or claims without conditions. 3. Conditional Partial Waiver and Release Upon Final Payment — Corporation or LL— - This type of waiver allows for the partial release of lien or claim rights upon receiving a specific partial payment, which is typically agreed upon by both parties in advance. 4. Unconditional Partial Waiver and Release Upon Final Payment — Corporation or LL— - Similar to the conditional partial waiver, this document releases a specified portion of lien or claim rights without any conditions or requirements. Each of these waivers serves a distinct purpose in a contractual relationship, providing the necessary legal protection and clarity for both parties involved in the payment process. It is important to consult with a legal professional or seek appropriate legal advice when drafting or using these documents to ensure compliance with local laws and regulations.The Clark Nevada Conditional Waiver and Release Upon Final Payment — Corporation or LLC is a legal document that serves as a proof of payment and an assurance that any lien or claim rights are waived upon receiving the final payment for services rendered or materials provided. This specific type of waiver and release is designed for corporations or limited liability companies (LCS) operating within Clark County, Nevada. By using the Clark Nevada Conditional Waiver and Release Upon Final Payment — Corporation or LLC, individuals or entities seeking payment can provide peace of mind to project owners or contractors, stating that they will not file any liens or claims against the property once payment has been settled in full. This waiver and release document allows stakeholders in construction projects or supplier arrangements to finalize any outstanding financial transactions in a legally binding manner. There are different types of conditional waivers and releases available under the Clark Nevada law, depending on the payment structure and the party involved. These may include: 1. Conditional Waiver and Release Upon Final Payment — Corporation or LL— - This waiver and release is applicable when the payment is being made by a corporation or LLC and ensures that the party receiving payment agrees not to claim any liens or rights against the property, materials, or services provided. 2. Unconditional Waiver and Release Upon Final Payment — Corporation or LL— - Similar to the conditional waiver, this document is used to waive any claim or right to file a lien upon receiving final payment. However, unlike the conditional waiver, it is not dependent on the receipt of payment and immediately releases any potential liens or claims without conditions. 3. Conditional Partial Waiver and Release Upon Final Payment — Corporation or LL— - This type of waiver allows for the partial release of lien or claim rights upon receiving a specific partial payment, which is typically agreed upon by both parties in advance. 4. Unconditional Partial Waiver and Release Upon Final Payment — Corporation or LL— - Similar to the conditional partial waiver, this document releases a specified portion of lien or claim rights without any conditions or requirements. Each of these waivers serves a distinct purpose in a contractual relationship, providing the necessary legal protection and clarity for both parties involved in the payment process. It is important to consult with a legal professional or seek appropriate legal advice when drafting or using these documents to ensure compliance with local laws and regulations.