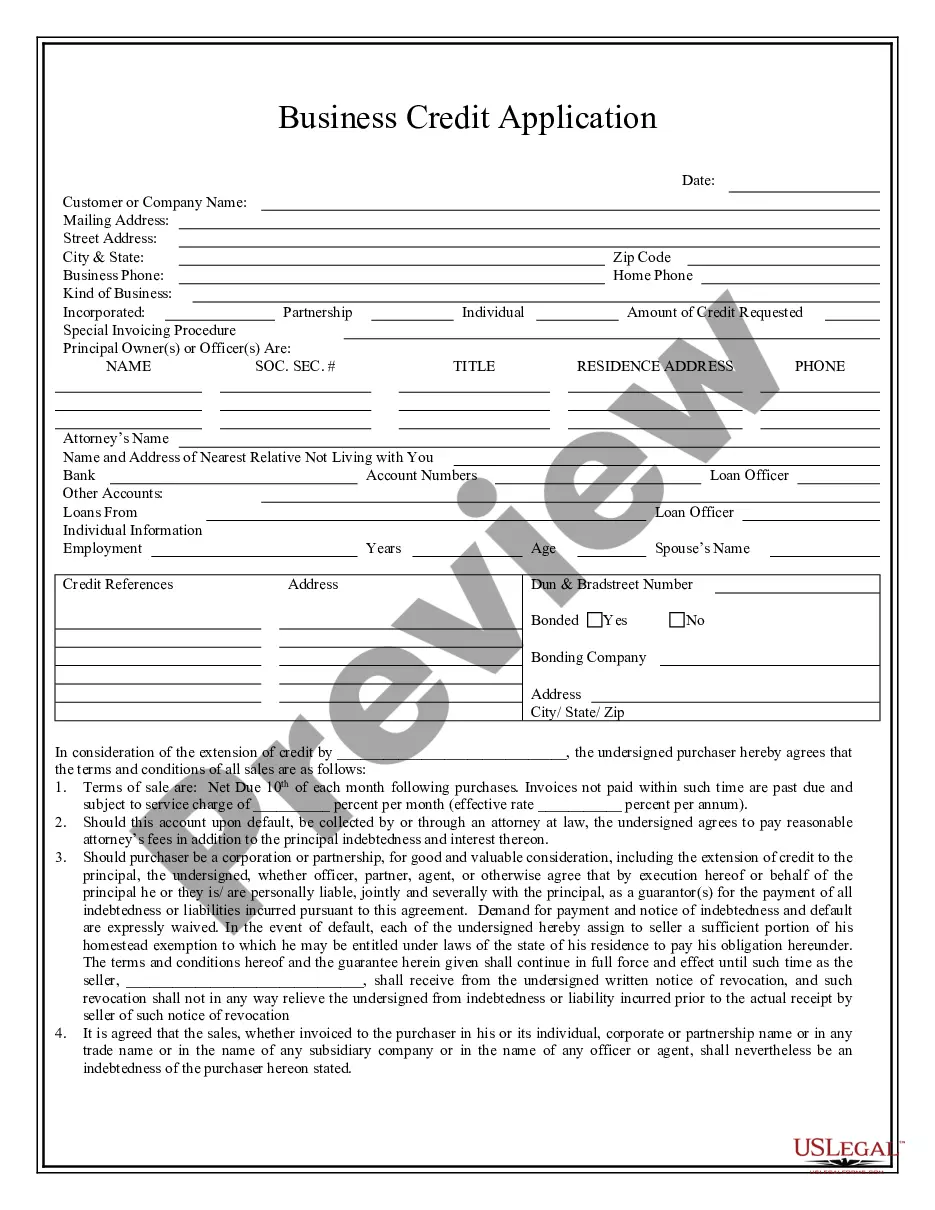

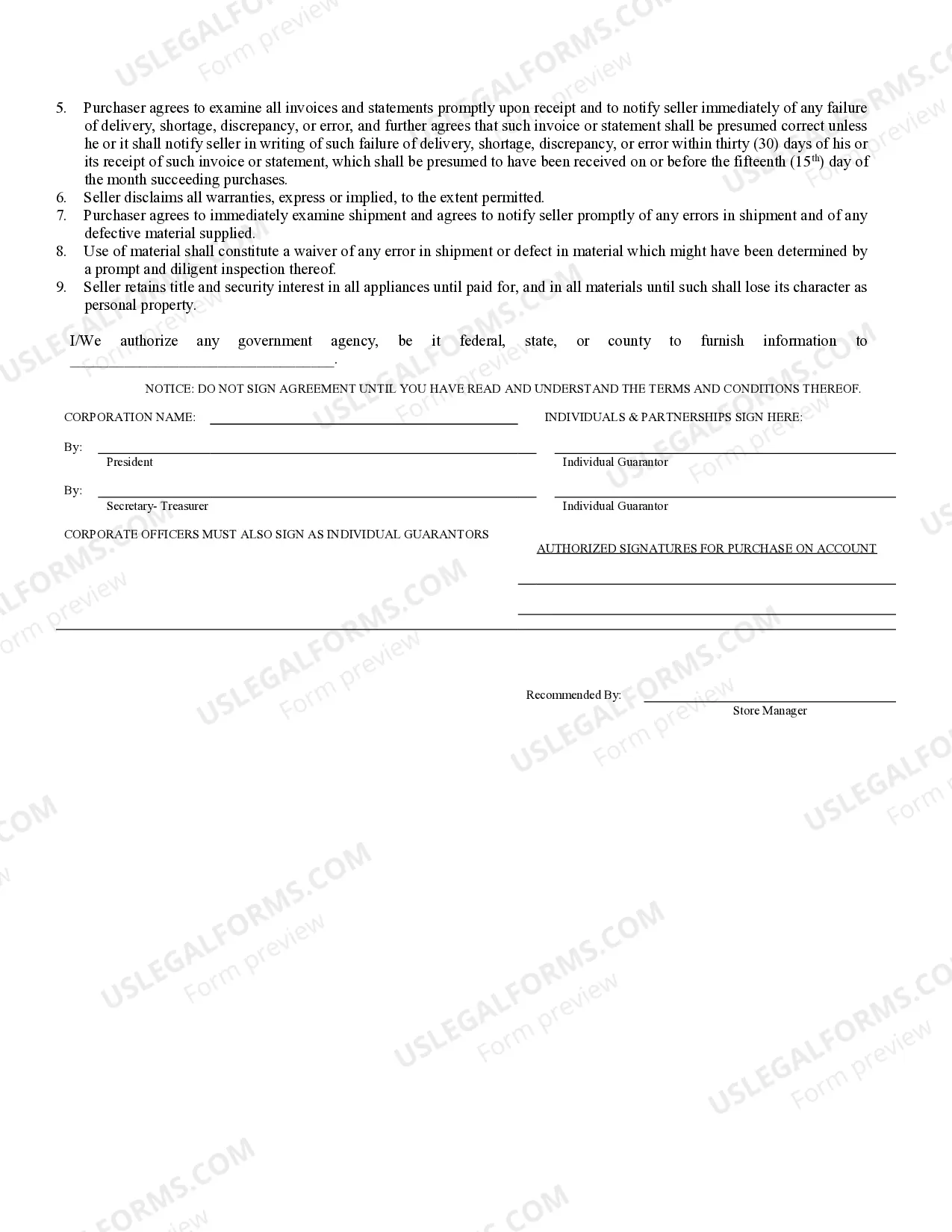

Sparks Nevada Business Credit Application is a comprehensive financial tool designed to assist businesses in obtaining credit from local financial institutions in the Sparks, Nevada area. This application serves as a formal request for credit facilities, allowing businesses to access the necessary funds to grow, expand, or address their financial needs. With a Sparks Nevada Business Credit Application, companies can apply for a range of credit options such as business loans, lines of credit, or credit cards, tailored to their unique financial requirements. This application ensures that businesses in Sparks, Nevada have easy access to financial solutions necessary for their development and success. Different types of Sparks Nevada Business Credit Application: 1. Business Loan Application: This type of application is designed for companies seeking a lump sum amount to invest in business expansion, equipment purchases, or any other financial requirement. Through this application, businesses can lay out their goals, financial history, and repayment plan to lenders. 2. Line of Credit Application: A line of credit provides businesses access to a pre-approved amount of money they can borrow when needed. This type of application allows companies to have a safety net for managing fluctuations in cash flow or unexpected expenses. 3. Credit Card Application: Sparks Nevada Business Credit Application also includes credit card options specifically tailored towards businesses. These cards allow companies to make necessary purchases and manage their expenses effectively, while also offering potential rewards or incentives. Regardless of the type of credit application chosen, the Sparks Nevada Business Credit Application process generally involves the submission of financial documents such as bank statements, tax returns, credit history, and other relevant information that portrays the financial health and creditworthiness of the business. By utilizing Sparks Nevada Business Credit Application services, local businesses can enhance their growth prospects, fulfill immediate financial needs, and establish a trusted relationship with local financial institutions.

Sparks Nevada Business Credit Application

Description

How to fill out Sparks Nevada Business Credit Application?

If you are looking for a valid form, it’s extremely hard to find a better platform than the US Legal Forms site – probably the most extensive libraries on the internet. Here you can get thousands of document samples for company and personal purposes by categories and states, or keywords. With our advanced search feature, discovering the most recent Sparks Nevada Business Credit Application is as easy as 1-2-3. Additionally, the relevance of each document is proved by a team of professional lawyers that on a regular basis check the templates on our platform and revise them based on the newest state and county laws.

If you already know about our system and have a registered account, all you need to receive the Sparks Nevada Business Credit Application is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have discovered the form you require. Check its explanation and use the Preview option to check its content. If it doesn’t suit your needs, use the Search option at the top of the screen to find the appropriate document.

- Confirm your selection. Choose the Buy now option. Next, choose the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Receive the template. Choose the format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the acquired Sparks Nevada Business Credit Application.

Every template you save in your profile has no expiry date and is yours forever. You can easily access them using the My Forms menu, so if you want to get an additional copy for enhancing or printing, feel free to come back and save it once more at any time.

Make use of the US Legal Forms professional library to get access to the Sparks Nevada Business Credit Application you were seeking and thousands of other professional and state-specific samples on a single website!