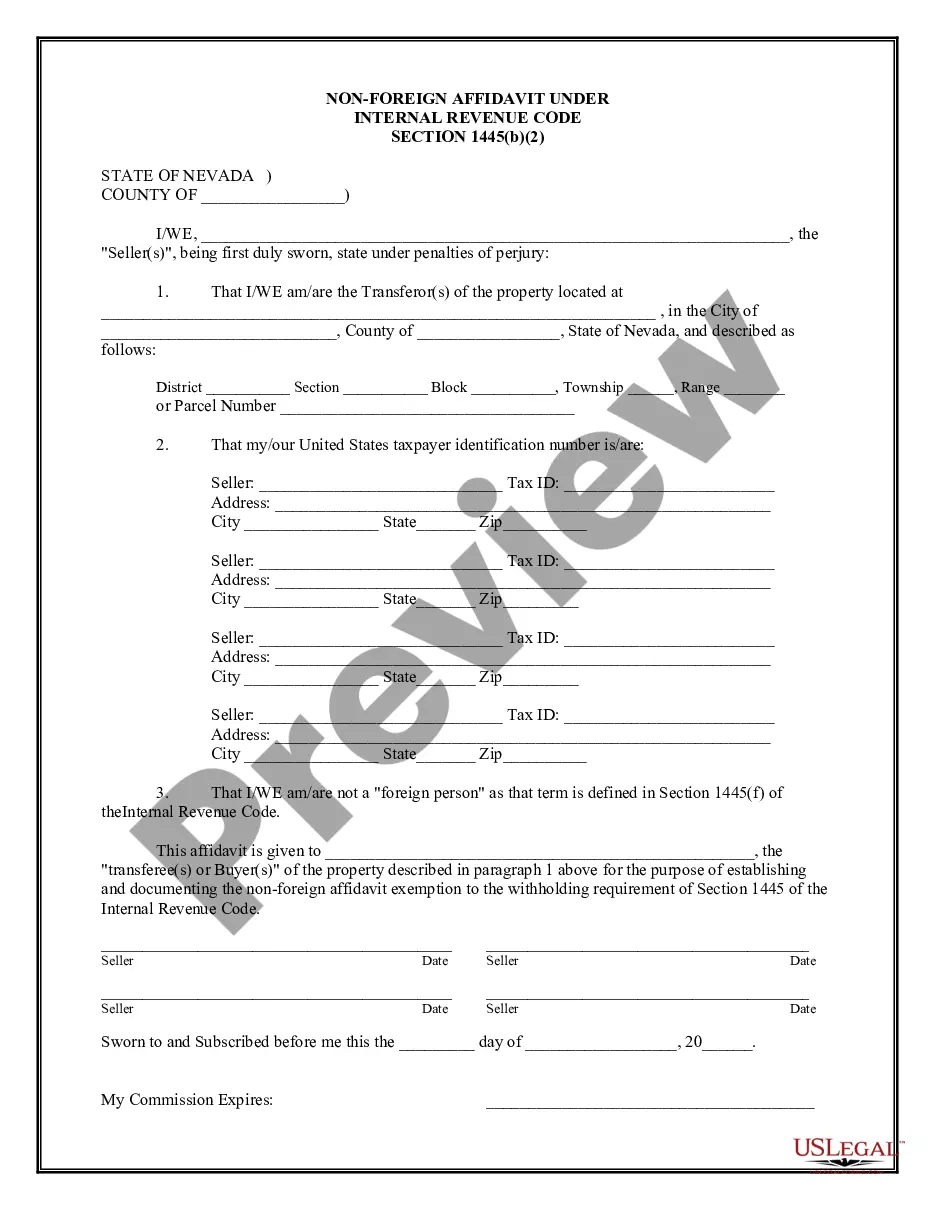

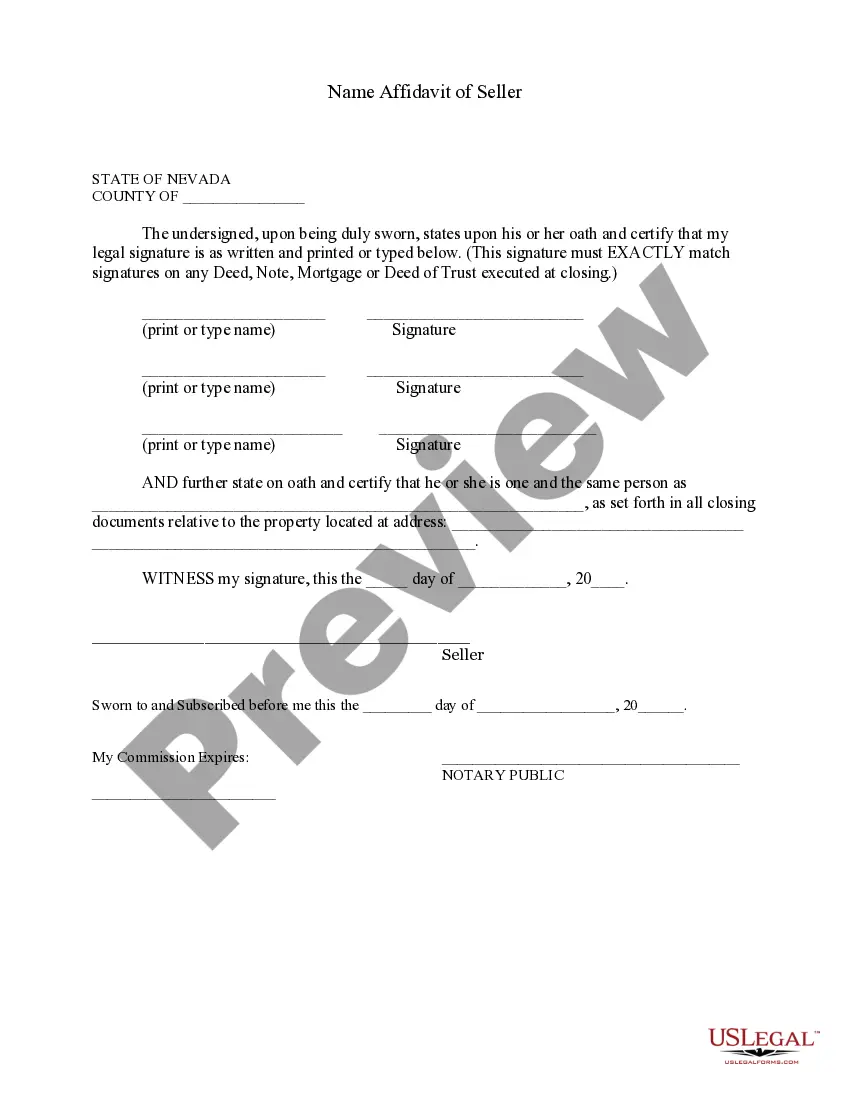

A Sparks Nevada Non-Foreign Affidavit Under IRC 1445 is a legal document utilized in real estate transactions involving the sale or transfer of property by a non-U.S. individual or entity. This affidavit is specifically required by the Internal Revenue Code (IRC) Section 1445 to ensure compliance with certain tax obligations related to the disposition of a U.S. real property interest in a non-foreign party. The affidavit serves as a declaration that the seller is not a foreign person and is, therefore, exempt from withholding tax requirements. The Sparks Nevada Non-Foreign Affidavit Under IRC 1445 is an essential document for both the buyer and the seller involved in the transaction. It provides assurance to the buyer that they are not required to withhold a certain percentage of the sale proceeds as tax and also protects the seller from any unnecessary tax withholding. By completing this affidavit, the seller confirms their status as a non-foreign individual or entity and declares that they hold no U.S. real property interest subject to withholding. Different types of Sparks Nevada Non-Foreign Affidavit Under IRC 1445 may exist based on the specific circumstances of the transaction or the parties involved. Some variations of this affidavit could include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual who is not a foreign person is selling or transferring their U.S. real property interest. It requires the seller to provide personal information such as their name, Social Security Number (SSN), and address. 2. Entity Non-Foreign Affidavit: When a non-foreign entity, such as a corporation, partnership, or limited liability company, is involved in the sale or transfer of U.S. real property interest, this affidavit type is typically used. It requires the entity to provide information like its legal name, Employer Identification Number (EIN), and principal place of business. 3. Trust Non-Foreign Affidavit: In cases where a trust, such as a revocable living trust, is selling or transferring U.S. real property interest, a Trust Non-Foreign Affidavit is necessary. This affidavit requires the trustee(s) to provide details about the trust, including its legal name, EIN (if applicable), and trust agreement provisions related to non-foreign status. Completing the Sparks Nevada Non-Foreign Affidavit Under IRC 1445 accurately and in a timely manner is crucial to avoid complications during the real estate transaction. Buyers and sellers must consult with legal professionals or tax advisors experienced in international real estate transactions to ensure compliance with all relevant laws and regulations, making the transfer of property a smooth and lawful process.

Sparks Nevada Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Sparks Nevada Non-Foreign Affidavit Under IRC 1445?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Sparks Nevada Non-Foreign Affidavit Under IRC 1445 becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Sparks Nevada Non-Foreign Affidavit Under IRC 1445 takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Sparks Nevada Non-Foreign Affidavit Under IRC 1445. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!