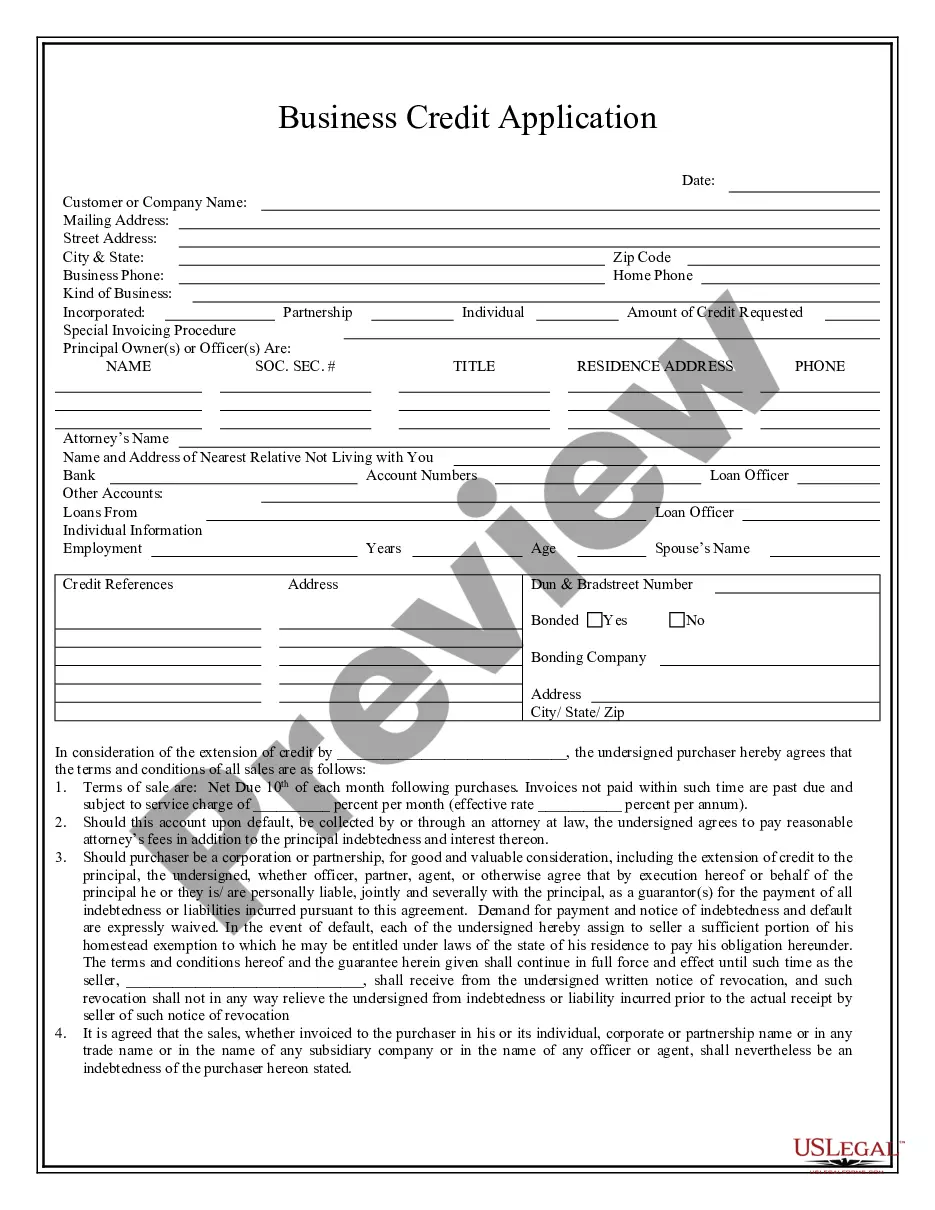

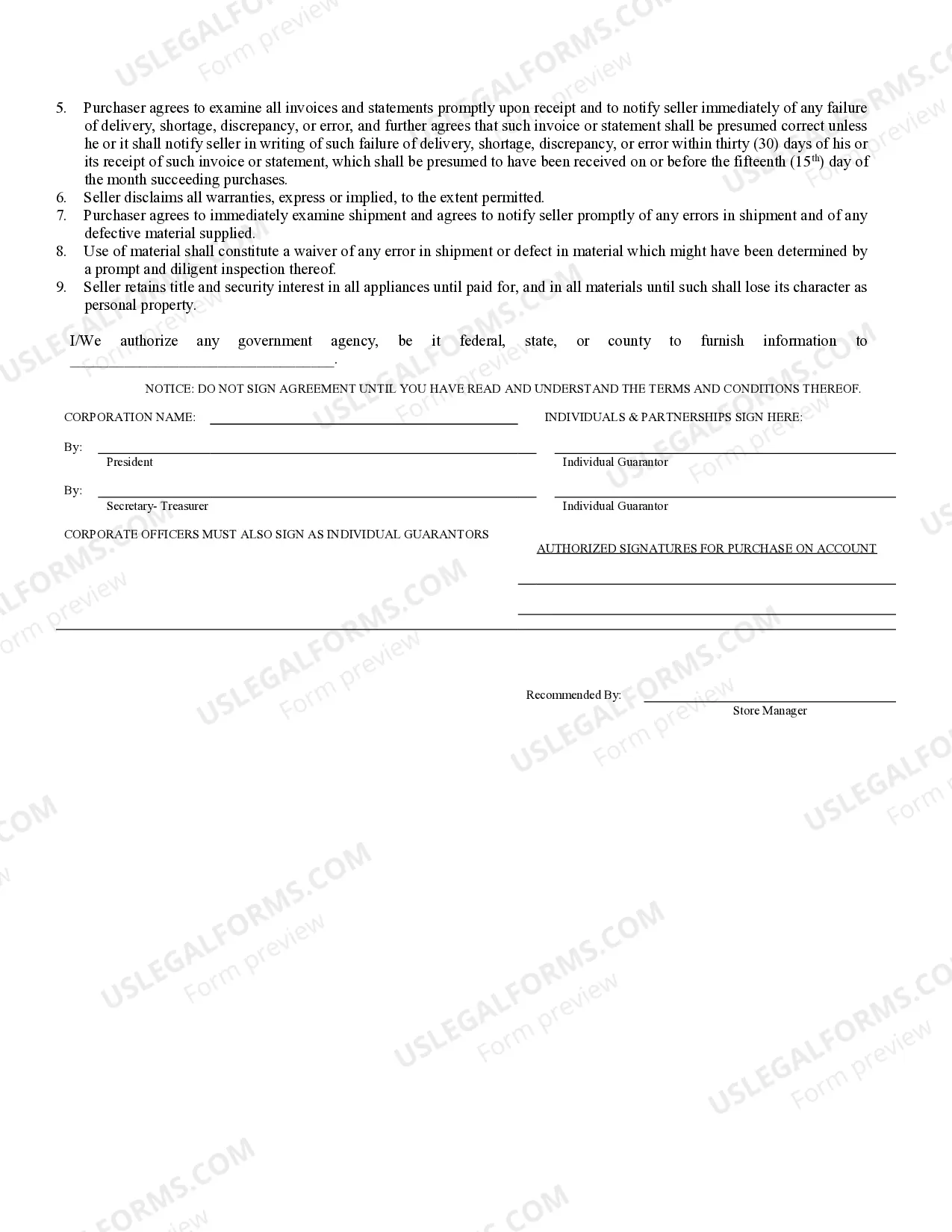

North Las Vegas, Nevada is home to a thriving business community with numerous opportunities for growth and expansion. To tap into these opportunities, local businesses often rely on North Las Vegas Nevada Business Credit Application. This application is designed to help businesses secure the necessary funding and credit to fuel their growth and achieve their goals. The North Las Vegas Nevada Business Credit Application is a comprehensive document that requires businesses to provide detailed information about their operations, financial history, and future plans. It typically contains sections for businesses to input their basic identification details, including legal name, address, and contact information. Additionally, applicants are required to provide their Employer Identification Number (EIN) and business formation date. The application then delves into the financial aspects of the business, requesting details about annual revenue, profit margins, and any outstanding debt or liabilities. Lenders may also require businesses to disclose their financial statements, including balance sheets and income statements. These documents help lenders assess the creditworthiness and financial stability of the business. Moreover, the North Las Vegas Nevada Business Credit Application often requires businesses to provide information about their industry, target market, and competitive landscape. This helps lenders understand the market dynamics and assess the business's potential for success. Furthermore, applicants may be asked to provide a detailed business plan outlining their goals, strategies, and projected financials. Several types of North Las Vegas Nevada Business Credit Applications cater to different needs. These may include: 1. Small Business Credit Application: Specifically designed for startups and small businesses looking for initial funding or credit to support their operations and expansion plans. 2. Commercial Credit Application: Geared towards larger businesses and corporations in need of substantial credit lines and financing options for their ongoing operations, equipment purchases, and inventory management. 3. Line of Credit Application: Tailored for businesses that require a revolving line of credit, allowing them to access funds when needed. This type of credit application enables businesses to manage cash flow gaps and seize opportunities promptly. 4. Equipment Financing Application: Focused on businesses seeking credit specifically for purchasing or leasing equipment necessary for their operations or expansion, such as machinery, vehicles, or technology tools. In summary, the North Las Vegas Nevada Business Credit Application is a crucial tool for local businesses to secure the funding and credit essential for their growth and success. By providing detailed information about their operations, finances, and plans, businesses can increase their chances of obtaining the necessary credit to fuel their aspirations in the competitive North Las Vegas business landscape.

North Las Vegas Nevada Business Credit Application

Description

How to fill out North Las Vegas Nevada Business Credit Application?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the North Las Vegas Nevada Business Credit Application gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the North Las Vegas Nevada Business Credit Application takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the North Las Vegas Nevada Business Credit Application. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!