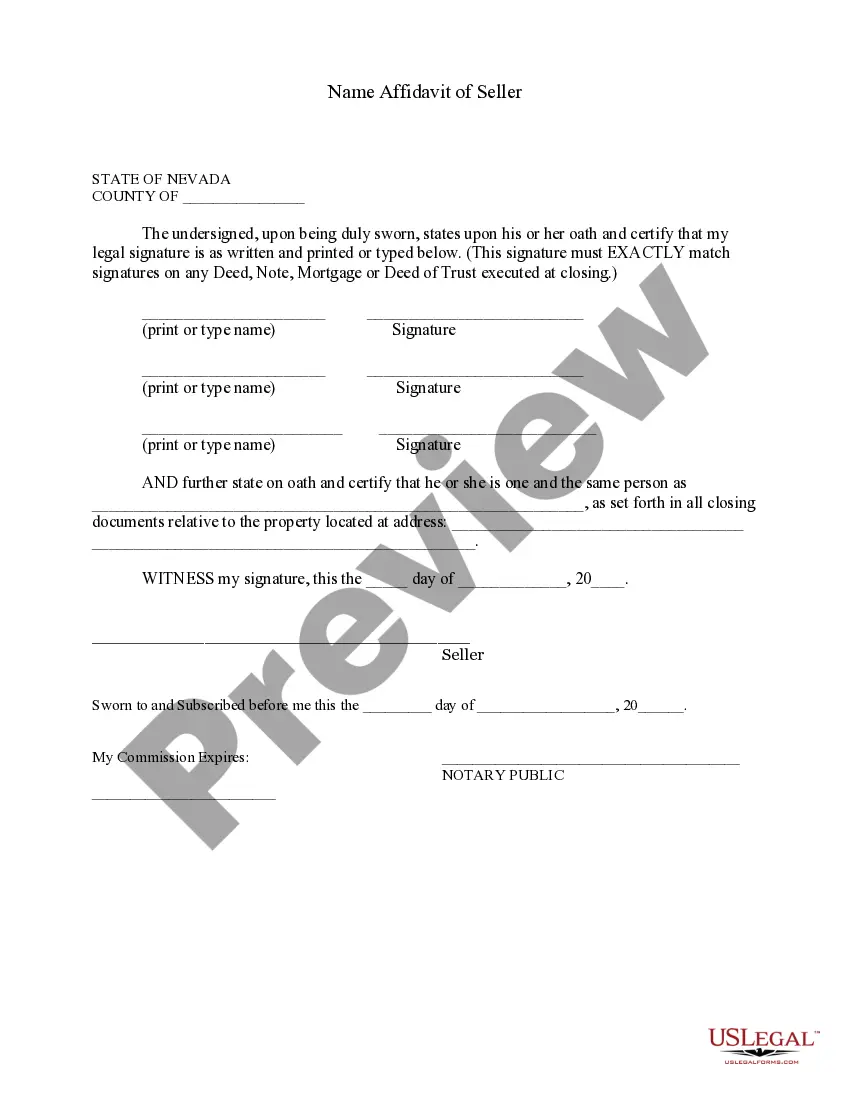

The Clark Nevada Name Affidavit of Seller is a legal document used in real estate transactions within Clark County, Nevada. This affidavit serves as an assurance by the seller that they are the rightful owner of the property being sold and that there are no undisclosed liens, claims, or encumbrances on the title. This affidavit is a crucial component of the sales process as it helps provide clarity and protect the buyer from any potential legal issues regarding the property's ownership. By signing the Clark Nevada Name Affidavit of Seller, the seller declares under oath that they are the true owner of the property and have the legal authority to sell it. The affidavit typically includes important details such as the seller's full legal name, contact information, the property's address, and a description of the property being sold. It may also require the seller to provide information about any mortgages, liens, or other encumbrances currently affecting the property. Additionally, the Clark Nevada Name Affidavit of Seller may encompass specific variations or types based on the nature of the property or specific circumstances. Some variations include: 1. Residential Property Name Affidavit of Seller: This type of affidavit is used in the sale of residential properties, including single-family homes, condominiums, or townhouses. 2. Commercial Property Name Affidavit of Seller: Used in the sale of commercial properties such as office buildings, retail spaces, industrial properties, or vacant land intended for commercial development. 3. Vacant Land Name Affidavit of Seller: Applied when selling undeveloped land or plots of land without any structures on them. 4. Investment Property Name Affidavit of Seller: Utilized in the sale of properties that are primarily purchased for investment purposes, such as rental properties or properties held for appreciation. 5. Condominium Name Affidavit of Seller: Specifically designed for the sale of individual condominium units within a larger condominium development, ensuring title clarity within this unique ownership structure. It is important for both buyers and sellers to understand the significance of the Clark Nevada Name Affidavit of Seller. This legal document aids in establishing transparency and mitigating any potential risks or disputes related to the property's ownership or its title status. Always consult with a qualified real estate attorney or licensed professional to ensure the accuracy and validity of the Clark Nevada Name Affidavit of Seller in any given transaction.

Clark Nevada Name Affidavit of Seller

Description

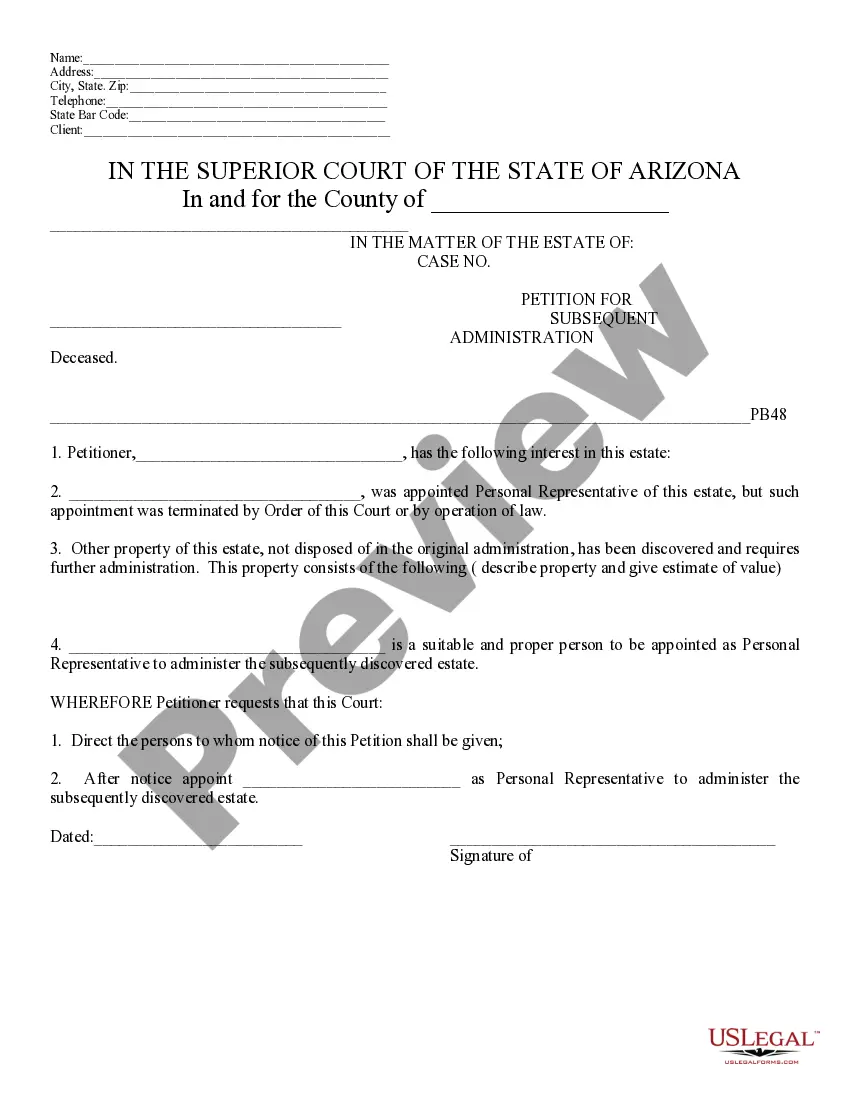

How to fill out Clark Nevada Name Affidavit Of Seller?

If you’ve already utilized our service before, log in to your account and save the Clark Nevada Name Affidavit of Seller on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Clark Nevada Name Affidavit of Seller. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!

Form popularity

FAQ

Prepare and Pay Real Property Transfer Tax - The transfer tax is calculated at the rate of $2.55 per $500 of value or a fraction thereof. The transfer tax is based on the full purchase price or the estimated fair market value.

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

How to fill out the Nevada Resale Certificate Step 1 ? Begin by downloading the Nevada Resale Certificate. Step 2 ? Enter the purchaser's seller's permit number. Step 3 ? Indicate the general line of business of the buyer. Step 4 ? Add the name of the seller. Step 5 ? Describe the property that will be purchased.

A Nevada quitclaim deed is a form of deed that functions essentially like a release. It transfers any title, interest, or claim the person signing the deed holds in the real estate with no promises regarding the quality of the transferred interest.

Normally the seller is responsible for such things as the title insurance fee, documentation charges and notary fees for instruments transferring the property to the buyer; real property transfer tax on the recording of the deed; the real estate broker's fee and one-half of the Escrow Holder's fee.

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.

The Grantee and Grantor are jointly and severally liable for the payment of the tax. When all taxes and recording fees required are paid, the deed is recorded. Each County Recorder's Office: 1.

A seller's permit can be obtained by registering through SilverFlume (State of Nevada Business Portal) or by mailing in Nevada Business Registration Form. Information needed to register includes: Type of business entity: Sole Proprietorship, Partnership, Corporation, Limited Liability Company (LLC)

Anyway, here's a quick example of the way in which RPTT would be calculated for real property with a value of let's say? $254,506.00. Therefore, upon the transfer of real property in Clark County with a value of $254,506.00, the RPTT would be $1,300.50. RPTT is Typically Paid by The Transferor of Real Property.

You would need to record a new Deed document in the Washoe County Recorder's Office to change how title is held to your property. You can obtain document forms from local office supply stores, or legal counsel can draw them up.

Interesting Questions

More info

See State Law about Leases and Rents. Affidavit. As soon as practical following the person's death. If not, contact your County Assessor for the number. Fill out the attached Affidavit cover sheet, Affidavit, and proposed Order. Typically, it is filled out in escrow and accompanies the deed when recorded. If “other” filldescriberb(n ( A quitclaim deed only transfers an owner's rights to the buyer, ensuring that the previous owner cannot come back later to claim an interest in the property. In the State of Nevada these records are confidential. See State Law about Leases and Rents. Affidavit. As soon as practical following the person's death. If not, contact your County Assessor for the number. Fill out the attached Affidavit cover sheet, Affidavit, and proposed Order. Typically, it is filled out in escrow and accompanies the deed when recorded.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.