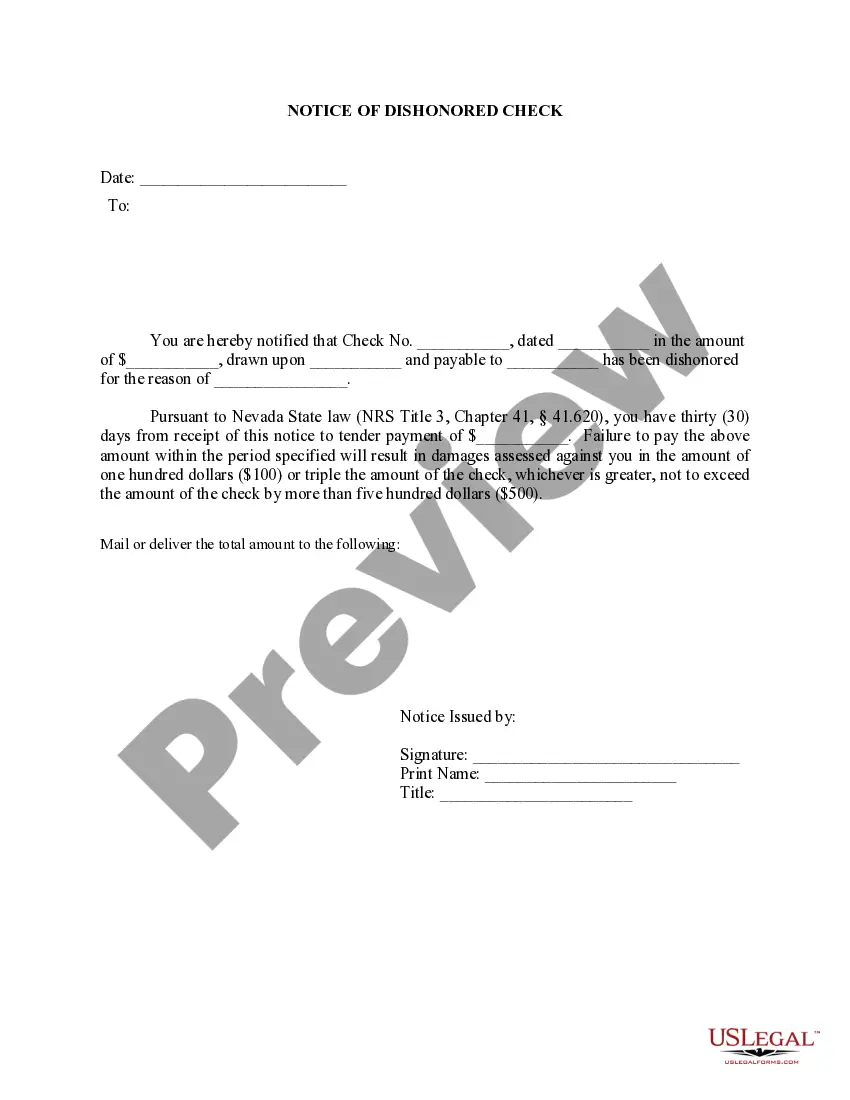

Sparks Nevada Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check A Sparks Nevada Notice of Dishonored Check — Civil is a legal document issued to inform the check writer that their check has been returned due to insufficient funds or a closed account. More commonly known as a bad check or a bounced check, this notice is a way for the payee or the bank to initiate legal actions to recover the owed payment. Types of Sparks Nevada Notice of Dishonored Check — Civil: 1. Standard Bad Check: This type of notice is sent to the check writer when their check fails to clear due to insufficient funds in the account. The recipient may be given a specific period to rectify the situation by providing an alternate form of payment or by covering the outstanding amount. 2. Closed Account Check: In cases where the account linked to the check has been closed, the payee or the bank may issue a Sparks Nevada Notice of Dishonored Check. This notifies the check writer that their check could not be processed because the associated account is no longer active. 3. Forgery or Fraudulent Check: If a check is suspected to be forged, counterfeit, or fraudulent, the recipient may pursue legal action by sending a Sparks Nevada Notice of Dishonored Check — Civil. This type of notice aims to alert the check writer of the suspicion and provide them with an opportunity to address the matter before further legal measures are taken. Key Components of a Sparks Nevada Notice of Dishonored Check — Civil: 1. Recipient Details: The notice includes the name and contact information of the check writer, ensuring they are properly identified. 2. Notice Date: This is the date when the notice is issued, indicating when the recipient becomes aware of the dishonored check. 3. Check Details: The notice specifies the relevant information of the bounced check, such as the check number, check amount, check date, and the bank on which it was drawn. 4. Reason for Dishonor: The notice states the reason for the dishonor, typically citing insufficient funds or a closed account. 5. Resolution Options: The recipient is informed of the necessary steps they must take to remedy the situation, such as providing an alternative payment method, covering the outstanding amount, or contacting the issuing party to resolve the issue. 6. Legal Consequences: The notice may also mention potential legal ramifications should the check writer fail to respond or rectify the situation within a specified timeframe. It's important to note that the content of a Sparks Nevada Notice of Dishonored Check — Civil may vary depending on the specific laws and regulations of the jurisdiction. It is advisable to consult a legal professional or refer to local laws to ensure the notice is drafted correctly and in compliance with applicable regulations.

Sparks Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Sparks Nevada Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Are you looking for a reliable and affordable legal forms supplier to get the Sparks Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? US Legal Forms is your go-to option.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of particular state and county.

To download the document, you need to log in account, find the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Sparks Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the document is intended for.

- Restart the search in case the template isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Sparks Nevada Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in any available format. You can return to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal paperwork online for good.