any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

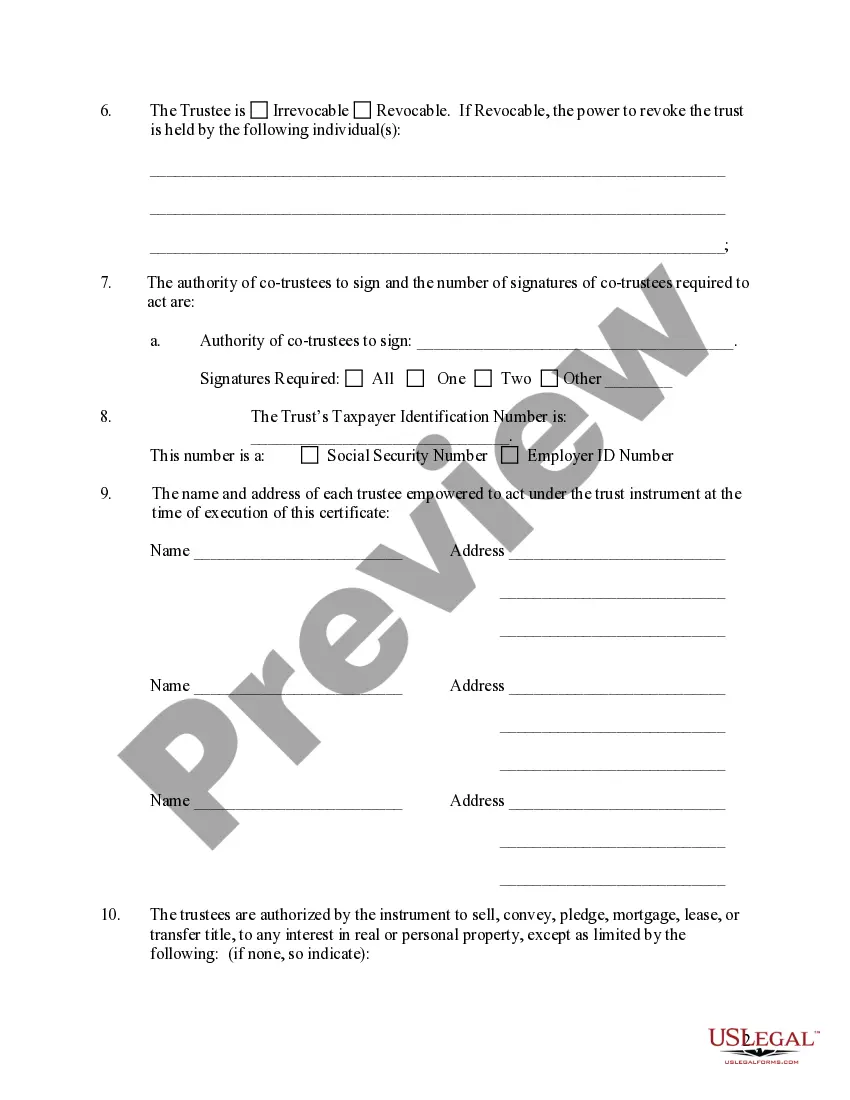

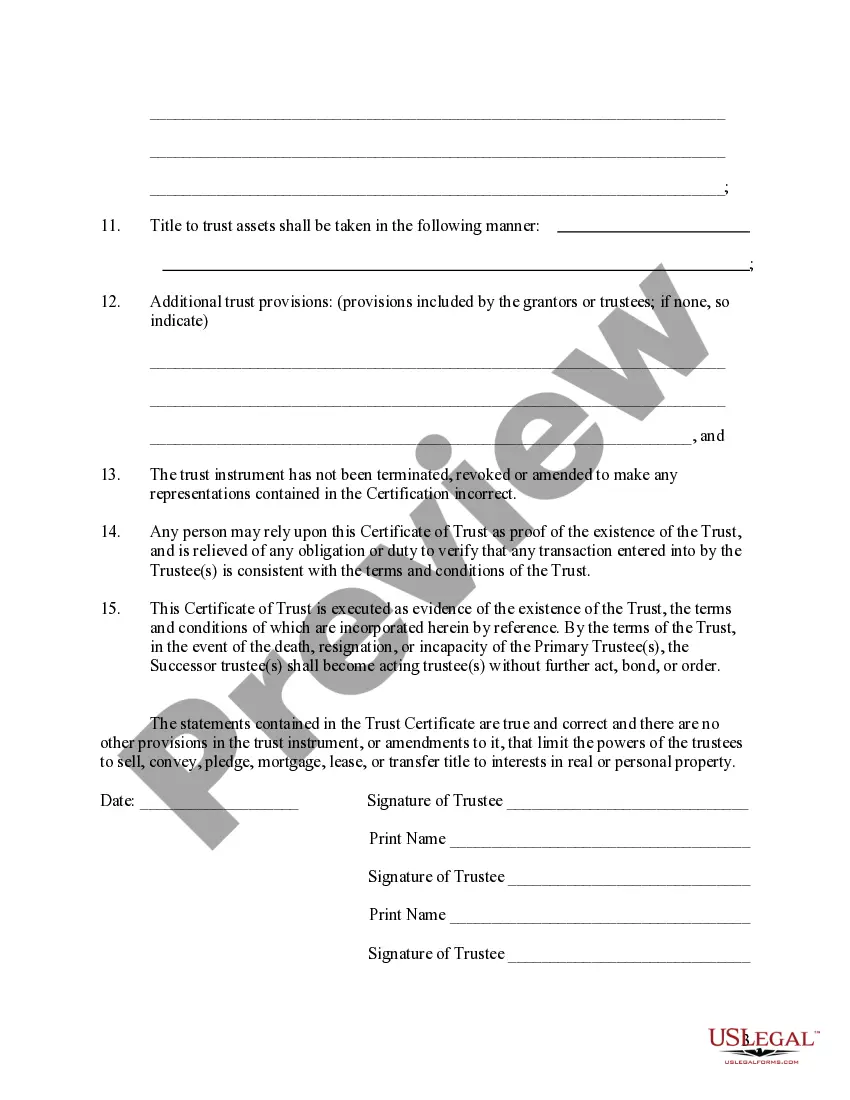

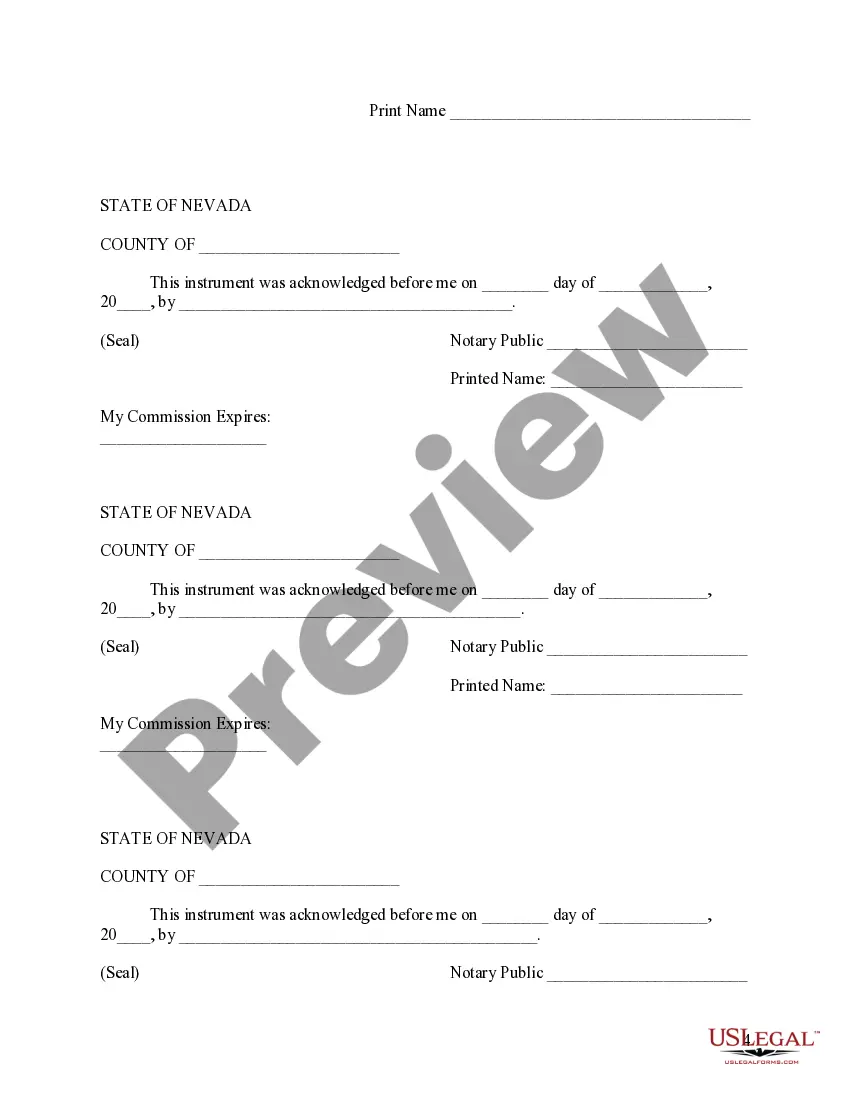

The Clark Nevada Certificate of Trust by Individual is a legal document that serves as proof of the existence of a trust in the state of Nevada. This certificate is specifically designed for individuals who have created a trust and wish to convey their authority as the trustee. The certificate contains essential information regarding the trust, including the name of the trust, the date of its creation, and the names of the granter(s) and trustee(s). It is filed with the Clark County Recorder's Office or another county office in Nevada where the trust property is located. By obtaining a Clark Nevada Certificate of Trust by Individual, the trustee can provide evidence of their authority to act on behalf of the trust. This is particularly important when conducting business transactions, such as buying or selling real estate, managing investments, or making financial decisions. It is worth mentioning that there are different types of Clark Nevada Certificates of Trust available, depending on the specific circumstances or requirements of the trustee. Some common variations may include: 1. Revocable Living Trust Certificates: These certificates are used when the trust is revocable, meaning that the granter retains the ability to modify, amend, or revoke the trust during their lifetime. 2. Irrevocable Trust Certificates: Irrevocable trust certificates are issued for trusts in which the granter has relinquished their control and cannot make changes without the consent of the beneficiaries. 3. Testamentary Trust Certificates: A testamentary trust is created through a person's last will and testament, and this type of certificate is issued to the individual named as the trustee in the will. Overall, the Clark Nevada Certificate of Trust by Individual plays a crucial role in establishing the authority of a trustee and provides necessary information about the trust to interested parties. Whether it is a revocable, irrevocable, or testamentary trust, obtaining the appropriate certificate is essential to ensure the smooth administration of the trust and adherence to legal requirements in Clark County, Nevada.