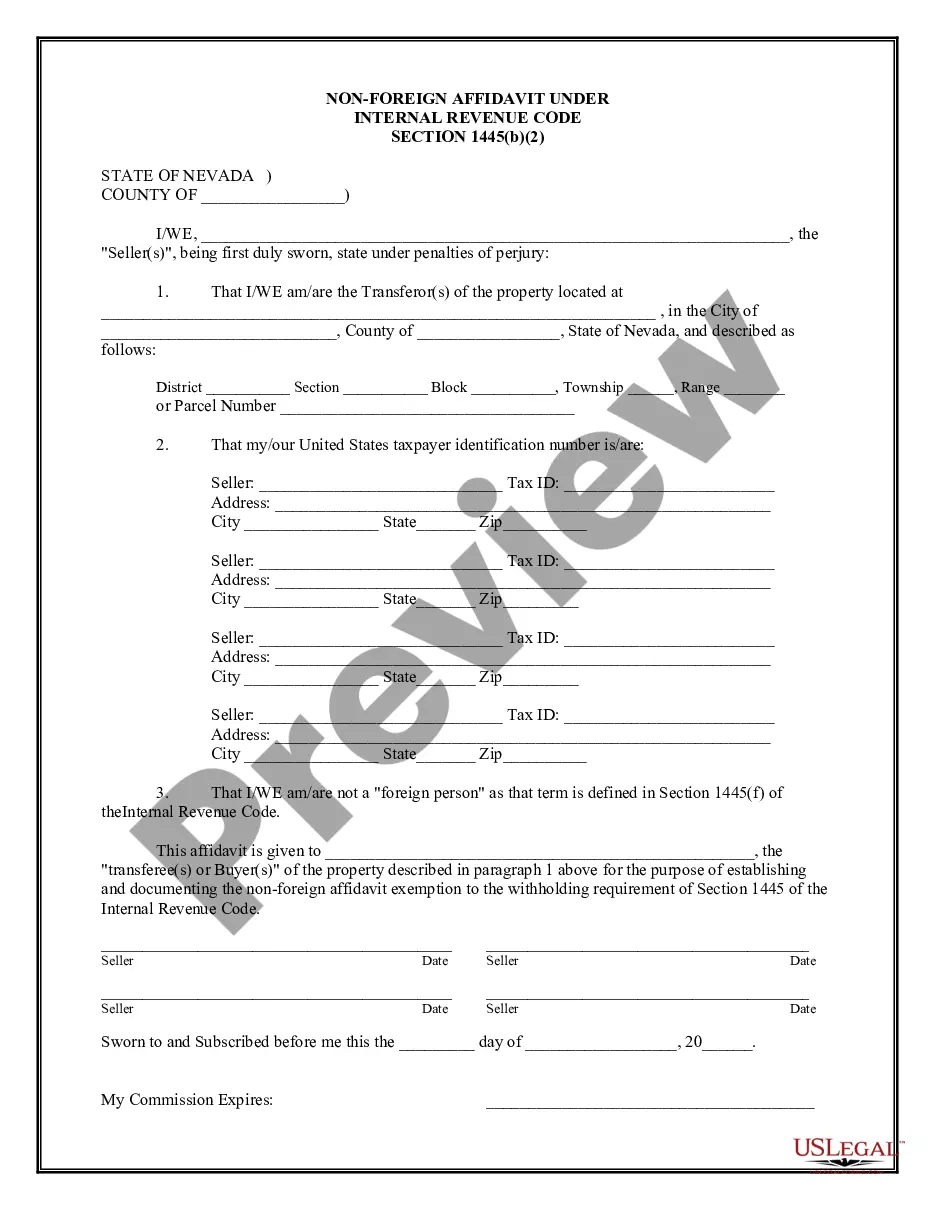

Clark Nevada Non-Foreign Affidavit Under IRC 1445 provides legal certification regarding the tax status of non-foreign individuals or entities involved in real estate transactions. This affidavit is required by the Internal Revenue Code (IRC) Section 1445, which imposes certain obligations on a buyer or transferee of a U.S. real property interest (US RPI) when the seller or transferor is a non-foreign person. The Clark Nevada Non-Foreign Affidavit Under IRC 1445 serves as an important document to establish the status of the seller or transferor as a non-foreign person for tax purposes. By completing this affidavit, the seller or transferor declares under penalty of perjury that they are not a non-resident alien, foreign corporation, partnership, trust, estate, or any other type of foreign entity subject to tax withholding under IRC 1445. The purpose of this affidavit is to ensure compliance with tax regulations by enabling the buyer or transferee to determine the tax obligations associated with the transaction. By obtaining this affidavit, the buyer or transferee can ascertain whether they are required to withhold a specific percentage of the total purchase price as an estimated tax payment to the IRS. If the seller or transferor is deemed a non-foreign person, the buyer or transferee is relieved of the withholding obligation. Different types of Clark Nevada Non-Foreign Affidavit Under IRC 1445 may include variations based on specific jurisdictions. For instance, Clark County, Nevada, may have its own version of the affidavit tailored to local tax regulations. However, the core purpose of the affidavit remains consistent — to establish the non-foreign status of the seller or transferor. In conclusion, the Clark Nevada Non-Foreign Affidavit Under IRC 1445 is a crucial legal document used in real estate transactions involving non-foreign parties. This affidavit ensures compliance with IRC 1445 regulations and determines the withholding obligations of the buyer or transferee. Proper completion and submission of this affidavit contribute to a smooth and legally compliant real estate transfer process.

Clark Nevada Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Clark Nevada Non-Foreign Affidavit Under IRC 1445?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone without any legal education to draft this sort of paperwork cfrom the ground up, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our service offers a massive catalog with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you need the Clark Nevada Non-Foreign Affidavit Under IRC 1445 or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Clark Nevada Non-Foreign Affidavit Under IRC 1445 quickly using our reliable service. If you are presently an existing customer, you can go ahead and log in to your account to get the needed form.

Nevertheless, if you are a novice to our library, ensure that you follow these steps before downloading the Clark Nevada Non-Foreign Affidavit Under IRC 1445:

- Ensure the template you have found is good for your area since the regulations of one state or county do not work for another state or county.

- Review the form and go through a short description (if available) of cases the document can be used for.

- In case the form you selected doesn’t meet your requirements, you can start over and look for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the Clark Nevada Non-Foreign Affidavit Under IRC 1445 once the payment is done.

You’re all set! Now you can go ahead and print the form or fill it out online. If you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

CERTIFICATION OF FOREIGN STATUS UNDER FIRPTA The purpose of this Certification is to notify Buyer of Seller's/Sellers' status under FIRPTA (Section 1445 of the Internal Revenue Code) with regard to a prospective real estate transaction involving the Property identified below.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

IRS Notice 1445 is a relatively newer notice that notifies taxpayers of their ability to receive tax help in other languages. It lays out the steps needed to receive this help, to ensure that anyone can process their taxes promptly and accurately.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

A citizen or resident of the United States, ? A domestic partnership, or ? A domestic corporation, or ? An estate or trust (other than a foreign estate of foreign trust as those terms are defined in Section 7701 (a) (31) of the Code.

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.

Interesting Questions

More info

(1) Bylaws of the Trustee for the City of Milton, adopted effective at the time the Trustee's Articles of Organization (The City Charter) were executed. See the attached copy of the City of Milton Bylaws adopted on June 1, 2011. (4) The City of Milton has designated a portion of the existing surface parking lot at 1616 Broadway (The Green Street Car Park) as surplus and surplus on a per-unit basis and has assigned the land and a portion of the parking lot to the Trustee under the terms of Chapter 12, Statutes of 2010. (5) The City of Milton is in receipt of the Notice of Federal Tax Lien for Taxes due on Building Materials at a property owned by the City of Milton (the City's Building Materials Trust Fund) and a portion of the proceeds from the Property's sale of the Trust Fund's surplus Building Materials, has been placed in escrow. 1545. AC electric motors of an output exceeding 124. Recorded in the official records of the county in which the Real Property is located.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.