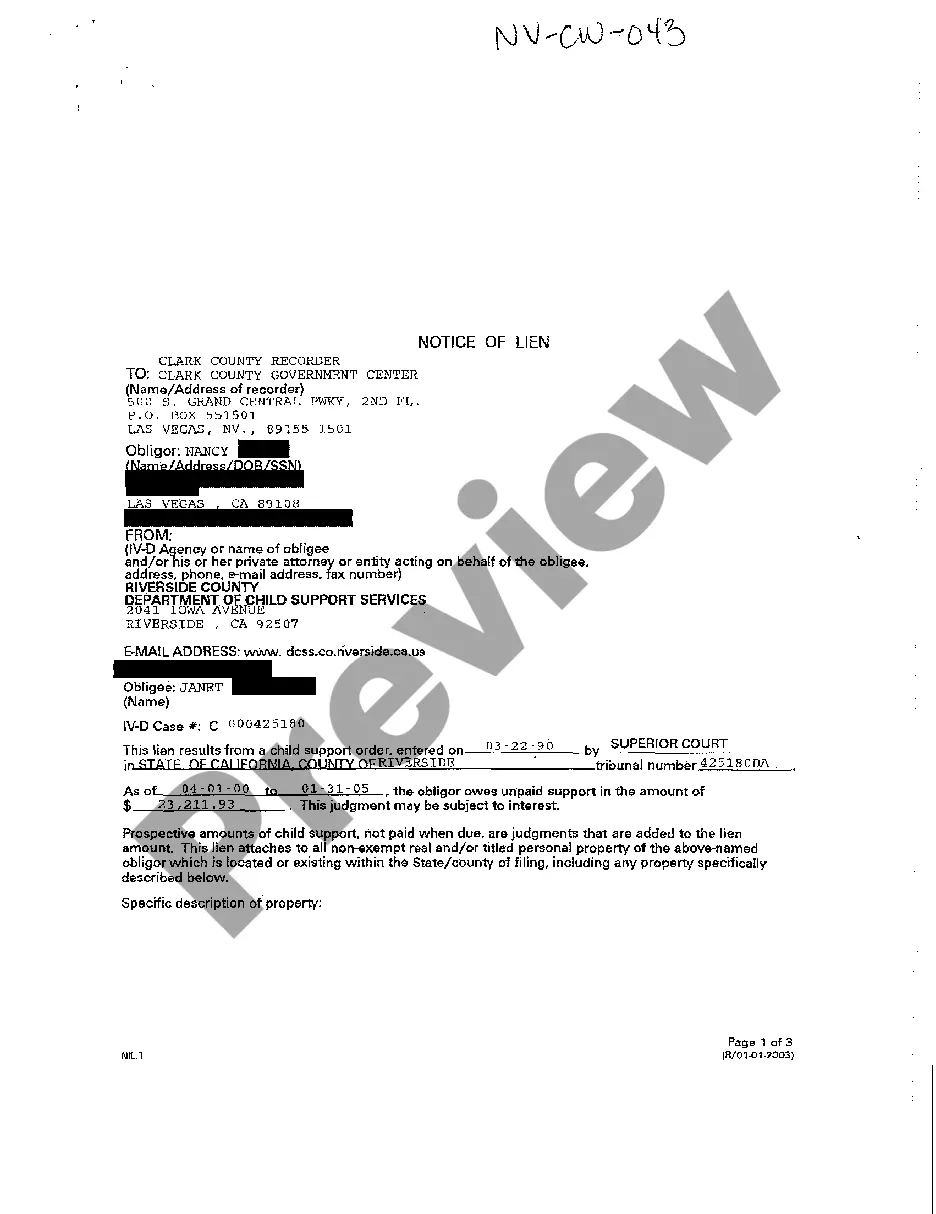

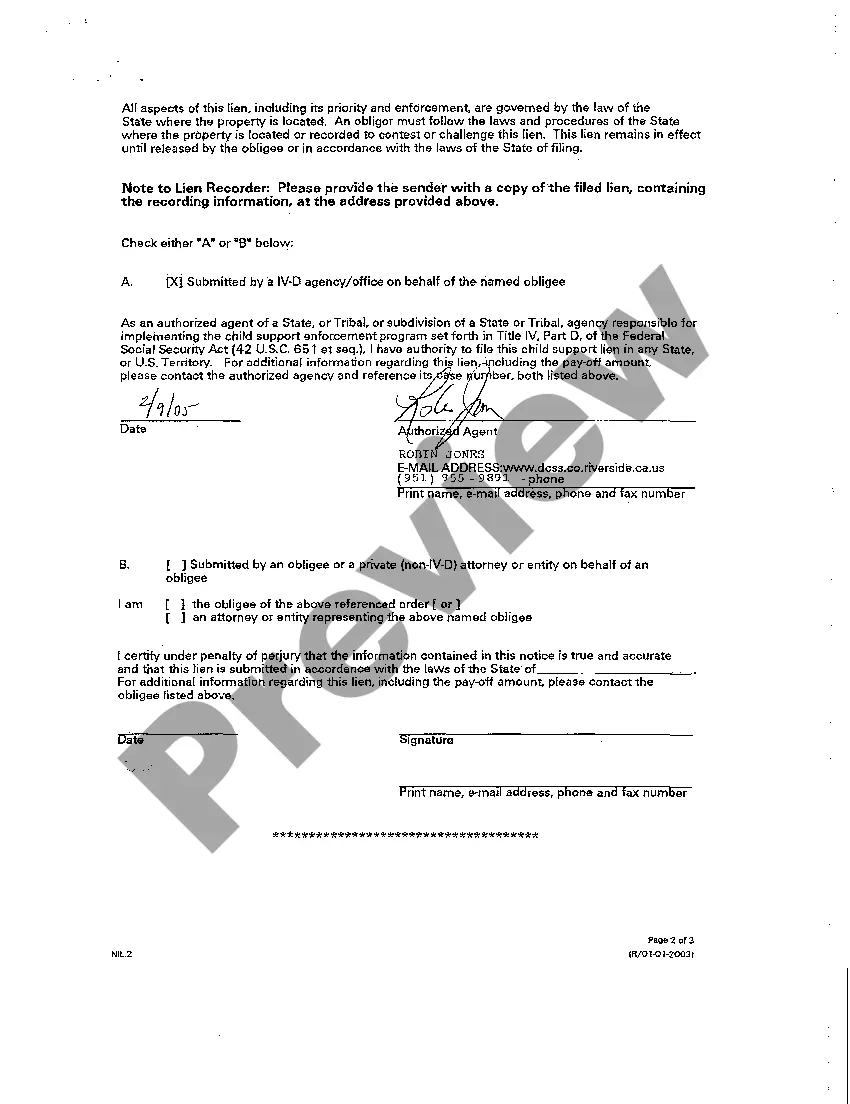

Title: Understanding Clark Nevada Notice of Lien Due to Unpaid Child Support Keywords: Clark Nevada Notice of Lien, Unpaid Child Support, Child Support Enforcement, Liens on Property, Financial Obligations, Legal Notice Introduction: The Clark Nevada Notice of Lien Due to Unpaid Child Support is a legal document issued by the Child Support Enforcement agency in Clark County, Nevada, to notify individuals of their outstanding child support arrears. This notice serves as a warning that failure to satisfy child support obligations may result in legal consequences, including placing a lien on the individual's property. Let's explore the various types of Clark Nevada Notice of Lien Due to Unpaid Child Support and understand their implications. 1. Standard Clark Nevada Notice of Lien Due to Unpaid Child Support: This type of notice is issued when an individual with arrears fails to meet their child support obligations within the required timeframe. The notice informs the delinquent parent that a lien may be placed on their property to secure the payment of overdue child support. 2. Notice of Lien Due to Unpaid Child Support — Property Lien: In cases where a parent has substantial unpaid child support, the Child Support Enforcement agency may initiate legal action to place a lien on the non-paying parent's property. This lien serves as a legal claim against the property, ensuring that the outstanding child support debt is addressed when the property is sold or refinanced. 3. Notice of Lien Due to Unpaid Child Support — Wage Lien: If a delinquent parent fails to pay child support, the Child Support Enforcement agency may obtain a notice of lien against their wages. This type of lien authorizes wage garnishment, enabling the agency to deduct a portion of the individual's wages until the outstanding child support debt is satisfied. 4. Notice of Lien Due to Unpaid Child Support — Bank Account Lien: In certain cases, when other means of collection are ineffective, the Child Support Enforcement agency may seek a lien against the non-paying parent's bank accounts. This grants them the authority to freeze and seize funds in the accounts to fulfill overdue child support obligations. 5. Notice of Lien Due to Unpaid Child Support — Tax Refund Interception: When a parent is significantly delinquent in child support payments, the agency may work in collaboration with the Internal Revenue Service (IRS) to intercept their federal tax refunds. This process ensures that the overdue child support payments are collected directly from the refund amount. Conclusion: The Clark Nevada Notice of Lien Due to Unpaid Child Support is a critical legal notice that notifies delinquent parents of their outstanding child support arrears and the potential consequences they may face. Whether it involves placing a lien on property, wage garnishment, freezing bank accounts, or intercepting tax refunds, these actions are aimed at enforcing financial responsibility and providing for the welfare of children. It is essential for individuals to act promptly upon receiving such notices to address their child support obligations and prevent further legal complications.

Clark Nevada Notice of Lien Due to Unpaid Child Support

Description

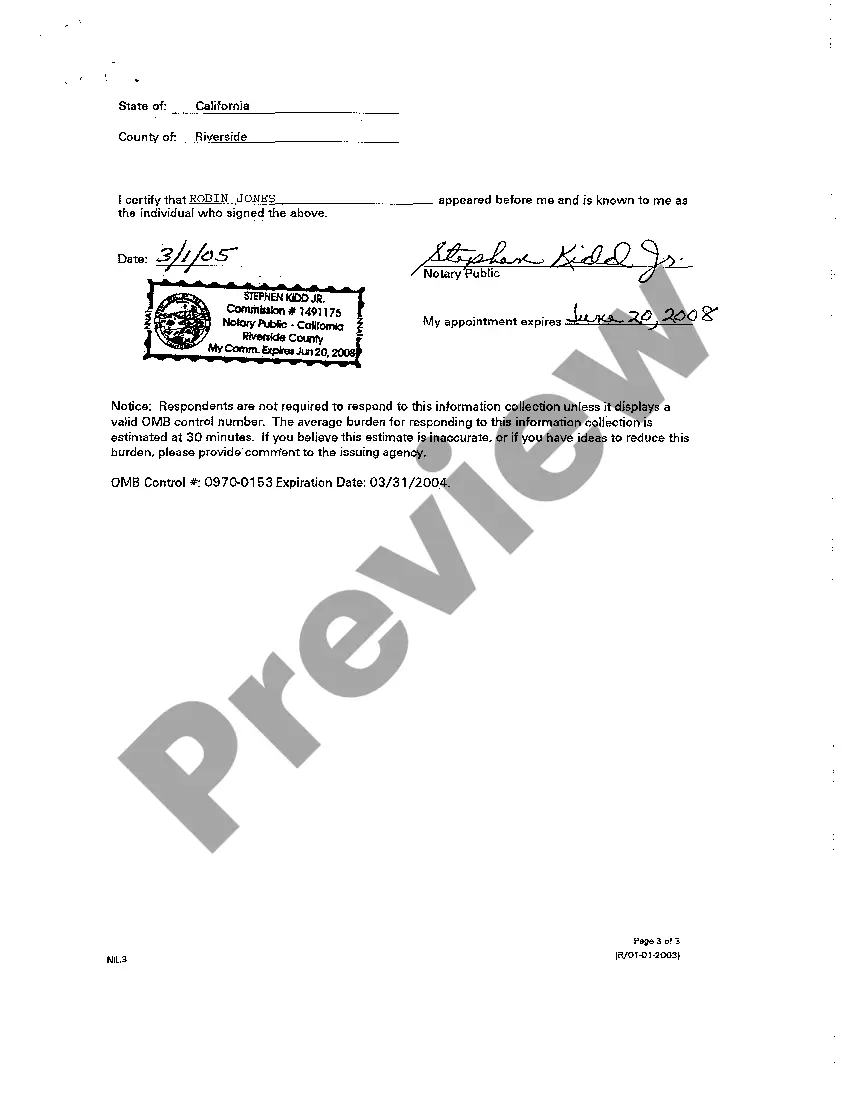

How to fill out Clark Nevada Notice Of Lien Due To Unpaid Child Support?

Take advantage of the US Legal Forms and have immediate access to any form sample you need. Our useful platform with a large number of templates simplifies the way to find and get almost any document sample you will need. It is possible to download, complete, and sign the Clark Nevada Notice of Lien Due to Unpaid Child Support in just a few minutes instead of surfing the Net for several hours attempting to find an appropriate template.

Utilizing our library is a wonderful way to improve the safety of your form submissions. Our experienced lawyers regularly review all the records to make sure that the forms are appropriate for a particular region and compliant with new acts and polices.

How can you get the Clark Nevada Notice of Lien Due to Unpaid Child Support? If you already have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. Moreover, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Find the form you require. Make certain that it is the form you were hoping to find: check its title and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Save the document. Choose the format to obtain the Clark Nevada Notice of Lien Due to Unpaid Child Support and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable template libraries on the internet. Our company is always happy to assist you in virtually any legal procedure, even if it is just downloading the Clark Nevada Notice of Lien Due to Unpaid Child Support.

Feel free to benefit from our form catalog and make your document experience as efficient as possible!