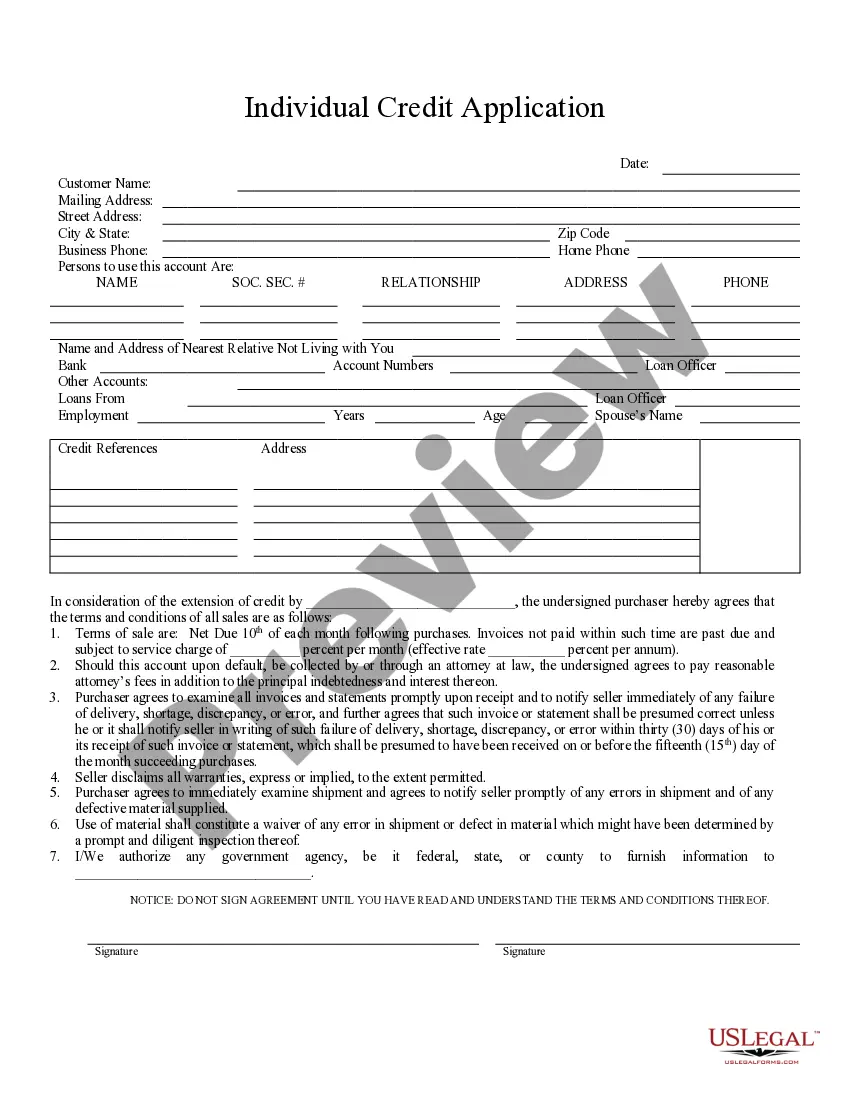

The North Las Vegas Nevada Individual Credit Application is a comprehensive form designed for individuals living in North Las Vegas, Nevada, to apply for credit services. This application is used by financial institutions, banks, and lenders to gather crucial information required to assess an individual's creditworthiness and ability to repay the borrowed amount. It plays a vital role in the loan approval process. Key information collected in the North Las Vegas Nevada Individual Credit Application includes personal details, financial records, employment history, and credit history. It is essential that applicants accurately provide this information to ensure the application's smooth processing and to increase their chances of eligibility. Completing this application allows lenders to evaluate applicants based on factors such as income, debt-to-income ratio, credit score, and employment stability. This evaluation helps lenders make informed decisions regarding an individual's creditworthiness and ability to manage their financial obligations. Different types of North Las Vegas Nevada Individual Credit Applications may include: 1. Mortgage Credit Application: Specifically designed for individuals applying for home loans or mortgage refinancing in North Las Vegas, Nevada. Applicants must provide additional information related to the subject property, like its location, purchase price, and intended use. 2. Auto Loan Credit Application: Tailored for individuals seeking financing for a new or used vehicle purchase in North Las Vegas, Nevada. Additional information regarding the vehicle, such as make, model, year, and VIN (Vehicle Identification Number), may be required. 3. Personal Loan Credit Application: Intended for individuals looking to obtain an unsecured loan for various personal needs. These loans are not tied to any specific purchase or collateral, and the funds can be used as per the applicant's requirements. 4. Credit Card Application: Used when an individual wants to apply for a credit card in North Las Vegas, Nevada. This application collects information related to previous credit card history, credit limits, and current outstanding balances. It is crucial to fill out the North Las Vegas Nevada Individual Credit Application honestly and accurately to facilitate the credit evaluation process and increase the chances of approval. Additionally, applicants must provide supporting documents such as bank statements, pay stubs, and identification to strengthen their application.

North Las Vegas Nevada Individual Credit Application

Description

How to fill out North Las Vegas Nevada Individual Credit Application?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person without any law background to create this sort of paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a huge library with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the North Las Vegas Nevada Individual Credit Application or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the North Las Vegas Nevada Individual Credit Application quickly using our reliable service. If you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are new to our library, ensure that you follow these steps before downloading the North Las Vegas Nevada Individual Credit Application:

- Ensure the form you have found is specific to your area since the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief description (if provided) of cases the paper can be used for.

- In case the one you picked doesn’t meet your requirements, you can start over and look for the suitable document.

- Click Buy now and choose the subscription option that suits you the best.

- with your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the North Las Vegas Nevada Individual Credit Application as soon as the payment is done.

You’re good to go! Now you can go on and print the form or complete it online. If you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.