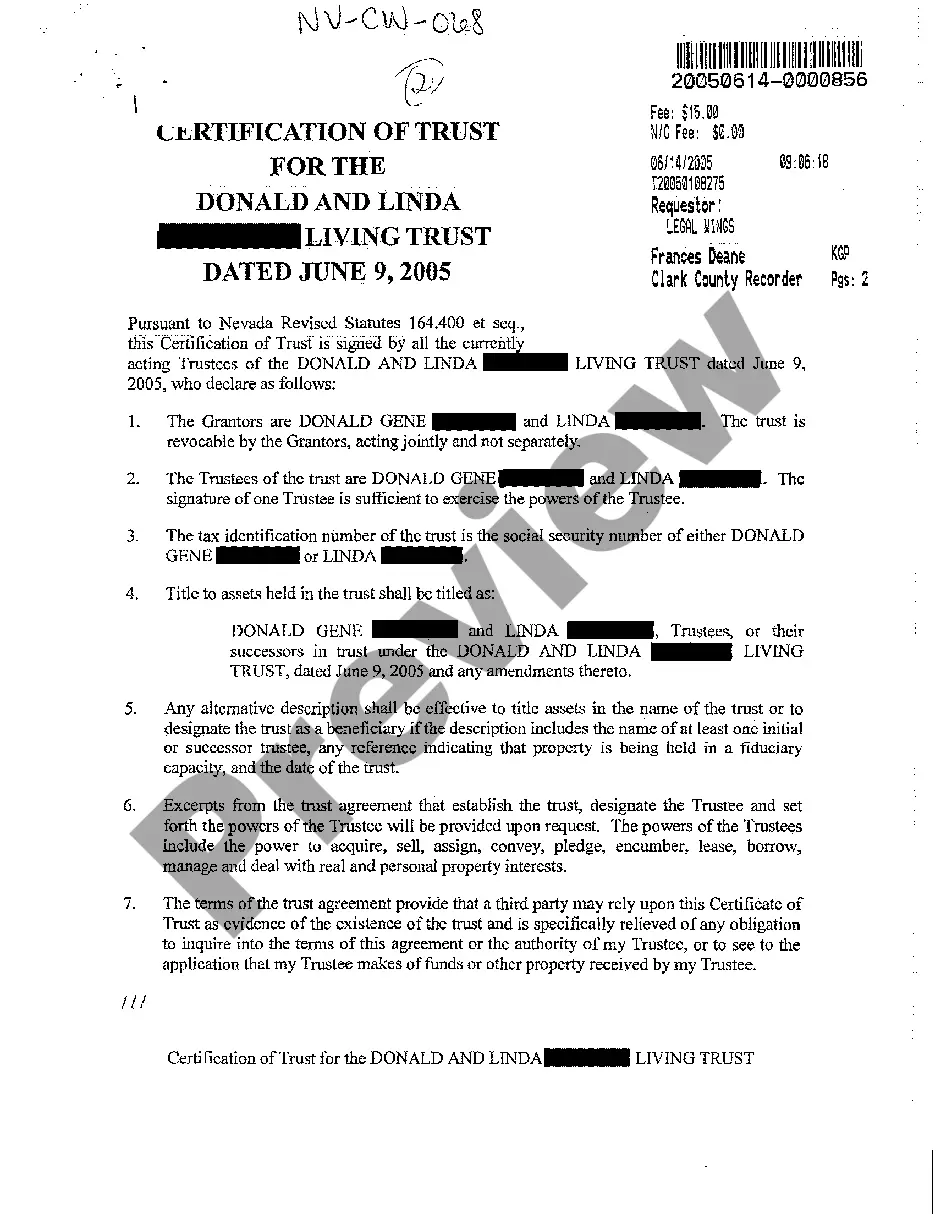

Clark Nevada Certification of Living Trust

Description

How to fill out Nevada Certification Of Living Trust?

If you have utilized our service previously, Log In to your account and retrieve the Clark Nevada Certification of Living Trust onto your device by selecting the Download button. Ensure that your subscription is active. If not, renew it per your payment arrangement.

If this is your initial encounter with our service, follow these straightforward instructions to acquire your document.

You have continuous access to every document you have acquired: you can find it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to quickly find and save any template for your individual or professional requirements!

- Verify you’ve located the correct document. Review the details and use the Preview feature, if available, to determine if it fulfills your requirements. If it does not, utilize the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and complete your payment. Provide your credit card information or use the PayPal method to finalize the purchase.

- Obtain your Clark Nevada Certification of Living Trust. Choose the file format for your document and store it to your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

One of the most significant mistakes parents often make is failing to fund the trust properly. A trust must hold actual assets to be effective, and neglecting to transfer ownership can lead to complications for heirs. When setting up a Clark Nevada Certification of Living Trust, ensure all intended assets are included to avoid future issues and protect your family’s financial legacy.

A certificate trust is a legal document that verifies the establishment of a trust while summarizing key information about it. This certificate demonstrates the authority of the trustee to manage assets according to the trust terms. For individuals dealing with a Clark Nevada Certification of Living Trust, witnessing how this document provides transparency can streamline financial transactions.

In Nevada, a living trust does not need to be recorded like a will. However, it can be beneficial to have certain assets, like real estate, placed into the trust formally. This process can help avoid probate and ensure smoother transitions for beneficiaries. If you're considering a Clark Nevada Certification of Living Trust, understanding how to manage recording can greatly help in asset protection.

You can obtain a certificate of trust from your attorney or through legal document services online. Websites like USLegalForms offer templates and guidance for creating a Clark Nevada Certification of Living Trust. It’s essential to ensure that the certificate meets state requirements, so consulting professionals can provide added assurance.

The three main types of trust are revocable trusts, irrevocable trusts, and testamentary trusts. A revocable trust allows changes during the creator's lifetime, while an irrevocable trust cannot be easily altered once established. Testamentary trusts come into effect after the creator's death, as specified in a will. If you are exploring options regarding a Clark Nevada Certification of Living Trust, consider these types to determine which suits your needs best.

No, a certificate of trust is not the same as a trust. While a trust is the actual legal arrangement governing the assets, the certificate acts as a summary or verification of that arrangement. It provides essential details about the trust without disclosing the entire trust document. People seeking a Clark Nevada Certification of Living Trust should understand this difference to make informed decisions.

A trust is a legal entity that holds assets on behalf of beneficiaries. In contrast, a certificate of trust is a document that outlines the specifics of the trust's existence, including the trustee’s powers and the beneficiaries. Essentially, the certificate serves to provide proof of the trust for various transactions without revealing sensitive information within the full trust document. For those in need of a Clark Nevada Certification of Living Trust, this distinction is crucial.

In Nevada, a trust does not need to be notarized to be valid; however, having your document notarized can provide an additional layer of authenticity. Many people prefer to notarize their trusts and the accompanying Clark Nevada Certification of Living Trust to prevent potential disputes. Whenever you consider legal documents, it's best to seek out professional assistance to ensure proper procedures are followed.

Nevada does not impose a state income tax on individuals, including trusts. However, federal tax regulations still apply, and your trust may be subject to taxation based on its income and distributions. Understanding the tax implications of your Clark Nevada Certification of Living Trust can help you plan effectively and make better financial decisions.

Setting up a living trust in Nevada involves drafting a trust agreement that outlines the terms and conditions of the trust. You will need to transfer your assets into the trust and designate a trustee to manage it. Consider using professional services, such as those provided by USLegalForms, to ensure that your Clark Nevada Certification of Living Trust is compliant and effective.