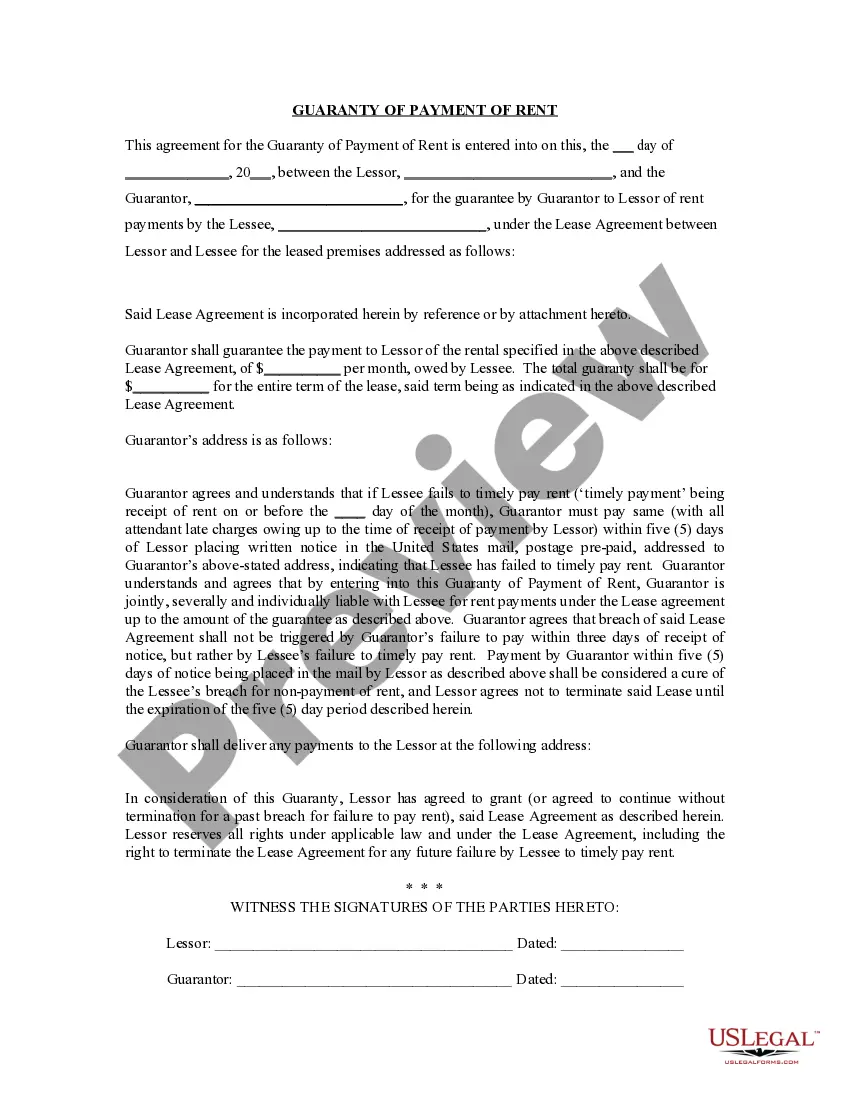

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). North Las Vegas, Nevada Guaranty or Guarantee of Payment of Rent ensures that landlords receive the agreed-upon rent amount even if the tenant defaults or fails to pay. Landlords often require this type of guarantee to mitigate potential financial risks and maintain a steady income stream. Here, we will explore the different types of North Las Vegas, Nevada Guaranty or Guarantee of Payment of Rent. 1. Personal Guarantor: A personal guarantor is an individual who guarantees the rent payment on behalf of the tenant. They become financially responsible if the tenant fails to fulfill their rental obligations. Generally, personal guarantors are required when tenants have insufficient credit history, low income, or limited rental references. Landlords may request a personal guarantor to provide proof of income, creditworthiness, and assets to ensure their ability to fulfill the guarantee. 2. Corporate Guarantor: In some cases, landlords may require a corporate guarantor for commercial leases or large-scale residential properties. A corporate guarantor is typically a business entity, such as a company or corporation, that assumes financial responsibility for the rent payment. This type of guarantor often demonstrates a stronger financial standing, making them a more secure option for landlords. 3. Surety Bond: A surety bond is an alternative to a personal or corporate guarantor. Instead of relying on an individual or entity, a surety bond is a type of insurance that guarantees the rent payment to the landlord. Tenants can purchase a surety bond from an insurance company, ensuring that the insurer will cover the rental payment in case of default. This option provides a layer of financial protection to both landlords and tenants. 4. Letter of Credit: A letter of credit is another form of North Las Vegas, Nevada Guaranty or Guarantee of Payment of Rent. It involves a banking institution issuing a letter to the landlord, guaranteeing that the rent will be paid in full, even if the tenant defaults. The bank evaluates the tenant's financial stability before approving the letter of credit, offering additional security to the landlord. Landlords in North Las Vegas, Nevada may consider utilizing one or more of these guarantee options to safeguard their rental income. It is important for both landlords and tenants to thoroughly understand the terms and conditions of the guarantee before entering into any rental agreement.

North Las Vegas, Nevada Guaranty or Guarantee of Payment of Rent ensures that landlords receive the agreed-upon rent amount even if the tenant defaults or fails to pay. Landlords often require this type of guarantee to mitigate potential financial risks and maintain a steady income stream. Here, we will explore the different types of North Las Vegas, Nevada Guaranty or Guarantee of Payment of Rent. 1. Personal Guarantor: A personal guarantor is an individual who guarantees the rent payment on behalf of the tenant. They become financially responsible if the tenant fails to fulfill their rental obligations. Generally, personal guarantors are required when tenants have insufficient credit history, low income, or limited rental references. Landlords may request a personal guarantor to provide proof of income, creditworthiness, and assets to ensure their ability to fulfill the guarantee. 2. Corporate Guarantor: In some cases, landlords may require a corporate guarantor for commercial leases or large-scale residential properties. A corporate guarantor is typically a business entity, such as a company or corporation, that assumes financial responsibility for the rent payment. This type of guarantor often demonstrates a stronger financial standing, making them a more secure option for landlords. 3. Surety Bond: A surety bond is an alternative to a personal or corporate guarantor. Instead of relying on an individual or entity, a surety bond is a type of insurance that guarantees the rent payment to the landlord. Tenants can purchase a surety bond from an insurance company, ensuring that the insurer will cover the rental payment in case of default. This option provides a layer of financial protection to both landlords and tenants. 4. Letter of Credit: A letter of credit is another form of North Las Vegas, Nevada Guaranty or Guarantee of Payment of Rent. It involves a banking institution issuing a letter to the landlord, guaranteeing that the rent will be paid in full, even if the tenant defaults. The bank evaluates the tenant's financial stability before approving the letter of credit, offering additional security to the landlord. Landlords in North Las Vegas, Nevada may consider utilizing one or more of these guarantee options to safeguard their rental income. It is important for both landlords and tenants to thoroughly understand the terms and conditions of the guarantee before entering into any rental agreement.