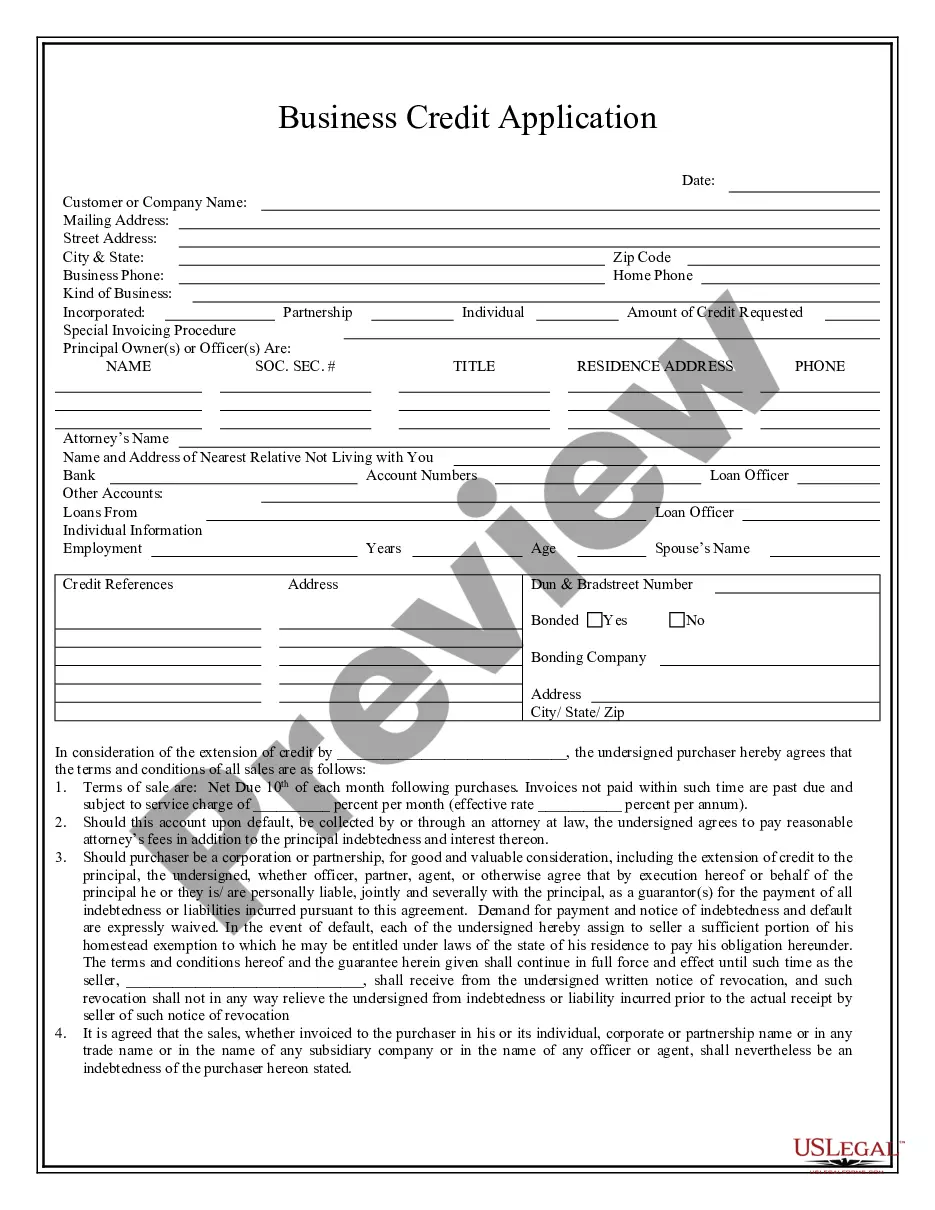

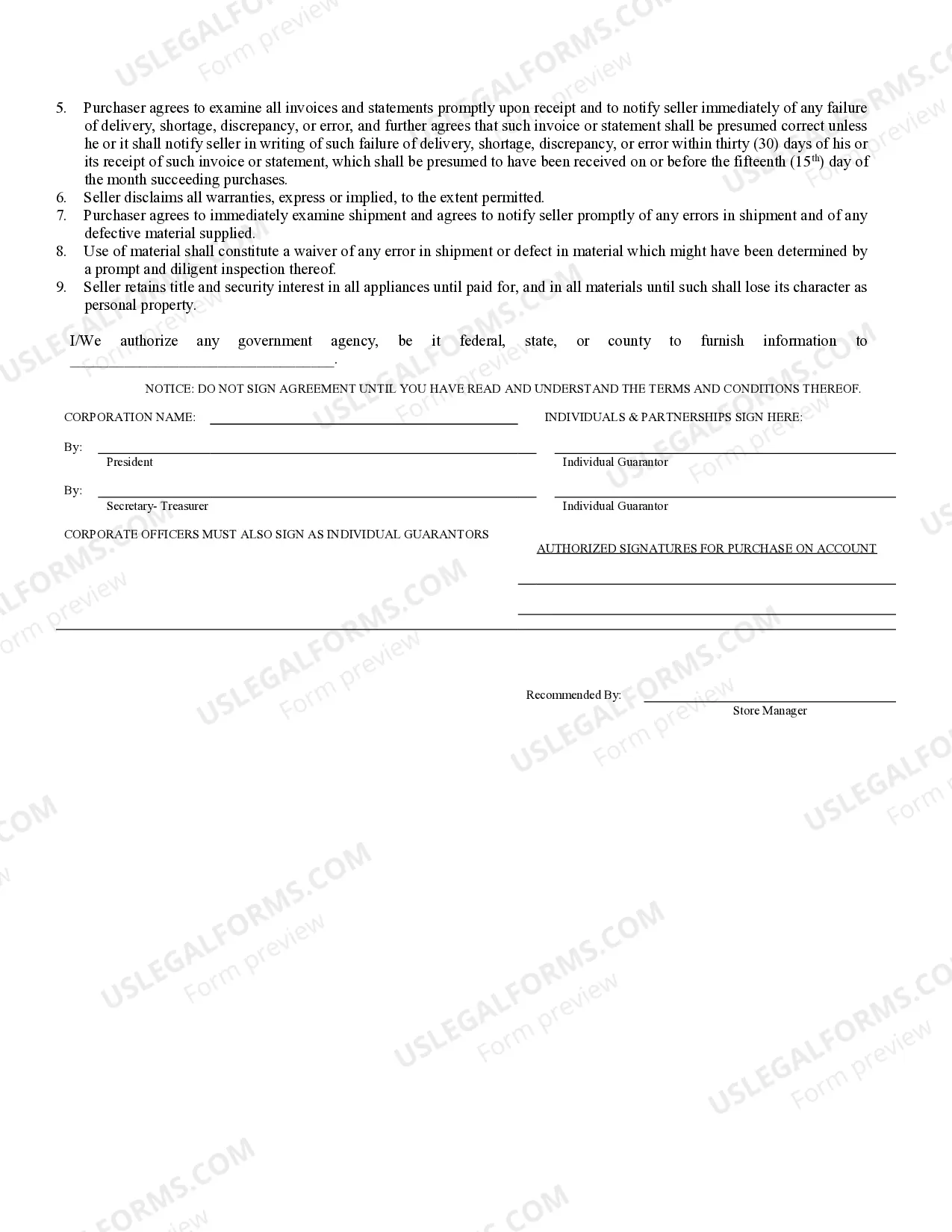

Clark Nevada Business Credit Application is a comprehensive and user-friendly form used by businesses operating in Clark, Nevada, to apply for credit. This application is specifically designed to cater to the needs of businesses seeking financial assistance or credit support in the Clark County area. With its simple and intuitive format, the Clark Nevada Business Credit Application makes the process of applying for credit seamless and efficient. Key elements included in the Clark Nevada Business Credit Application are: 1. Contact Information: The application commences with a section where the business provides its full legal name, contact person details, phone number, email address, and physical address. 2. Business Information: This section requires the applicant to provide vital information about the business, such as its industry, legal structure, years in operation, and Federal Tax ID number. 3. Financial Information: Applicants are expected to furnish detailed financial information, including gross revenue, net income, outstanding debts, and assets owned by the business. This section allows the reviewing party to assess the financial health and creditworthiness of the applicant. 4. Credit Requirements: Here, the business can specify the type and amount of credit being sought. It may include a working capital line of credit, equipment financing, trade credit, or other types of credit facilities as relevant to the applicant's requirements. 5. References: The application may require the applicant to provide trade references, typically three to five companies they have conducted business with, including their names, contact information, and the nature of the relationship. 6. Additional Documentation: Depending on the specific type of credit being applied for, the Clark Nevada Business Credit Application may need to be accompanied by supporting documentation, such as financial statements, tax returns, business plans, or any other relevant paperwork. Different types of Clark Nevada Business Credit Applications may exist to cater to various credit offerings or specific industries. These could include: 1. Small Business Credit Application: Tailored for small businesses operating within the Clark County area, this variant of the application focuses on the unique needs and requirements of small enterprises. 2. Real Estate Credit Application: Designed for businesses involved in real estate ventures, this specialized application may include additional sections to assess the feasibility and creditworthiness of real estate projects. 3. Equipment Financing Credit Application: This type of application caters to businesses seeking credit specifically for the purchase or lease of equipment. It may require additional information about the equipment being financed and its value. 4. Construction Credit Application: Aimed at businesses in the construction industry, this variant of the application may include sections for project details, subcontractor information, and performance bond requirements. In conclusion, the Clark Nevada Business Credit Application is a comprehensive and customizable form that allows businesses in Clark, Nevada, to effectively apply for credit while presenting their financial information and credit needs. Various types of applications may exist, each designed to meet the specific credit requirements of different industries or business sizes.

Clark Nevada Business Credit Application

Category:

State:

Nevada

County:

Clark

Control #:

NV-20-CR

Format:

Word;

Rich Text

Instant download

Description

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Clark Nevada Business Credit Application is a comprehensive and user-friendly form used by businesses operating in Clark, Nevada, to apply for credit. This application is specifically designed to cater to the needs of businesses seeking financial assistance or credit support in the Clark County area. With its simple and intuitive format, the Clark Nevada Business Credit Application makes the process of applying for credit seamless and efficient. Key elements included in the Clark Nevada Business Credit Application are: 1. Contact Information: The application commences with a section where the business provides its full legal name, contact person details, phone number, email address, and physical address. 2. Business Information: This section requires the applicant to provide vital information about the business, such as its industry, legal structure, years in operation, and Federal Tax ID number. 3. Financial Information: Applicants are expected to furnish detailed financial information, including gross revenue, net income, outstanding debts, and assets owned by the business. This section allows the reviewing party to assess the financial health and creditworthiness of the applicant. 4. Credit Requirements: Here, the business can specify the type and amount of credit being sought. It may include a working capital line of credit, equipment financing, trade credit, or other types of credit facilities as relevant to the applicant's requirements. 5. References: The application may require the applicant to provide trade references, typically three to five companies they have conducted business with, including their names, contact information, and the nature of the relationship. 6. Additional Documentation: Depending on the specific type of credit being applied for, the Clark Nevada Business Credit Application may need to be accompanied by supporting documentation, such as financial statements, tax returns, business plans, or any other relevant paperwork. Different types of Clark Nevada Business Credit Applications may exist to cater to various credit offerings or specific industries. These could include: 1. Small Business Credit Application: Tailored for small businesses operating within the Clark County area, this variant of the application focuses on the unique needs and requirements of small enterprises. 2. Real Estate Credit Application: Designed for businesses involved in real estate ventures, this specialized application may include additional sections to assess the feasibility and creditworthiness of real estate projects. 3. Equipment Financing Credit Application: This type of application caters to businesses seeking credit specifically for the purchase or lease of equipment. It may require additional information about the equipment being financed and its value. 4. Construction Credit Application: Aimed at businesses in the construction industry, this variant of the application may include sections for project details, subcontractor information, and performance bond requirements. In conclusion, the Clark Nevada Business Credit Application is a comprehensive and customizable form that allows businesses in Clark, Nevada, to effectively apply for credit while presenting their financial information and credit needs. Various types of applications may exist, each designed to meet the specific credit requirements of different industries or business sizes.

Free preview

How to fill out Clark Nevada Business Credit Application?

If you’ve already used our service before, log in to your account and download the Clark Nevada Business Credit Application on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Clark Nevada Business Credit Application. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!