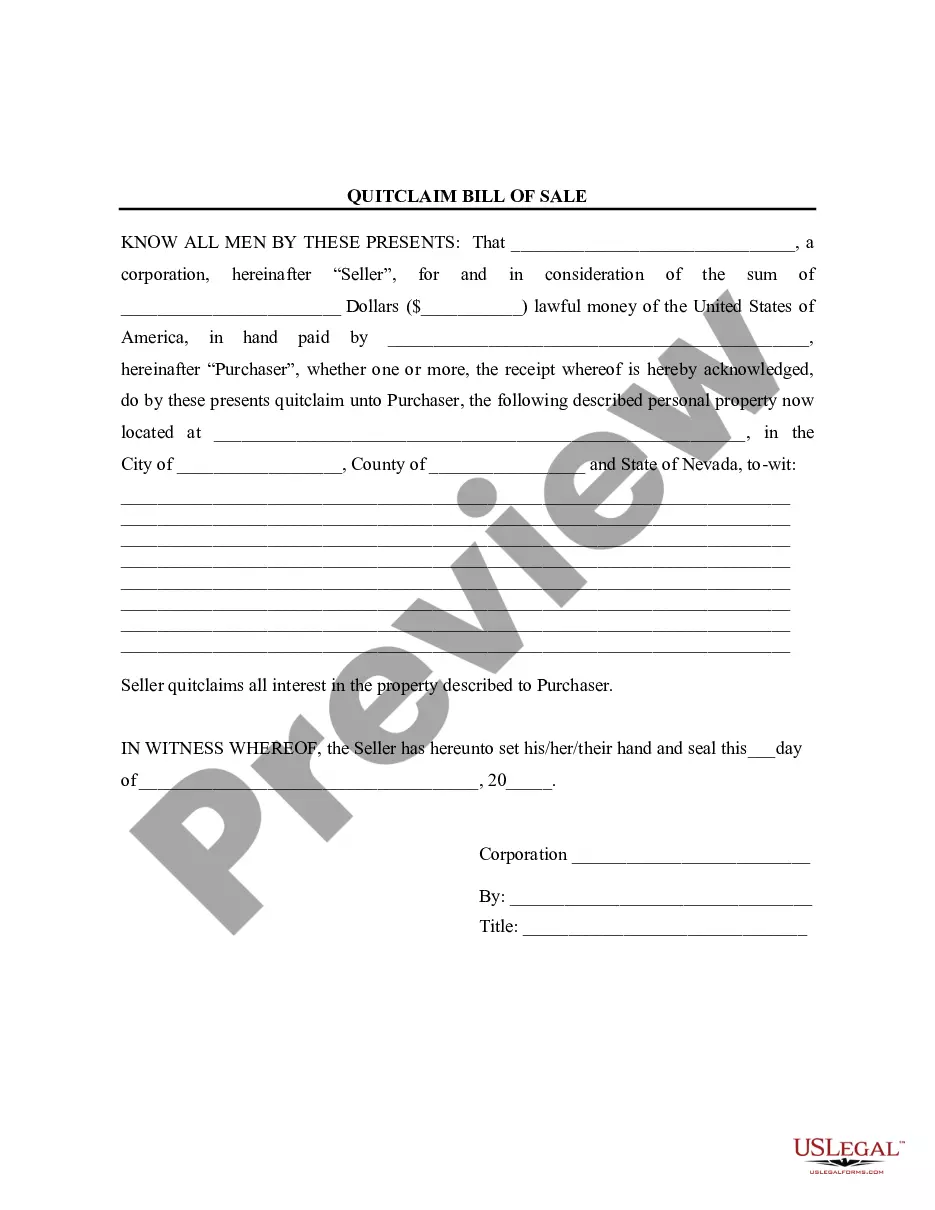

The Sparks Nevada Bill of Sale without Warranty by Corporate Seller is a legally binding document that records the sale of goods or property from a corporate entity to another party, without any express or implied warranties. This type of bill of sale is commonly used in business transactions conducted in Sparks, Nevada. It is crucial for both the seller and buyer to carefully review and understand the terms and conditions of this agreement before proceeding with the sale. The Sparks Nevada Bill of Sale without Warranty by Corporate Seller outlines the precise details of the transaction, including the identification of the corporate seller, the buyer, and a description of the goods or property being sold. This document acts as proof of purchase and transfer of ownership, protecting both parties' interests. Keywords: Sparks Nevada, bill of sale, warranty, corporate seller, without warranty, business transaction, legal document, terms and conditions, proof of purchase, transfer of ownership. Different types of Sparks Nevada Bill of Sale without Warranty by Corporate Seller may include: 1. Vehicle Bill of Sale without Warranty by Corporate Seller: Used when a corporate entity sells a motor vehicle or any other mode of transportation without providing any warranties regarding its condition or functionality. 2. Property Bill of Sale without Warranty by Corporate Seller: Used for the sale of real estate or any type of tangible property where the corporate seller explicitly disclaims any warranties, either expressed or implied. 3. Equipment Bill of Sale without Warranty by Corporate Seller: Used for the sale of machinery, appliances, tools, or any other types of equipment, whereby the corporate seller offers no warranties concerning the equipment's performance or suitability for a specific purpose. 4. Business Asset Bill of Sale without Warranty by Corporate Seller: Used when a corporate entity sells its business assets, including inventory, fixtures, or intellectual property, without providing any warranties to the buyer. In all cases, it is important for both parties involved in the transaction to consult legal professionals to ensure full compliance with Sparks Nevada laws and regulations.

Sparks Nevada Bill of Sale without Warranty by Corporate Seller

Description

How to fill out Sparks Nevada Bill Of Sale Without Warranty By Corporate Seller?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial affairs. To accomplish this, we apply for legal services that, as a rule, are extremely expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Sparks Nevada Bill of Sale without Warranty by Corporate Seller or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Sparks Nevada Bill of Sale without Warranty by Corporate Seller complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Sparks Nevada Bill of Sale without Warranty by Corporate Seller would work for your case, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!