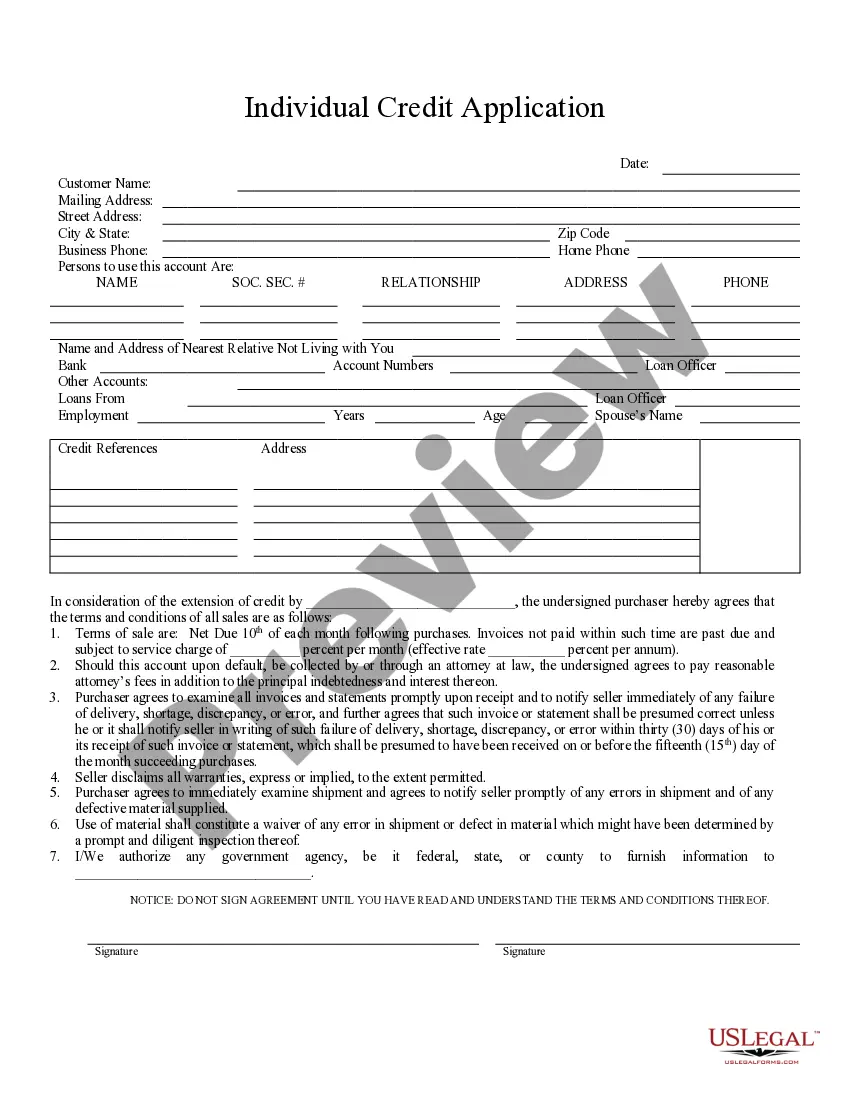

Sparks Nevada Individual Credit Application is a comprehensive form used by individuals residing in the Sparks, Nevada area to apply for credit from various financial institutions, banks, or lenders. This application plays a crucial role in assessing an individual's financial standing, creditworthiness, and determining the eligibility for obtaining loans, mortgages, credit cards, or any other form of credit. The Sparks Nevada Individual Credit Application typically requires applicants to provide personal details such as their full name, address, contact information, social security number, date of birth, and employment details. These pieces of information are necessary to authenticate the individual's identity and establish their residence in the Sparks, Nevada region. Furthermore, the form also requires applicants to provide comprehensive financial information, including their current income, employment status, monthly expenses, outstanding debts, and any previous bankruptcy or delinquency records. This information is essential for lenders to evaluate the applicant's ability to repay the requested credit and to assess their overall financial stability. Additionally, the Sparks Nevada Individual Credit Application might consist of specific sections tailored to different types of credit requests, such as auto loans, personal loans, home mortgages, or credit cards. These sections may require additional details relevant to the specific type of credit being sought. For example, a mortgage loan application section may ask for property information, current rental expenses, or details about any existing real estate owned. Other important components of the Sparks Nevada Individual Credit Application might include consent forms for the lender to perform credit checks, acknowledgment of the terms and conditions of the credit agreement, and a signature section for the applicant to attest to the accuracy of the provided information. It is crucial for individuals to accurately complete the Sparks Nevada Individual Credit Application, as any false or misleading information can lead to rejection of the credit request or potential legal consequences. Applicants should closely review the application form and ensure they understand the terms and requirements before signing it. In summary, the Sparks Nevada Individual Credit Application is a vital document for individuals seeking credit from financial institutions in the Sparks, Nevada area. This detailed application collects essential personal and financial information, enabling lenders to assess the applicant's creditworthiness and make informed decisions. Different types of credit applications may exist, such as auto loan applications, mortgage applications, personal loan applications, or credit card applications, each tailored to their specific credit type.

Sparks Nevada Individual Credit Application

Description

How to fill out Sparks Nevada Individual Credit Application?

If you are looking for a relevant form template, it’s impossible to choose a better service than the US Legal Forms site – one of the most extensive libraries on the web. Here you can find thousands of templates for organization and individual purposes by categories and regions, or keywords. With our advanced search feature, discovering the newest Sparks Nevada Individual Credit Application is as easy as 1-2-3. In addition, the relevance of each record is verified by a team of expert lawyers that regularly check the templates on our platform and update them based on the latest state and county demands.

If you already know about our platform and have an account, all you should do to receive the Sparks Nevada Individual Credit Application is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have found the sample you want. Look at its explanation and use the Preview function (if available) to see its content. If it doesn’t suit your needs, use the Search option near the top of the screen to find the proper document.

- Affirm your choice. Click the Buy now button. After that, pick the preferred pricing plan and provide credentials to register an account.

- Make the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the template. Select the file format and save it on your device.

- Make adjustments. Fill out, revise, print, and sign the received Sparks Nevada Individual Credit Application.

Each template you add to your account has no expiration date and is yours forever. It is possible to access them using the My Forms menu, so if you need to receive an extra duplicate for modifying or creating a hard copy, you may return and export it again at any moment.

Make use of the US Legal Forms extensive collection to gain access to the Sparks Nevada Individual Credit Application you were looking for and thousands of other professional and state-specific templates on one website!

Form popularity

FAQ

You must be unemployed or underemployed and have low or very low income....You must also be one of the following: Have a child 18 years of age or younger, or. Be pregnant, or. Be 18 years of age or younger and the head of your household.

Access Nevada - How to link your current account - YouTube YouTube Start of suggested clip End of suggested clip Your case ID can be found on any correspondence received from our agency. When you complete a newMoreYour case ID can be found on any correspondence received from our agency. When you complete a new application a VRU pin number is generated and mailed out to you. You can also call our customer.

How do I apply for this program? You can go to your local welfare office to pick/file an application or you may request an application be mailed to you. The application may be mailed, dropped off or faxed and may be used to apply for any and all programs listed on the form.

Access Nevada - How to upload documents - YouTube YouTube Start of suggested clip End of suggested clip You can drag and drop your documents to the application. Or you can browse for them acceptableMoreYou can drag and drop your documents to the application. Or you can browse for them acceptable document types are pictures such as TIFF gif or JPEG z' or Adobe PDF documents up to 3 megabytes.

I forgot my username and/or password and am unable to access my account. Go to the Nevada Health Link website and click on Log In. Click on the Forgot Password?Enter the email address associated with your NVHL account and click Continue. Follow the directions in your email to access your account.

Be sure to inform the store clerk the payment is for ?Nevada Child Support? and be prepared to provide your 9 digit case number, also known as your UPI (Unique Person Identifier).

Be responsible for a child 18 years of age or younger, or. Blind, or. Have a disability or a family member in your household with a disability, or. Be 65 years of age or older.

Access Nevada - How to link your current account - YouTube YouTube Start of suggested clip End of suggested clip Your case ID can be found on any correspondence received from our agency. When you complete a newMoreYour case ID can be found on any correspondence received from our agency. When you complete a new application a VRU pin number is generated and mailed out to you. You can also call our customer.

Check the status of your benefits online at dwss.nv.gov.

Access Nevada - How to link your current account - YouTube YouTube Start of suggested clip End of suggested clip You can do that by clicking on any of the links on access Nevada and filling in your case ID. NumberMoreYou can do that by clicking on any of the links on access Nevada and filling in your case ID. Number your VRU pin number and your date of birth.