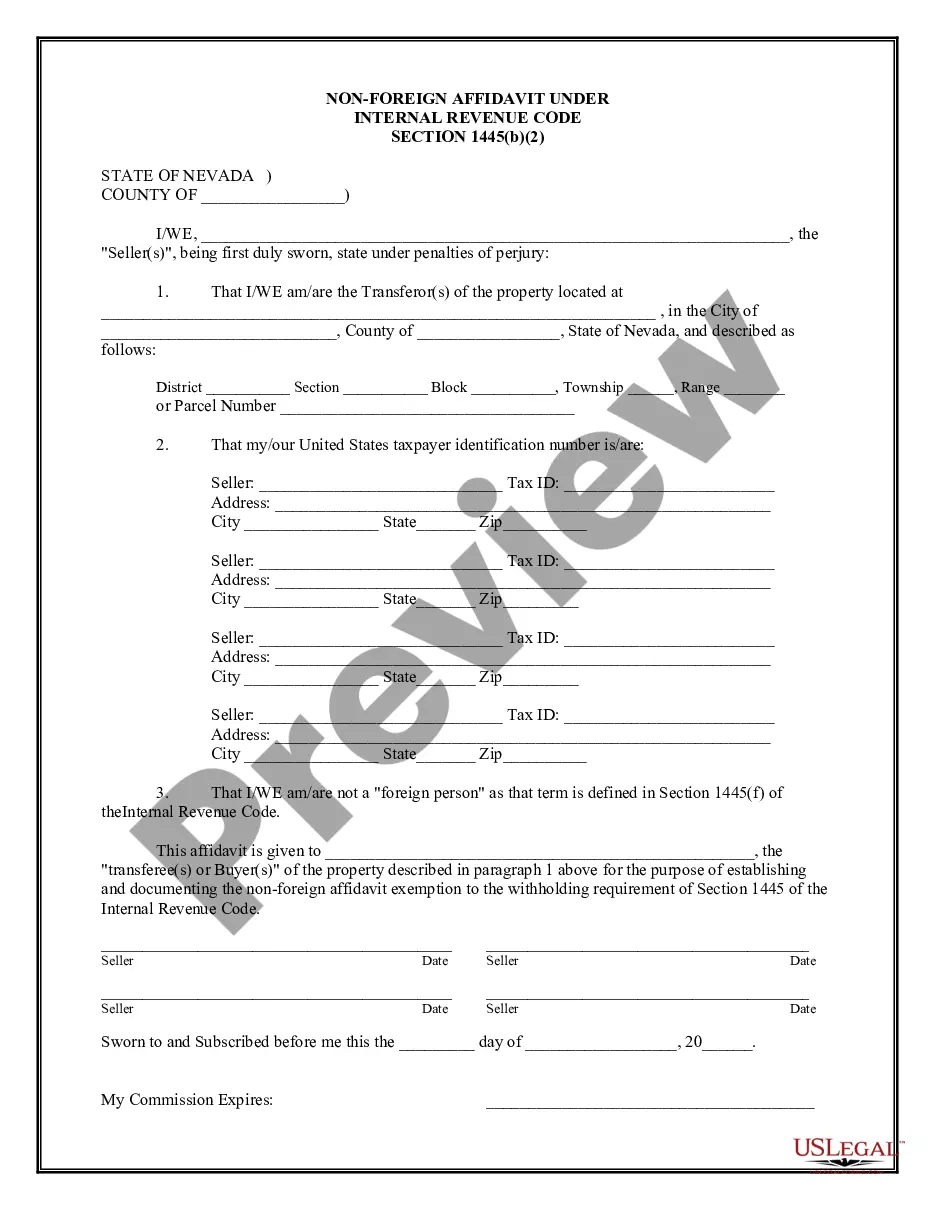

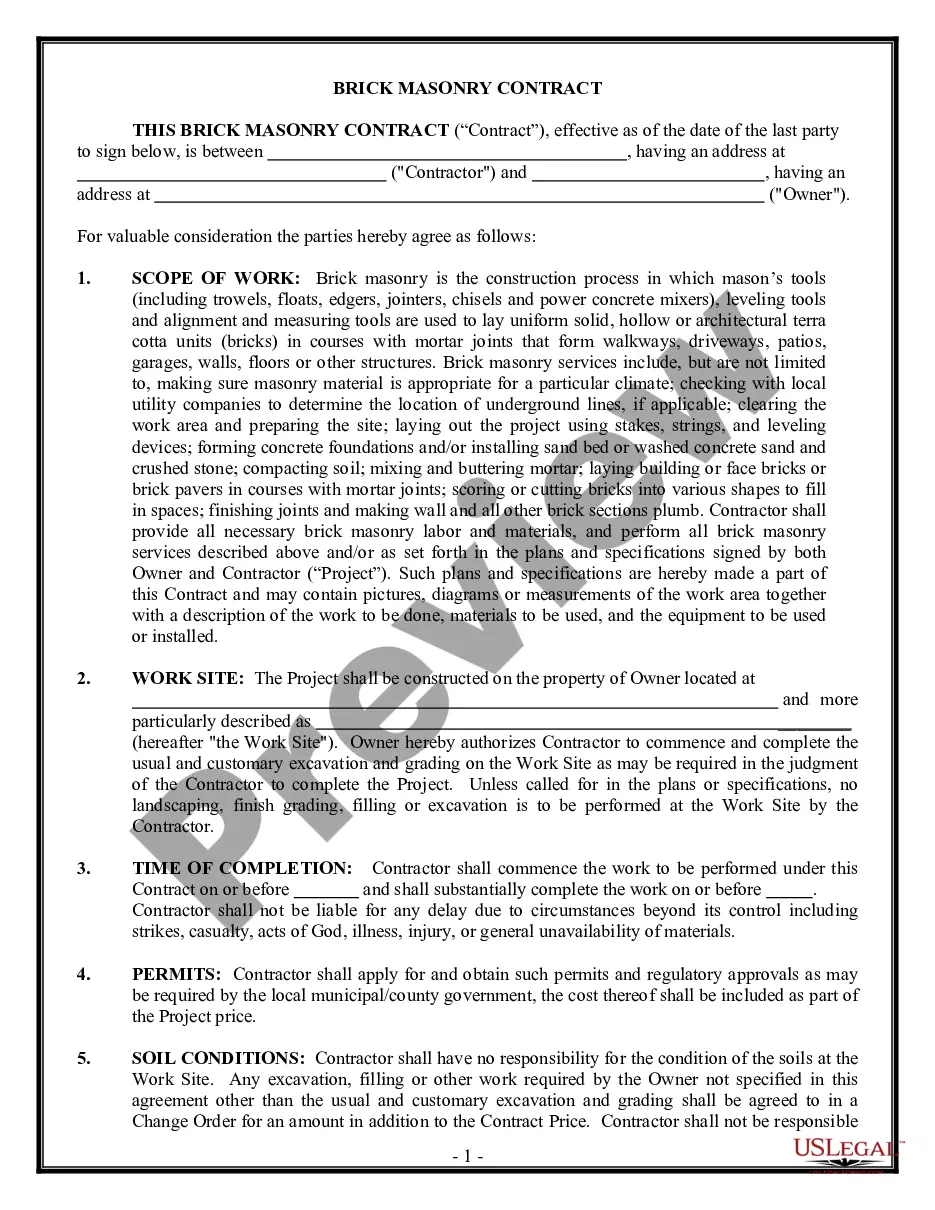

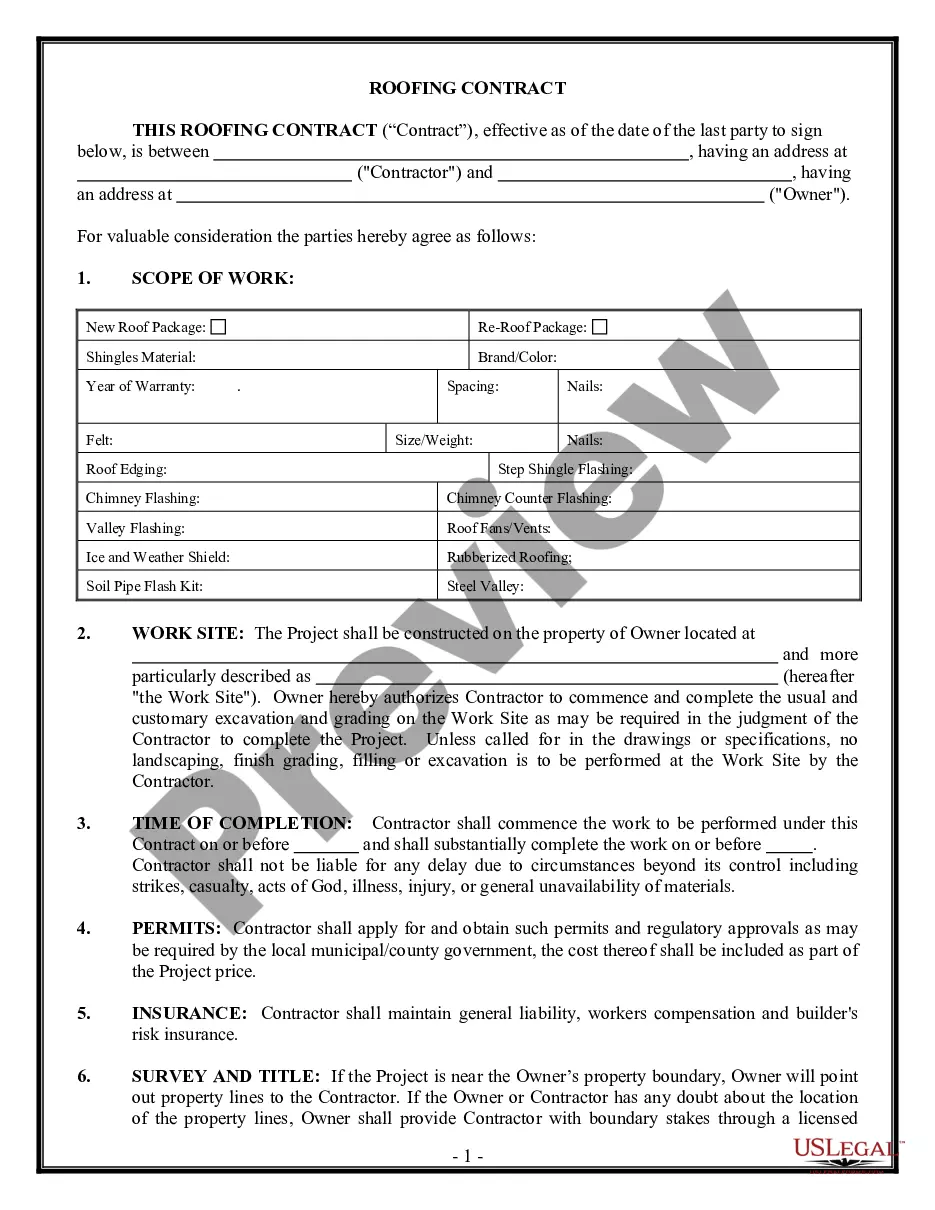

Las Vegas Nevada Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Las Vegas Nevada Non-Foreign Affidavit Under IRC 1445?

Make use of the US Legal Forms and get instant access to any form you need. Our beneficial platform with a huge number of document templates simplifies the way to find and get almost any document sample you want. It is possible to export, complete, and certify the Las Vegas Nevada Non-Foreign Affidavit Under IRC 1445 in just a few minutes instead of surfing the Net for hours searching for an appropriate template.

Using our collection is a great way to raise the safety of your record filing. Our experienced attorneys regularly review all the records to make sure that the templates are relevant for a particular state and compliant with new laws and polices.

How do you obtain the Las Vegas Nevada Non-Foreign Affidavit Under IRC 1445? If you already have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Moreover, you can get all the earlier saved records in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Open the page with the form you require. Make sure that it is the form you were looking for: examine its title and description, and make use of the Preview feature when it is available. Otherwise, utilize the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Export the file. Choose the format to get the Las Vegas Nevada Non-Foreign Affidavit Under IRC 1445 and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable document libraries on the web. We are always happy to help you in any legal procedure, even if it is just downloading the Las Vegas Nevada Non-Foreign Affidavit Under IRC 1445.

Feel free to make the most of our platform and make your document experience as efficient as possible!